If you have to full, down load, or print out legitimate papers layouts, use US Legal Forms, the most important assortment of legitimate types, that can be found online. Utilize the site`s easy and hassle-free look for to discover the papers you need. Various layouts for organization and individual purposes are categorized by classes and claims, or key phrases. Use US Legal Forms to discover the Arizona Receipt of Beneficiary for Early Distribution from Estate and Indemnity Agreement in a few clicks.

If you are presently a US Legal Forms buyer, log in in your account and click on the Acquire key to find the Arizona Receipt of Beneficiary for Early Distribution from Estate and Indemnity Agreement. You may also accessibility types you in the past acquired within the My Forms tab of the account.

Should you use US Legal Forms for the first time, follow the instructions below:

- Step 1. Be sure you have chosen the form for your appropriate city/nation.

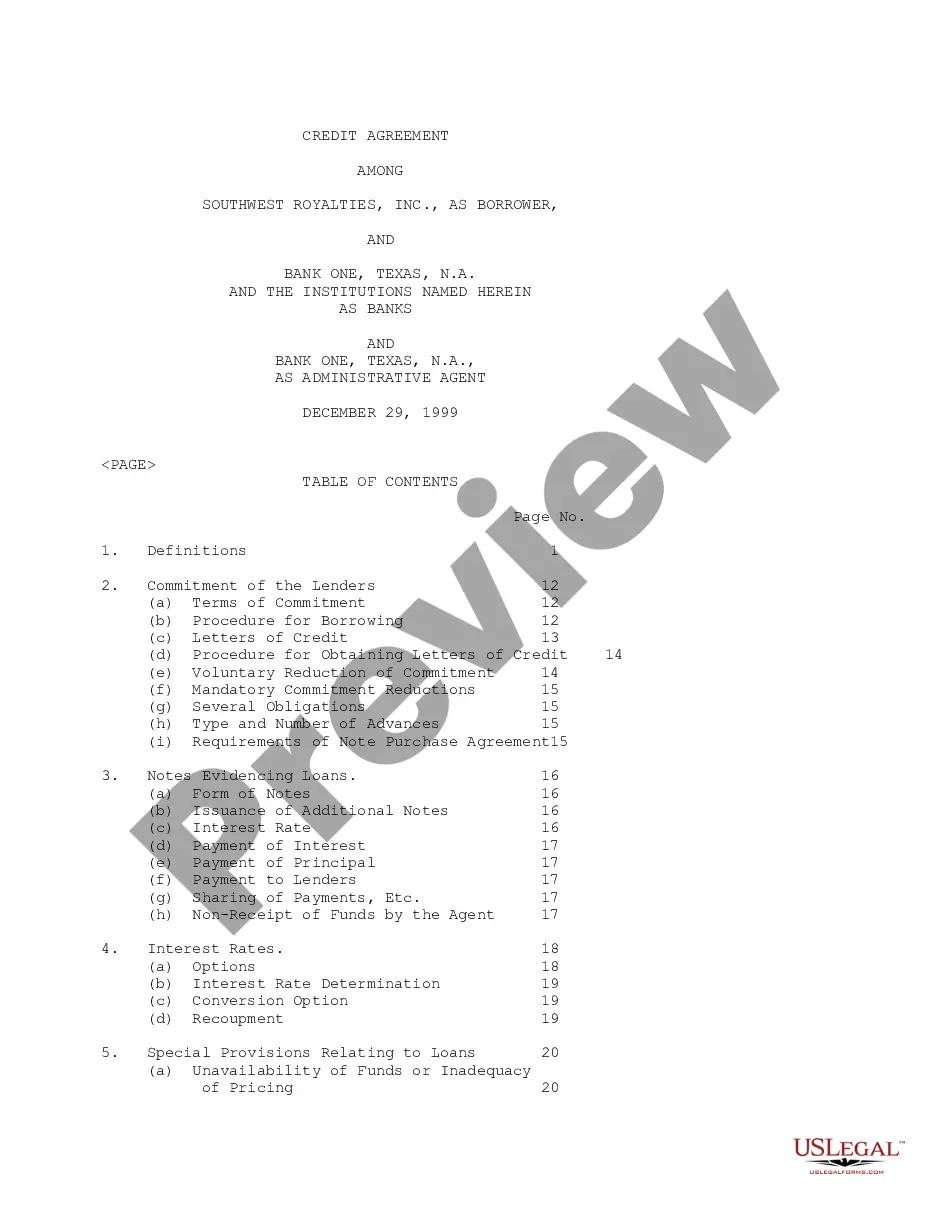

- Step 2. Utilize the Review method to look over the form`s content. Don`t overlook to learn the outline.

- Step 3. If you are not happy with the kind, utilize the Look for industry at the top of the monitor to discover other types from the legitimate kind web template.

- Step 4. Upon having found the form you need, click on the Get now key. Choose the costs plan you like and add your references to register for an account.

- Step 5. Method the financial transaction. You should use your credit card or PayPal account to complete the financial transaction.

- Step 6. Pick the file format from the legitimate kind and down load it in your gadget.

- Step 7. Full, edit and print out or indication the Arizona Receipt of Beneficiary for Early Distribution from Estate and Indemnity Agreement.

Each and every legitimate papers web template you purchase is yours permanently. You may have acces to every kind you acquired within your acccount. Click on the My Forms portion and decide on a kind to print out or down load yet again.

Be competitive and down load, and print out the Arizona Receipt of Beneficiary for Early Distribution from Estate and Indemnity Agreement with US Legal Forms. There are many professional and express-particular types you can utilize for the organization or individual requirements.