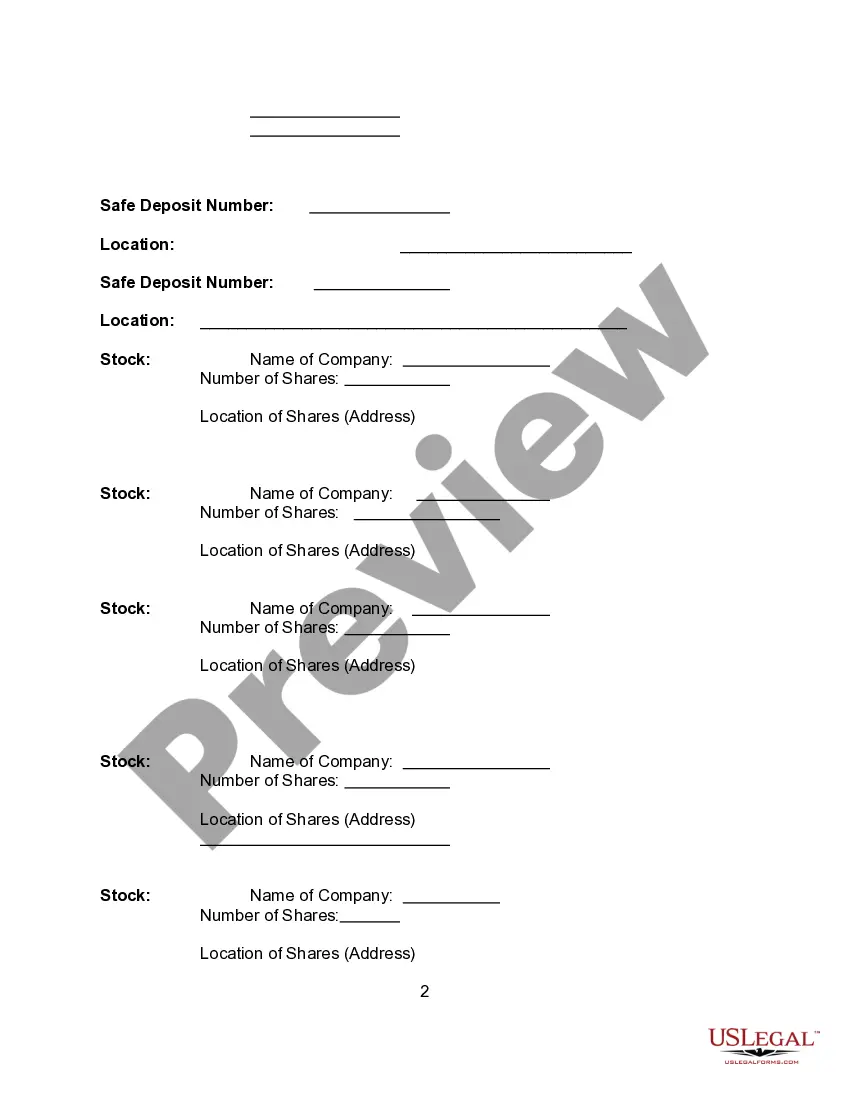

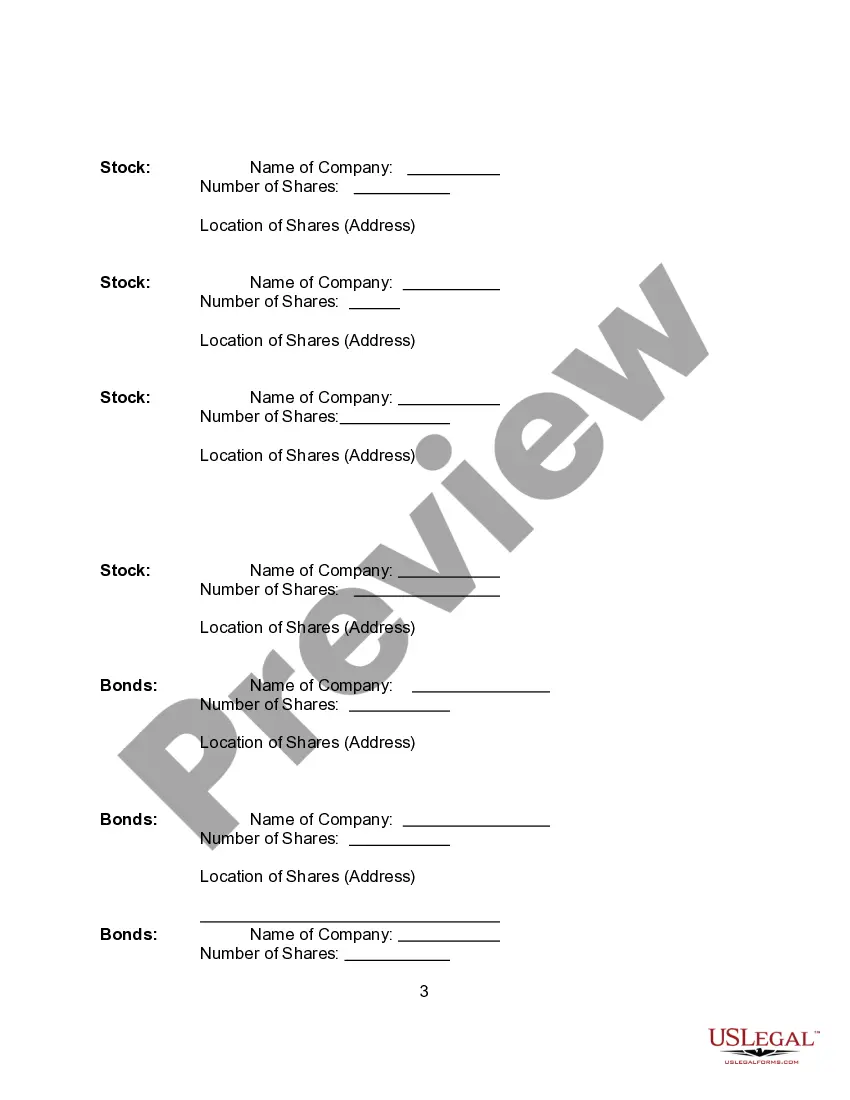

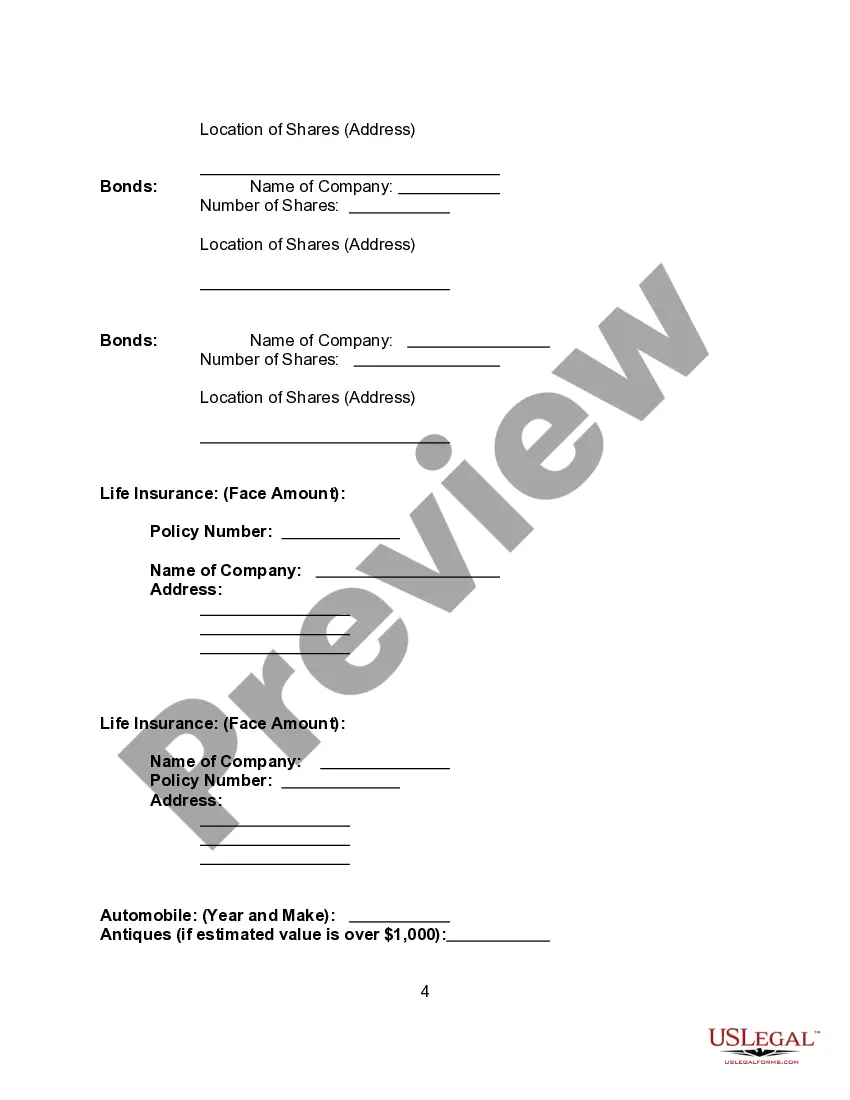

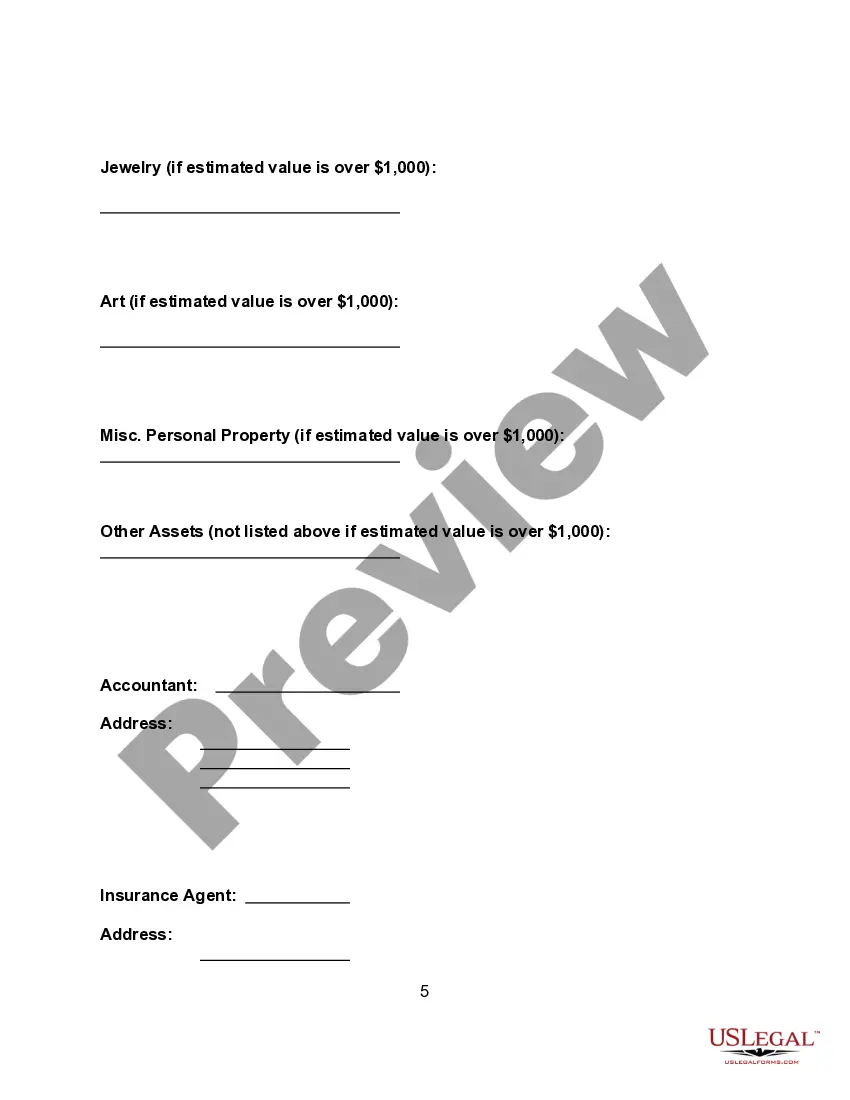

Arizona Asset Information Sheet

Description

How to fill out Asset Information Sheet?

Are you presently in a situation where you require documents for either business or personal reasons almost all the time.

There is a multitude of legal document templates available online, but finding ones you can trust isn’t simple.

US Legal Forms offers a wide selection of form templates, such as the Arizona Asset Information Sheet, that are designed to comply with federal and state requirements.

Once you locate the right form, click Purchase now.

Choose the pricing plan you desire, enter the necessary information to create your account, and complete your purchase using PayPal or a credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Arizona Asset Information Sheet template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it's for your correct city/county.

