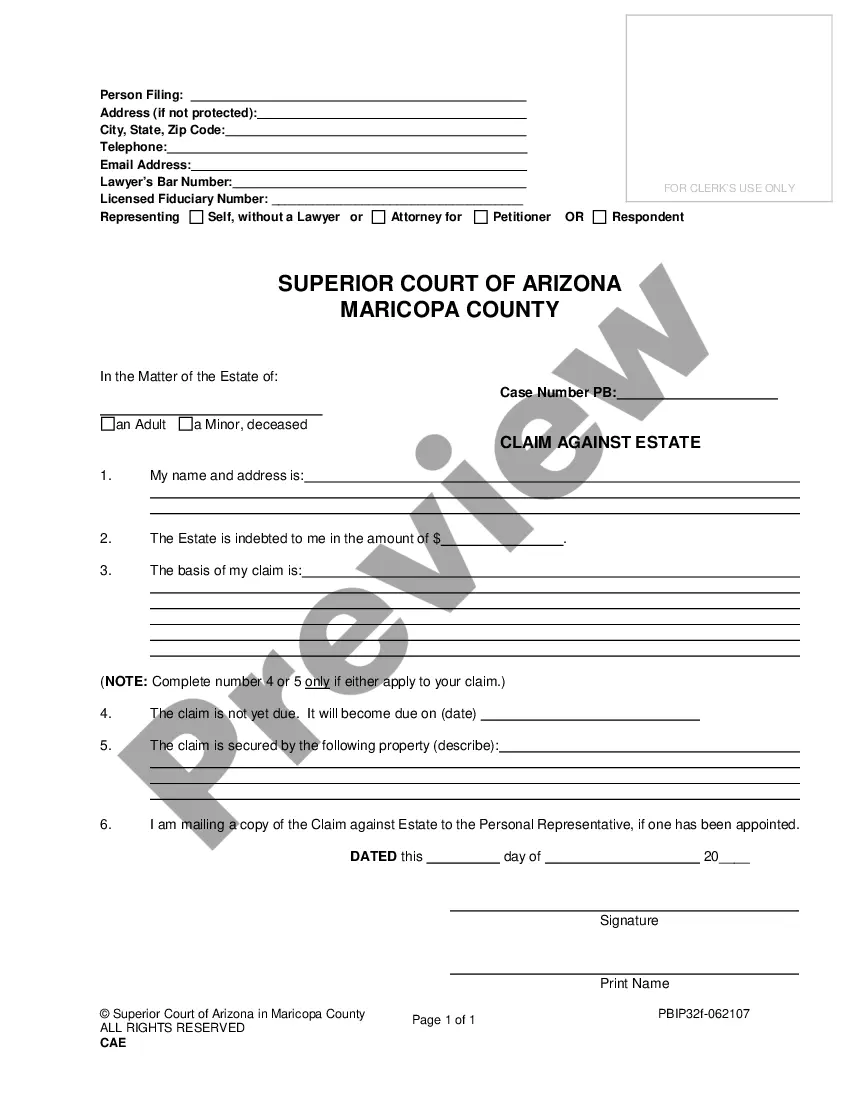

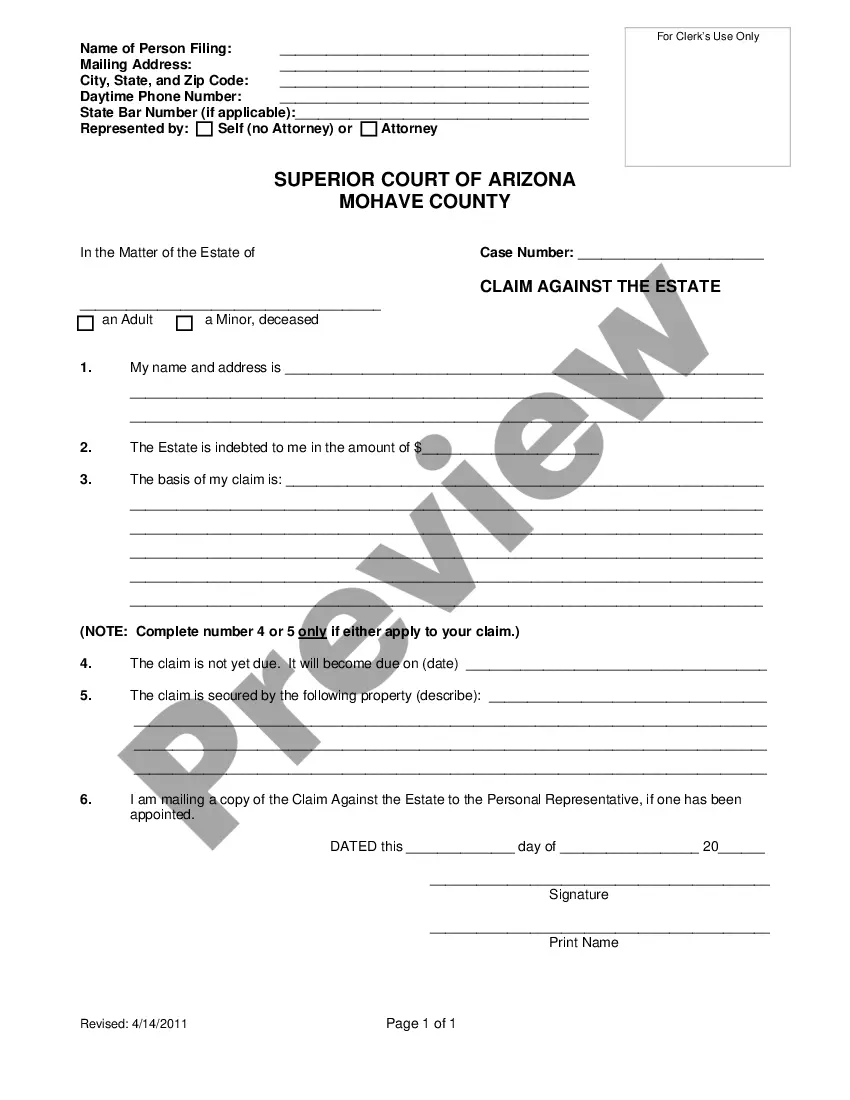

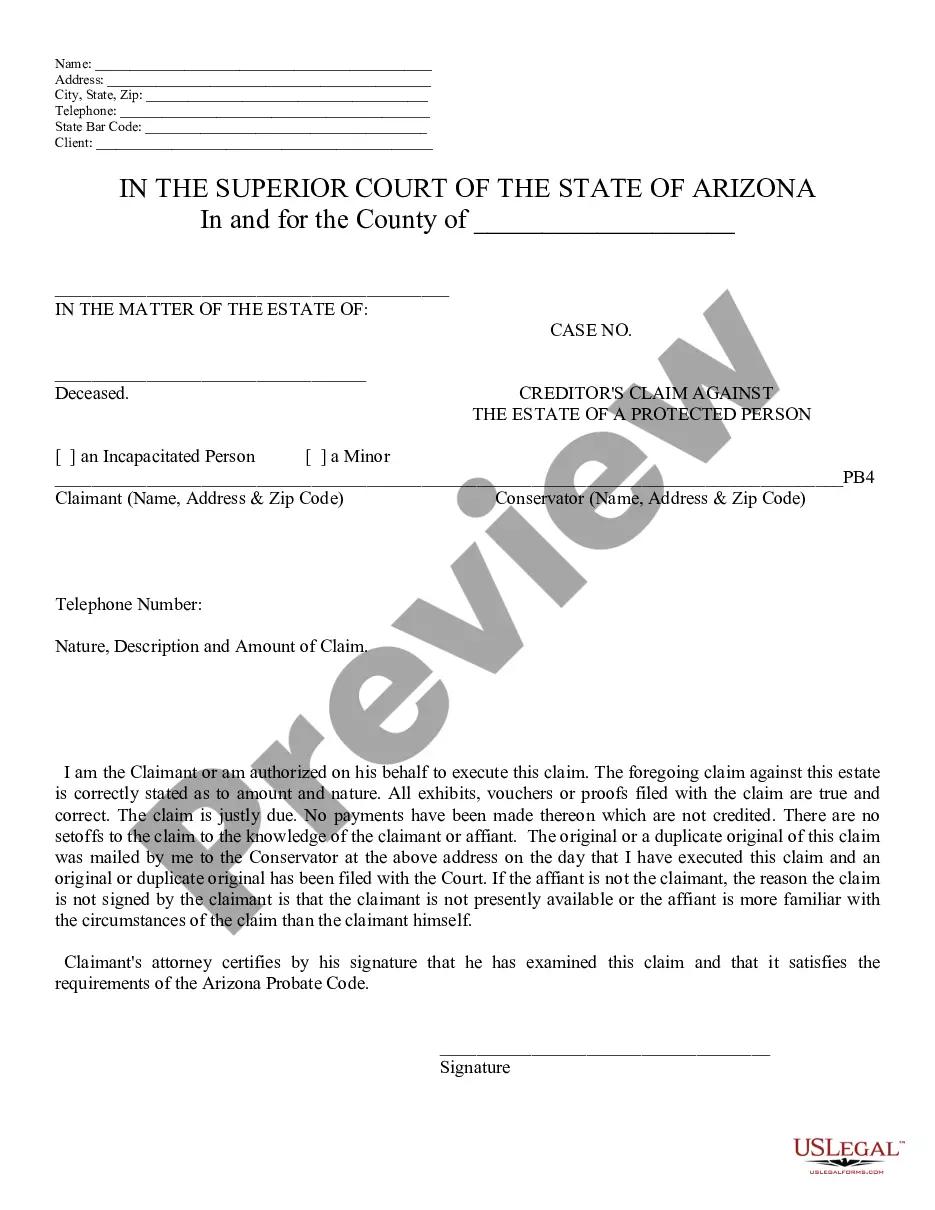

Creditors Claim in Probate - Arizona: This form is signed by a creditor, stating that he/she has a claim against the decedent's estate. The form further lists the claim, and the services performed for said claim. It is available for download in both Word and Rich Text formats.

