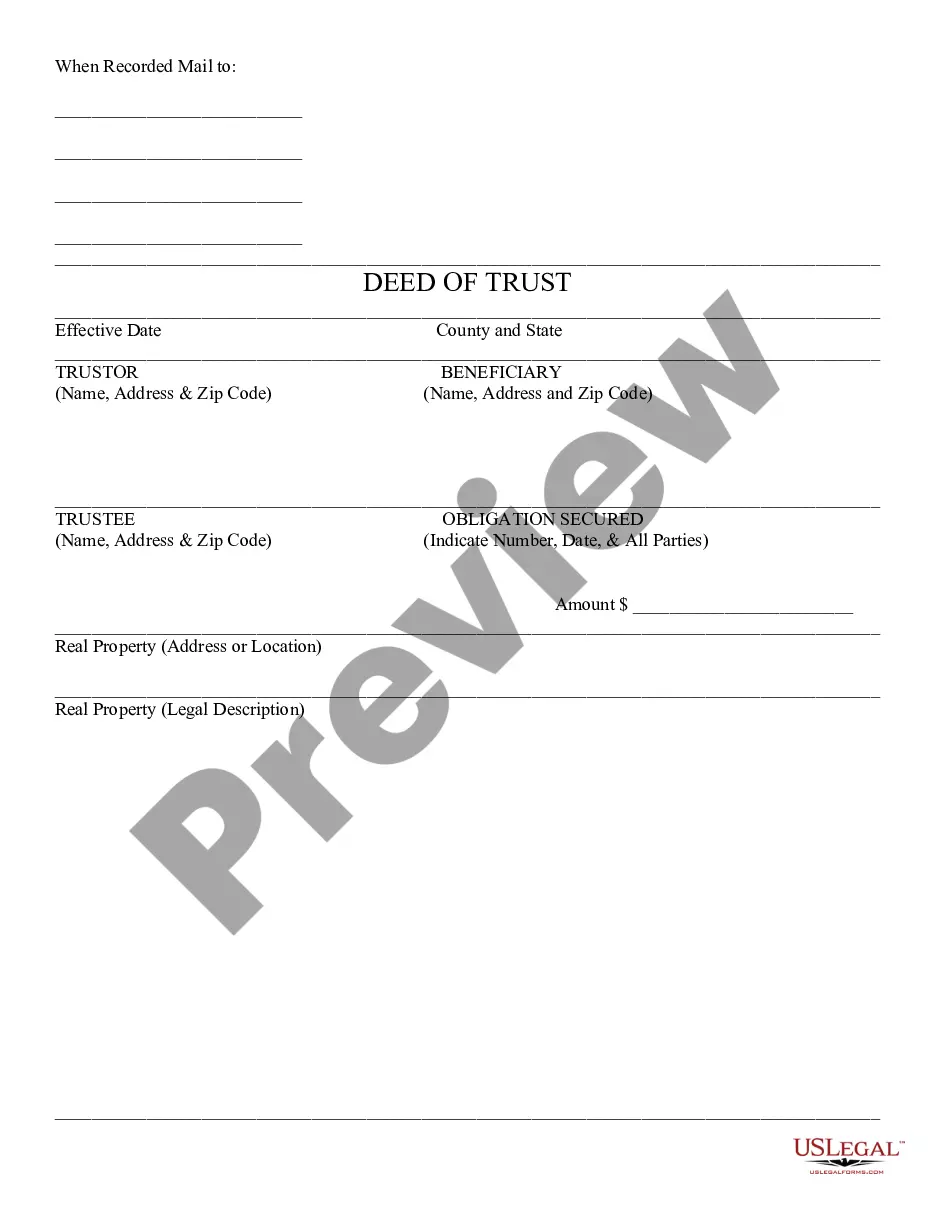

This deed, or deed-related form, is for use in property transactions in the designated state. This document, a sample Deed of Trust - Arizona, can be used in the transfer process or related task. Adapt the language to fit your circumstances. Available for download now in standard format(s).

Arizona Deed of Trust

Description

Definition and meaning

An Arizona Deed of Trust is a legal document used in real estate transactions that allows a borrower (Trustor) to borrow money from a lender (Beneficiary) while placing the property being purchased as collateral. This arrangement is akin to a mortgage, but it involves three parties: the Trustor, the Beneficiary, and the Trustee. The Trustee holds the legal title to the property until the loan is repaid in full.

How to complete a form

To fill out the Arizona Deed of Trust, follow these steps:

- Effective Date: Enter the date the Deed of Trust becomes effective.

- County and State: Provide the specific county and state details.

- Trustor Information: Fill in the name, address, and zip code of the Trustor.

- Beneficiary Information: Provide the name, address, and zip code of the Beneficiary.

