Arizona Proposal for the Stock Split and Increase in the Authorized Number of Shares

Description

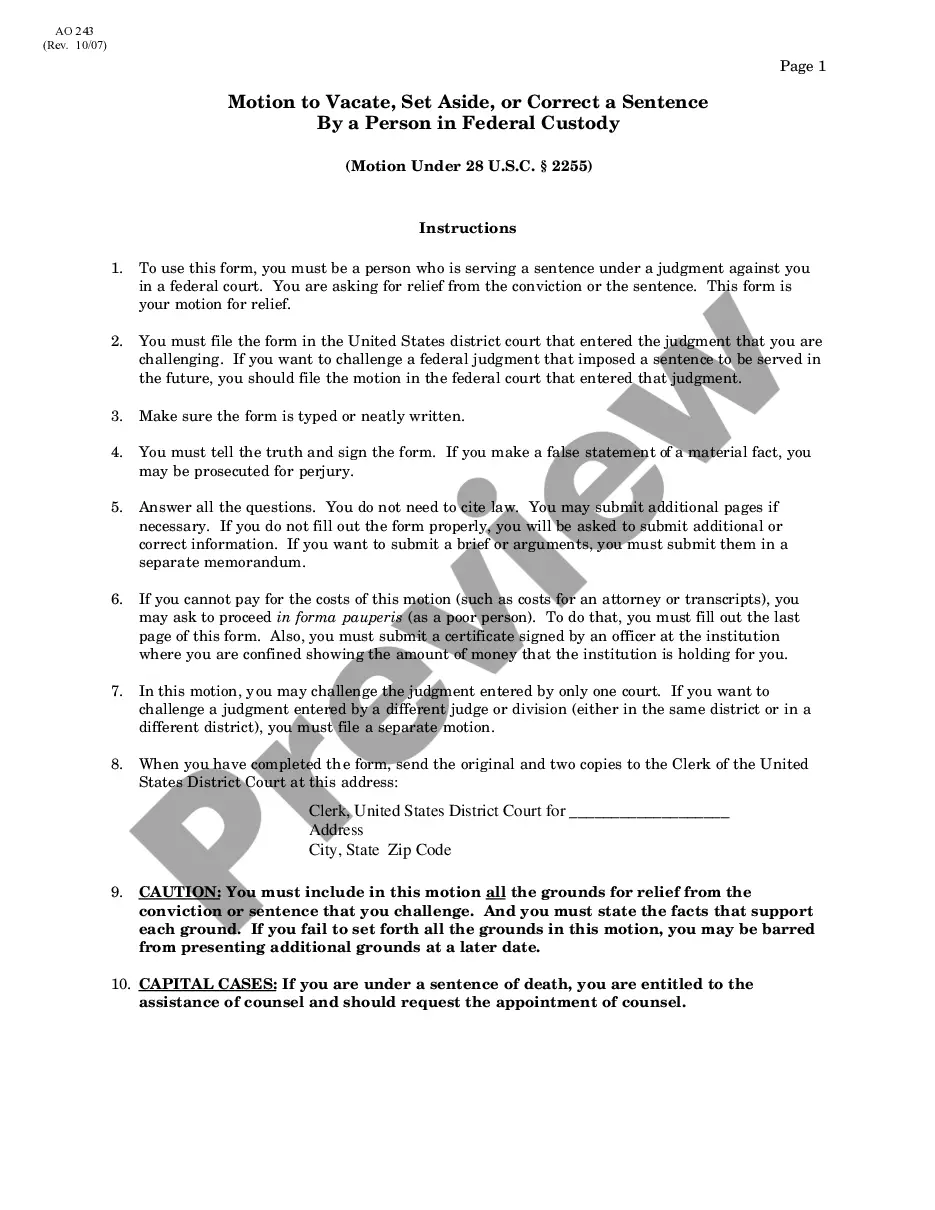

How to fill out Proposal For The Stock Split And Increase In The Authorized Number Of Shares?

Finding the right authorized papers template could be a struggle. Of course, there are a variety of web templates accessible on the Internet, but how will you obtain the authorized develop you need? Take advantage of the US Legal Forms site. The service offers a large number of web templates, including the Arizona Proposal for the Stock Split and Increase in the Authorized Number of Shares, which you can use for company and personal requirements. All of the forms are checked by experts and meet federal and state demands.

If you are presently signed up, log in to the account and then click the Acquire switch to obtain the Arizona Proposal for the Stock Split and Increase in the Authorized Number of Shares. Make use of account to search throughout the authorized forms you have purchased previously. Go to the My Forms tab of your account and acquire another backup from the papers you need.

If you are a fresh end user of US Legal Forms, allow me to share easy directions that you should follow:

- Initial, be sure you have chosen the appropriate develop for the area/region. You are able to look through the shape while using Review switch and read the shape description to make sure this is the best for you.

- In the event the develop fails to meet your expectations, make use of the Seach industry to find the appropriate develop.

- When you are sure that the shape is suitable, click the Purchase now switch to obtain the develop.

- Pick the pricing strategy you want and enter in the necessary details. Create your account and pay for your order utilizing your PayPal account or credit card.

