Arizona Credit Approval Form

Description

How to fill out Credit Approval Form?

If you require exhaustive, acquire, or producing legal document templates, utilize US Legal Forms, the largest assortment of legal forms available online.

Utilize the site's straightforward and user-friendly search to find the documents you require.

Various templates for business and personal purposes are organized by categories and jurisdictions, or keywords.

Step 4. After you have found the form you need, click the Download now button. Choose the pricing plan that suits you and provide your information to create an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Utilize US Legal Forms to locate the Arizona Credit Approval Form in just a few clicks.

- If you are currently a US Legal Forms user, Log In to your account and click the Download button to acquire the Arizona Credit Approval Form.

- You can also access forms you have previously obtained from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Make sure you have selected the form for the correct city/state.

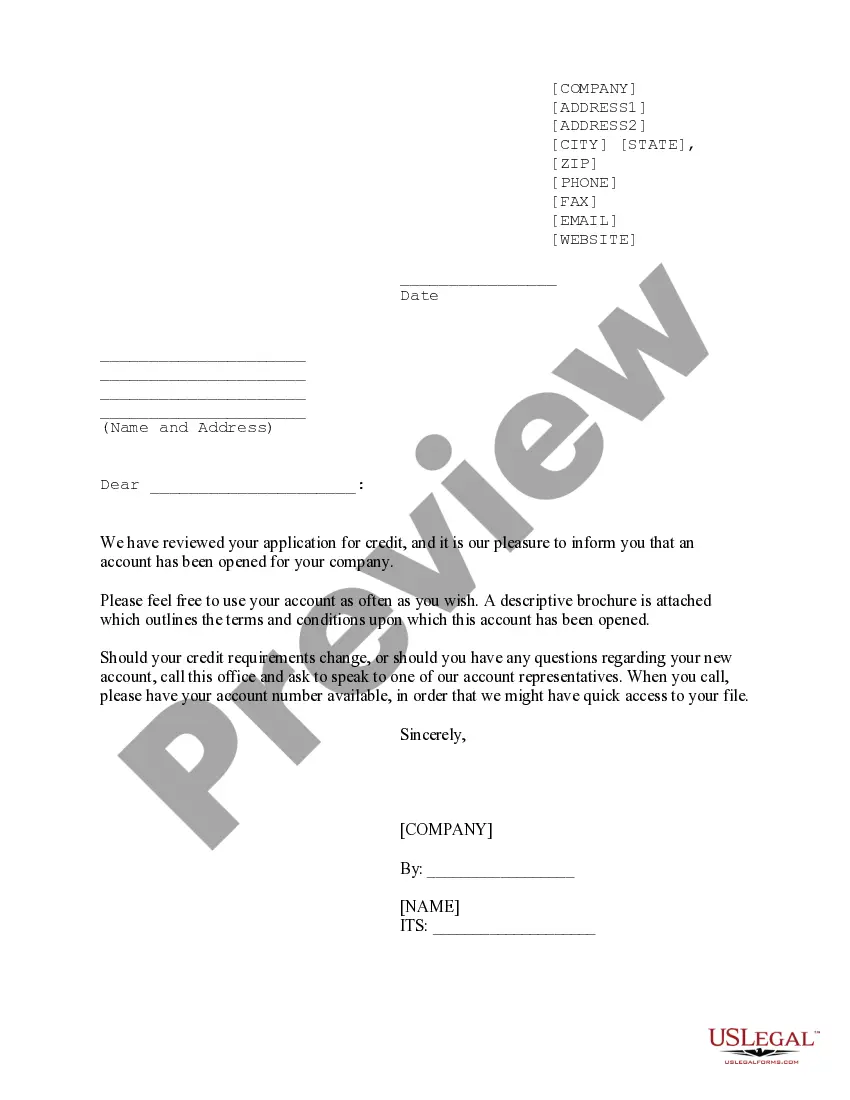

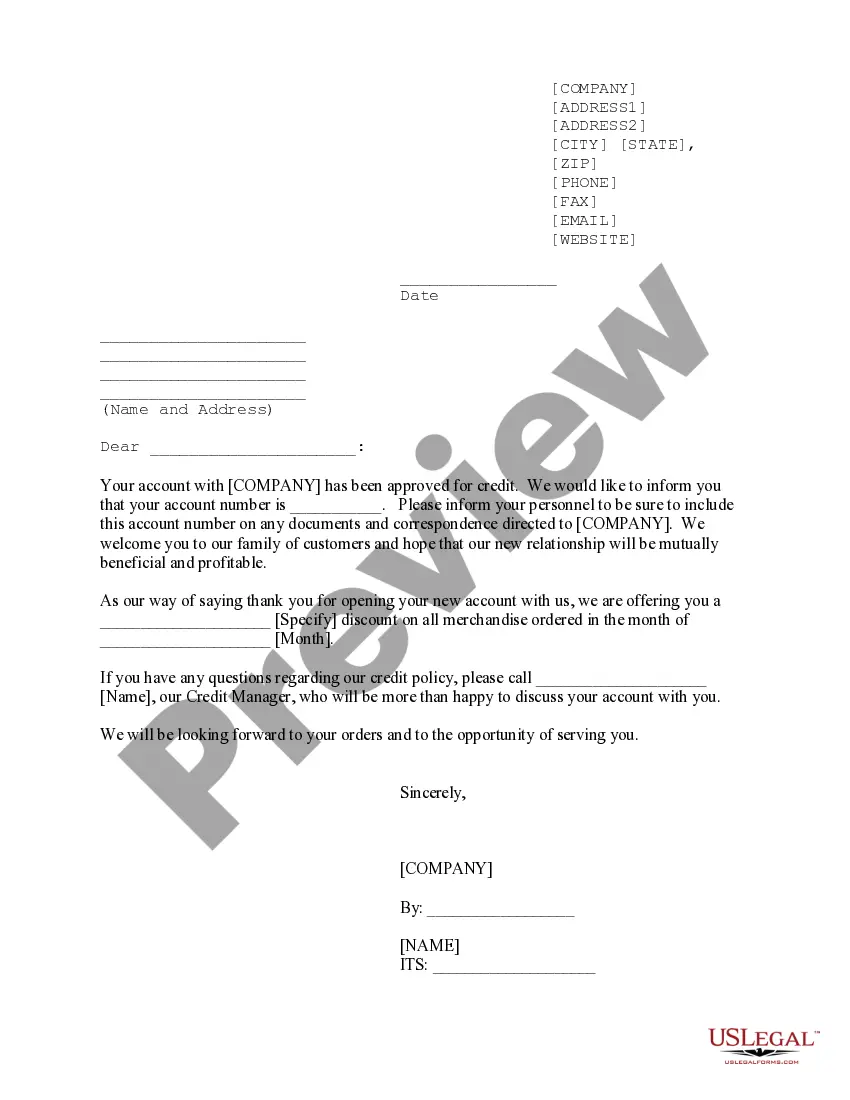

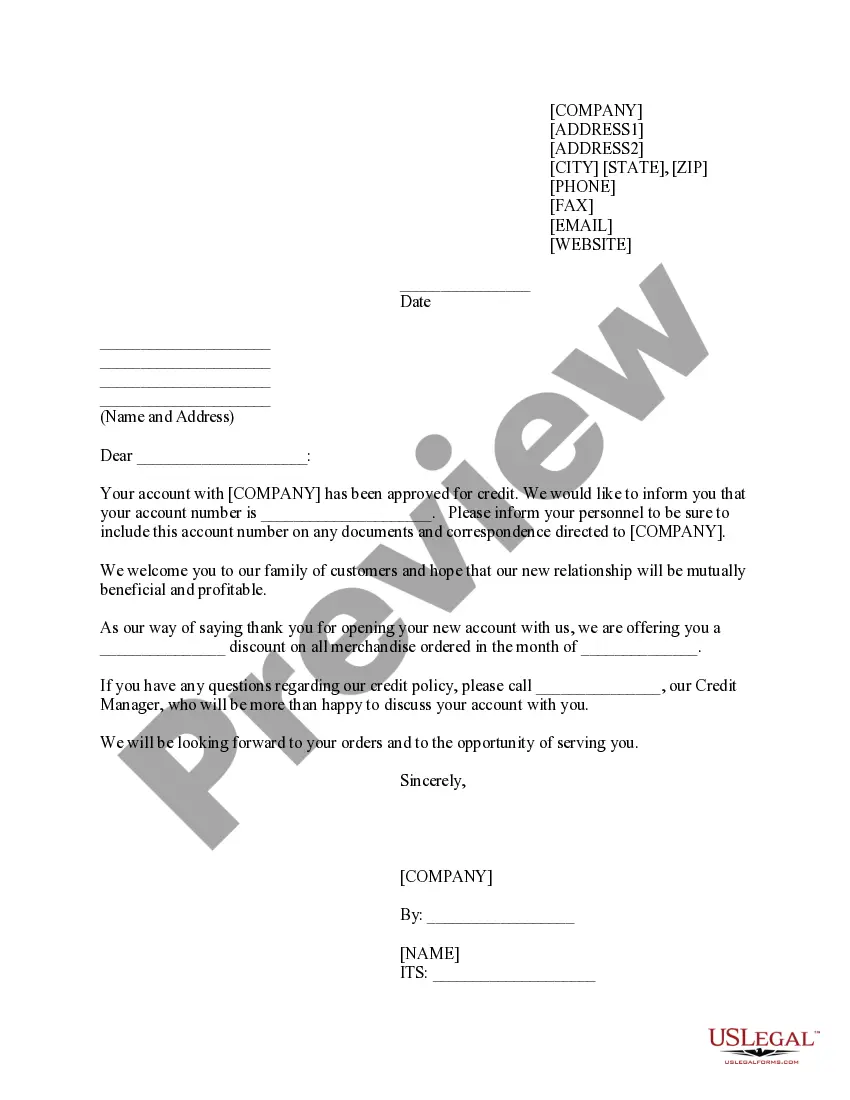

- Step 2. Use the Preview option to review the form's content. Be sure to read the details.

