Arizona Equity Compensation Plan

Description

How to fill out Equity Compensation Plan?

If you wish to complete, download, or print legitimate file web templates, use US Legal Forms, the biggest variety of legitimate kinds, which can be found online. Take advantage of the site`s easy and practical look for to obtain the paperwork you will need. A variety of web templates for enterprise and person functions are categorized by groups and states, or search phrases. Use US Legal Forms to obtain the Arizona Equity Compensation Plan in a handful of click throughs.

Should you be presently a US Legal Forms buyer, log in to your accounts and click the Download switch to have the Arizona Equity Compensation Plan. Also you can entry kinds you earlier saved in the My Forms tab of your own accounts.

Should you use US Legal Forms the first time, refer to the instructions under:

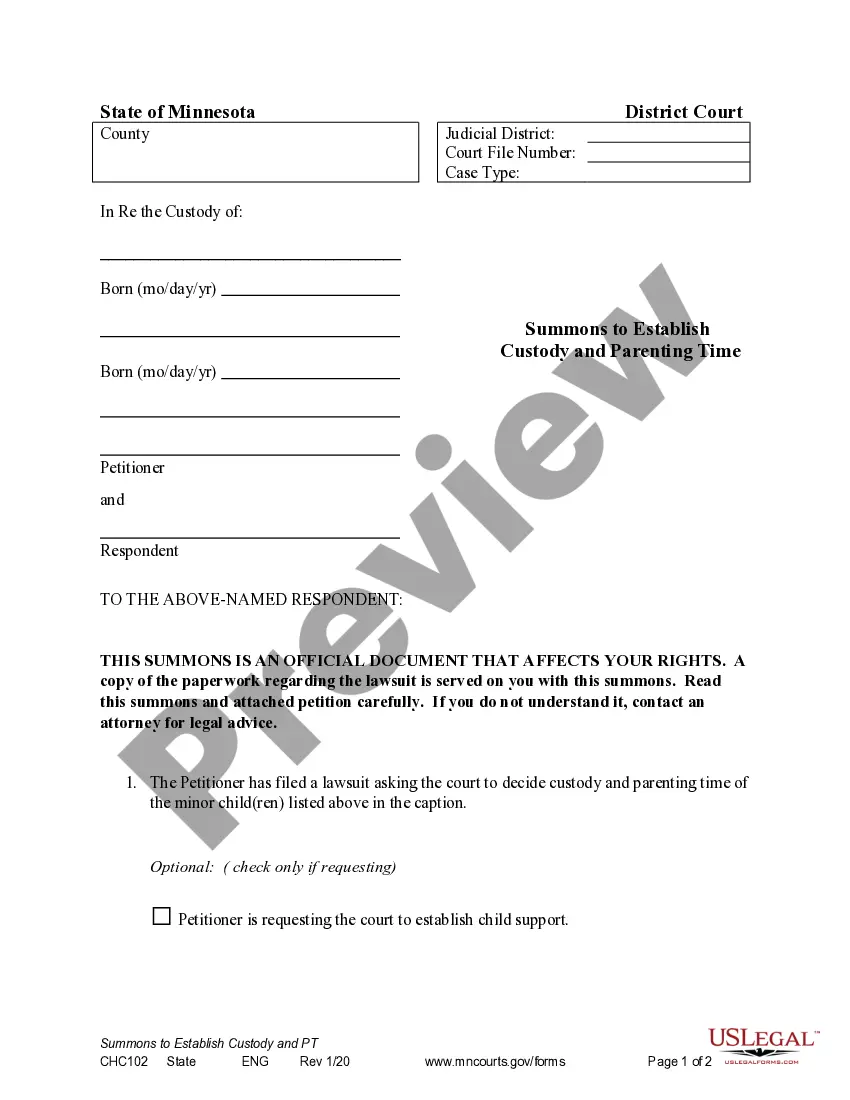

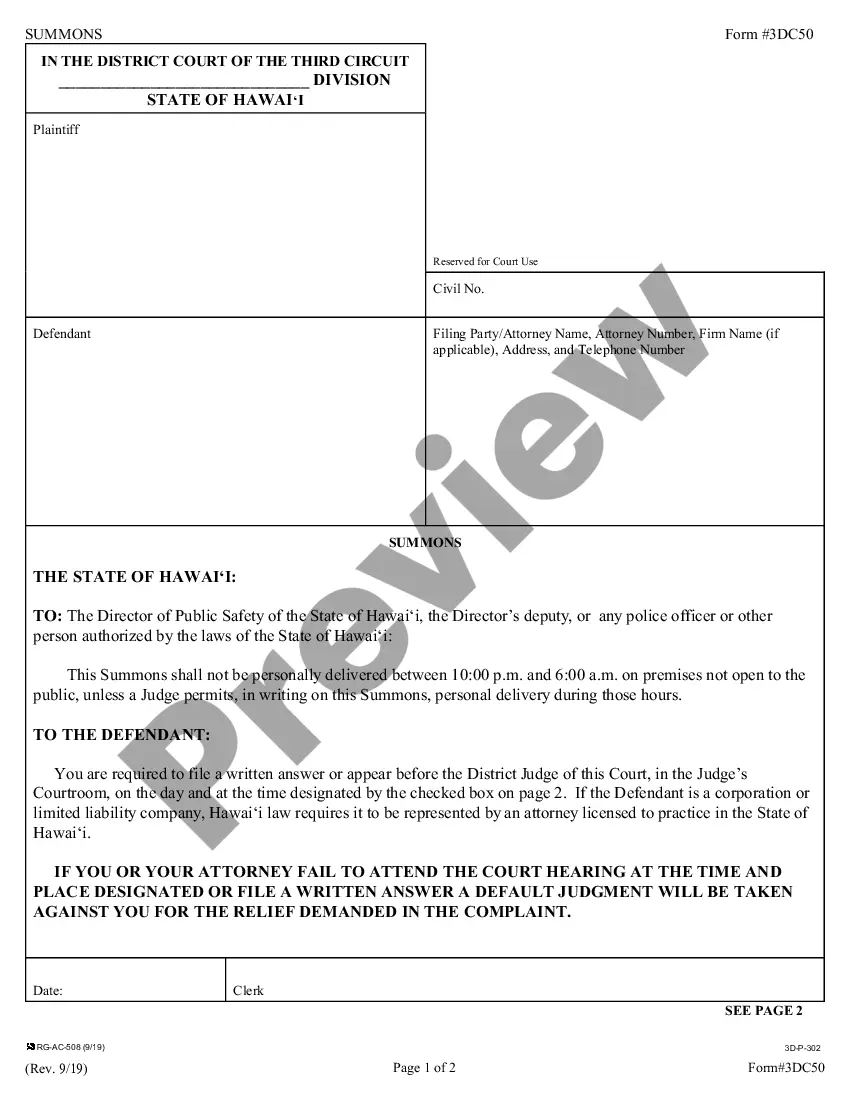

- Step 1. Be sure you have selected the shape for the appropriate area/country.

- Step 2. Utilize the Review option to examine the form`s content. Don`t neglect to learn the information.

- Step 3. Should you be not satisfied with the develop, utilize the Research discipline at the top of the display to find other versions in the legitimate develop template.

- Step 4. Once you have discovered the shape you will need, click on the Get now switch. Select the prices prepare you favor and add your credentials to register for an accounts.

- Step 5. Method the transaction. You should use your credit card or PayPal accounts to accomplish the transaction.

- Step 6. Find the structure in the legitimate develop and download it on your own system.

- Step 7. Comprehensive, revise and print or sign the Arizona Equity Compensation Plan.

Every legitimate file template you purchase is your own property eternally. You may have acces to every single develop you saved with your acccount. Click on the My Forms section and pick a develop to print or download again.

Contend and download, and print the Arizona Equity Compensation Plan with US Legal Forms. There are many professional and status-certain kinds you can utilize for the enterprise or person requires.

