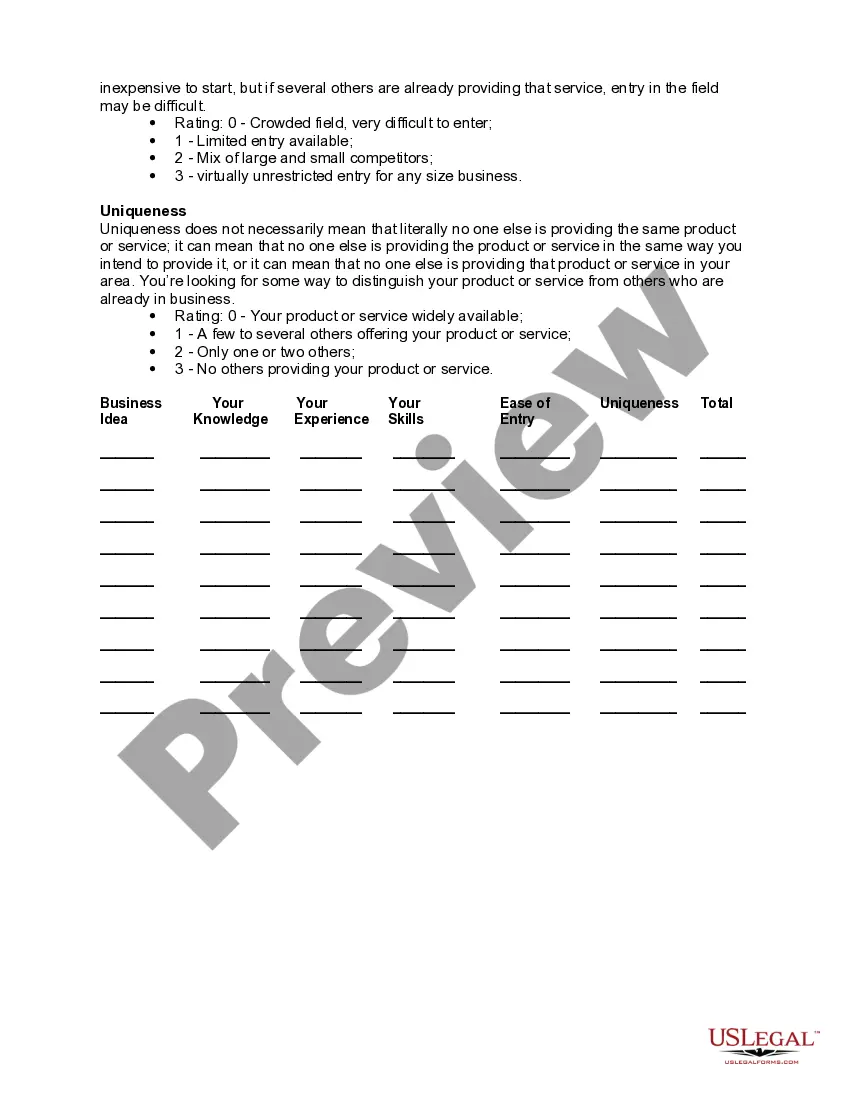

Arizona Business Selection Worksheet

Description

How to fill out Business Selection Worksheet?

Have you ever been in a location where you need documents for both professional and personal purposes almost every day.

There are numerous legitimate form templates available online, but finding trustworthy ones can be challenging.

US Legal Forms offers a wide variety of form templates, such as the Arizona Business Selection Worksheet, designed to meet federal and state requirements.

Once you find the right form, click Purchase now.

Choose the pricing plan you want, fill out the necessary information to create your account, and complete your order using PayPal or a credit card.

- If you are already familiar with the US Legal Forms website and have an account, just Log In.

- Then, you can download the Arizona Business Selection Worksheet template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Obtain the form you need and confirm it is for the correct city/region.

- Utilize the Review button to examine the form.

- Check the summary to ensure you have selected the appropriate form.

- If the form is not what you are looking for, use the Search feature to find the form that fits your needs and requirements.

Form popularity

FAQ

The employee can submit a Form A-4 for a minimum withholding of 0.8% of the amount withheld for state income tax. An employee required to have 0.8% deducted may elect to increase this rate to 1.3%, 1.8%, 2.7%, 3.6%, 4.2%, or 5.1% by submitting a Form A-4.

The employee can submit a Form A-4 for a minimum withholding of 0.8% of the amount withheld for state income tax. An employee required to have 0.8% deducted may elect to increase this rate to 1.3%, 1.8%, 2.7%, 3.6%, 4.2%, or 5.1% by submitting a Form A-4. The $15,000 annual wages threshold has been removed.

What is the best percentage for Arizona withholding Reddit? Your tax burden is $1,195, or 2.98%. If you want to owe a little bit at the end of the year, pick the 2.7% withholding - you'll owe an additional 0.28% ($112) in April. If you want a little back, pick 3.36% and you'll get 0.38% ($152) back in April.

Here's your rule of thumb: the more allowances you claim, the less federal income tax your employer will withhold from your paycheck (the bigger your take home pay). The fewer allowances you claim, the more federal income tax your employer will withhold from your paycheck (the smaller your take home pay).

If you have an Arizona tax liability when you file your return or if at any time during the current year conditions change so that you expect to have a tax liability, you should promptly file a new Form A-4 and choose a withholding percentage that applies to you.

To keep your withholding the same as last year, choose a withholding percentage of 1.8% (40,000 x . 018 = 720) and withhold an additional $10.77 per biweekly pay period (1,000 - 720 = 280 / 26 = 10.77). Be sure to take into account any amount already withheld for this year.

FICA Taxes - Who Pays What? Withhold half of the total (7.65% = 6.2% for Social Security plus 1.45% for Medicare) from the employee's paycheck. For the employee above, with $1,500 in weekly pay, the calculation is $1,500 x 7.65% (. 0765) for a total of $114.75.

What is the best percentage for Arizona withholding Reddit? Your tax burden is $1,195, or 2.98%. If you want to owe a little bit at the end of the year, pick the 2.7% withholding - you'll owe an additional 0.28% ($112) in April. If you want a little back, pick 3.36% and you'll get 0.38% ($152) back in April.

How withholding is determinedFiling status: Either the single rate or the lower married rate.Number of withholding allowances claimed: Each allowance claimed reduces the amount withheld.Additional withholding: An employee can request an additional amount to be withheld from each paycheck.