Arizona Acceptance of Appointment in a Limited Liability Company LLC

Description

How to fill out Acceptance Of Appointment In A Limited Liability Company LLC?

It is possible to devote time on-line searching for the authorized record web template which fits the federal and state requirements you require. US Legal Forms offers 1000s of authorized forms that happen to be evaluated by pros. It is simple to obtain or print out the Arizona Acceptance of Appointment in a Limited Liability Company LLC from my assistance.

If you currently have a US Legal Forms accounts, you can log in and click the Acquire key. Afterward, you can complete, edit, print out, or signal the Arizona Acceptance of Appointment in a Limited Liability Company LLC. Each and every authorized record web template you acquire is your own property forever. To obtain an additional copy of any purchased develop, go to the My Forms tab and click the corresponding key.

Should you use the US Legal Forms web site initially, keep to the basic directions below:

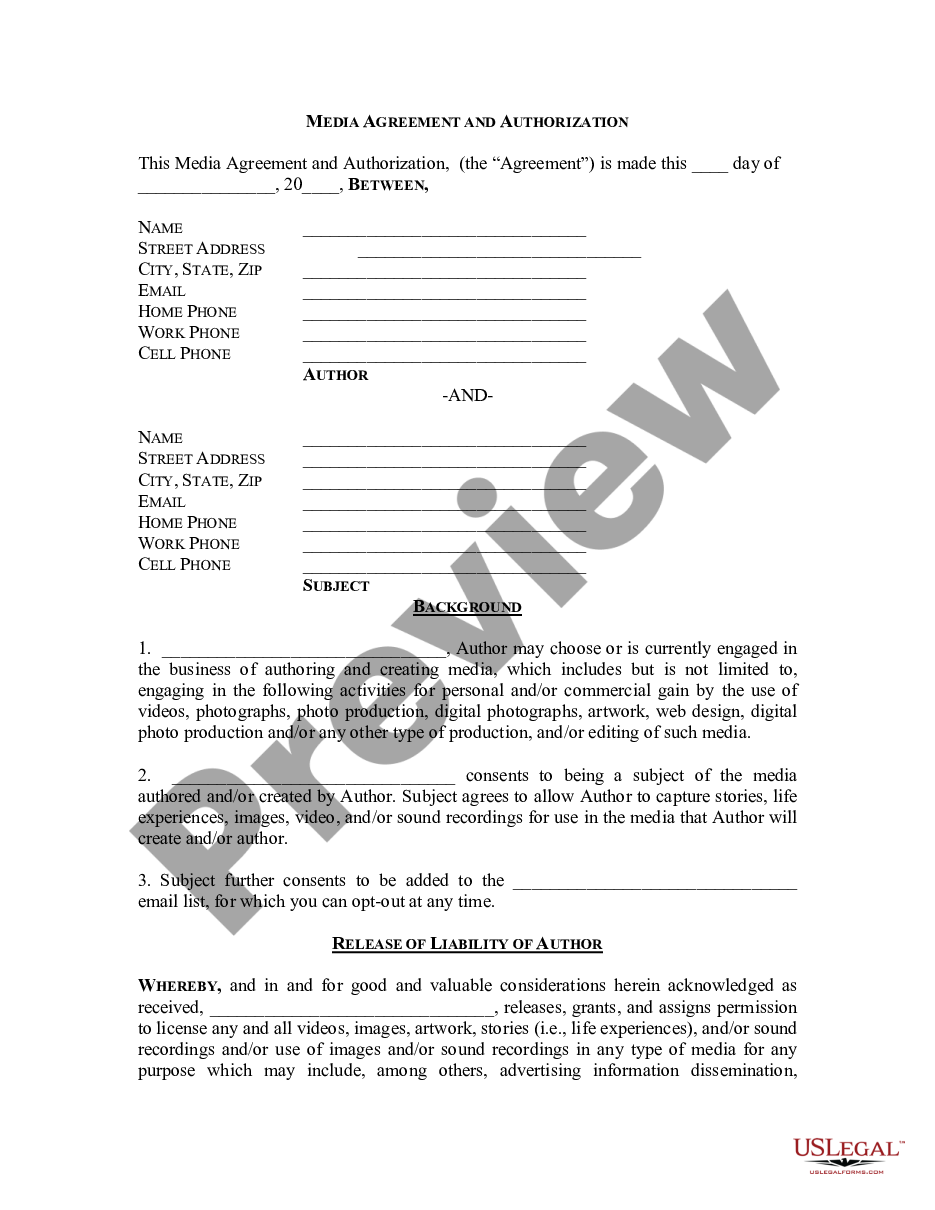

- First, be sure that you have chosen the correct record web template for that region/city that you pick. Read the develop information to ensure you have selected the appropriate develop. If readily available, make use of the Review key to search through the record web template at the same time.

- If you wish to locate an additional edition in the develop, make use of the Lookup area to get the web template that fits your needs and requirements.

- After you have identified the web template you desire, simply click Get now to proceed.

- Pick the prices strategy you desire, type in your references, and register for a free account on US Legal Forms.

- Total the transaction. You may use your credit card or PayPal accounts to fund the authorized develop.

- Pick the structure in the record and obtain it to your gadget.

- Make adjustments to your record if required. It is possible to complete, edit and signal and print out Arizona Acceptance of Appointment in a Limited Liability Company LLC.

Acquire and print out 1000s of record web templates utilizing the US Legal Forms web site, which provides the biggest selection of authorized forms. Use expert and state-particular web templates to deal with your organization or person requirements.

Form popularity

FAQ

Yes, as long as you're okay with sharing your name and address on the public record, you can be your own registered agent in Arizona. You'll have to maintain regular business hours to accept service of process in person.

Though processing times vary depending on the number of pending applications, it generally takes a little under two months to process an LLC registration in Arizona. Most applicants report the process takes 50 ? 55 days. If time is of the essence, you can pay an additional fee for expedited processing.

Checking Arizona LLC Status After filing Articles of Organization to form a new LLC, you can check to see whether these documents have been approved and/or verify that your business information is listed correctly by searching for your business name on the Arizona Corporation Commission's (ACC) database.

Arizona requires LLCs to publish notice of the incorporation within 60 days of incorporation in a publication (i.e. newspaper) in the known place of business for three consecutive publications.

If an LLC doesn't fulfill the publication requirements, the company's authority to do business in New York can be suspended. The costs of publication vary widely from county to county, ranging from around $300 in some upstate counties to over $1,600 in New York County (Manhattan).

Name your Arizona LLC. ... Choose your statutory agent. ... Prepare and file articles of organization. ... Receive a certificate from the state. ... Create an operating agreement. ... Complete publication requirements. ... Get an Employer Identification Number.

Do LLCs have to file annual reports? No, LLCs are not required to file annual reports. Pursuant to Arizona law, only Corporations are required to file annual reports, on or before their prescribed due date.

States that require newspaper publication for DBAs: California. Georgia. Florida.