Arizona Order Confirming Chapter 12 Plan - B 230A

Description

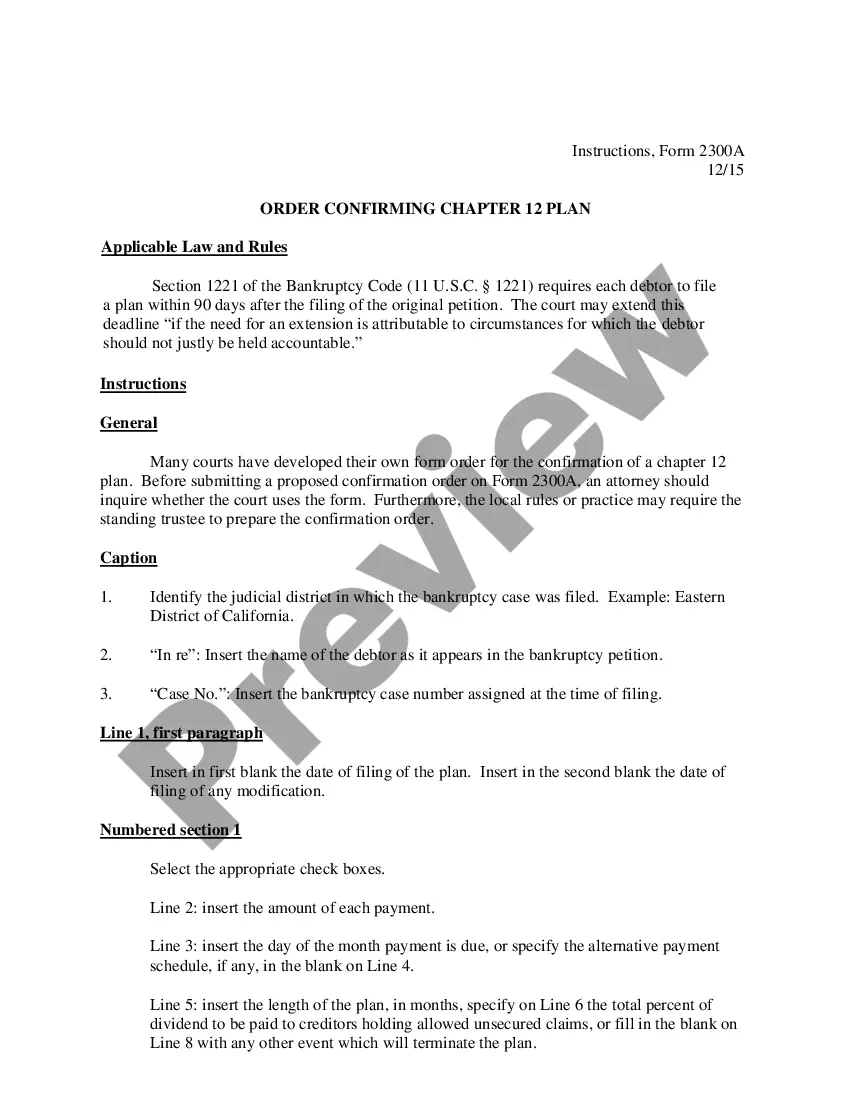

How to fill out Order Confirming Chapter 12 Plan - B 230A?

Are you in a position that you need to have papers for both company or person uses virtually every day time? There are tons of legitimate record layouts available online, but locating types you can rely on is not simple. US Legal Forms delivers a huge number of form layouts, like the Arizona Order Confirming Chapter 12 Plan - B 230A, which are created in order to meet state and federal specifications.

When you are presently informed about US Legal Forms website and have your account, basically log in. After that, you are able to obtain the Arizona Order Confirming Chapter 12 Plan - B 230A format.

Should you not provide an account and wish to begin to use US Legal Forms, follow these steps:

- Get the form you want and make sure it is for your appropriate town/county.

