Arizona Management Long Term Incentive Compensation Plan of of SCEcorp

Description

How to fill out Management Long Term Incentive Compensation Plan Of Of SCEcorp?

If you have to total, obtain, or print out authorized record web templates, use US Legal Forms, the most important variety of authorized forms, which can be found online. Take advantage of the site`s simple and easy practical lookup to obtain the documents you want. A variety of web templates for business and person uses are categorized by categories and states, or key phrases. Use US Legal Forms to obtain the Arizona Management Long Term Incentive Compensation Plan of of SCEcorp in just a couple of mouse clicks.

Should you be already a US Legal Forms buyer, log in for your account and then click the Down load key to obtain the Arizona Management Long Term Incentive Compensation Plan of of SCEcorp. You may also access forms you in the past saved from the My Forms tab of your own account.

If you use US Legal Forms the very first time, follow the instructions beneath:

- Step 1. Make sure you have chosen the shape for that right metropolis/land.

- Step 2. Utilize the Review choice to look over the form`s articles. Never overlook to read through the outline.

- Step 3. Should you be unhappy with the kind, utilize the Research field on top of the display screen to discover other variations in the authorized kind template.

- Step 4. Once you have identified the shape you want, click on the Get now key. Choose the prices program you like and include your qualifications to sign up for an account.

- Step 5. Method the purchase. You can utilize your credit card or PayPal account to complete the purchase.

- Step 6. Select the format in the authorized kind and obtain it on your own gadget.

- Step 7. Total, change and print out or indicator the Arizona Management Long Term Incentive Compensation Plan of of SCEcorp.

Every single authorized record template you buy is your own forever. You might have acces to every single kind you saved in your acccount. Click the My Forms section and select a kind to print out or obtain once more.

Remain competitive and obtain, and print out the Arizona Management Long Term Incentive Compensation Plan of of SCEcorp with US Legal Forms. There are thousands of skilled and express-specific forms you can utilize for your business or person requires.

