"Data Input Sheet" is a American Lawyer Media form. This is a form is an instructional form on how to fill out the different real estate forms.

Arizona Data Input Sheet

Description

How to fill out Data Input Sheet?

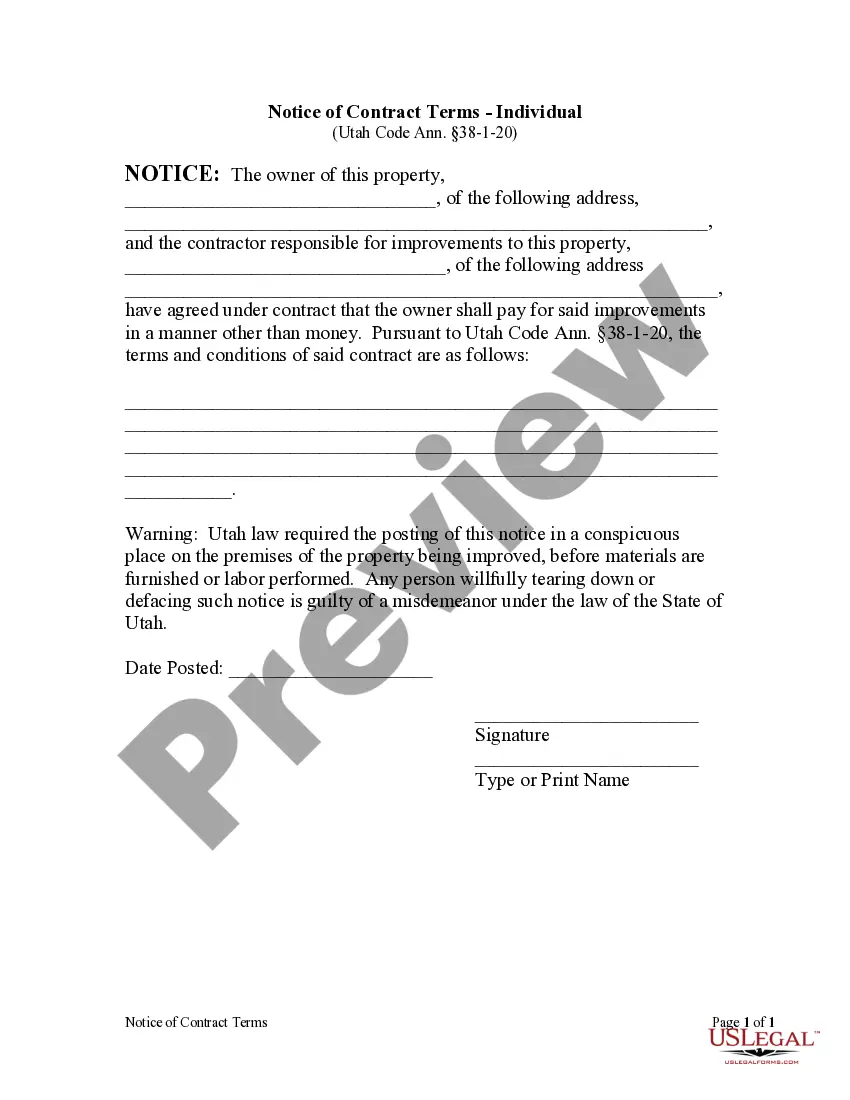

Choosing the best legal file web template can be quite a struggle. Naturally, there are a variety of themes available on the Internet, but how do you find the legal form you require? Make use of the US Legal Forms website. The services offers thousands of themes, including the Arizona Data Input Sheet, that can be used for company and personal requirements. All the types are checked out by experts and satisfy federal and state demands.

In case you are previously listed, log in to your account and click the Obtain key to have the Arizona Data Input Sheet. Make use of your account to search through the legal types you have bought formerly. Check out the My Forms tab of the account and obtain another duplicate from the file you require.

In case you are a whole new customer of US Legal Forms, allow me to share straightforward instructions for you to stick to:

- Initial, ensure you have selected the appropriate form for your personal town/state. You may look over the shape using the Preview key and browse the shape description to make certain this is basically the right one for you.

- If the form does not satisfy your needs, utilize the Seach area to discover the correct form.

- When you are positive that the shape would work, click on the Get now key to have the form.

- Select the prices prepare you want and enter in the required details. Make your account and purchase the order utilizing your PayPal account or Visa or Mastercard.

- Pick the data file file format and down load the legal file web template to your system.

- Full, modify and print and signal the received Arizona Data Input Sheet.

US Legal Forms is the largest collection of legal types where you will find a variety of file themes. Make use of the service to down load expertly-produced papers that stick to status demands.

Form popularity

FAQ

The 1099-NEC is a multi-part form that is handled as follows: Copy A ? File with IRS by the paper or electronic-filing deadline. Copy 1/State Copy ? File with the appropriate state taxing authority, if applicable. Copy B ? Distribute this copy to individuals, who then file it with their federal income tax return.

When filing state copies of forms 1099 with Arizona department of revenue, the agency contact information is: Arizona Department of Revenue, 1600 W. Monroe, Phoenix, Arizona 85007-2650. Compliance rules: You may file the Arizona state 1099 copies on paper or on optical media.

NEC FILING REQUIRED Forms filed to the IRS are automatically forwarded to the state, eliminating separate reporting to the participating states.

Taxpayers only need to submit Form 1099-NEC if there is Arizona withheld. All federal attachments (including Form 1099-NEC) are due with Arizona reconciliation forms. Arizona reconciliation Form A1-R and Form A1-APR are due January 31 of the calendar year after the wages were paid or payments were made.

Taxpayers only need to submit Form 1099-NEC if there is Arizona withheld. All federal attachments (including Form 1099-NEC) are due with Arizona reconciliation forms. Arizona reconciliation Form A1-R and Form A1-APR are due January 31 of the calendar year after the wages were paid or payments were made.

The department will continue to accept the electronic filing of the Arizona Quarterly Withholding Tax Return (Arizona Form A1-QRT) through AZFSET or through AZTaxes.gov.

Employers required to make Arizona withholding payments on a quarterly, monthly, semi-weekly, or one-banking day basis file Arizona Form A1-QRT. File Arizona Form A1-QRT quarterly to reconcile Arizona withholding payments made during the calendar quarter.

To change the amount of Arizona income tax withheld, an employee must complete Arizona Form A-4 and submit to his or her employer to choose a different withholding percentage option. Employees may request to have an additional amount withheld by their employer.