Arizona Sample Letter regarding Authority to Cancel Deed of Trust

Description

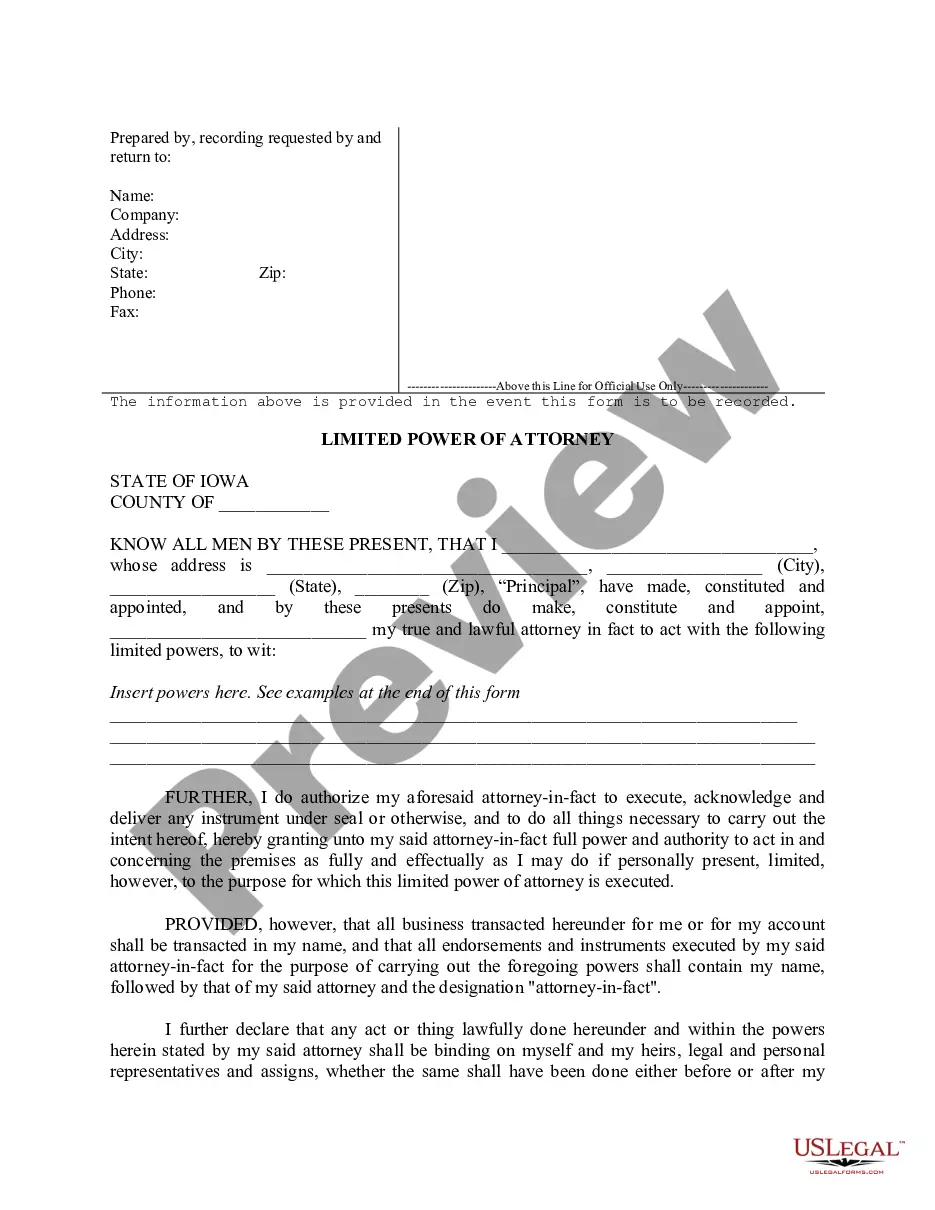

How to fill out Sample Letter Regarding Authority To Cancel Deed Of Trust?

US Legal Forms - one of the largest repositories of legal documents in the United States - offers a vast selection of legal document templates that you can download or print.

By utilizing the website, you will find thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can access the most recent forms such as the Arizona Sample Letter concerning Authority to Cancel Deed of Trust within moments.

If you already have a monthly subscription, Log In and retrieve the Arizona Sample Letter regarding Authority to Cancel Deed of Trust from the US Legal Forms collection. The Acquire button will appear on every form you view. You have access to all previously saved forms in the My documents tab of your account.

Process the payment. Use your credit card or PayPal account to complete the transaction. Choose the format and download the form to your device.

Make modifications. Fill out, edit and print and sign the saved Arizona Sample Letter concerning Authority to Cancel Deed of Trust. Each template you add to your account does not have an expiration date and is yours indefinitely. Thus, if you wish to download or print another copy, simply navigate to the My documents section and click on the form you desire. Access the Arizona Sample Letter regarding Authority to Cancel Deed of Trust with US Legal Forms, the most extensive repository of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- Ensure you have selected the correct form for your city/region.

- Click the Preview button to review the form’s content.

- Consult the form description to make sure you have chosen the right form.

- If the form does not meet your needs, use the Search field at the top of the screen to find the one that does.

- Once you are satisfied with the form, confirm your selection by clicking the Buy now button.

- Then, select the payment plan you prefer and provide your details to register for an account.

Form popularity

FAQ

It's fairly simple. The borrower gives the lender a promissory note in exchange for the deed of trust. (The promissory note states the borrower's promise to pay back their debt.) Then, once the borrower pays their debt in full, the trustee relinquishes the deed to them.

Generally, the trustee must be an attorney, title insurance company, trust company, bank, savings and loan, credit union, or other company specifically authorized by law to serve as a trustee. Other states have no limitations.

Six years after the Trust Deed starts, your credit rating will contain no mention of it. It's important to remember, if you have already missed payments or have been paying reduced amounts to your creditors then your credit rating may already have been adversely affected.

A trust deed is a legal document that sets out the rules for establishing and operating your fund. It includes such things as the fund's objectives, who can be a member and whether benefits can be paid as a lump sum or income stream.

Definitions. Trust: A legal document that spells out how a person's assets should be managed during their lifetime or after their death.

A deed of trust will include the same type of information stated in a mortgage document, such as: The identities of the borrower, lender, and trustee. A full description of the property to be placed in trust. Any restrictions or requirements on the use of the property while it is in trust.