- Use the Preview button to review the document.

- Check the description to ensure you have selected the correct form.

- If the form isn’t what you’re looking for, utilize the Search box to find the form that fits your requirements.

Form popularity

FAQ

Minimum income to file taxes Single filing status: $12,550 if under age 65. $14,250 if age 65 or older.

Income Tax Filing Requirements. For tax years ending on or before December 31, 2019, Individuals with an adjusted gross income of at least $5,500 must file taxes, and an Arizona resident is subject to tax on all income, including from other states.

Individual. Form 140A - Arizona Resident Personal Income Tax Booklet.

In the state of Arizona, full-year resident or part-year resident individuals must file a tax return if they are: Single or married filing separately and gross income (GI) is greater than $12,550; Head of household and GI is greater than $18,800; or. Married and filing jointly and GI is greater than $25,100.

If you do not owe Arizona income taxes by the tax deadline of April 18, 2022, you do not have to prepare and file a AZ tax extension. In case you expect a AZ tax refund, you will need to file or e-File your AZ tax return in order to receive your tax refund money.

Individual Estimated Income Tax Payment. FOR CALENDAR YEAR. 2020. 25a1 Check if this payment is on behalf of a Nonresident Composite return - 140NR.

140NR. Nonresident Personal Income Tax Return.

Form 140 - Resident Personal Income Tax Form -- Calculating Personal income tax return filed by resident taxpayers. You may file Form 140 only if you (and your spouse, if married filing a joint return) are full year residents of Arizona.

AZ-140V. Arizona Individual Income Tax. Payment Voucher for Electronic Filing.

Voters in November 2020 approved Proposition 208 with 51.7% of the vote. It imposed a 3.5% surcharge on taxable incomes over $250,000 for single filers and $500,000 for joint filers. The tax was set to be collected when people and businesses filed their 2021 taxes, due next month.