- Step 3. If you are dissatisfied with the document, take advantage of the Search area at the top of the screen to find other variations of the legal form template.

Form popularity

FAQ

Form 140 - Resident Personal Income Tax Form -- Calculating Personal income tax return filed by resident taxpayers. You may file Form 140 only if you (and your spouse, if married filing a joint return) are full year residents of Arizona.

The Arizona Private School Tuition Tax Credit allows Arizona taxpayers to give to AZTO and receive a dollar-for-dollar tax credit against your Arizona Income Taxes. AZTO then issues tuition awards to eligible students attending one of AZTO's participating schools.

The only change for the 2021 tax credit was a small increase to the private school donation limits. Qualifying Charitable Organization (QCO) Tax Credit. The QCO, formerly known as the Charitable Tax Credit, single or head-of-household credit is up to $400; for those filing jointly, it is up to $800.

In the state of Arizona, full-year resident or part-year resident individuals must file a tax return if they are: Single or married filing separately and gross income (GI) is greater than $12,550; Head of household and GI is greater than $18,800; or. Married and filing jointly and GI is greater than $25,100.

Simply put, the Arizona dollar for dollar tax program repays you, dollar for dollar, on the money you donate to qualifying Arizona charities. If you donate $400 to a qualifying state charity, the state of Arizona takes that $400 off your final state tax bill.

If you do not owe Arizona income taxes by the tax deadline of April 18, 2022, you do not have to prepare and file a AZ tax extension. In case you expect a AZ tax refund, you will need to file or e-File your AZ tax return in order to receive your tax refund money.

The Arizona Tax Credit reduces your Arizona state tax liability independently from any tax that you may have withheld during the year. If you withheld an amount equal to or greater than your tax liability, the credit will increase your state tax refund. And, you may carry the credit forward for five consecutive years.

$20,000 or less in the case of a married couple filing a joint return with not more than one dependent or a single person who is a head of a household with not more than one dependent.$23,600 or less in the case of a married couple filing a joint return with two dependents.More items...

Tax Credit Amount First year: $3,000 per net new qualified employment position created during the taxable year or partial year of employment. Second year: $3,000 per qualified employment position, employed for the second full taxable year of continuous employment.