Arizona Lab Worker Employment Contract - Self-Employed

Description

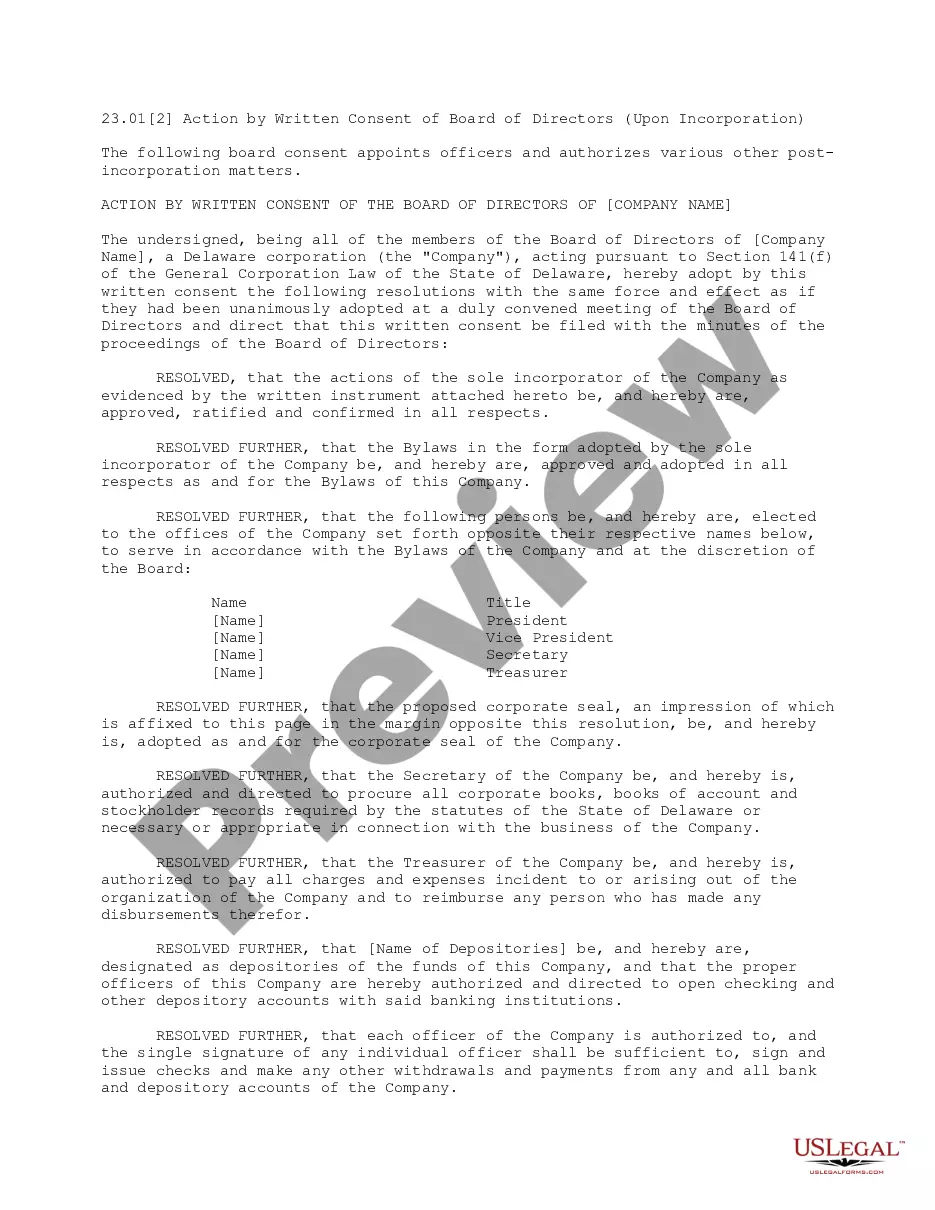

How to fill out Lab Worker Employment Contract - Self-Employed?

If you require to be thorough, obtain, or create authorized document templates, utilize US Legal Forms, the largest assortment of legal forms that can be found online.

Employ the site's simple and user-friendly search to locate the documents you need. Various templates for business and personal purposes are categorized by groups and keywords.

