This form anticipates that a decedent left a will directing that all assets in a certain investment account be transferred to a trust. This form is a sample request to the investment firm from the trustee/executor for the assets.

Arizona Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent

Description

How to fill out Letter Of Instruction To Investment Firm Regarding Account Of Decedent From Executor / Trustee For Transfer Of Assets In Account To Trustee Of Trust For The Benefit Of Decedent?

Locating the appropriate legal document template can pose challenges.

Certainly, there are numerous formats accessible online, but how can you secure the legal template you desire.

Utilize the US Legal Forms website. The platform offers an extensive array of templates, such as the Arizona Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent, suitable for both business and personal needs. All templates are reviewed by experts and comply with state and federal requirements.

If the form does not meet your expectations, use the Search field to find the appropriate form. Once you are certain the form is suitable, click on the Get Now button to acquire the form. Choose the payment plan you prefer and provide the necessary information. Create your account and complete the purchase using your PayPal account or Visa or Mastercard. Select the file format and download the legal document template to your device. Complete, modify, print, and sign the acquired Arizona Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent. US Legal Forms is the largest collection of legal forms where you can find a variety of document layouts. Take advantage of the service to obtain professionally-crafted documents that meet state requirements.

- If you are already registered, sign in to your account and click the Download button to obtain the Arizona Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent.

- Use your account to browse through the legal forms you have previously purchased.

- Go to the My documents section of your account and acquire another copy of the document you need.

- If you are a new user of US Legal Forms, follow these simple instructions.

- First, ensure you have selected the correct form for your locale.