- Select the document formatting and acquire the authorized papers template to the gadget.

- Full, edit and printing and indicator the received Arizona Proposal for the Stock Split and Increase in the Authorized Number of Shares.

US Legal Forms will be the greatest library of authorized forms in which you can discover a variety of papers web templates. Take advantage of the company to acquire skillfully-created papers that follow condition demands.

Form popularity

FAQ

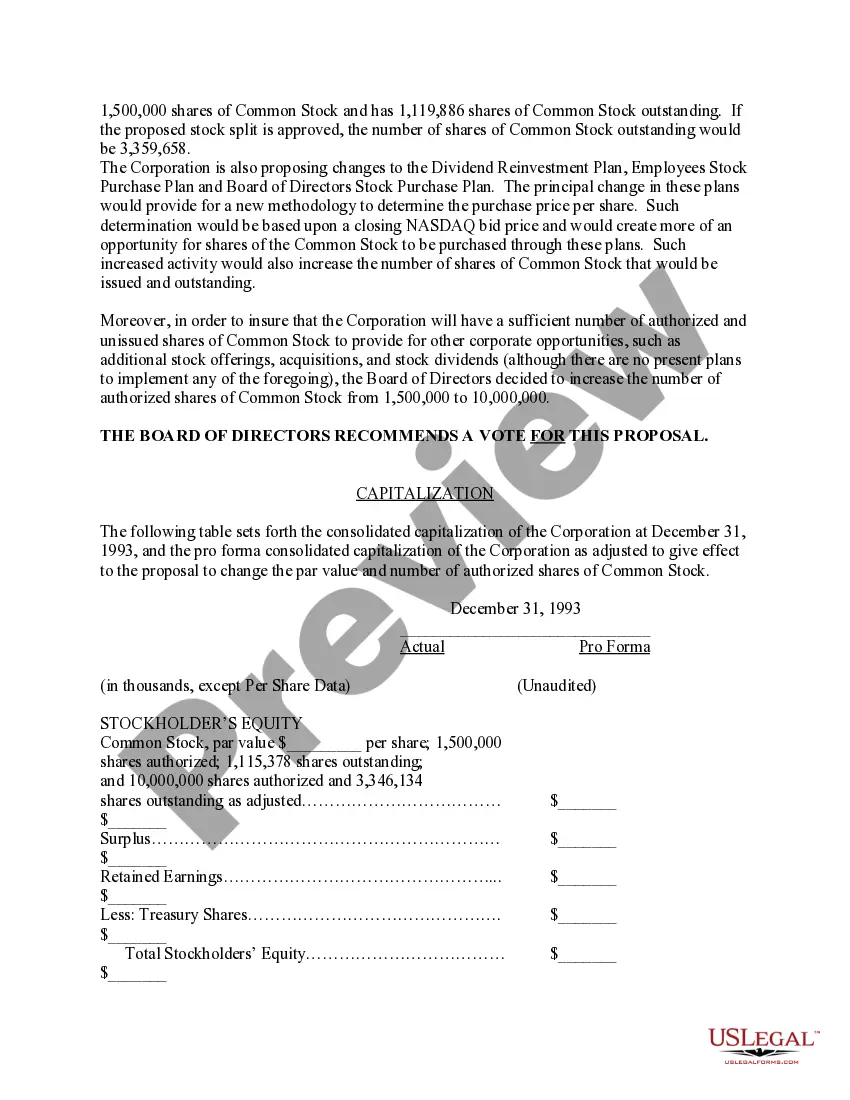

2023 Stock Splits DateSymbolCompany NameQNRXQuoin Pharmaceuticals Ltd.NVOSNovo Integrated Sciences IncFOXOFoxo Technologies IncDOGZDogness (international) Corp87 more rows

A stock split is a decision by a company's board to increase the number of outstanding shares in the company by issuing new shares to existing shareholders in a set proportion. Stock splits come in multiple forms, but the most common are 2-for-1, 3-for-2 or 3-for-1 splits.

A stock split increases the number of shares outstanding and lowers the individual value of each share. While the number of shares outstanding change, the overall market capitalization of the company and the value of each shareholder's stake remains the same.

The number of outstanding shares of Common Stock will be decreased as a result of a Reverse Stock Split, but the number of authorized shares of Common Stock will not be so decreased.

A stock split is a decision by a company's board of directors to increase the number of shares outstanding by issuing more shares to current shareholders. For example, in a 2-for-1 stock split, a shareholder receives an additional share for each share held.

For example, a common stock split ratio is a forward 2-1 split (i.e., 2 for 1), where a stockholder would receive 2 shares for every 1 share owned. This results in an increase in the total number of shares outstanding for the company, though no change in a shareholder's proportional ownership.

After a split, the stock starts trading at the adjusted price. In this example, if the share price was ?900, then it would fall to ?450 ( ratio) immediately after the split. Beyond the immediate impact, the price of the stock may actually go up if there is higher demand for it.

Earnings per share (EPS) and other per-share metrics will be affected by stock splits. If a company was earning $10/share prior to a 4-for-1 stock split, the earnings will represent only $2.50 per share afterwards.