Form popularity

FAQ

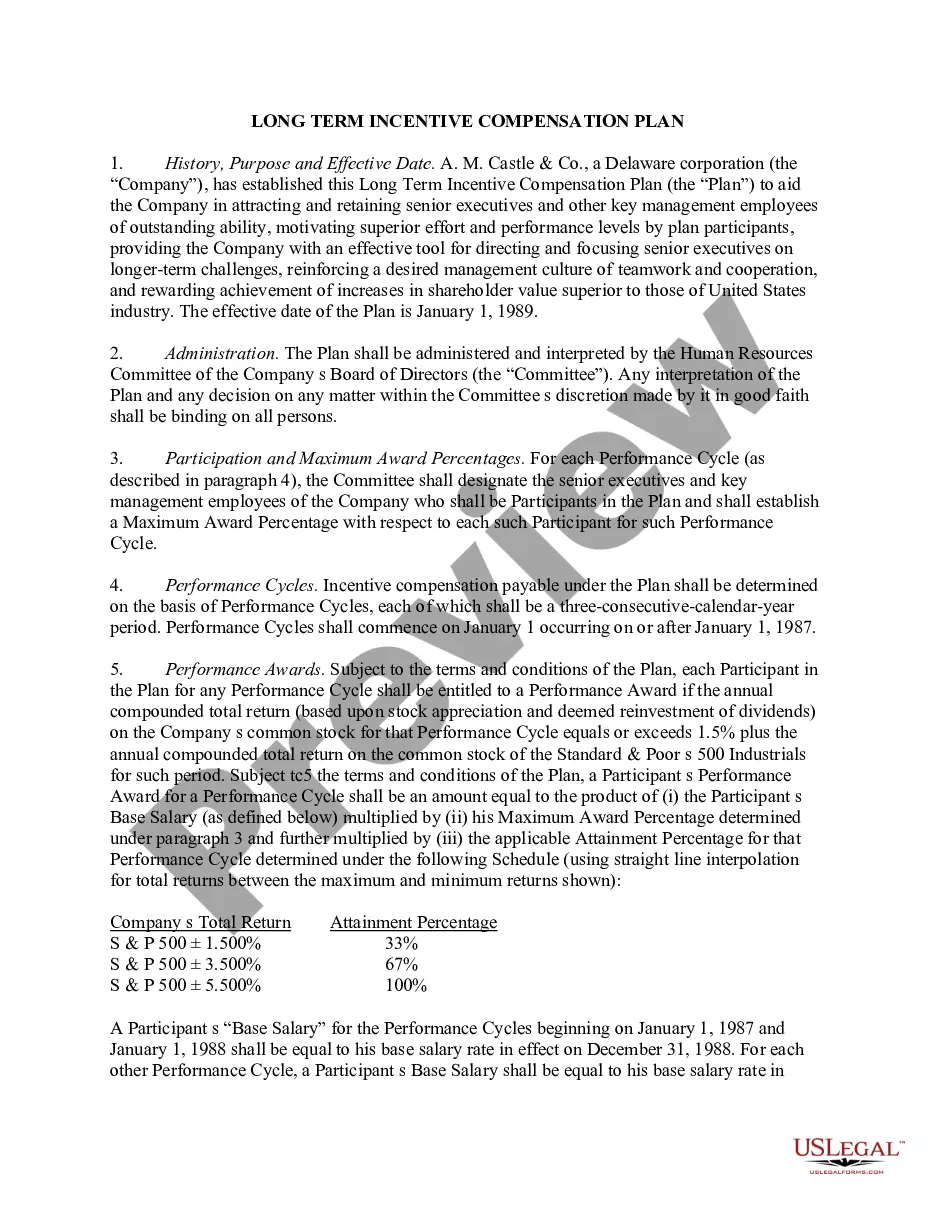

Multiply total sales by total bonus percentage. For example, you make $10,000 in sales, and your company offers you a 5% commission. ... $10,000 x .05 = $500. One employee makes $50,000 per year, and the bonus percentage is 3%. ... $50,000 x .03 = $1,500.

A good example of a monetary incentive is a sales-based incentive. Sales-based incentive compensation is ideal for employees who are responsible for talking to customers and closing sales. Employers often structure these incentive plans as a percentage, like 5% of all the deals each sales rep closes.

For example, a manager agrees to give everyone working on a certain marketing account a $500 bonus if they can complete all deliverables and get client approval by the end of the week.

It involves paying the employee a percentage of the profit (s)he generates. This variable compensation model is used to reward an employee's contribution to overall earnings. Commission is rarely capped and sometimes has an accelerator, at which point the employee receives a higher percentage.

Payout Opportunity A Participant's payout target amount under the Plan is determined by pay grade as follows: The range of incentive opportunity for a Plan Participant is 0% to 200% of the Participant's total value target. This means the maximum payout that a Participant can receive from this Plan is 200%.

For example, the employer may offer health insurance, dental insurance, life insurance, short- and long-term disability insurance and vision insurance. Employee retirement plans, like 401(k) plans, are another common form of indirect compensation. Equity-based programs are another compensation offering.

Incentive compensation management is the strategic use of incentives to drive better business outcomes and more closely align sales rep behavior with the organization's goals. Incentives can be structured in multiple ways, including straight commissions, bonuses, prizes, ?spiffs,? awards, and recognition.

term incentive plan (LTIP or LTI plan) is a deferred compensation strategy to attract, reward and motivate your employees, while also helping your company to retain valued talent and grow. LTIP prevalence: 98% of public companies provide LTIPs while 63% of private companies offer LTIPs. ( Source: SHRM)

Incentive pay is a type of wage or salary payment that is made to employees in addition to their normal wages or salaries. Incentive pay is designed to motivate employees to work harder or to achieve specific goals. It can take the form of individual bonuses, group bonuses, or profit sharing payments.

An annual incentive plan outlines compensation to be paid to employees when they achieve certain performance-related goals over 12 months. This compensation is in addition to their regular salary ? it may be an employee gift, cash incentive, or another type of bonus or reward.