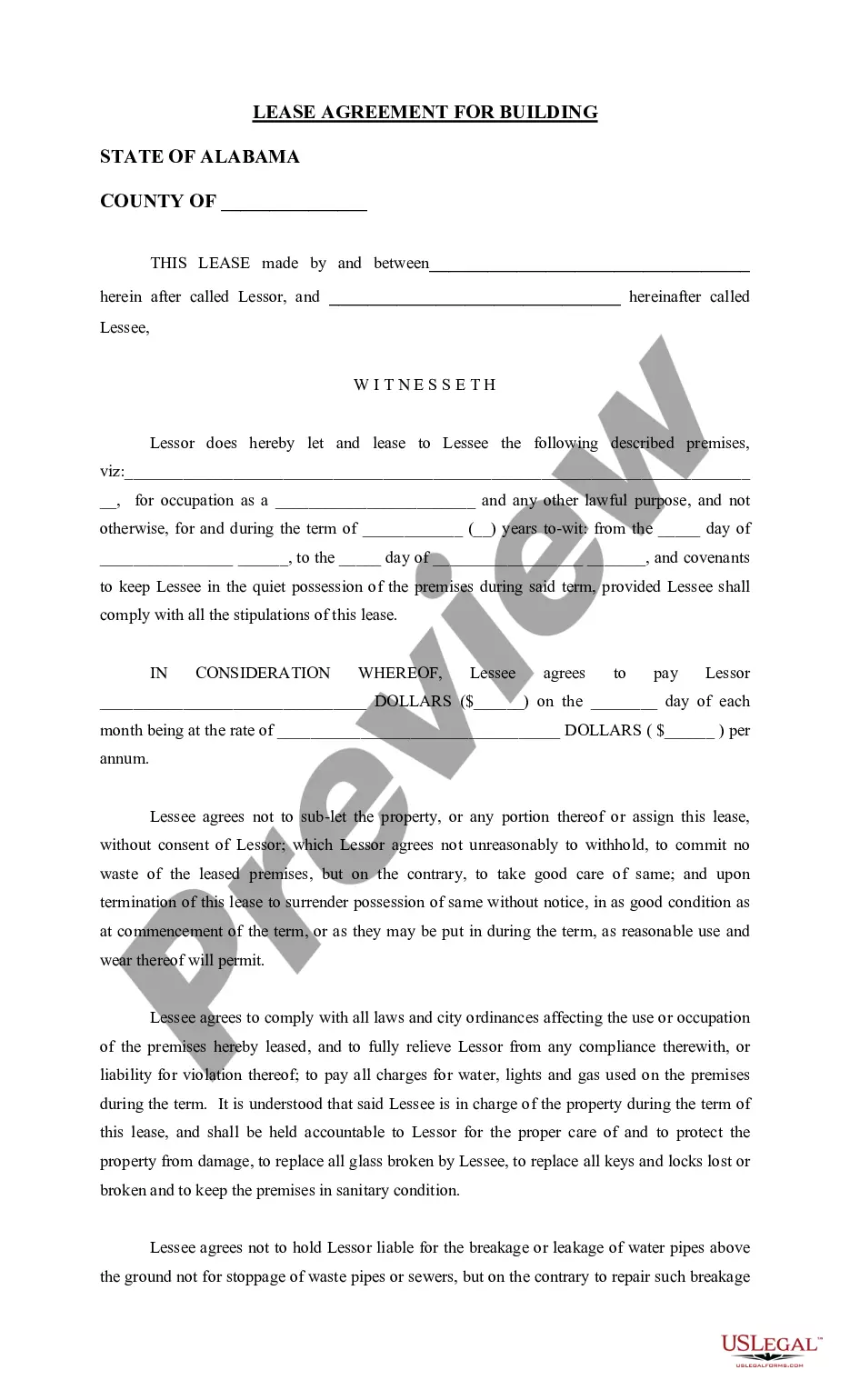

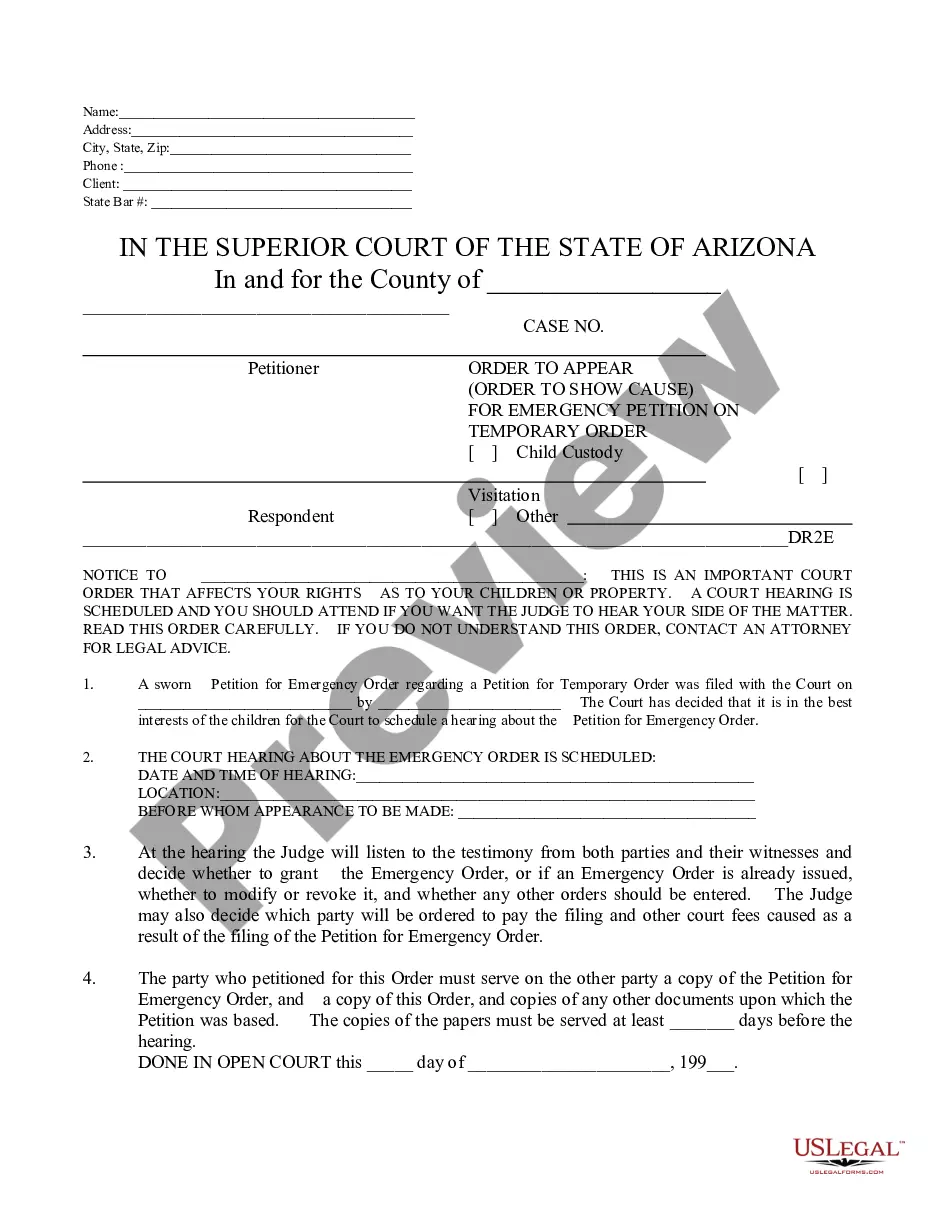

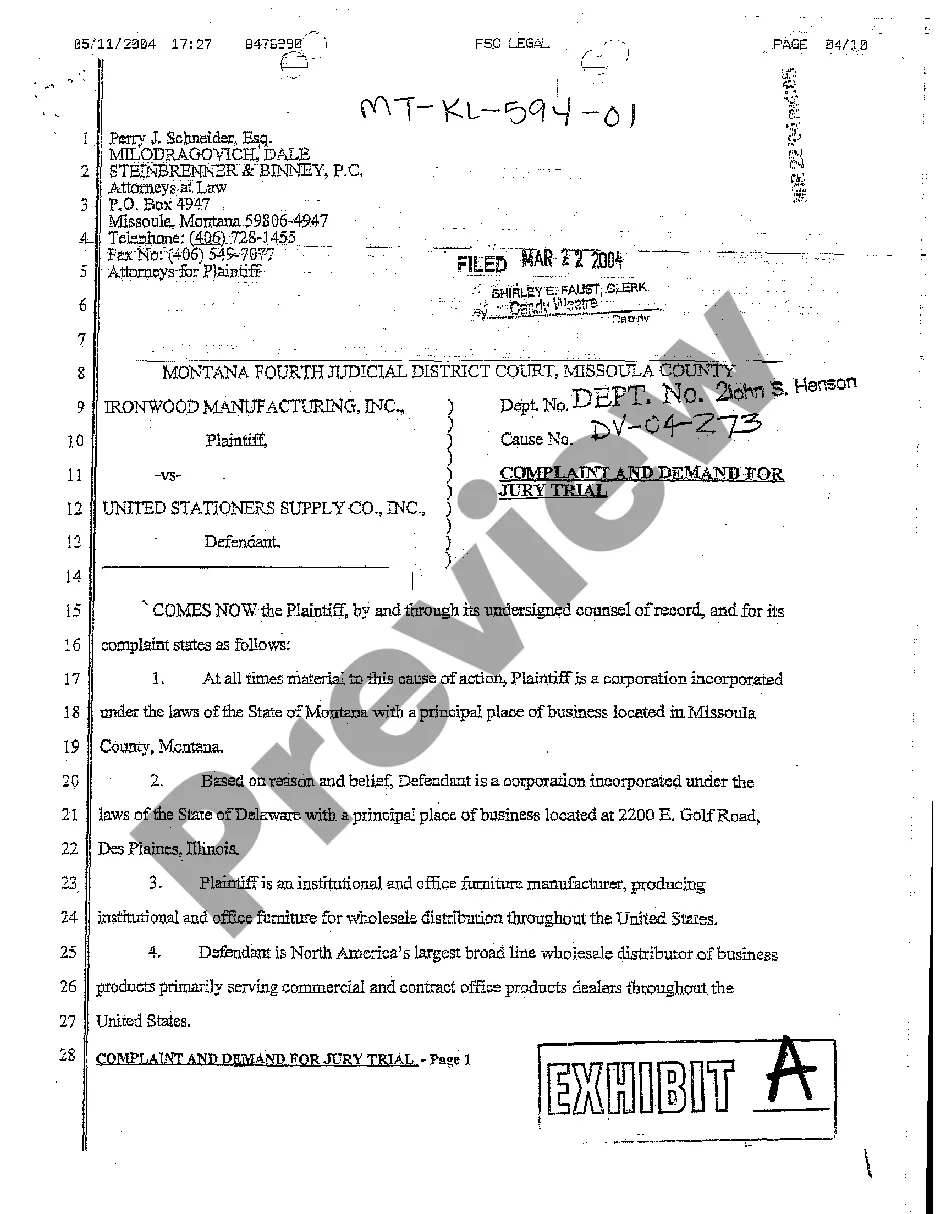

- You can browse the form using the Preview button and check the form description to confirm it is suitable for you.

Form popularity

FAQ

A letter of instruction to the bank after death serves as a guiding document for financial institutions regarding the handling of a deceased person's accounts. This letter outlines the expectations and necessary steps for transferring assets to the designated beneficiaries or trusts. It plays a crucial role in simplifying the process during a difficult time. For clarity and direction, an Arizona Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent can provide essential information to the bank.

In Arizona, a trustee can indeed be a beneficiary of a trust. This arrangement is permissible under state law, provided that the trust document allows for such an arrangement. It is essential to clearly outline the trustee's role and their rights as a beneficiary in the estate plan. For seamless asset transfers, consider utilizing an Arizona Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent.

A trustee in Arizona is required to notify beneficiaries about the trust as soon as possible, typically within 60 days of their appointment. This initial communication is essential to keep beneficiaries informed about their interests in the trust. Failing to notify beneficiaries in a timely manner can lead to misunderstandings or legal complications. To aid in this process, the Arizona Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent can provide guidance on proper correspondence.

