Arizona Employment Application for Event Vendor

Description

How to fill out Employment Application For Event Vendor?

If you wish to be thorough, download, or create legal document templates, utilize US Legal Forms, the largest selection of legal forms available online.

Take advantage of the site's straightforward and convenient search feature to locate the documents you require.

Various templates for business and personal use are categorized by topics and states, or keywords.

Step 4. Once you have located the form you desire, click the Purchase Now button. Choose your preferred payment plan and provide your details to register for an account.

Step 5. Complete the payment. You may use your credit card or PayPal account to finalize the process.

- Utilize US Legal Forms to find the Arizona Employment Application for Event Vendor quickly.

- If you are currently a US Legal Forms user, Log In to your account and click the Download button to access the Arizona Employment Application for Event Vendor.

- You can also retrieve forms you previously submitted electronically from the My documents tab in your account.

- If you are using US Legal Forms for the first time, refer to the steps outlined below.

- Step 1. Ensure you have selected the form for the correct city/state.

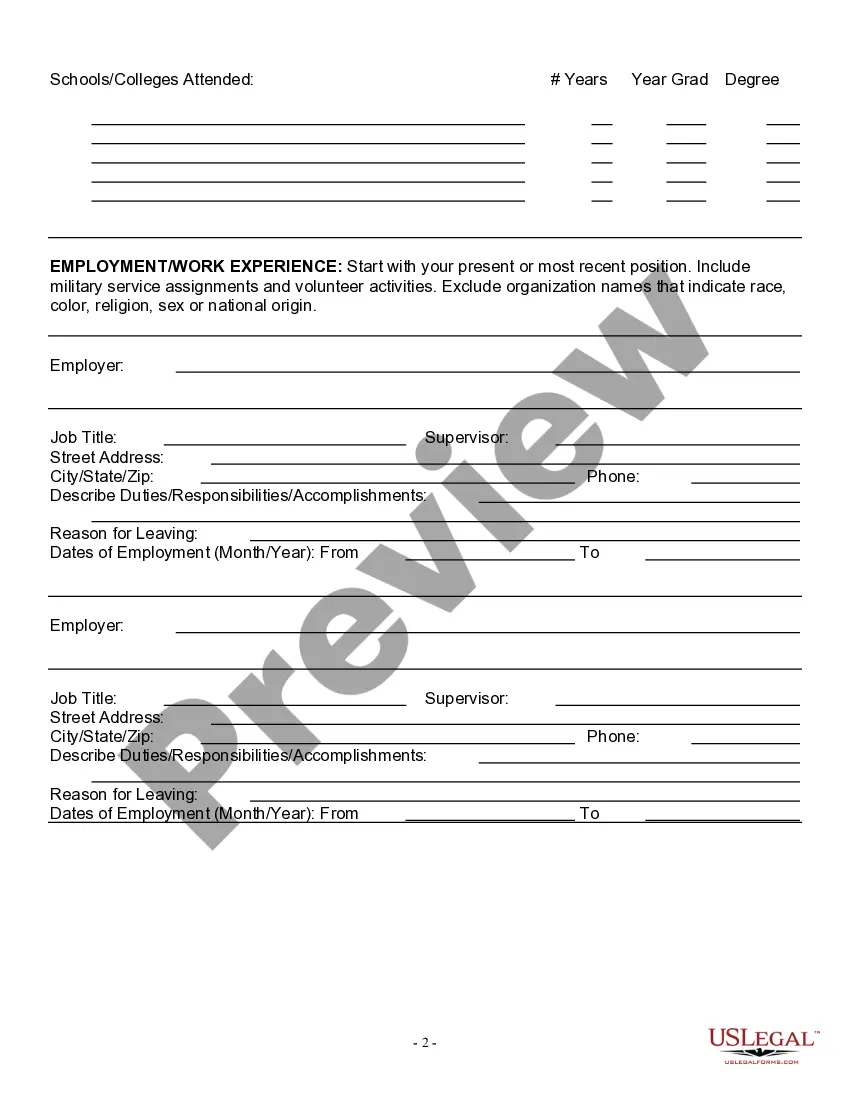

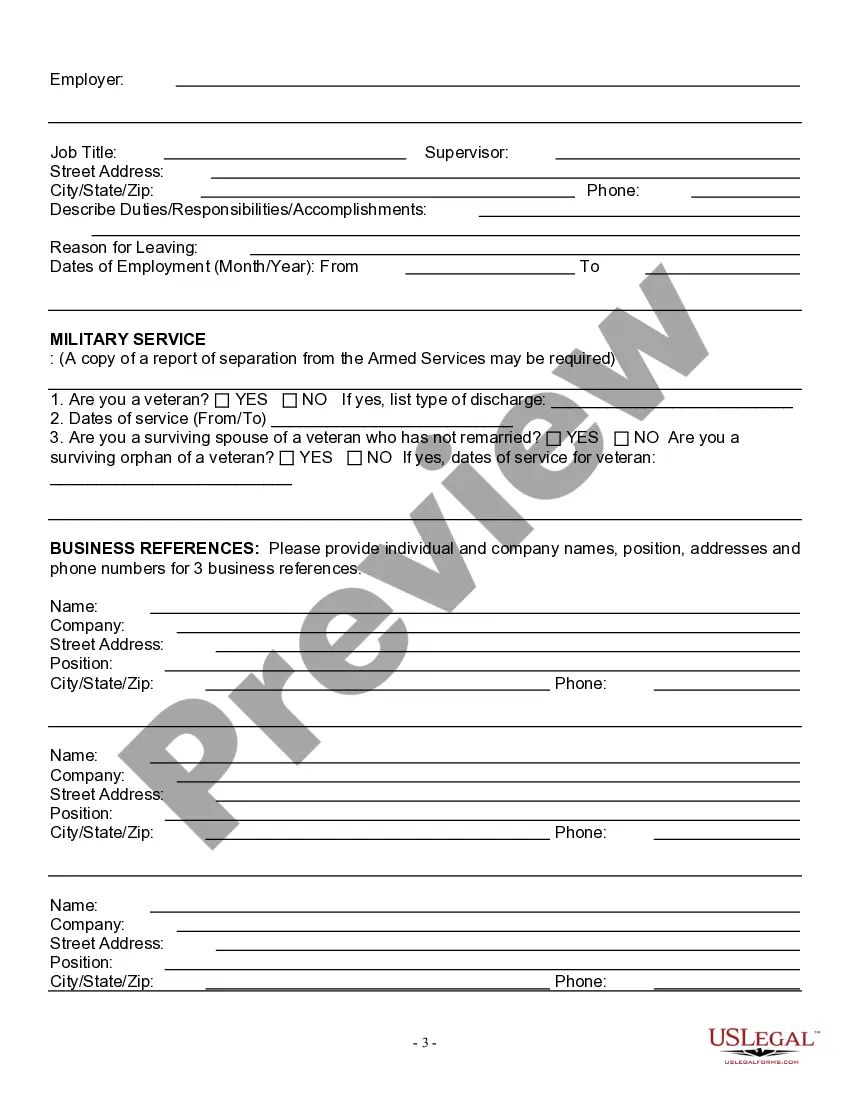

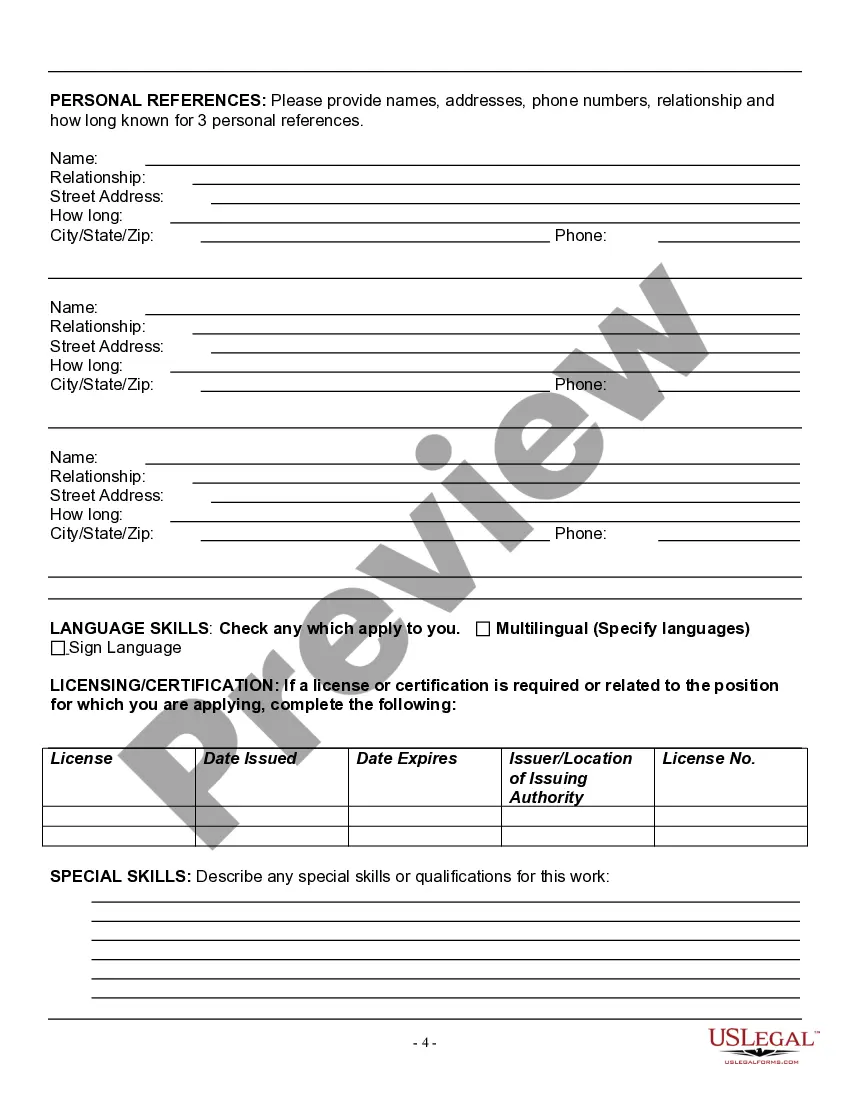

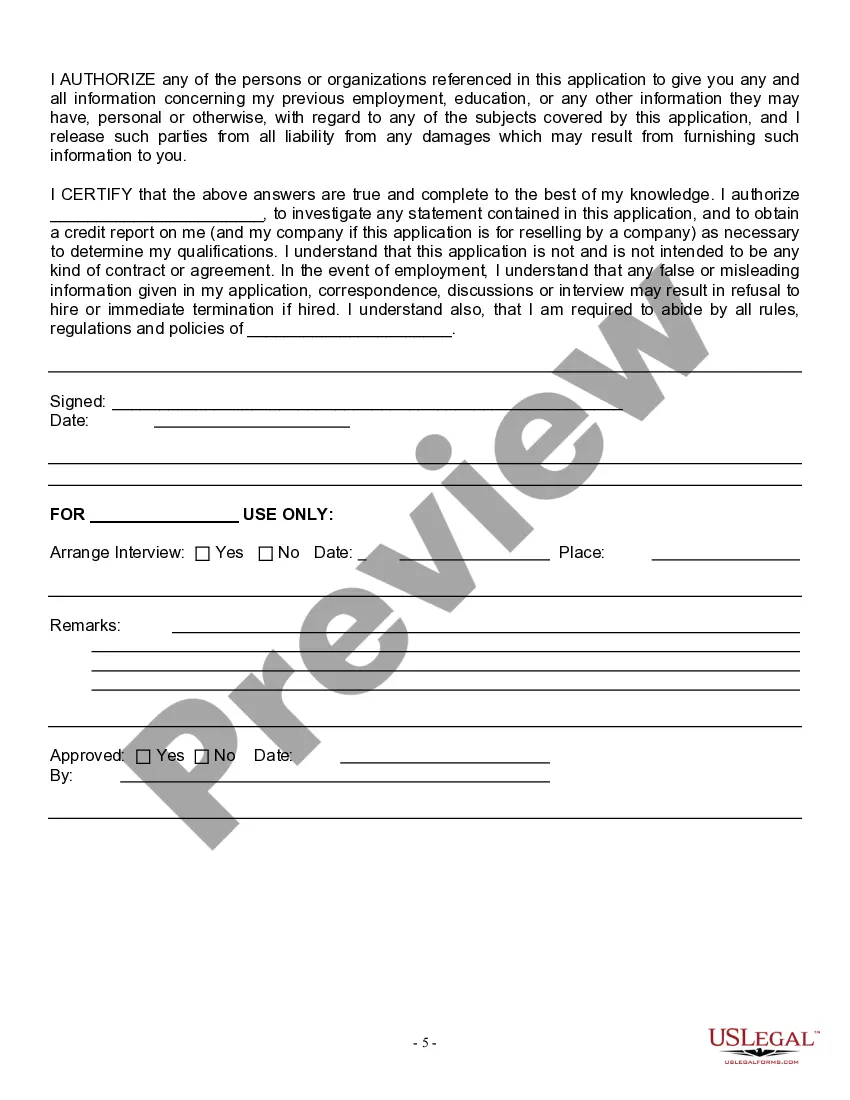

- Step 2. Use the Preview option to assess the form's content. Be sure to review the details.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

Taxpayers conducting a special event, swap meet or arts and crafts show may need an Arizona Transaction Privilege & Use Tax (TPT) license. Taxpayers who employ personnel other than family members during the special event may also need to register for Arizona withholding tax.

Become A Qualified VendorProspective vendor agency reviews the DDD QVA user guide and manual.Prospective vendor agency completes and submits an application both electronically and in hard copy.Division Contracts Administration Unit, Network Unit, and Finance Unit review the submitted application.More items...