Utilize US Legal Forms to discover the Arizona Lab Worker Employment Contract - Self-Employed in just a few clicks.

Every legal document template you purchase is yours permanently. You have access to every document you downloaded within your account. Click on the My documents section and select a form to print or download again.

Be proactive and download, and print the Arizona Lab Worker Employment Contract - Self-Employed with US Legal Forms. There are many professional and state-specific forms available for your business or personal needs.

- In case you are an existing US Legal Forms user, Log In to your account and click the Download button to find the Arizona Lab Worker Employment Contract - Self-Employed.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are utilizing US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have chosen the form for your correct city/state.

- Step 2. Use the Preview option to review the form's content. Don’t forget to read the summary.

- Step 3. If you are not satisfied with the document, use the Search field at the top of the screen to find other versions of the legal document template.

- Step 4. Once you have found the form you need, select the Buy now button. Choose the payment plan you prefer and enter your details to register for an account.

- Step 5. Complete the purchase. You can use your Visa or Mastercard or PayPal account to finalize the transaction.

- Step 6. Choose the format of the legal document and download it to your device.

- Step 7. Complete, review and print or sign the Arizona Lab Worker Employment Contract - Self-Employed.

Form popularity

FAQ

Contract work and self-employment share similarities but are not exactly the same. Contract work, like what is outlined in an Arizona Lab Worker Employment Contract - Self-Employed, is often project-specific and time-bound. Self-employment could involve long-term business endeavors or various clients. Understanding these distinctions can help you better navigate your career choices.

A contract employee is often considered self-employed, particularly if they work under a contract for services. In scenarios presented by an Arizona Lab Worker Employment Contract - Self-Employed, you have the flexibility to operate independently while delivering services. However, the classification can vary based on the terms outlined in your contract. Ensure clarity in your agreements to avoid confusion.

While closely related, contract work is not exactly the same as being self-employed. Contract workers usually operate under a specific agreement for limited tasks or timeframes, like those found in an Arizona Lab Worker Employment Contract - Self-Employed. In contrast, self-employment can encompass a broader range of entrepreneurial activities. It's important to understand the structure of your work arrangement.

Yes, contract work does count as a form of employment, though it differs from traditional full-time roles. In this setting, you work based on specific agreements, such as the Arizona Lab Worker Employment Contract - Self-Employed. This arrangement allows you to have a great deal of autonomy while still fulfilling the terms of the contract. Remember, your relationship with the hiring entity is crucial in defining your employment status.

An independent contractor typically needs to complete a W-9 form, which provides the necessary taxpayer identification information. Additionally, you should have a clear Arizona Lab Worker Employment Contract - Self-Employed, outlining the terms of your agreement. It's also wise to keep invoices for your services and any relevant receipts for expenses. These documents help establish your self-employed status.

Yes, a 1099 employee is considered self-employed. This means they are not on the employer's payroll, allowing for greater flexibility. They manage their own taxes and are responsible for their business expenses. When you enter into an Arizona Lab Worker Employment Contract - Self-Employed, you will often find yourself classified as a 1099 employee.

To become an independent contractor in Arizona, start by defining your services and market. Next, register your business if necessary, and understand the requirements for contracts and taxes. Utilizing an Arizona Lab Worker Employment Contract - Self-Employed can streamline the process, ensuring you have all necessary agreements in place when working with clients.

Both terms can be used interchangeably, but choosing one may depend on your specific context. Generally, 'self-employed' emphasizes your entrepreneurial status, while 'independent contractor' highlights your contractual arrangement. Regardless of the term you use, having an Arizona Lab Worker Employment Contract - Self-Employed enhances your professional image.

Yes, you can be self-employed and have a contract. Formalizing an arrangement through an Arizona Lab Worker Employment Contract - Self-Employed clarifies expectations and fosters trust between you and your clients. This contract also helps protect your rights as a self-employed worker, ensuring that both sides understand the agreed terms.

Creating a private contract with yourself is unusual, but it can serve as a useful tool for setting personal expectations. By doing so, you can outline your goals and responsibilities clearly. However, having an Arizona Lab Worker Employment Contract - Self-Employed is more beneficial for establishing a professional agreement when working with clients.