This form set up what is known as present interest trusts, with the intention of meeting the requirements of Section 2503(c) of the Internal Revenue Code.

Arizona Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children

Description

How to fill out Trust Agreement For Minors Qualifying For Annual Gift Tax Exclusion - Multiple Trusts For Children?

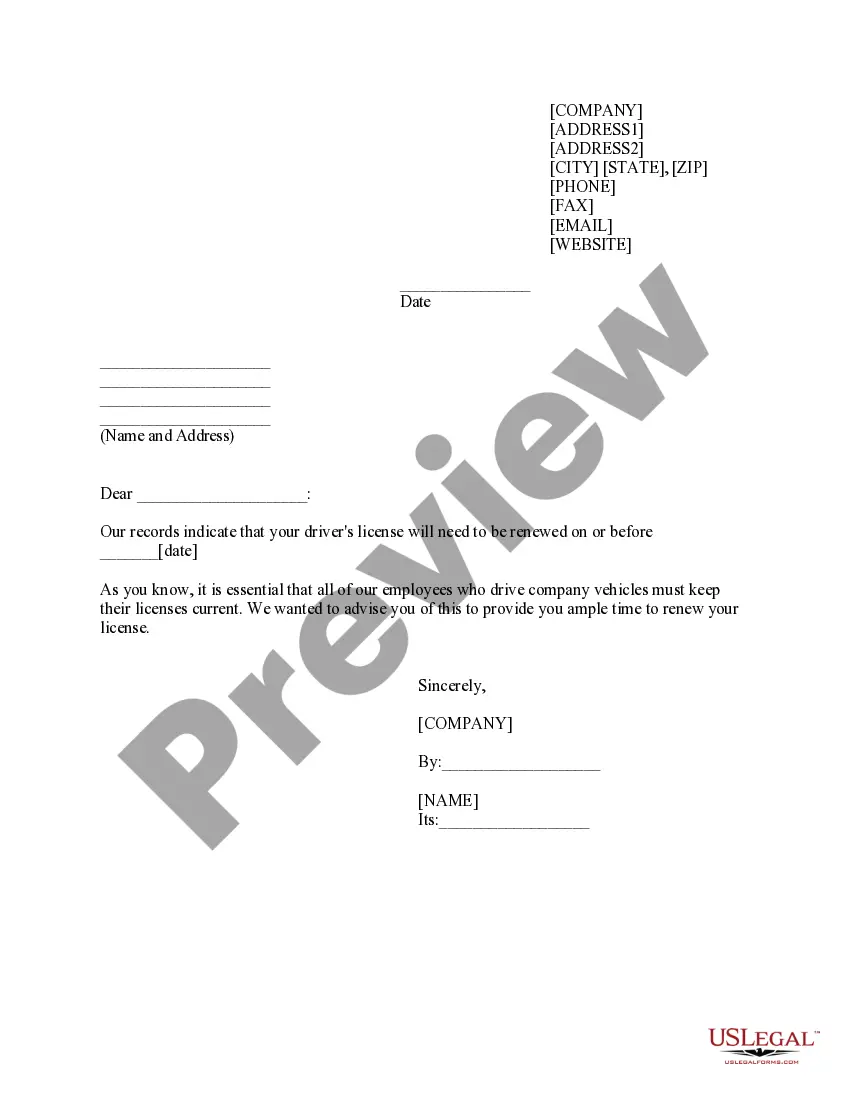

Finding the appropriate official document format can be a challenge. Of course, there are numerous templates accessible online, but how do you secure the valid form you require? Utilize the US Legal Forms website. The service offers a wide array of templates, including the Arizona Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children, which you can employ for both business and personal purposes. All of the documents are vetted by professionals and comply with federal and state regulations.

If you are already a registered user, Log In to your account and click on the Download button to access the Arizona Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children. Use your account to review the official forms you have purchased previously. Go to the My documents section of your account and obtain another copy of the document you require.

If you are a new user of US Legal Forms, here are simple steps for you to follow: First, ensure you have selected the correct form for your area/state. You can browse the template using the Preview button and review the document summary to confirm it is suitable for you. If the form does not meet your needs, utilize the Search field to find the appropriate form. Once you are confident that the form is correct, click the Get now button to acquire the document. Select the pricing plan you need and enter the necessary information. Create your account and place an order using your PayPal account or credit card. Choose the file format and download the official document template for your records. Fill out, modify, print, and sign the downloaded Arizona Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children.

- US Legal Forms is the largest repository of official documents where you can find various document formats.

- Use the service to obtain professionally crafted papers that adhere to state requirements.

Form popularity

FAQ

Yes, you can gift to a grantor trust, and such gifts may also qualify for the annual gift tax exclusion if specific conditions are met. A grantor trust allows the grantor to maintain control over the assets while benefiting the named beneficiaries. Utilizing the Arizona Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children can enhance gifting strategies and optimize tax efficiency.

Yes, when a trust makes a distribution to a beneficiary, it can be characterized as a gift. However, this gift must also adhere to the annual exclusion limits set by the IRS. With proper structuring through the Arizona Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children, you can maximize your gifting potential while serving the interests of your minor beneficiaries.

To qualify for a 2503 C trust, the trust must be set up for the benefit of a minor, and the funds must be distributed to the child upon reaching age 21. This type of trust allows contributions to grow while benefiting from the annual gift tax exclusion, efficiently utilizing the Arizona Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children. This structure is beneficial in managing and protecting assets intended for minors.

Yes, a trust can make annual exclusion gifts, provided that it meets certain conditions. Specifically, the trust must allow beneficiaries access to the income or principal, aligning with the parameters of the Arizona Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children. This can facilitate gifting strategies while preserving benefits for minor beneficiaries.

The annual exclusion for gifts to minors allows you to provide a set amount each year without incurring federal gift tax. As of 2023, this exclusion is $17,000 per recipient, which can be crucial when establishing an Arizona Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children. This strategy helps in efficient wealth transfer while minimizing tax implications.

The primary difference between UTMA (Uniform Transfers to Minors Act) and 2503(c) trusts lies in how they manage assets for minors. UTMA accounts are custodial accounts that allow minors to hold assets until they reach the age of majority, typically 18 or 21, depending on the state. In contrast, a 2503(c) trust is a specific estate planning tool that provides more control over the timing and use of funds. The Arizona Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children can be structured to offer benefits from both models, ensuring that the minors' best interests are prioritized.

The best type of trust for a minor often includes provisions for both financial management and growth. The Arizona Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children is tailored for this purpose. This trust allows you to maintain control over the assets while providing financial support to minors when they need it most. Its design ensures that funds are used in the best interest of the child, whether for education or other critical needs.

In Arizona, trusts must follow certain legal guidelines to be valid. For example, the settlor must have the capacity to create a trust, and the trust must have a lawful purpose. When it comes to the Arizona Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children, it's essential to ensure that all requirements are met to protect the trust's integrity. Additionally, trust administration must adhere to both state laws and the trust document’s specific terms.

The best type of trust to set up usually depends on your financial situation and your objectives. For parents concerned about gifts to minors, the Arizona Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children presents an excellent choice. It allows you to distribute assets in a tax-efficient manner while maintaining control over the funds. This arrangement offers security for your children's future while ensuring compliance with tax regulations.

A minor trust is typically established to manage assets on behalf of a child until they reach adulthood. The Arizona Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children is an example of this type of trust. It provides structure and control over how and when funds are disbursed, ensuring that minors are well-supported during their formative years. This can include provisions for education, healthcare, and other significant expenses.