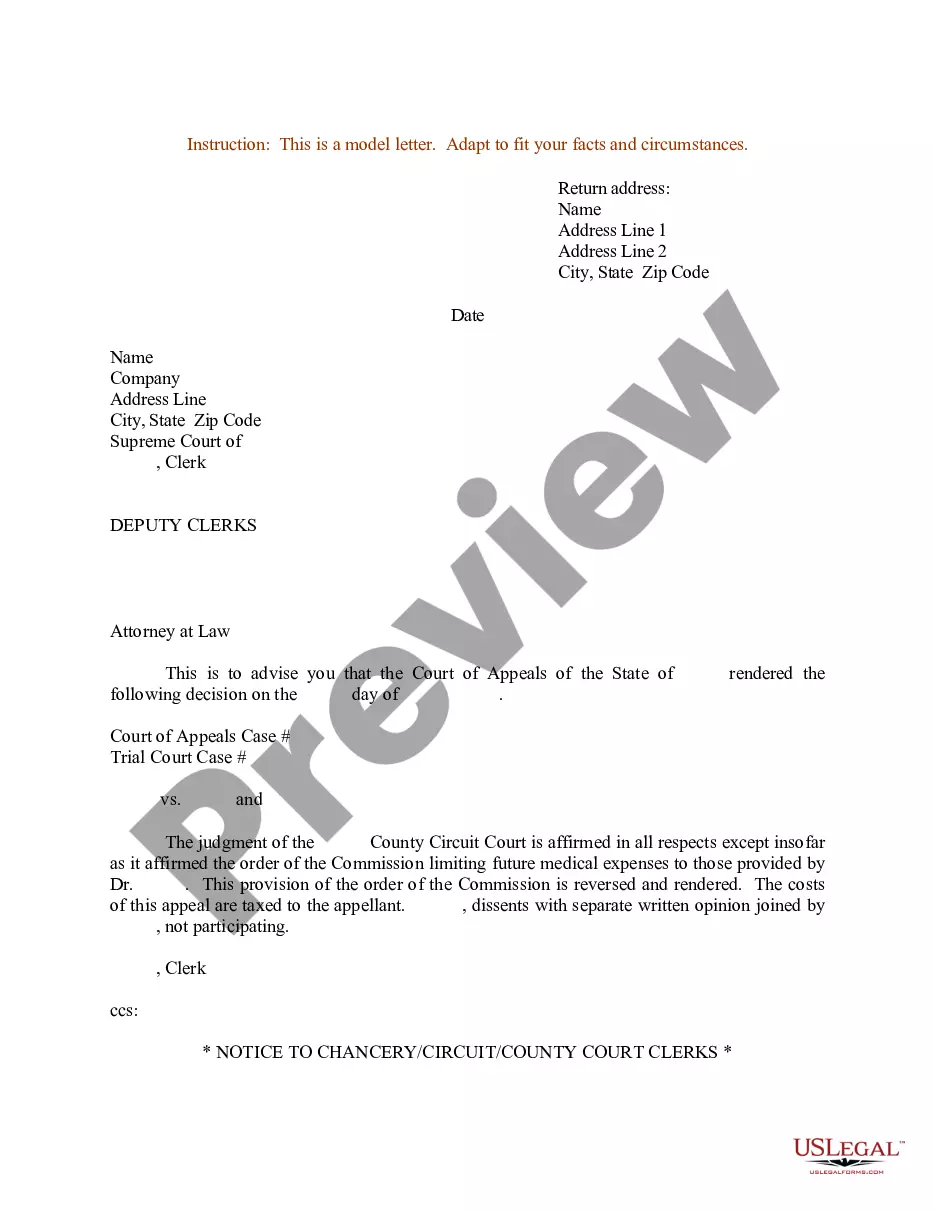

- Take advantage of the Review button to examine the shape.

- Browse the explanation to ensure that you have selected the correct form.

- In case the form is not what you`re searching for, use the Search area to discover the form that meets your requirements and specifications.

- When you find the appropriate form, just click Acquire now.

- Select the costs prepare you would like, fill out the specified information to produce your money, and pay for the transaction with your PayPal or charge card.

- Pick a practical document file format and obtain your version.

Get all of the record layouts you possess purchased in the My Forms menu. You can get a extra version of Arizona Order Confirming Chapter 12 Plan - B 230A whenever, if necessary. Just click the necessary form to obtain or produce the record format.

Use US Legal Forms, one of the most extensive collection of legitimate types, to save some time and stay away from blunders. The assistance delivers skillfully manufactured legitimate record layouts that can be used for an array of uses. Generate your account on US Legal Forms and initiate producing your lifestyle easier.

Form popularity

FAQ

Crammed down refers to an investor or creditor being forced to accept undesirable terms. Crammed down is mainly used to describe either a dilutive venture capital (VC) financing round or the imposition of a bankruptcy reorganization plan by the court.

Chapter 7 bankruptcy works well for low-income debtors with little or no assets or those who can protect all household belongings. If you don't have any assets to sell, creditors receive nothing.

The individual or individual and spouse must be engaged in a farming operation or a commercial fishing operation. The total debts (secured and unsecured) must not exceed $11,097,350 (if a family farmer) or $2,268,550 (if a family fisherman).

Meaning of cram something down in English to eat a lot of something quickly: I just had time to cram down a few biscuits before we left. Eating.

A cramdown is the imposition of a bankruptcy reorganization plan by a court despite any objections by certain classes of creditors. A cramdown is often utilized as a part of the Chapter 13 bankruptcy filing and involves the debtor changing the terms of a contract with a creditor with the help of the court.

One of the primary purposes of bankruptcy is to discharge certain debts to give an honest individual debtor a "fresh start." The debtor has no liability for discharged debts. In a chapter 7 case, however, a discharge is only available to individual debtors, not to partnerships or corporations.

The cram down effect provides that the court may approve a rehabilitation plan over the opposition of creditors, holding a majority of the total liabilities of the debtor if, in its judgment, the rehabilitation of the debtor is feasible and the opposition of the creditors is manifestly unreasonable. (

"Cram down" simply means the process by which the bankruptcy court can, as part of the confirmation of a Chapter 12 Bankruptcy Plan, force treatment upon an objecting creditor, provided the Plan otherwise meets all of the other confirmation criteria under Section 1225 of the Bankruptcy Code.