- Trustee Information: Enter the name, address, and zip code of the Trustee.

- Obligation Secured: Specify the amount of money being secured by the Deed of Trust.

- Real Property Address: Fill in the address and legal description of the real property.

Who should use this form

The Arizona Deed of Trust should be utilized by individuals or entities engaging in real estate transactions where a property is used as collateral for a loan. This form is suitable for homeowners seeking to purchase or refinance real estate, as well as real estate investors looking to secure financing for property investments.

Legal use and context

The Arizona Deed of Trust is governed by the laws of the State of Arizona, specifically under ARS Title 11, Chapter 6.1. This document provides lenders with a legal interest in the property being loaned against, allowing them to foreclose if the borrower fails to meet repayment obligations. It is commonly used in residential mortgage transactions and can also apply to commercial real estate dealings.

Key components of the form

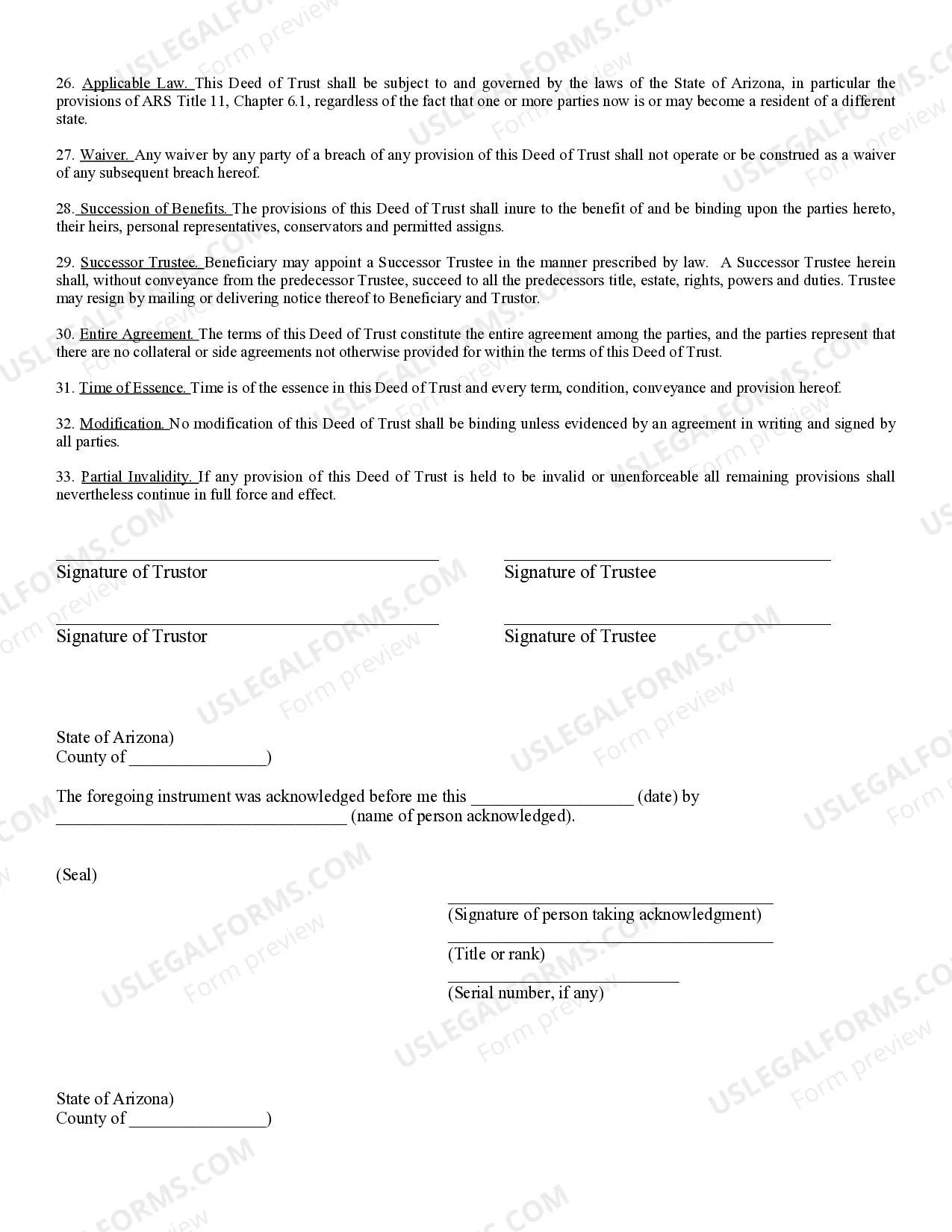

The Arizona Deed of Trust includes several key elements:

- Trustor: The borrower who is granting the interest in the property.

- Beneficiary: The lender receiving the secured interest.

