Arizona Petition For Approval Of Final Accounting is a legal document used in the state of Arizona to petition the court for the approval of a Final Accounting. This document is typically used in probate law proceedings, such as in the distribution of assets from an estate. It outlines the assets, liabilities, and expenses of the estate, and requests the court’s approval of the accounting. There are three types of Arizona Petition For Approval Of Final Accounting: 1) Petition For Approval Of Final Accounting By Personal Representative; 2) Petition For Approval Of Final Accounting By Trustee; and 3) Petition For Approval Of Final Accounting By Conservator.

Arizona Petition For Approval Of Final Accounting

Description

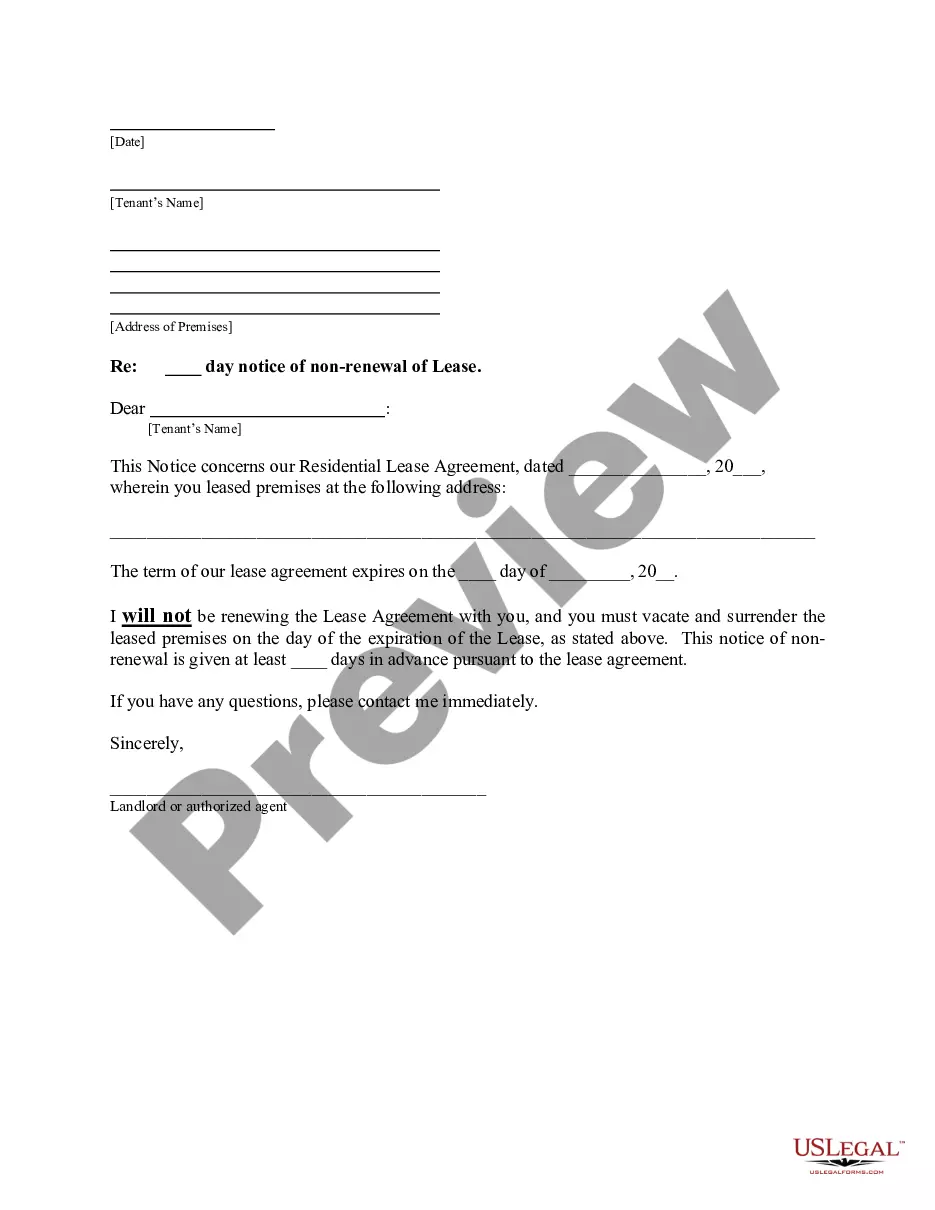

How to fill out Arizona Petition For Approval Of Final Accounting?

