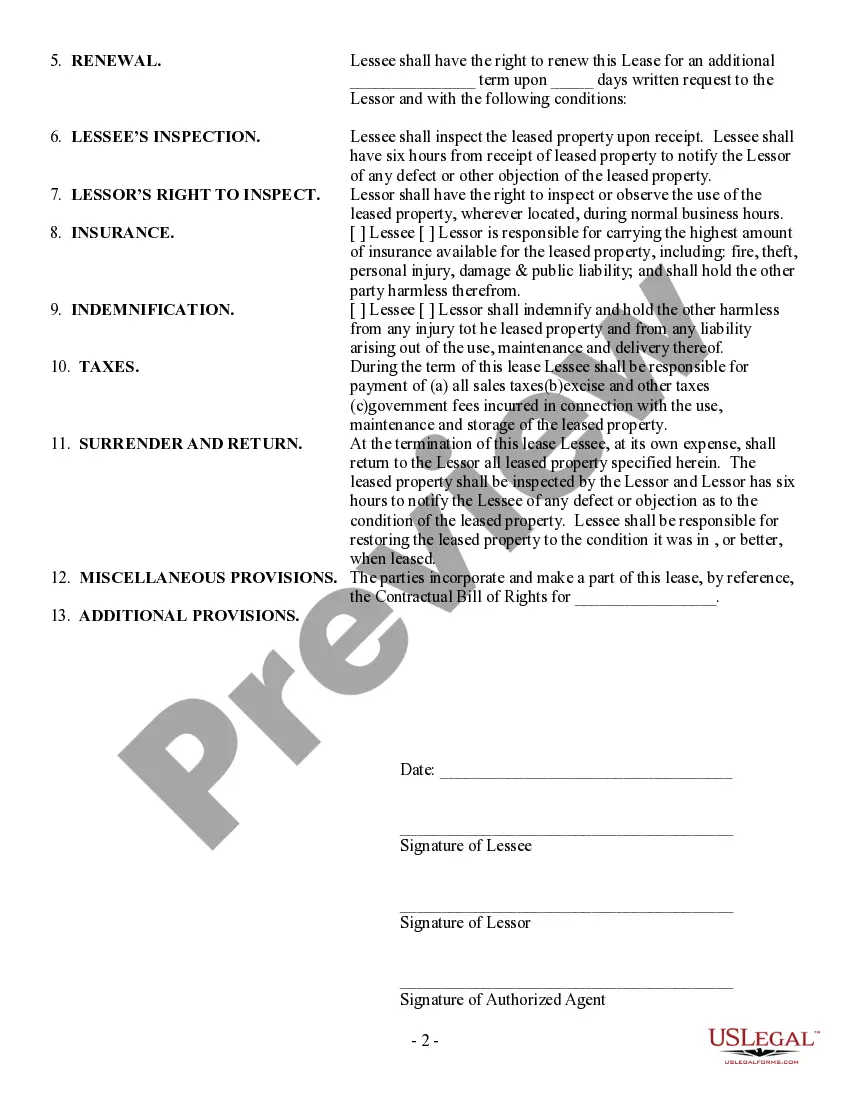

Arizona Simple Equipment Lease

Description

How to fill out Simple Equipment Lease?

Selecting the ideal legal document template can be quite a challenge. Of course, there are numerous templates accessible online, but how can you find the legal form you need? Utilize the US Legal Forms website.

The service offers a wide array of templates, including the Arizona Simple Equipment Lease, which can be utilized for business and personal purposes. All of the forms are reviewed by experts and comply with state and federal regulations.

If you are already registered, Log In to your account and click the Download button to obtain the Arizona Simple Equipment Lease. Utilize your account to browse through the legal forms you have previously purchased. Visit the My documents tab of your account to download another copy of the document you require.

Complete, modify, and print and sign the obtained Arizona Simple Equipment Lease. US Legal Forms is the largest library of legal forms where you can find a variety of document templates. Use the service to download properly crafted documents that adhere to state requirements.

- If you are a new user of US Legal Forms, here are simple instructions for you to follow.

- First, ensure you have selected the correct form for your city/state. You can preview the document using the Preview button and review the document outline to ensure it is suitable for you.

- If the form does not meet your requirements, use the Search field to find the appropriate form.

- Once you are confident the form is correct, click the Purchase now button to acquire the document.

- Choose the pricing plan you desire and enter the necessary information. Create your account and pay for your order using your PayPal account or credit card.

- Select the file format and download the legal document template to your device.

Form popularity

FAQ

You can make your own lease agreement in Arizona, but it's important to include all essential components for it to be enforceable. Ensuring clarity around terms, payment schedules, and obligations is crucial. While customizing your lease may seem appealing, using a template like the Arizona Simple Equipment Lease from USLegalForms could save you time and help you avoid potential legal pitfalls. This approach strikes a balance between personalization and legal compliance.

Yes, a handwritten rental agreement can be legal in Arizona, provided it meets certain requirements. Both parties must agree to the terms, and the document should specify key elements, such as the rental period and payment details. However, for an Arizona Simple Equipment Lease, using a standardized form can help ensure you cover all necessary aspects and protect your interests. It's wise to consult resources like USLegalForms to create a legally sound lease.

Equipment rental fees are generally taxable in Arizona unless specifically exempted under the law. This means that when you enter into an Arizona Simple Equipment Lease, expect to see sales tax applied to the rental fees. To ensure compliance and avoid unexpected costs, our platform at US Legal Forms provides essential information on this topic.

Yes, in most cases, equipment rental is subject to sales tax in Arizona. The tax applies to the total rental amount, with exceptions depending on the nature of the equipment. Using our US Legal Forms will help you navigate these sales tax requirements effectively when drafting your Arizona Simple Equipment Lease.

Self-employment tax (SE tax) generally applies to individuals engaged in business activities. If you are renting equipment as part of your trade, then SE tax may apply to the income generated. For a comprehensive understanding of how this affects an Arizona Simple Equipment Lease, consider exploring our resources on US Legal Forms.

In Arizona, certain items may be exempt from sales tax, including some agricultural supplies and services. However, equipment rentals typically do not fall under these exemptions. If you're looking to lease equipment and want to know more about the tax implications, our US Legal Forms platform can provide clarity through our detailed guides.

A good equipment lease rate in Arizona depends on several factors, including the type of equipment, the lease term, and the condition of the equipment. Typically, rates range from 1% to 5% of the equipment's value per month. For a more tailored approach, consider using our US Legal Forms platform to secure an Arizona Simple Equipment Lease that suits your specific needs.

Yes, it's possible to get approved for an Arizona Simple Equipment Lease with a 600 credit score, but options may be limited. Lenders might require additional documentation or higher down payments. Your overall financial picture will play a critical role in the approval process. Working with knowledgeable platforms like uslegalforms can help you navigate these challenges.

Qualifying for an Arizona Simple Equipment Lease involves several factors, primarily your credit score and business financials. Lenders will examine your credit history, annual revenue, and length of time in business. Providing thorough documentation increases your chances of approval. Utilizing platforms like uslegalforms can streamline your application process.

The minimum credit score for an Arizona Simple Equipment Lease varies, but typically, a score of 600 is considered a baseline. Lenders may assess your overall financial health beyond just the score. This includes income, existing debts, and business history. Therefore, it is essential to present a strong application.