You must register your company with Arizona Procurement Portal (APP) to do business with the state of Arizona. Only registered vendors are assured of receiving notifications of Requests for Proposals and Invitations for Bid. Suppliers may go to the Arizona Procurement Portal and register at any time.

Go to the provider's primary office and ask for a respite care worker's application. In order to work as a respite care provider, you must be at least 18 years old, have your GED or high school diploma and a government issued picture identification card.

It is not necessary for sellers to have a business license to sell on Etsy. If you are a small business selling online, you are required to follow any laws that apply to you as a small business.

A remote seller is any person or business making direct sales to Arizona customers and shipping products into Arizona but does not have a physical presence or other legal requirements to obtain a TPT license. Physical presence includes having a storefront, people or equipment in Arizona.

If you are an online retailer who ONLY sells on approved marketplaces (such as Amazon, eBay, etc), Arizona sales tax will be remitted by the marketplace and you do not need to get a sales tax permit in Arizona. However, you may choose to apply for an exemption certificate so you can purchase inventory tax-free.

Business License - Arizona does not issue nor require a state business license, however, most city/town offices issue business licenses.

Minimum Qualifications:Applicants must be 18 years or older.Applicants should be able to work at least 2 late afternoons per week (Monday-Friday) to provide care during after-school hours.In most cases this is a a part-time job with flexible scheduling, and usually a total of 10 to 15 hours per week.More items...

The state of Arizona charges $12.00 per application for a sales tax permit. On top of that, vendors are required to file for a sales tax permit in individual cities where they do business. (Out-of-state sellers with nexus in Arizona, read more about that here.)