Arizona Current Employer Information is information related to businesses and employers in the state of Arizona. It includes data such as business name, address, contact information, and number of employees. It also includes details about the business owner, such as their name, employer identification number, and contact information. Arizona Current Employer Information also includes information about the company’s financials, such as gross receipts and net income. Different types of Arizona Current Employer Information include business registration information, tax records, and employee records.

Arizona Current Employer Information

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

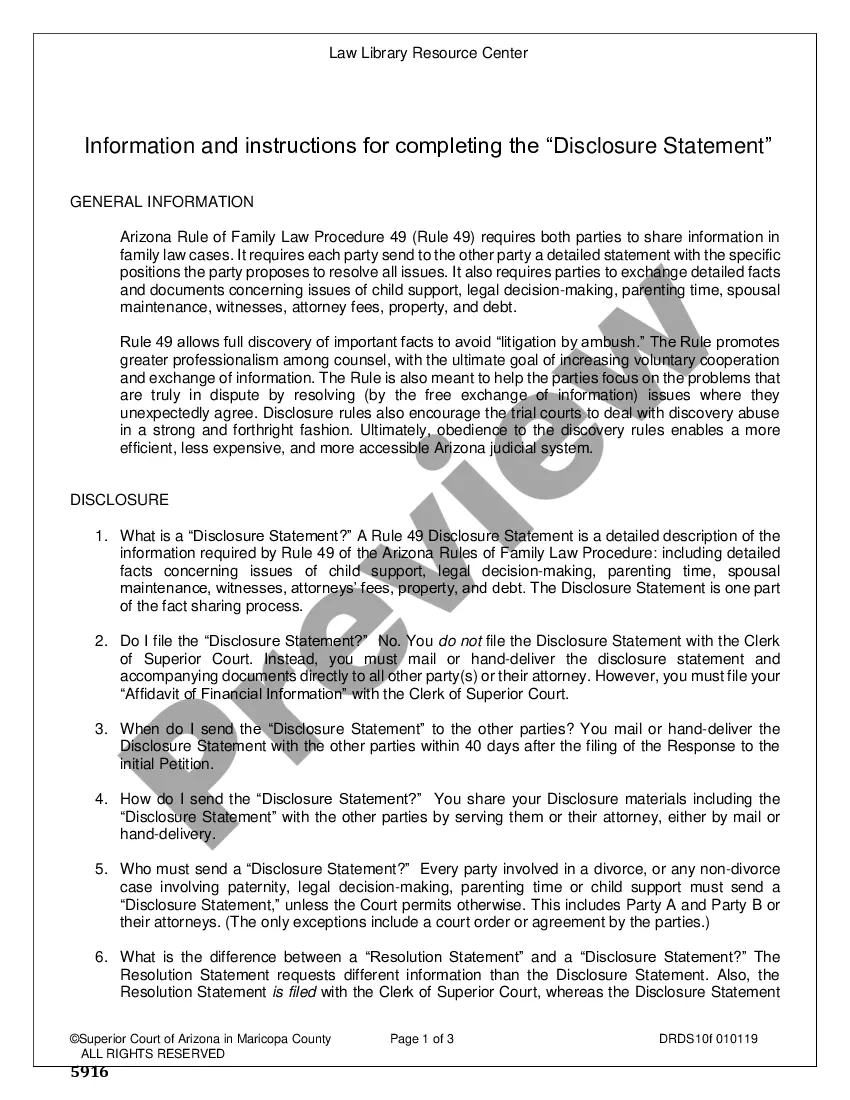

How to fill out Arizona Current Employer Information?

Engaging with legal documents demands diligence, accuracy, and the use of well-prepared templates. US Legal Forms has been assisting individuals nationwide for 25 years, so when you select your Arizona Current Employer Information template from our collection, you can be assured it complies with federal and state laws.

Utilizing our service is simple and efficient. To acquire the necessary documents, all you need is an account with an active subscription. Here’s a quick overview for you to secure your Arizona Current Employer Information in moments.

All documents are designed for multiple uses, like the Arizona Current Employer Information displayed on this site. If you require them again, you can complete them without additional payment - simply access the My documents tab in your profile and finalize your document anytime you need it. Try US Legal Forms and accomplish your business and personal paperwork swiftly and in full legal compliance!

- Be sure to thoroughly review the form's content and its alignment with general and legal standards by previewing it or perusing its description.

- Look for another official template if the one you have opened doesn’t match your requirements or state laws (the tab for that is in the upper page corner).

- Log In to your account and save the Arizona Current Employer Information in the preferred format. If it’s your first experience on our website, click Buy now to proceed.

- Establish an account, select your subscription option, and pay using your credit card or PayPal account.

- Choose in which format you wish to receive your form and click Download. Print the template or upload it to a professional PDF editor to submit it electronically.

