Arizona Electrologist Agreement - Self-Employed Independent Contractor

Description

How to fill out Electrologist Agreement - Self-Employed Independent Contractor?

You might spend hours online searching for the official document template that meets the federal and state requirements you require.

US Legal Forms provides thousands of legal forms that can be reviewed by professionals.

You can download or print the Arizona Electrologist Agreement - Self-Employed Independent Contractor from our platform.

If available, use the Preview button to view the document template as well. To find another version of the form, use the Lookup field to find the template that suits your needs and requirements. Once you have identified the template you want, click Acquire now to proceed. Choose the payment plan you desire, enter your details, and create your account on US Legal Forms. Complete the transaction. You can use your Visa or Mastercard or PayPal account to pay for the legal form. Choose the format of the document and download it to your device. Make modifications to your document if necessary. You can complete, edit, sign, and print the Arizona Electrologist Agreement - Self-Employed Independent Contractor. Access and print thousands of document templates using the US Legal Forms website, which offers the largest selection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you have a US Legal Forms account, you can Log In and press the Obtain button.

- After that, you can complete, modify, print, or sign the Arizona Electrologist Agreement - Self-Employed Independent Contractor.

- Every legal document template you buy is yours to keep indefinitely.

- To obtain an additional copy of a purchased form, visit the My documents section and click the relevant button.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions below.

- First, ensure that you have selected the correct document template for the location/region of your choice.

- Review the form description to confirm that you have chosen the right form.

Form popularity

FAQ

In Arizona, 1099 employees are considered independent contractors and are not entitled to benefits like traditional employees. As an Arizona Electrologist operating under a Self-Employed Independent Contractor agreement, it is vital to maintain proper records and report income accurately. You must provide clients with a W-9 form and receive a 1099 form for tax purposes at year-end. Understanding these rules helps ensure compliance and protects your business interests.

Yes, an independent contractor in Arizona typically needs a business license to operate legally. This requirement ensures you comply with state regulations while providing services as an Arizona Electrologist under a Self-Employed Independent Contractor agreement. It's important to check local regulations, as some municipalities might have specific licensing requirements. Always stay informed to avoid potential legal issues.

Legal requirements for independent contractors in Arizona include registering your business if necessary, understanding tax obligations, and adhering to the terms of your contract. An Arizona Electrologist Agreement - Self-Employed Independent Contractor can specify the legal parameters that govern your work. Additionally, you must follow specific workplace regulations and industry standards. Familiarizing yourself with these requirements helps you establish a legitimate and thriving independent practice.

Yes, an independent contractor is indeed considered self-employed. When you enter into an Arizona Electrologist Agreement - Self-Employed Independent Contractor, you operate your own business, providing services without a traditional employer-employee relationship. This status gives you autonomy over your work, but it also brings responsibilities like managing your taxes and expenses. Embracing the self-employed status allows for greater freedom in your career.

Yes, having a contract is essential as an independent contractor. An Arizona Electrologist Agreement - Self-Employed Independent Contractor clearly outlines your responsibilities, payment terms, and working conditions. This legal document protects both you and your client, ensuring you understand your role and obligations. It helps prevent misunderstandings and can provide clarity in your working relationship.

