Arizona Terminate S Corporation Status - Resolution Form - Corporate Resolutions

Description

How to fill out Terminate S Corporation Status - Resolution Form - Corporate Resolutions?

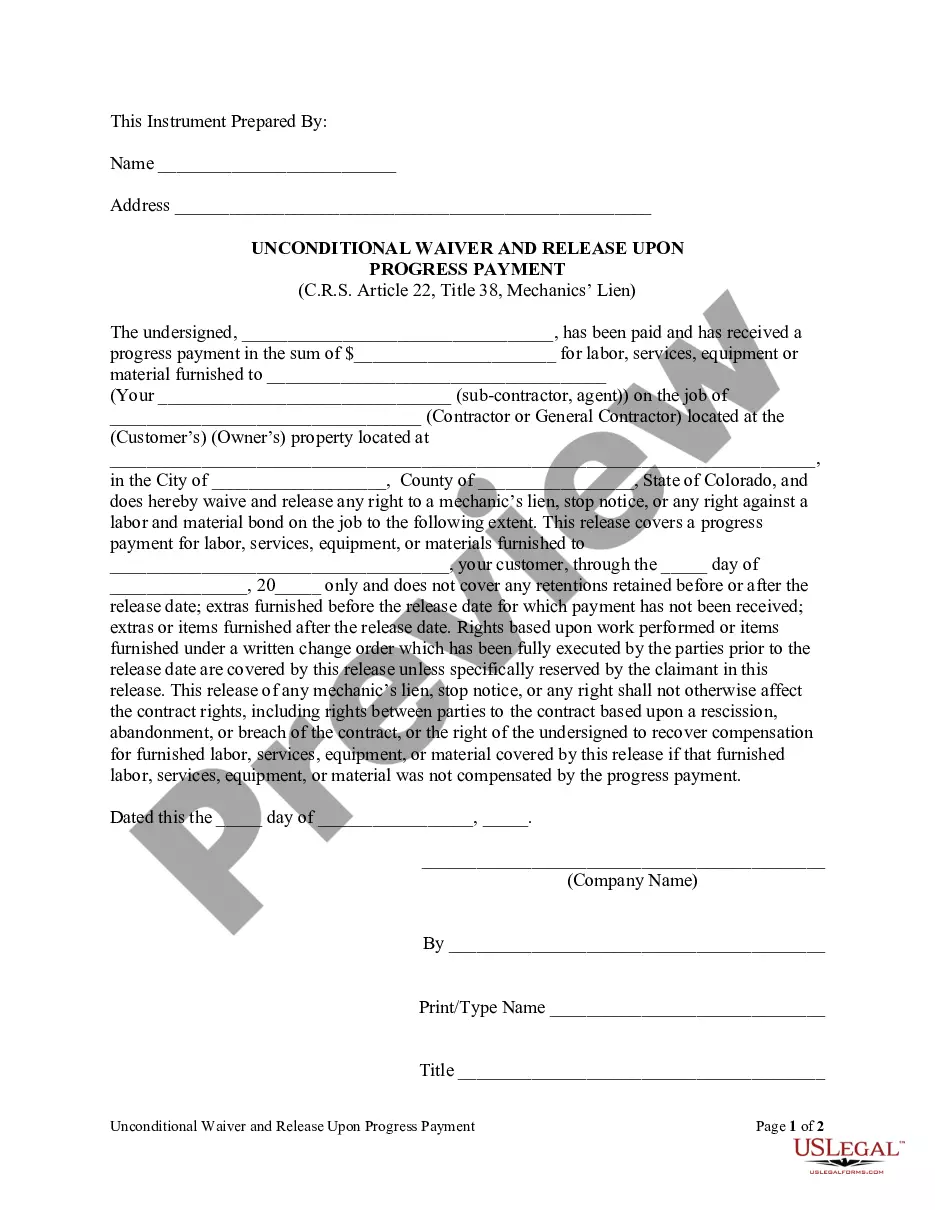

It is feasible to invest time online attempting to locate the official document formats that comply with the federal and state requirements you need.

US Legal Forms provides thousands of official templates that can be evaluated by professionals.

You can conveniently download or print the Arizona Terminate S Corporation Status - Resolution Form - Corporate Resolutions from our service.

First, ensure you have selected the appropriate document format for the region/city of your choice.

- If you possess a US Legal Forms account, you can sign in and then click the Obtain button.

- After that, you are able to complete, modify, print, or sign the Arizona Terminate S Corporation Status - Resolution Form - Corporate Resolutions.

- Each official document format you purchase is yours indefinitely.

- To obtain another copy of a purchased form, navigate to the My documents tab and click the relevant button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

Form popularity

FAQ

A company resolution is a legally binding decision made by directors or shareholders. If a majority vote is achieved in favour of any proposed resolution, the resolution is 'passed'. Shareholders can pass ordinary resolutions or special resolutions at general meetings.

To revoke a Subchapter S election/small business election that was made on Form 2553, submit a statement of revocation to the service center where you file your annual return. The statement should state: The corporation revokes the election made under Section 1362(a)

If business owners want to revoke the S Corp election retroactively to the first day of their tax year, they must submit their statement by the 16th day of the third month of the tax year.

Normally, however, board resolutions are used for more routine management decisions, such as changing the company's registered office address, changing the location of statutory company registers, appointing an accountant, or entering into important contracts with clients.

An ordinary resolution is used for all matters unless the Companies Act or the company's articles of association require any other type of resolution. Rather confusingly, it is sometimes necessary to call an extraordinary general meeting in order to deal with something immediately.

To revoke a Subchapter S election/small business election that was made on Form 2553, submit a statement of revocation to the service center where you file your annual return. The statement should state: The corporation revokes the election made under Section 1362(a)

An S corporation election may be terminated involuntarily if the entity ceases to qualify as a small business corporation or its passive income exceeds the passive income limitation. An S corporation ceases to qualify as an S corporation if it does not meet the criteria in Sec.

Corporate resolutions are required whenever the board of directors makes a major decision. The resolution acts as a written record of the decision and is stored with other business documents. These board resolutions are binding on the company.

Primarily a board resolution is needed to keep a record of two things: To record decisions concerning company affairs (except for shares) made in the board of directors meeting. This is also known as a board resolution. To record decisions concerning company equity made by shareholders of the corporation.

Inadvertent Termination of the S Election An entity will cease being a small business corporation if at any time it issues a second class of stock, acquires more than 100 shareholders, or has an ineligible shareholder.