In Arizona, an executor typically has a reasonable time to distribute assets, though the state allows them up to 12 months to settle the estate. Prompt distribution is often appreciated, and it may benefit the executor to communicate with the beneficiaries regularly. Remaining organized and responsive will help avoid disputes. To facilitate smooth distributions, utilizing the Arizona Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent is advisable.

Generally, bank accounts in Arizona can go through probate unless they are set up with a payable-on-death designation or held in joint tenancy. If an account is solely in the decedent's name, it will likely be subject to the probate process. Understanding this can help in planning your estate efficiently. Using tools like the Arizona Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent can streamline the transfer if you have to navigate probate.

The final accounting to beneficiaries is a detailed report provided by the executor or trustee that summarizes the estate's financial activity. This includes a listing of all income, expenses, distributions, and a final balance. It is important for transparency and helps beneficiaries understand how the estate was managed. If you are preparing this accounting, the Arizona Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent can assist you in ensuring all assets are accurately documented.

In Arizona, certain assets are exempt from probate, which can make transferring assets smoother and quicker. Common exemptions include assets held in joint tenancy, accounts with designated beneficiaries, and assets in a living trust. This ensures that your loved ones receive their inheritance without unnecessary delays. For specific guidance on how to direct the transfer of such assets, consider using the Arizona Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent.

To file for the executor of an estate in Arizona, you will need to prepare and submit several documents to the local probate court. Start by completing the application, which includes forms such as the Petition for Probate and the Death Certificate. After this, you must provide a Notice of Hearing to interested parties. Utilizing a resource like the US Legal forms can simplify the process of completing the Arizona Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent.

Yes, in Arizona, an executor is generally required to provide an accounting of the estate to the beneficiaries. This process ensures transparency and builds trust as beneficiaries see how assets are managed and distributed. By utilizing the Arizona Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent, executors can ensure they fulfill their obligations while protecting the interests of beneficiaries.

The letter of instruction in case of death offers guidance to the executor or family members on managing the deceased's affairs. This letter may outline funeral wishes, asset distribution, and specific instructions regarding personal belongings. Leveraging the information from the Arizona Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent can provide a comprehensive understanding of the decedent's final wishes and streamline the process for the executor.