Arizona Private Annuity Agreement with Payments to Last for Life of Annuitant

Description

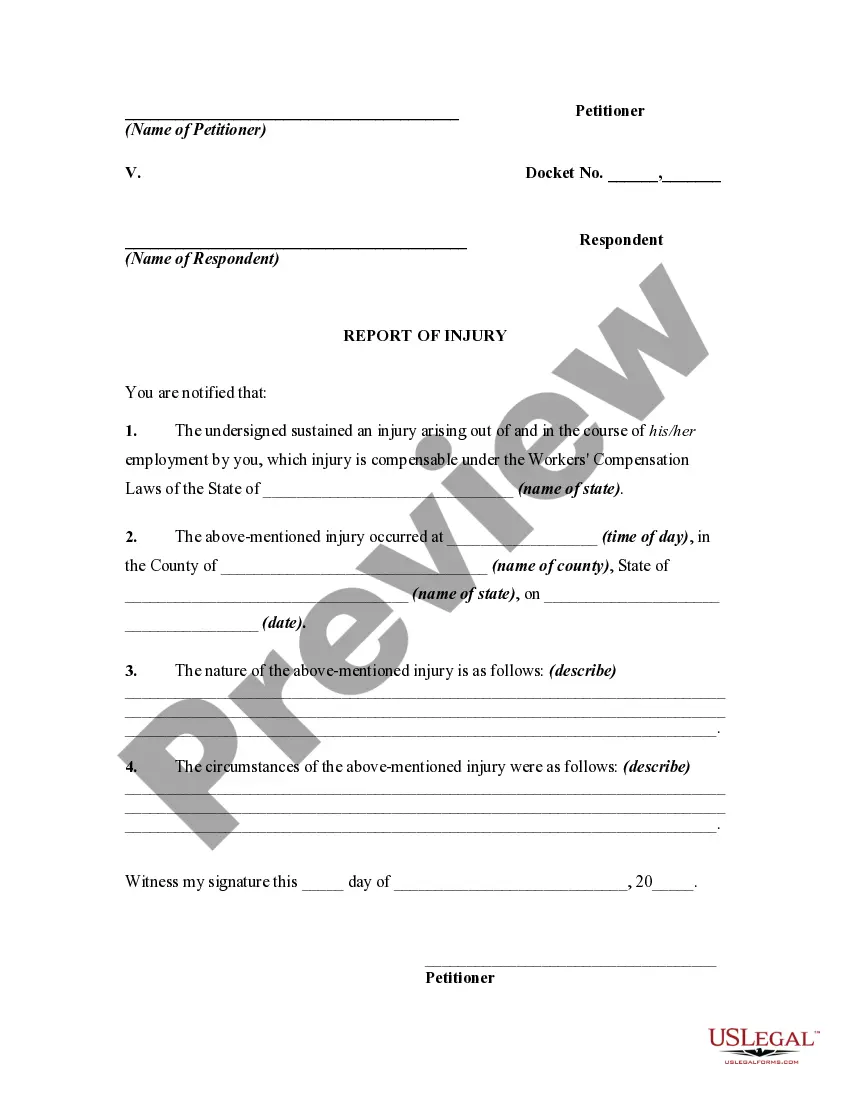

How to fill out Private Annuity Agreement With Payments To Last For Life Of Annuitant?

US Legal Forms - one of the largest collections of legal forms in the United States - offers a broad selection of legal document templates that you can download or print.

By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can obtain the latest versions of forms such as the Arizona Private Annuity Agreement with Payments to Continue for the Lifetime of the Annuitant in minutes.

If you already have an account, Log In and download the Arizona Private Annuity Agreement with Payments to Continue for the Lifetime of the Annuitant from the US Legal Forms database. The Download button will be visible on each form you view. You can access all previously downloaded forms in the My documents section of your account.

- Ensure you have selected the correct form for your city/state.

- Click the Preview button to review the form's details.

- Examine the form description to confirm you have selected the appropriate form.

- If the form does not meet your requirements, utilize the Search area at the top of the screen to find the one that does.

- If you are satisfied with the form, finalize your selection by clicking the Purchase now button.

- Next, choose the payment plan you prefer and provide your details to sign up for an account.

Form popularity

FAQ

An annuity agreement is a contract between you and an insurer that outlines how payments will be made over time. This document specifies the amount, duration, and terms of the payments. In the context of an Arizona Private Annuity Agreement with Payments to Last for Life of Annuitant, this means establishing clear guidelines on how you will receive your income until the end of the annuitant's life. Platforms like UsLegalForms can provide you with the needed documentation and information to create a secure annuity agreement.

While a private annuity can be beneficial, it does have disadvantages. For example, the payments may be fixed, limiting your income potential if market conditions change. Additionally, there may be tax implications upon selling the asset, which can impact your overall financial situation. Understanding the intricacies of an Arizona Private Annuity Agreement with Payments to Last for Life of Annuitant can help you navigate these concerns carefully.

A private annuity allows you to convert an asset into a steady income stream. Essentially, you sell an asset to an individual in exchange for payments that last for the life of the annuitant. This arrangement provides financial security while potentially reducing estate taxes. If you consider an Arizona Private Annuity Agreement with Payments to Last for Life of Annuitant, you can create a reliable source of income tailored to your needs.

The option that provides payments for the lifetime of the annuitant and a specified duration for the beneficiary is called a period certain annuity. This type of annuity ensures that, in the event of the annuitant's passing, the beneficiary receives payments for the agreed time frame. This feature enhances financial security and peace of mind, which is particularly beneficial in an Arizona Private Annuity Agreement with Payments to Last for Life of Annuitant. To explore your options in more detail, consider utilizing resources from uslegalforms, where you can find guidance tailored to your specific needs.

The taxation of a private annuity typically occurs when the annuitant receives payments. Payments are considered income and may be subject to income tax. To navigate the complexities of taxation effectively, especially with an Arizona Private Annuity Agreement with Payments to Last for Life of Annuitant, it may be wise to consult a tax advisor or financial planner.

When an annuitant passes away, the taxation of annuities can depend on various factors, including the type of annuity and beneficiary designation. The beneficiaries may face income tax on payments received, and any unpaid balance may be subjected to estate taxes. Understanding the tax implications surrounding annuities, especially an Arizona Private Annuity Agreement with Payments to Last for Life of Annuitant, is essential for effective estate planning.

The lifetime annuity payout option is designed to provide guaranteed payments for the duration of the annuitant's life. This option offers peace of mind, ensuring that you will receive a stable income regardless of how long you live. An Arizona Private Annuity Agreement with Payments to Last for Life of Annuitant is an excellent choice for those who prioritize long-term financial security.

A private annuity agreement is a contract between two parties, typically involving the transfer of asset ownership in exchange for a series of payments made to the seller for life. This agreement can be a strategic financial tool, allowing individuals to secure their income and manage assets effectively. By using an Arizona Private Annuity Agreement with Payments to Last for Life of Annuitant, you can ensure sustainable financial support throughout your lifetime.

Upon the death of the annuitant, private annuities may result in tax implications for the beneficiaries. Generally, the payments received as income before death are subject to income tax, while the remaining value may be included in the annuitant's estate. Consulting with a tax professional can provide you with clarity on navigating an Arizona Private Annuity Agreement with Payments to Last for Life of Annuitant.

An arrangement that stops payments upon the death of the annuitant is known as a term certain annuity. This type of annuity provides payments for a predetermined period, and once the annuitant passes away, the payments cease. If you seek more assurance regarding lifetime income, consider an Arizona Private Annuity Agreement with Payments to Last for Life of Annuitant for continued support.