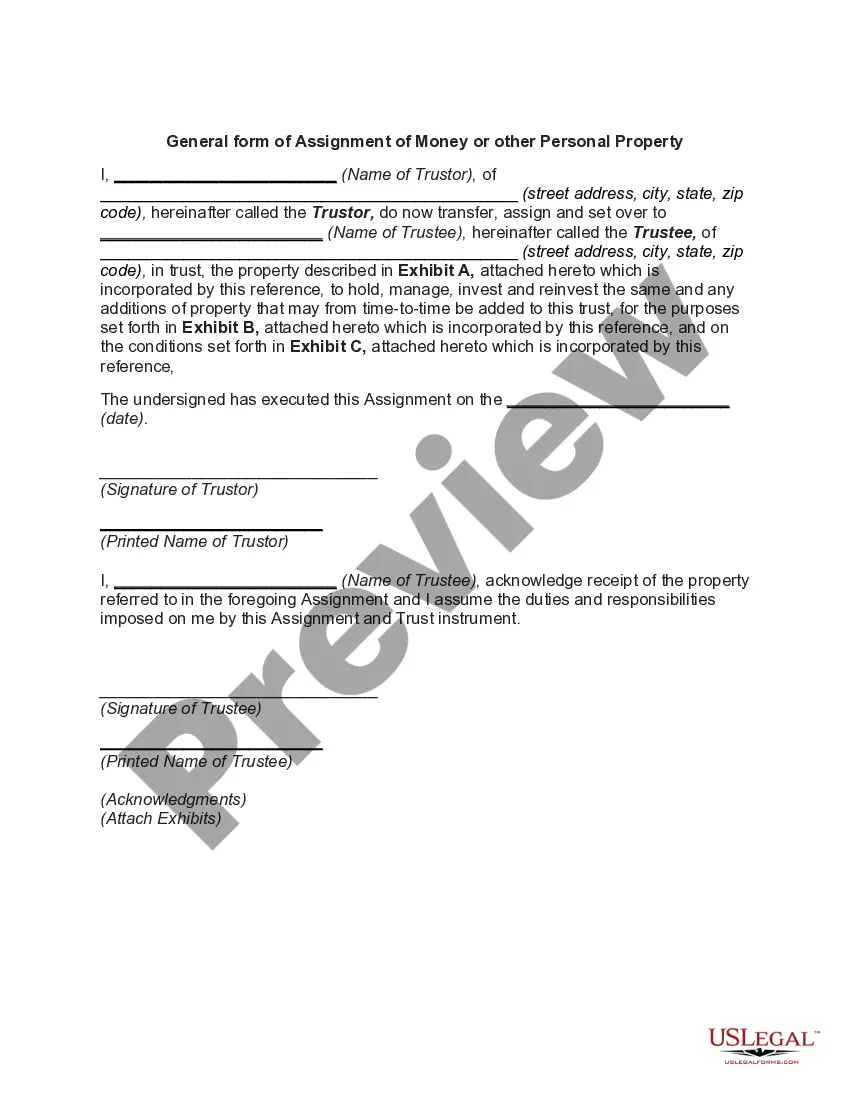

Filling out an independent contractor agreement starts by inputting basic information for both parties involved. You should then describe the services, payment terms, and project timeline. To ensure comprehensive coverage of all necessary details, consider using the Arizona Electrologist Agreement - Self-Employed Independent Contractor from US Legal Forms, which is designed to guide you through this process.

An independent contractor typically needs to complete an independent contractor agreement, tax forms like a W-9, and possibly a declaration of independent contractor status. Each document plays a crucial role in defining your work status and tax obligations. The Arizona Electrologist Agreement - Self-Employed Independent Contractor from US Legal Forms covers all these essentials, making it easier for you to stay organized.

To fill out a declaration of independent contractor status form, include your business details and the nature of the contract work. It is also important to confirm that you understand your classification as an independent contractor. By using the Arizona Electrologist Agreement - Self-Employed Independent Contractor template from US Legal Forms, you can streamline this task and adhere to all necessary legal guidelines.

Filling out an independent contractor form begins with entering your personal information, such as name and address, followed by details about the services you'll provide. Make sure to specify the payment structure, along with any relevant tax information. Utilizing the Arizona Electrologist Agreement - Self-Employed Independent Contractor from US Legal Forms can simplify this process, ensuring accuracy and compliance.

To write an independent contractor agreement, start by clearly defining the scope of work, project deadlines, and payment terms. It's essential to outline both parties' responsibilities to avoid future misunderstandings. Use the Arizona Electrologist Agreement - Self-Employed Independent Contractor template from US Legal Forms to ensure you incorporate all necessary elements effectively.