- Trustee: The neutral third party holding the legal title.

- Obligation Secured: Details the amount owed by the Trustor.

- Legal Description: Provides the exact description of the property.

Common mistakes to avoid when using this form

When completing the Arizona Deed of Trust, avoid these common errors:

- Incorrectly entering names or addresses, leading to legal complications.

- Failing to ensure all parties have signed the document, which could invalidate the agreement.

- Omitting the legal description of the property, which is crucial for clear title.

- Not notarizing the Deed of Trust, as notarization may be a requirement for enforceability.

How to fill out Arizona Deed Of Trust?

If you're seeking precise Arizona Deed of Trust examples, US Legal Forms is exactly what you require; access documents generated and reviewed by state-authorized lawyers.

Utilizing US Legal Forms not only alleviates concerns regarding legal documents; additionally, you conserve time, effort, and money! Downloading, printing, and completing a professional form is significantly less expensive than hiring an attorney to do it for you.

And that's it. In just a few simple clicks, you obtain an editable Arizona Deed of Trust. Once you register, all future requests will be processed even more easily. If you have a US Legal Forms subscription, simply Log In to your account and click the Download button you see on the form’s page. When you need to use this example again, you can always find it in the My documents section. Don't waste your time and energy comparing numerous forms across various websites. Acquire professional templates from a single reliable service!

- To start, complete your registration by entering your email and creating a password.

- Follow the instructions provided below to set up your account and obtain the Arizona Deed of Trust example to address your needs.

- Utilize the Preview feature or review the document details (if available) to ensure that the example is the one you require.

- Assess its suitability in your state.

- Click Buy Now to place an order.

- Choose a preferred pricing plan.

- Create an account and pay using your credit card or PayPal.

- Select an appropriate file format and save the document.

Form popularity

FAQ

A trust is a legal entity that holds title to property for the benefit of beneficiaries, whereas a beneficiary deed is a tool that allows property to transfer automatically upon death without going through probate. With an Arizona Deed of Trust, you can fund a trust, providing control and benefits for the designated beneficiaries. Understanding these differences can help you make informed decisions about asset management and estate planning.

Transferring a deed to a trust in Arizona involves preparing a new deed that names the trust as the new property owner. Alongside this, you will need to record the new deed with the county recorder’s office. This action effectively updates the ownership under the Arizona Deed of Trust and ensures that the property is managed according to the terms of the trust.

In Arizona, the time limit to enforce a deed of trust is typically six years from the date of default. After this period, the lender may lose the right to foreclose on the property. It's important to stay informed about the specifics related to the Arizona Deed of Trust to ensure all parties involved are aware of their rights and responsibilities.

Yes, Arizona is a deed of trust state, which means that most real estate transactions in the state utilize a deed of trust instead of a mortgage. This choice often provides a faster process for lenders to reclaim property in case of default. Understanding the implications of an Arizona Deed of Trust is crucial for anyone involved in real estate transactions in Arizona.

To put your home in a trust in Arizona, you need to create a trust document that outlines all terms and conditions. Next, you will need to transfer the property title into the trust's name, which is often done through a deed. Ensure you follow Arizona's legal requirements to establish a valid Arizona Deed of Trust, as this will safeguard your home's ownership under the trust.

Arizona is considered a deed of trust state, which means that most real estate transactions utilize a deed of trust rather than a traditional mortgage. This method provides a streamlined process for lenders to secure loans and protect their interests. Understanding this distinction is crucial for anyone buying or refinancing a property in Arizona. If you need help securing the right documents, you can turn to US Legal Forms for assistance with your Arizona Deed of Trust.

To obtain a copy of your deed in Arizona, you can visit the county recorder's office where your property is located. Most counties also provide online access to property records, allowing you to search for your deed digitally. If you need assistance navigating this process, platforms like US Legal Forms can offer guidance and resources to help you find your Arizona Deed of Trust.

A trust is a legal arrangement where one party holds property for the benefit of another, while a trust deed is a specific document used in real estate transactions in Arizona. A trust deed involves three parties: the borrower, the lender, and the trustee. It's crucial to understand these differences, especially when dealing with an Arizona Deed of Trust.

To put your house in a trust in Arizona, start by creating a trust document that outlines how you want the property managed, including an Arizona Deed of Trust to facilitate the transfer. Sign the deed in front of a notary, clearly indicating that the property is moving from your name into the trust's name. Finally, record the deed with the county recorder’s office to complete the process and ensure your house is properly held in trust.

One common mistake parents make when setting up a trust fund is failing to properly fund the trust with their assets, which can lead to complications later. If properties are not correctly transferred using instruments like an Arizona Deed of Trust, beneficiaries may miss out on intended benefits. Proper planning ensures that your wishes are fulfilled and provides peace of mind for you and your family.