US Legal Forms is the easiest and most lucrative method to discover appropriate formal templates.

It’s the largest online repository of business and personal legal documents created and validated by legal experts.

Here, you can locate printable and fillable templates that adhere to national and local laws - just like your Arizona Petition For Approval Of Final Accounting.

Review the form description or preview the document to ensure you’ve found the one that meets your requirements, or search for an alternative using the search bar above.

Click Buy now when you’re certain of its suitability with all the criteria, and select the subscription plan that you prefer the most.

- Obtaining your template involves just a few straightforward steps.

- Users who already possess an account with an active subscription only need to Log In to the online service and download the form onto their device.

- After that, they can find it in their profile under the My documents tab.

- Here’s how you can obtain a well-prepared Arizona Petition For Approval Of Final Accounting if you are using US Legal Forms for the first time.

Form popularity

FAQ

To become an executor of an estate in Arizona, you need to be appointed by the probate court during the probate process. This can occur through the will, which specifies who the executor is, or through a petition if there is no will. You will be required to file the Arizona Petition For Approval Of Final Accounting together with other documents to formally accept your duties. Being an executor involves managing the estate’s assets, including debts and distributions, so ensure you are ready for this responsibility.

In Arizona, you typically have a timeframe of two years from the date of death to file probate proceedings. However, it is advisable to file the Arizona Petition For Approval Of Final Accounting sooner to address any estate concerns and distribute assets promptly. Delaying the filing may complicate the process and create potential legal issues. Always consult with a legal expert to ensure you meet your obligations effectively.

To start the probate process in Arizona, you must file a petition with the local probate court in the county where the deceased person lived. You will need to include the required documents, such as the death certificate and a will, if it exists. Completing the Arizona Petition For Approval Of Final Accounting is essential to ensure proper financial handling of the estate. Once the petition is filed, the court will schedule a hearing to address any issues.

In Arizona, there is no automatic divorce after a period of separation. You must file for divorce, regardless of how long you have been separated. However, if you streamline your process with an Arizona Petition For Approval Of Final Accounting, you can expedite your divorce proceedings, making it easier to reach finality.

A petition to enforce in Arizona is a legal request to compel compliance with a court order or agreement. If one party fails to meet their obligations, the other can bring this petition to get the court involved. Using an Arizona Petition For Approval Of Final Accounting can help clarify these obligations, facilitating smoother enforcement.

The final accounting of the estate details all the financial transactions that occurred during the estate administration. It includes information about income, expenses, and distributions to beneficiaries. Filing your Arizona Petition For Approval Of Final Accounting is crucial in ensuring accountability and transparency to all parties involved.

You must live in Arizona for at least 90 days before you can file for divorce. This requirement ensures that the court has jurisdiction over your case. As you prepare your documents, consider using an Arizona Petition For Approval Of Final Accounting to streamline the completion of your divorce.

To dissolve a marriage in Arizona, you need to file a petition for dissolution with the court. This process begins once you meet the residency requirements. After filing, you will submit your Arizona Petition For Approval Of Final Accounting to finalize matters like asset distribution and any outstanding debts.

In Arizona, the shortest residency requirement for divorce is just 90 days. This means you must reside in the state for at least 90 days before filing for divorce. If you meet this residency requirement, you can file your Arizona Petition For Approval Of Final Accounting to ensure the dissolution process is smooth and legally compliant.

To prepare final accounts, first collect all relevant financial records, including bank statements and invoices. Then, categorize the income and expenses related to the estate, ensuring accuracy in reporting. Once completed, draft a concise summary that illustrates the financial position clearly. This summary is essential when submitting your Arizona Petition For Approval Of Final Accounting to finalize the estate and distribute assets.