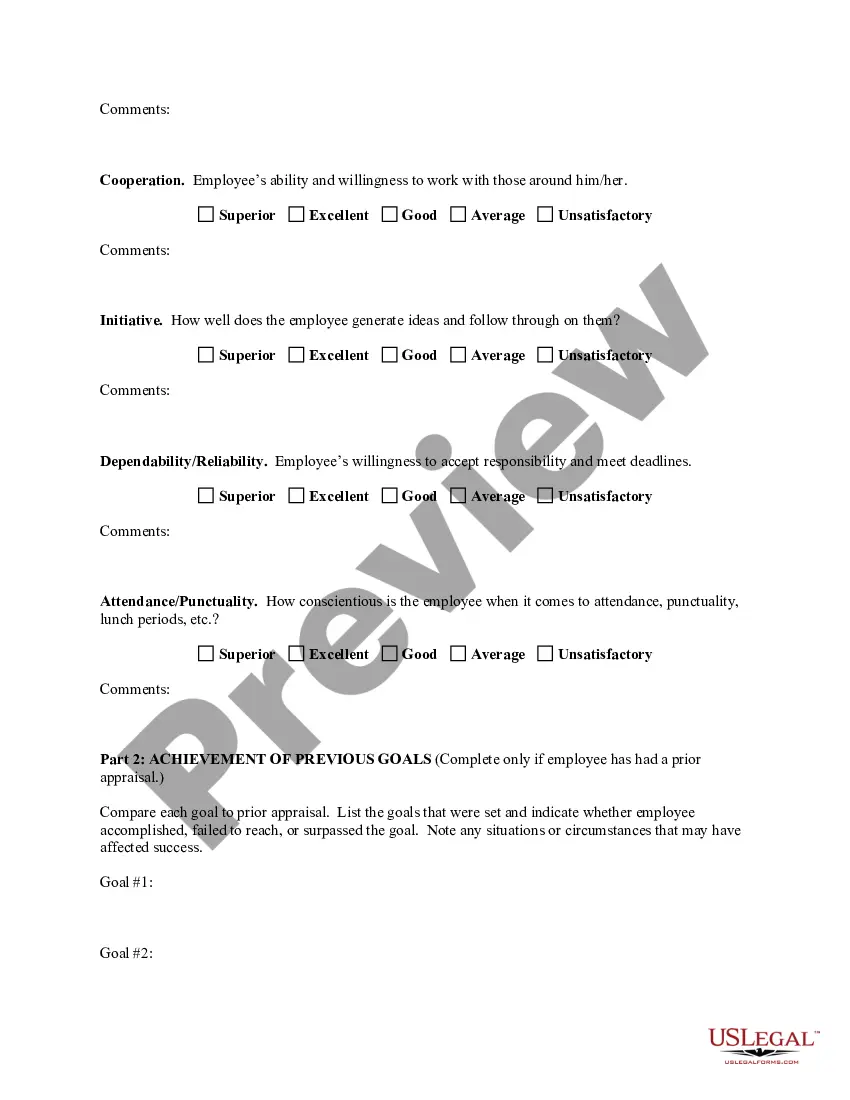

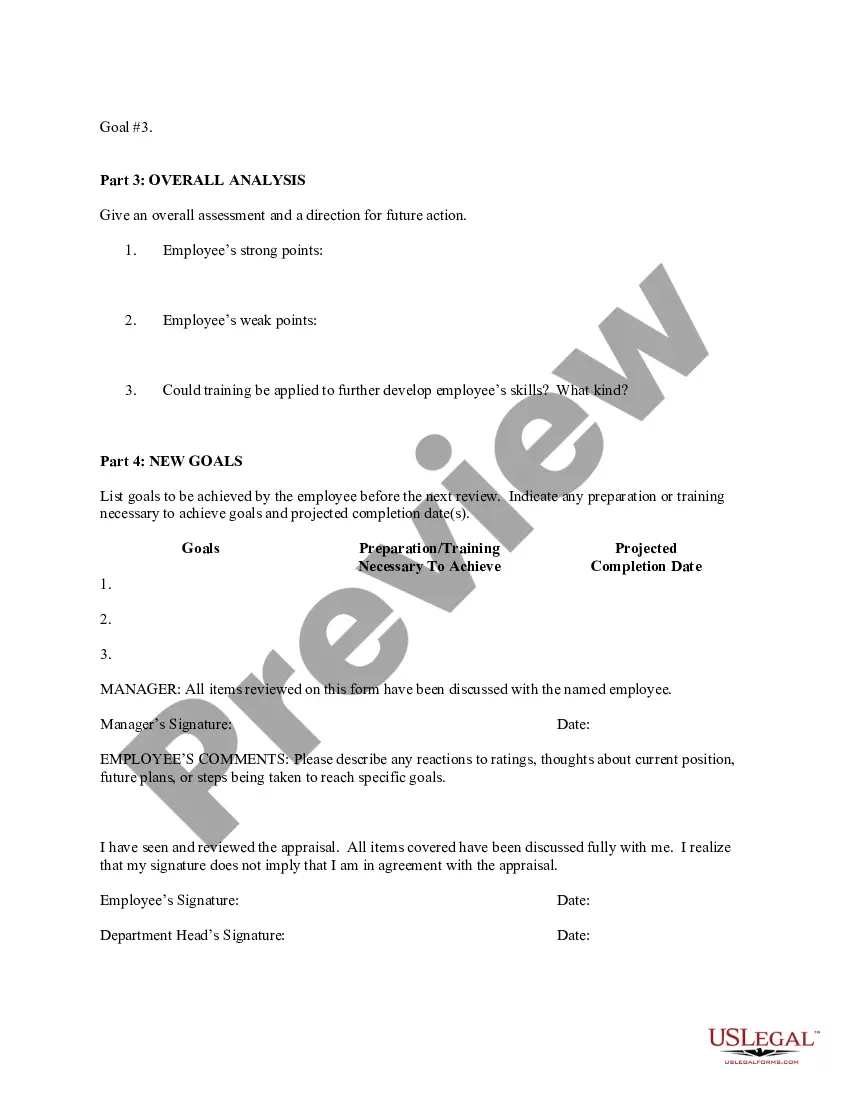

Arizona Employee Evaluation Form for Accountant

Description

How to fill out Employee Evaluation Form For Accountant?

Selecting the appropriate legal document template can be a challenge. Naturally, there are numerous formats available online, but how will you find the legal form you require.

Utilize the US Legal Forms website. The platform provides an extensive array of templates, including the Arizona Employee Evaluation Form for Accountant, which you can utilize for business and personal purposes.

All of the forms are reviewed by professionals and comply with federal and state regulations.

If the form does not meet your requirements, make use of the Search field to find the appropriate form. Once you are certain that the form is suitable, click the Get now button to retrieve the form. Choose the pricing plan you prefer and input the required details. Create your account and complete your order using your PayPal account or credit card. Select the document format and download the legal document template to your device. Finally, complete, modify, print, and sign the finalized Arizona Employee Evaluation Form for Accountant. US Legal Forms is the largest repository of legal documents where you can find a wide variety of document templates. Utilize the service to obtain professionally crafted papers that comply with state regulations.

- If you are already registered, Log In to your account and click the Download button to locate the Arizona Employee Evaluation Form for Accountant.

- Use your account to search for the legal forms you have previously purchased.

- Visit the My documents section of your account and obtain another copy of the document you need.

- If you are a new user of US Legal Forms, here are straightforward steps for you to follow.

- Firstly, ensure you have selected the correct form for your city/region.

- You can review the form using the Review button and check the form details to confirm it is the correct one for you.

Form popularity

FAQ

Here are a few ways to measure and evaluate employee performance data:Graphic rating scales. A typical graphic scale uses sequential numbers, such as 1 to 5, or 1 to 10, to rate an employee's relative performance in specific areas.360-degree feedback.Self-Evaluation.Management by Objectives (MBO).Checklists.

