Arizona Work for Hire Addendum - Self-Employed

Description

How to fill out Work For Hire Addendum - Self-Employed?

Locating the appropriate legal document format may be challenging. Clearly, there are numerous templates accessible online, but how can you find the legal form you need? Visit the US Legal Forms website.

The service offers thousands of templates, such as the Arizona Work for Hire Addendum - Self-Employed, suitable for business and personal purposes. All forms are validated by experts and adhere to federal and state regulations.

If you are already registered, Log In to your account and click on the Download button to retrieve the Arizona Work for Hire Addendum - Self-Employed. Use your account to reference the legal forms you have previously purchased. Navigate to the My documents section of your account to obtain another copy of the document you need.

US Legal Forms is the largest library of legal forms where you can find various document templates. Use the service to obtain professionally crafted documents that meet state requirements.

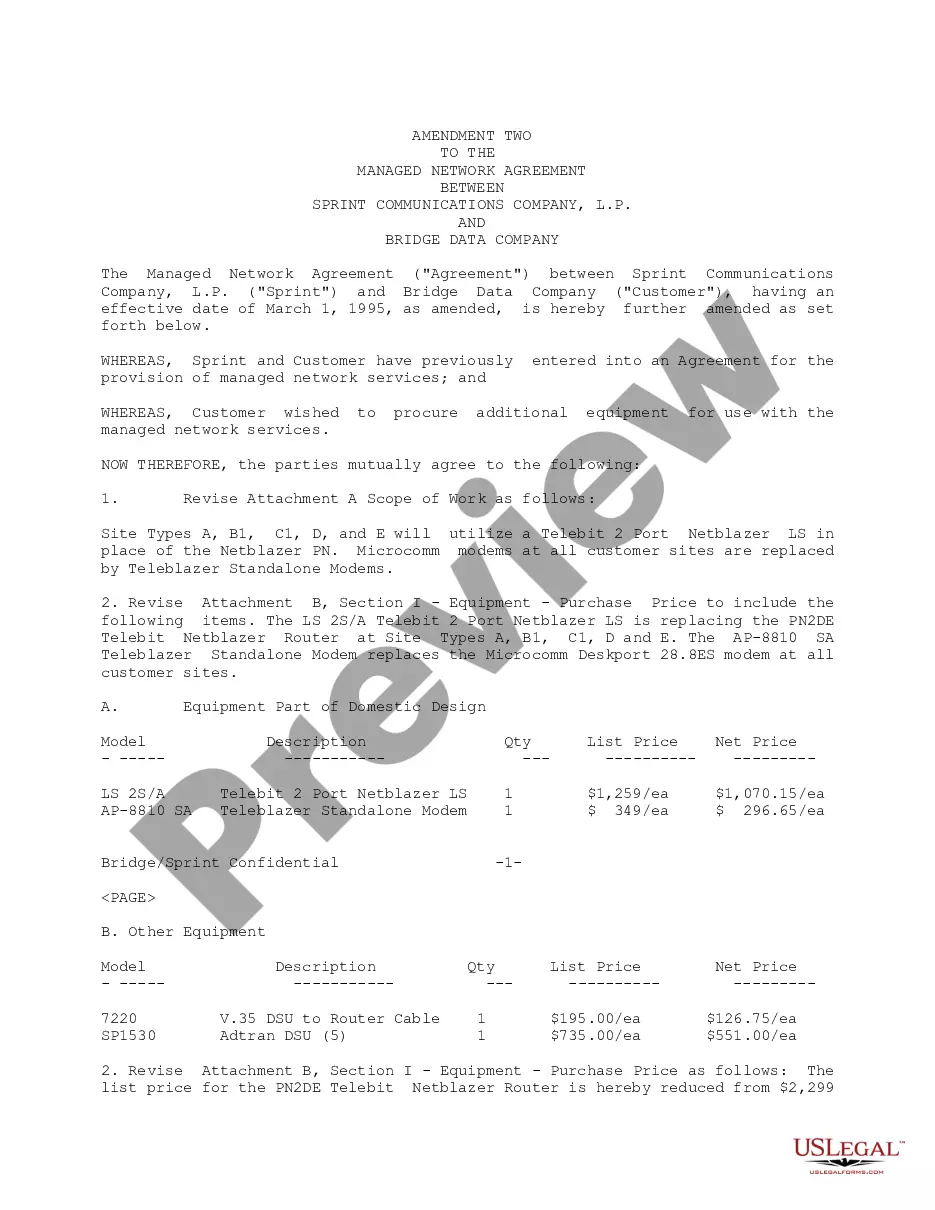

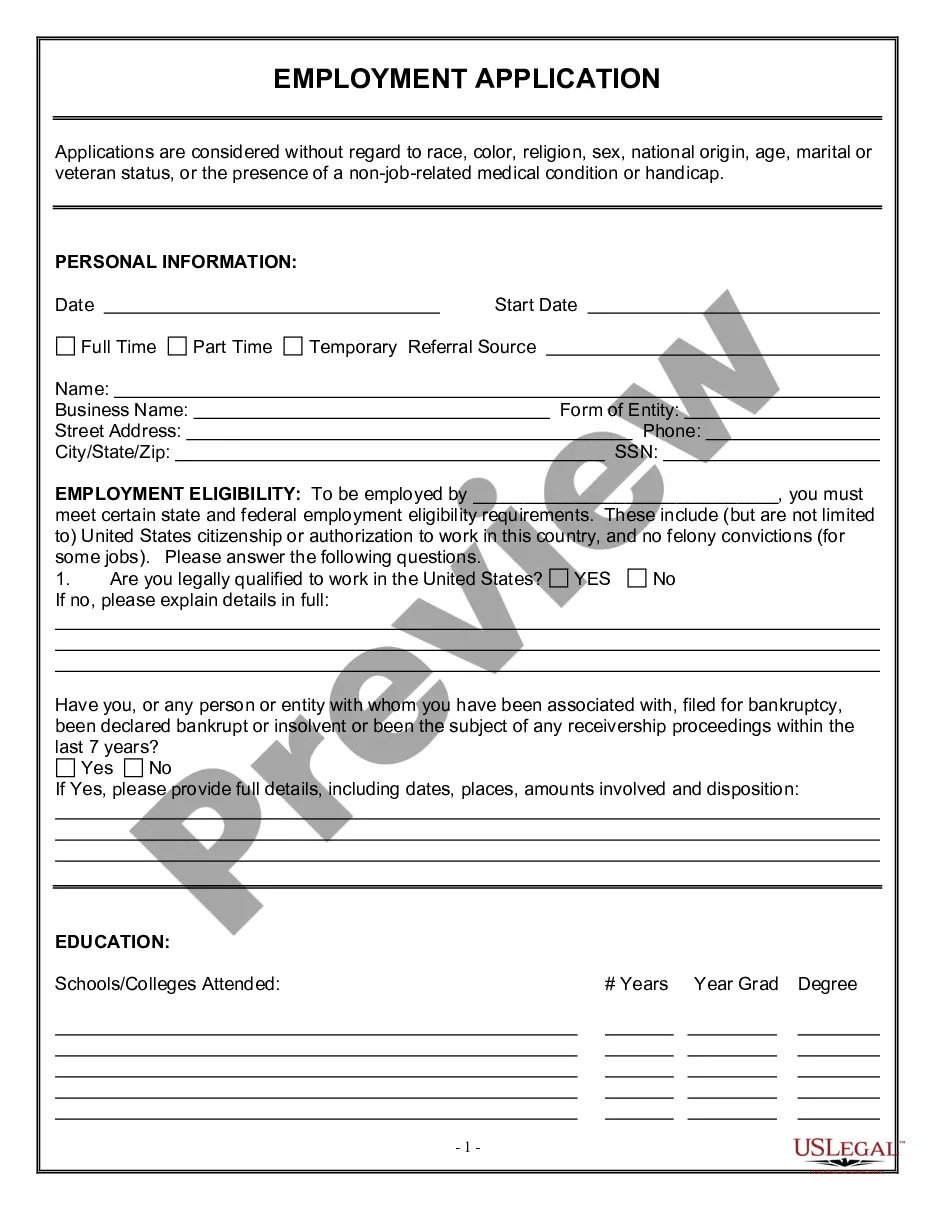

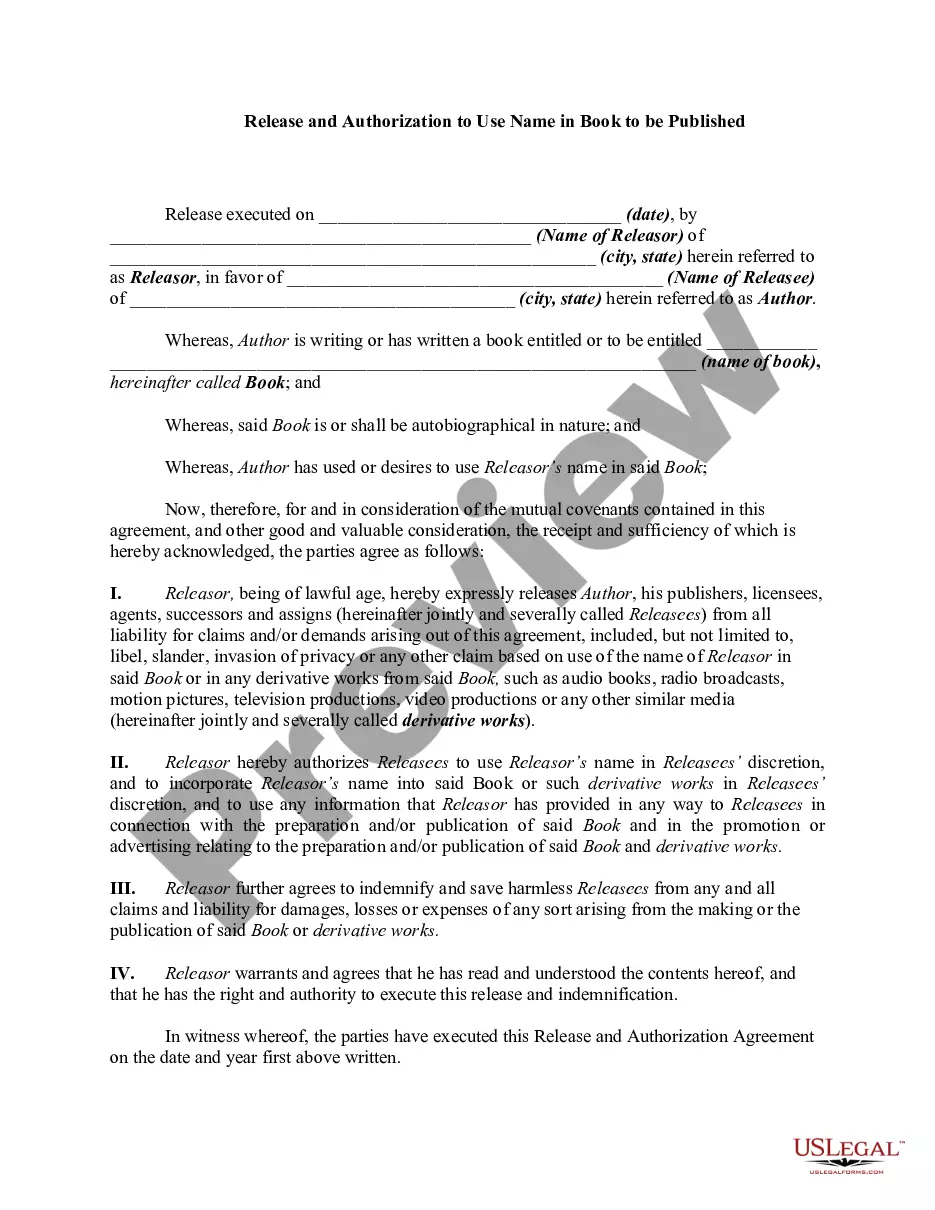

- First, ensure you have selected the correct form for your city/county. You can view the form using the Review button and check the form description to confirm it is indeed the right one for you.

- If the form does not suit your needs, utilize the Search field to find the appropriate form.

- Once you are certain that the form is correct, click the Purchase now button to acquire the form.