Form popularity

FAQ

An equity incentive program offers an employee shares of the company they work for. Shares can be awarded through stock options, stocks, warrants, or bonds. Stock options are the most common and recognizable form of employee equity.

Equity compensation, also known as share-based compensation, is a type of non-cash pay that a company offers to employees to partake in ownership of the firm. Some examples are stock options, restricted stock, stock appreciation rights (SARs) and ESPPs.

Each company pays out equity differently. The two main types of equity are vested equity and granted stock. With vested equity, payments are made over a predetermined number of installments delineated by a contract. Granted stock is provided at the beginning of a contract.

The most common type of equity compensation, restricted stock units (RSUs), are offered when a company has a stable valuation or goes public. Similar to stock options, they vest over time, but you don't have to buy them. Therefore, RSUs have less risk while enticing employees to stick around for their assets to vest.

Equity is compensation that allows employees the opportunity to become part owners of the companies they work for. This system regularly rewards people who maintain longevity as employees and sometimes can result in large cash payouts.

Equity compensation is non-cash pay that is offered to employees. Equity compensation may include options, restricted stock, and performance shares; all of these investment vehicles represent ownership in the firm for a company's employees.

An employee gains all rights to their Equity at the time in which it vests. When this occurs is unique to each person's equity as a compensation agreement with their employer. Once someone has all rights to their equity, then they have the option to cash out by selling their portion of ownership back to their employer.

Equity compensation is non-cash pay that is offered to employees. Equity compensation may include options, restricted stock, and performance shares; all of these investment vehicles represent ownership in the firm for a company's employees. At times, equity compensation may accompany a below-market salary.