Arizona Creditors Claim in Probate

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Arizona Creditors Claim In Probate?

If you're searching for precise Arizona Creditors Claim in Probate examples, US Legal Forms is what you require; obtain documents supplied and verified by state-accredited legal professionals.

Utilizing US Legal Forms not only helps you avoid issues related to legal documentation; you also save time, energy, and money! Downloading, printing, and completing a professional template is considerably less expensive than hiring a lawyer to complete it on your behalf.

And that’s it. With a few simple clicks, you obtain an editable Arizona Creditors Claim in Probate. Once you set up an account, all future purchases will be processed even more easily. With a US Legal Forms subscription, simply Log In to your profile and click the Download button available on the form’s page. Then, when you need to use this template again, you'll always be able to access it in the My documents section. Don’t waste your time sifting through countless forms on various online sources. Acquire professional copies from a single secure platform!

- To start, finish your sign-up procedure by providing your email and setting a password.

- Follow the directions below to create your account and access the Arizona Creditors Claim in Probate template to meet your requirements.

- Utilize the Preview feature or examine the document details (if available) to ensure that the example is what you need.

- Verify its legality in your jurisdiction.

- Click Buy Now to place an order.

- Choose a preferred pricing plan.

- Create your account and pay with your credit card or PayPal.

- Select a convenient format and save the document.

Form popularity

FAQ

Creditors have a period of one year from the date of the decedent's death to collect debts owed to them from the estate. This timeline is important as it sets the limits for claims made against the estate’s assets. Understanding this timeframe is vital for those managing Arizona Creditors Claim in Probate.

In Arizona, there isn't a strict timeline for settling an estate, but the process typically takes about six to twelve months, depending on the complexity of the estate. Estate administrators should aim to settle all debts and distribute assets in a timely manner to avoid complications. Timeliness is crucial in handling Arizona Creditors Claim in Probate.

Rule 51 in Arizona probate specifies the procedures for filing a claim against an estate after a notice to creditors is published. This rule instructs claimants on the required format and submission process for their claims, ensuring they comply with legal standards. Adhering to Rule 51 is essential for anyone filing an Arizona Creditors Claim in Probate.

To file a claim against an estate in Arizona, start by preparing a written claim that outlines the amount owed and the basis for the claim. Then, submit this claim to the personal representative of the estate, as well as the probate court. Understanding the process involved with Arizona Creditors Claim in Probate can help you navigate these steps more effectively.

Creditors in Arizona have a period of four months to file a claim against an estate once they receive notice of the probate proceedings. If they miss this deadline, they typically forfeit their right to seek repayment from the estate. It’s crucial for those involved in Arizona Creditors Claim in Probate to stay informed about these timelines to protect their interests.

To publish a notice to creditors in Arizona, you must first draft the notice that meets legal requirements. Then, publish this notice in a newspaper that is widely circulated in the county where the probate case is filed. This step ensures that creditors are aware of the probate process and encourages them to file their claims, particularly important for Arizona Creditors Claim in Probate.

In Arizona, the statute of limitations to contest a will is generally three years from the date the will is admitted to probate. If a person fails to file a contest within this time frame, they lose their right to challenge the will. This time constraint emphasizes the importance of timely action when dealing with Arizona Creditors Claim in Probate.

Certain assets in Arizona may be exempt from probate, including life insurance proceeds, retirement accounts, and property held in joint tenancy. Additionally, small estates under a specific value may qualify for simplified probate procedures. Familiarizing yourself with these exemptions can help you better understand Arizona Creditors Claim in Probate and protect your inheritance.

In Arizona, the statute of limitations for most debts is typically three to six years, depending on the type of debt. After this period, creditors may no longer legally enforce collection of the debt. Knowing the timeframe can be beneficial, especially when navigating Arizona Creditors Claim in Probate.

In Arizona, you typically do not inherit debt unless you are legally tied to that debt, such as being a co-signer. Creditors can only claim against the deceased's estate for outstanding debts during the probate process. This relationship with Arizona Creditors Claim in Probate is essential for understanding how your own finances may be impacted.