- Choose the pricing plan you prefer and input the required details. Create your account and complete the payment for your order using your PayPal account or credit card.

- Select the document format and download the legal document format to your device.

- Complete, modify, print, and sign the downloaded Arizona Work for Hire Addendum - Self-Employed.

Form popularity

FAQ

Retroactive claims can be filed by calling 877-600-2722 or by completing a Weekly Claim form for each week.

Some ways to prove self-employment income include:Annual Tax Return. This is the most credible and straightforward way to demonstrate your income over the last year since it's an official legal document recognized by the IRS.1099 Forms.Bank Statements.Profit/Loss Statements.Self-Employed Pay Stubs.

Acceptable 2019 or 2020 income documents, depending on the year you filed your claim, may include one or more of the following:Federal tax return (IRS Form 1040, Schedule C or F).State tax return (CA Form 540).W-2.Paycheck stubs.Payroll history.Bank receipts.Business records.Contracts.More items...?

In the example shown below, the first week of unemployment on a newly established benefit year is a waiting week . If there are no issues established on your claim, you can expect your first benefit payment (normally after you've filed your second weekly claim) within approximately 10 business days.

Unemployment Insurance BeneficiariesRetroactive $600 per week payments were also issued to eligible claimants who filed weekly certifications back to March 29, 2020. Claims for unemployment benefits due to COVID-19 continue to increase, with a record number of applications, benefits paid and calls received.

As a result, independent contractors have not been eligible to apply for or receive unemployment benefits. Only employees for whom a business has paid Federal and State unemployment taxes have been eligible to receive these benefits.

Retroactive payments will be made for weeks claimed going back to March 29 for individuals receiving UI as well as individuals receiving PUA. You are eligible for FPUC if you receive any of the following benefits: Unemployment Insurance (UI) Unemployment Compensation for Federal Employees (UCFE)

If you applied for PUA in 2020 and are still collecting in 2021, you just need a single document that shows you were working at some point between January 2019 and your application for PUA. It could be pay stubs, tax documents, contracts, business licenses, letters, etc.

The CARES Act created a Pandemic Unemployment Assistance (PUA) program for individuals that are self-employed, contract workers, those ineligible for state unemployment benefits or have exhausted benefits. PUA is available through benefit week ending September 4, 2021 and applications are currently being accepted.

Pay stubs and W-2 forms are commonly used as proof of employment.Your employer may write a verification letter or use an automated verification service to confirm your job title, employment history, and salary information.More items...?