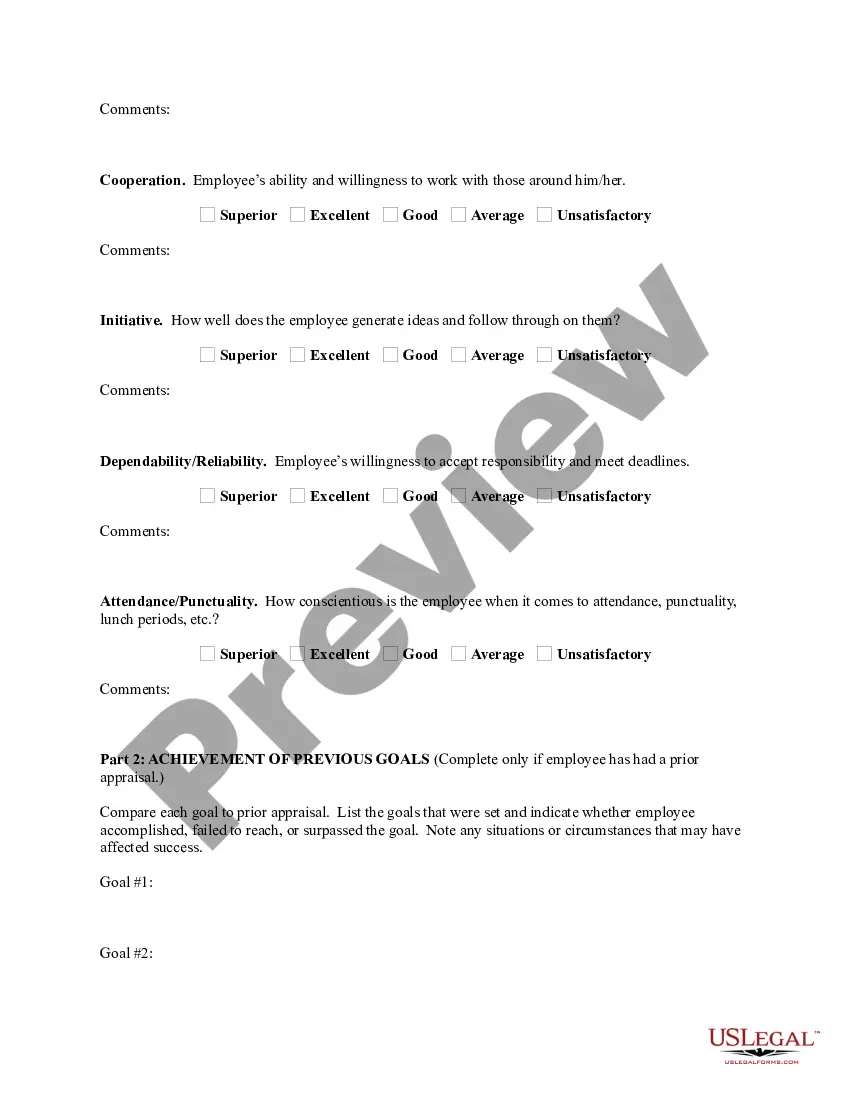

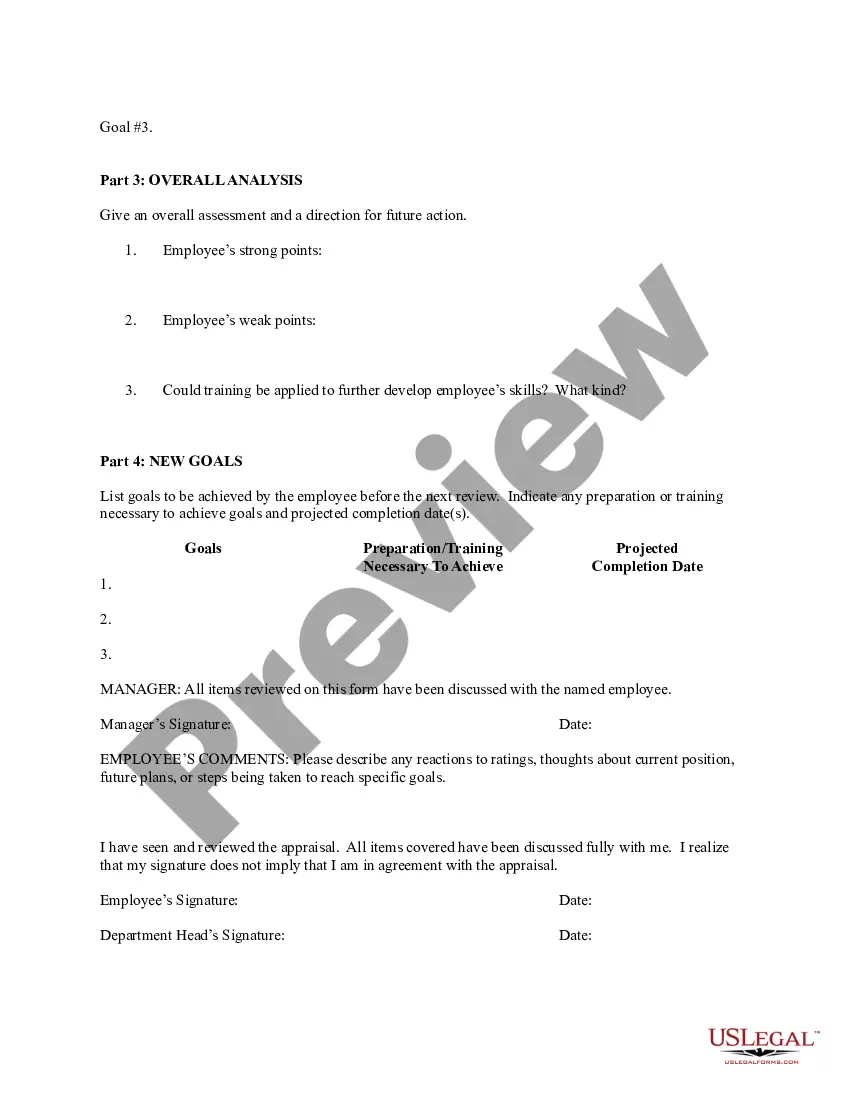

Arizona Performance Evaluation for Nonexempt Employees

Description

How to fill out Performance Evaluation For Nonexempt Employees?

You can invest several hours online trying to locate the legal document template that meets the state and federal requirements you need.

US Legal Forms offers thousands of legal forms that have been reviewed by professionals.

You can easily download or print the Arizona Performance Evaluation for Nonexempt Employees from the platform.

If available, utilize the Review button to look through the document template as well.

- If you possess a US Legal Forms account, you may Log In and click the Acquire button.

- Thereafter, you may complete, edit, print, or sign the Arizona Performance Evaluation for Nonexempt Employees.

- Each legal document template you purchase is yours permanently.

- To obtain another copy of a bought form, navigate to the My documents tab and click the relevant button.

- If this is your first time using the US Legal Forms website, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the state/city of your choice.

- Review the form outline to confirm you have chosen the right form.

Form popularity

FAQ

10 Easy Ways to Evaluate an Employee's PerformanceLevel of execution.Quality of work.Level of creativity.Amount of consistent improvement.Customer and peer feedback.Sales revenue generated.Responsiveness to feedback.Ability to take ownership.More items...

Why Employers Use Employee Evaluations Regular employee evaluation helps remind workers what their managers expect in the workplace. They provide employers with information to use when making employment decisions, such as promotions, pay raises, and layoffs.

