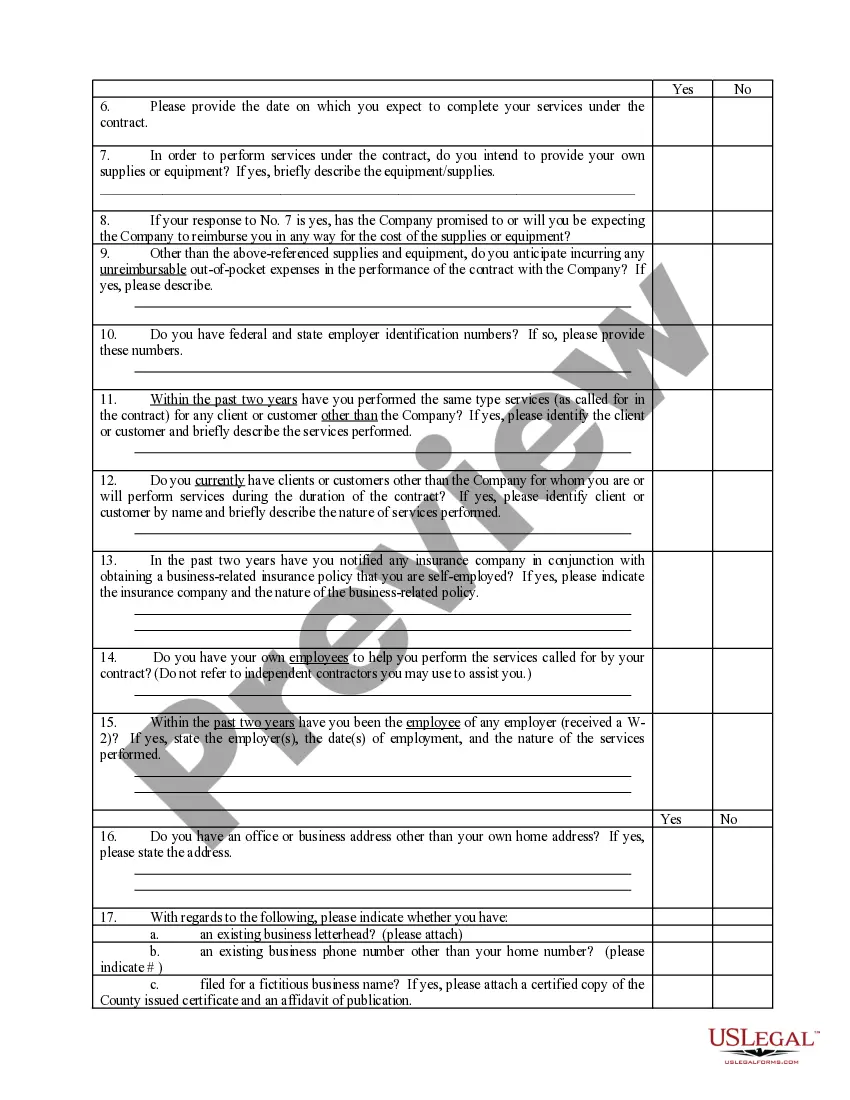

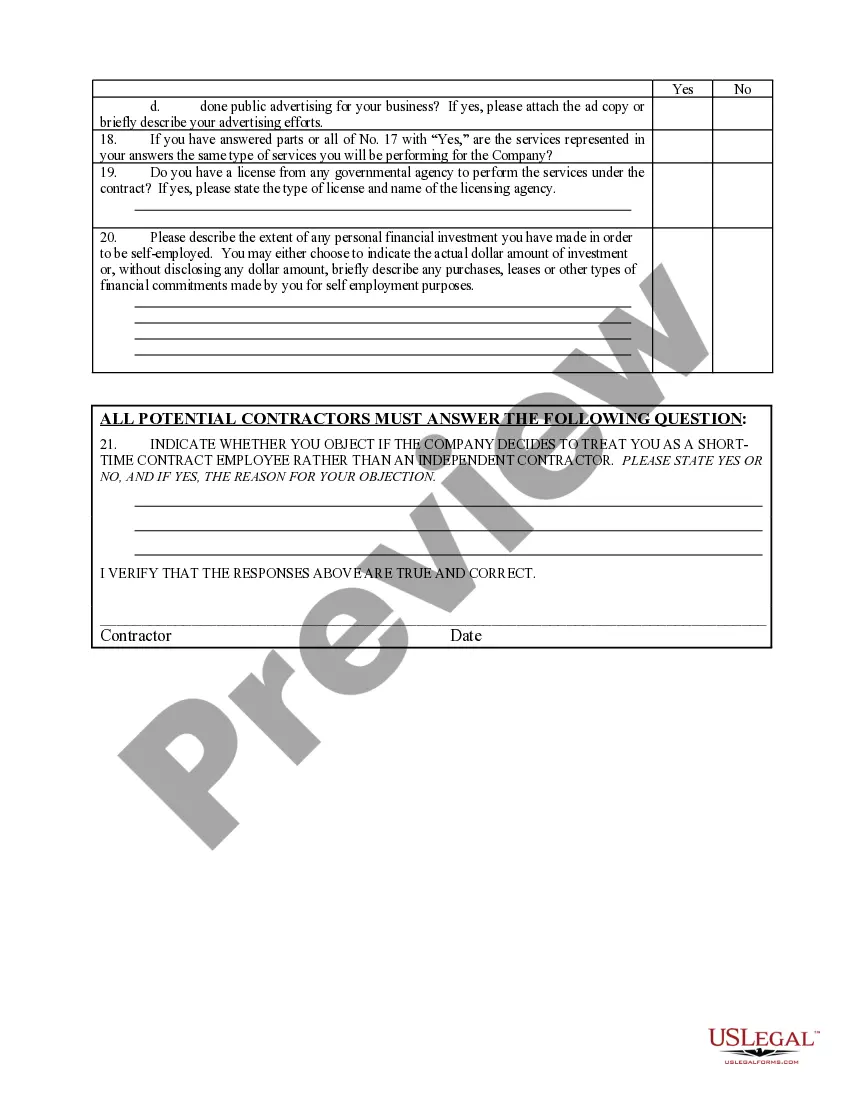

Arizona Self-Employed Independent Contractor Questionnaire

Description

How to fill out Self-Employed Independent Contractor Questionnaire?

You can spend hours online attempting to locate the legal document template that meets both state and federal requirements that you require.

US Legal Forms offers a vast array of legal templates that have been reviewed by professionals.

You can easily download or print the Arizona Self-Employed Independent Contractor Questionnaire from my service.

If you want to find another version of the form, utilize the Search section to locate the template that suits your needs and requirements.

- If you possess a US Legal Forms account, you can sign in and click on the Obtain button.

- Subsequently, you can complete, modify, print, or sign the Arizona Self-Employed Independent Contractor Questionnaire.

- Every legal document template you purchase is yours indefinitely.

- To receive an additional copy of a purchased form, navigate to the My documents section and select the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions below.

- First, ensure you have selected the correct document template for the state/city of your choice.

- Review the form description to confirm that you have chosen the appropriate document.

Form popularity

FAQ

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

The new law allows Arizona employing units and independent contractors to establish their shared intent for the status of their relationship from its inception by permitting employing units to require their independent contractors to execute declarations affirming that their relationship with the business is as an

An independent contractor is defined as an individual who contracts to work for others without having the legal status of an employee. By engaging independent contractors, employers can avoid many of the costs associated with hiring employees.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.

Arizona allows employers to request that individuals classified as independent contractors sign a Declaration of Independent Business Status (DIBS). The execution of a DIBS is not mandatory in order to establish the existence of an independent contractor relationship between a business and an independent contractor.