Arizona Statutory Notices Required for California Foreclosure Consultants

Description

How to fill out Statutory Notices Required For California Foreclosure Consultants?

It is feasible to spend numerous hours online searching for the lawful document template that meets the state and federal requirements you desire.

US Legal Forms offers a wide range of legal templates that are reviewed by professionals.

You can acquire or print the Arizona Statutory Notices Required for California Foreclosure Consultants through my services.

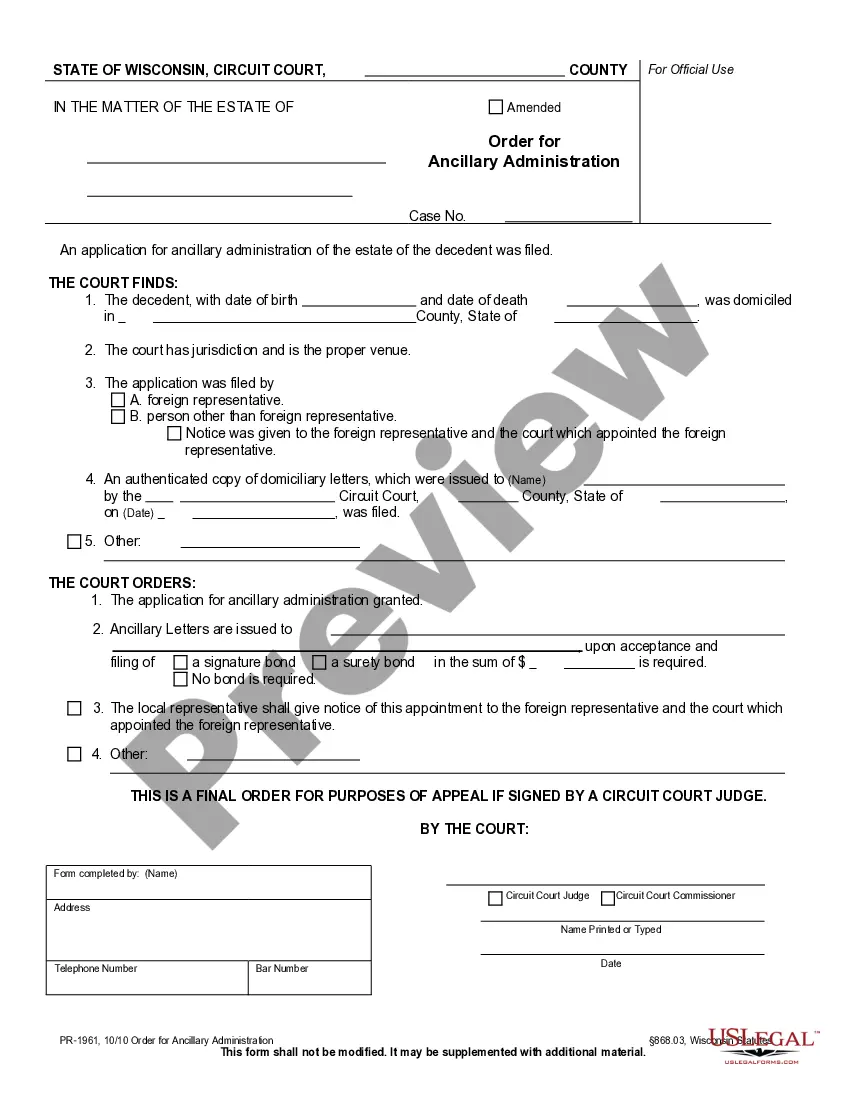

If available, use the Preview button to view the document template as well.

- If you already have a US Legal Forms account, you can Log In and then click the Download button.

- After that, you can complete, modify, print, or sign the Arizona Statutory Notices Required for California Foreclosure Consultants.

- Every legal document template you obtain is yours indefinitely.

- To retrieve an additional copy of a purchased form, navigate to the My documents section and click the relevant button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions listed below.

- First, ensure that you have chosen the appropriate document template for the region/city of your choice.

- Review the form details to confirm that you have selected the correct form.

Form popularity

FAQ

The 37-day rule refers to specific regulations that require lenders to send homeowners a notice of default and provide a period for them to respond before the foreclosure process advances. This timeframe emphasizes the importance of communication between the homeowner and lender, allowing for possible solutions. For California foreclosure consultants, knowing the implications of the 37-day rule and the Arizona Statutory Notices Required for California Foreclosure Consultants can enhance client outcomes and foster more informed decisions.

The new foreclosure law in California aims to increase protections for homeowners, providing more time before a foreclosure can occur. Under this law, lenders must now adhere to additional notice requirements and offer more opportunities for borrowers to seek assistance. For California foreclosure consultants, it is crucial to understand how these changes relate to Arizona Statutory Notices Required for California Foreclosure Consultants, ensuring compliance and better support for clients.

In Arizona, the foreclosure process typically lasts about 90 to 120 days. This timeline can vary based on the lender's actions and any potential delays. Understanding these durations is essential for California foreclosure consultants, especially when considering the Arizona Statutory Notices Required for California Foreclosure Consultants. By being aware of the timelines, you can better assist clients facing foreclosure.

The 37-day foreclosure rule refers to a specific timeline related to the notice of sale in Arizona. Lenders must wait a minimum of 37 days after giving notice before proceeding with the auction. This period allows homeowners additional time to address their financial issues or seek assistance. For California foreclosure consultants, being aware of the Arizona statutory notices required ensures you’re well-informed and prepared when guiding your clients.

Yes, California does provide a statutory right of redemption, allowing homeowners to reclaim their property after a foreclosure sale. This right exists for one year following the sale but is limited in certain circumstances. This provision can offer a critical lifeline for struggling homeowners, instilling some peace of mind. For California foreclosure consultants, knowing the Arizona statutory notices required is vital to advise clients accurately on their options.

Arizona's foreclosure laws dictate that lenders must follow specific procedures before seizing a property. Homeowners receive various statutory notices outlining their rights and obligations during the process. Importantly, these laws prioritize transparent communication, ensuring homeowners have the chance to rectify their situations. Familiarity with Arizona statutory notices required for California foreclosure consultants is crucial to navigate these regulations effectively.

In Arizona, foreclosure typically begins when a homeowner misses their mortgage payments. The lender issues a notice of default, allowing the homeowner 90 days to catch up on payments. If the debt remains unpaid, the property may be sold at a public auction. Understanding the Arizona statutory notices required for California foreclosure consultants can clarify the processes involved.

Foreclosure in Arizona can take anywhere from 120 to 180 days from the initial missed payment to the auction date. This timeline can vary, depending on various factors such as the lender’s actions and any legal challenges. California foreclosure consultants should be aware of the Arizona Statutory Notices Required for California Foreclosure Consultants to provide informed guidance to their clients. Understanding the timeline can help clients navigate their options more efficiently.

The foreclosure process in Arizona usually begins with the lender issuing a Notice of Default after missed payments. After the required notice period, the property can be auctioned off. For California foreclosure consultants, familiarizing themselves with the Arizona Statutory Notices Required for California Foreclosure Consultants is crucial for compliance and to assist their clients effectively. Knowing the steps can make a significant difference during this stressful time.

In Arizona, homeowners typically face foreclosure after missing three monthly payments. This can start the process, but it's important to know that lenders may offer alternatives to foreclosure during this time. Understanding the Arizona Statutory Notices Required for California Foreclosure Consultants can help you navigate this complex situation. Being proactive and seeking help early can lead to better outcomes.