Can I take the CPA exam without an accounting degree? Yep, you can take the CPA exam without an accounting degreethe exam is dependent on much more than that. However, before you get to the exam, you will need to pass through the CPA program.

Here's a step-by-step guide to effectively evaluating employees:Set Performance Standards.Set Specific Goals.Take Notes Throughout the Year.Be Prepared.Be Honest and Specific with Criticism.Don't Compare Employees.Evaluate the Performance, Not the Personality.Have a Conversation.More items...

All 50 states require a bachelor's degree with at least 150 credit hours of coursework to become a licensed CPA. Some states will let you sit for the CPA Exam with 120 hours of study, though you still must complete 150 hours before you can apply for a license (these are called two-tier states).

Arizona CPA licensure requirementsMust complete at least 150 semester hours of education that includes: At least 36 semester hours of non-duplicative accounting courses of which at least 30 semester hours are upper-level courses. At least 30 semester hours are business related courses.

To give you a head start, here are five common performance review methods:Self-Evaluation. A self-evaluation requires an employee to judge his or her own performance against predetermined criteria.Behavioral Checklist.360-Degree Feedback.Management by Objectives.Ratings Scale.

What is the best percentage for Arizona withholding Reddit? Your tax burden is $1,195, or 2.98%. If you want to owe a little bit at the end of the year, pick the 2.7% withholding - you'll owe an additional 0.28% ($112) in April. If you want a little back, pick 3.36% and you'll get 0.38% ($152) back in April.

In an employee performance review, managers evaluate that individual's overall performance, identify their strengths and weaknesses, offer feedback, and help them set goals. Employees typically have the opportunity to ask questions and share feedback with their manager as well.

To keep your withholding the same as last year, choose a withholding percentage of 1.8% (40,000 x . 018 = 720) and withhold an additional $10.77 per biweekly pay period (1,000 - 720 = 280 / 26 = 10.77). Be sure to take into account any amount already withheld for this year.

Evaluating Your Own PerformanceCheck Your Attitude. "Attitude is very important," says employment consultant Rick Waters.Be Reflective.Assess Your Performance Against the Job Specifications.Keep a File.Find out the Supervisor's Expectations.Get Feedback From Others.Be a Team Player.Plan Ahead.