In an employee performance review, managers evaluate that individual's overall performance, identify their strengths and weaknesses, offer feedback, and help them set goals. Employees typically have the opportunity to ask questions and share feedback with their manager as well.

Nonexempt vs. Exempt employees are paid on a salary basis and are excluded from overtime payment. Nonexempt employees who are paid hourly must report hours worked and are paid overtime for each hour worked over 40 hours per week.

An exempt employee is not entitled to overtime pay according to the Fair Labor Standards Act (FLSA). To be exempt, you must earn a minimum of $684 per week in the form of a salary. Non-exempt employees must be paid overtime and are protected by FLSA regulations.

An employer must thereafter evaluate the productivity of each worker with a disability who is paid an hourly commensurate wage rate at least every 6 months, or whenever there is a change in the methods or materials used or the worker changes jobs.

Exempt employees must be paid at least $23,600 per year, receive a salary, and they must perform certain exempt job duties. If an employee fails to meet any of these criteria, they must be paid overtime pay even though they are on salary.

As a general rule, most companies conduct performance reviews every 3-6 months. This keeps employees' focused and motivated, and ensures feedback is relevant and timely.

Exempt employees' salary may fall below the minimum wage if they work enough hours and their salary is near the current $23,660, and this is legal (they are exempt). Non-exempt employees must be paid at least the minimum wage for all hours worked.

Nonexempt: An individual who is not exempt from the overtime provisions of the FLSA and is therefore entitled to overtime pay for all hours worked beyond 40 in a workweek (as well as any state overtime provisions). Nonexempt employees may be paid on a salary, hourly or other basis.