Form popularity

FAQ

To file Arizona tax withholding, you need to submit forms through the Arizona Department of Revenue's online portal or via mail. Ensuring timely filing is important to avoid penalties. Regularly checking your Arizona Current Employer Information can help you stay updated on deadlines and filing requirements. Utilizing resources from uslegalforms can also simplify this process.

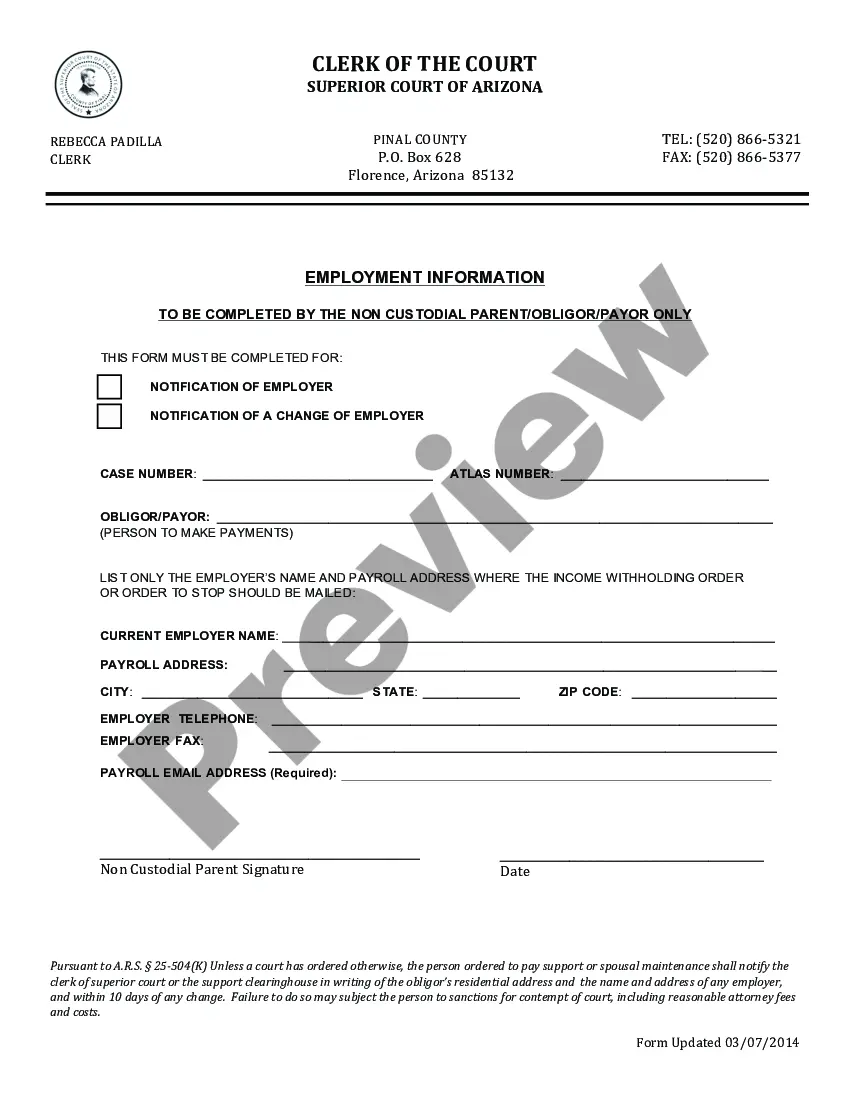

An income withholding order in Arizona is a legal directive requiring employers to withhold a portion of an employee's wages for child support payments. This order ensures that support obligations are met directly from the employee’s paycheck. Understanding these orders is crucial for both employees and employers. Stay informed on Arizona Current Employer Information to manage these obligations effectively.

Yes, you must notify child support enforcement if you change jobs in Arizona. This ensures that the correct withholding orders are in place for appropriate support payments. Keeping your Arizona Current Employer Information updated will help facilitate this process and maintain compliance. Prompt notifications also contribute to the timely support distribution.

Yes, Arizona has a state withholding tax that employers must deduct from employee wages. This tax is essential for funding state services and obligations. Employers should be aware of their responsibilities regarding this withholding and stay informed through Arizona Current Employer Information. Complying will help avoid penalties and ensure smooth operations.

The percentage you should withhold for Arizona state taxes varies based on the employee's income and filing status. Typically, withholding ranges from 0.75% to 4.5%. Always refer to the latest Arizona Current Employer Information for the most accurate and updated withholding rates. Using these rates will help you comply with state regulations.

To set up a withholding account in Arizona, you need to register with the Arizona Department of Revenue. This process can often be completed online, making it efficient and convenient. Once registered, you can start withholding the appropriate state taxes for your employees. Keep your Arizona Current Employer Information handy to streamline and simplify this setup.

Choosing your Arizona withholding involves evaluating your income levels, deductions, and credits. By using the Arizona withholding calculator, you can estimate the right amount to withhold based on your financial situation. This ensures you meet your tax obligations without overpaying. For more comprehensive guidance, consider consulting Arizona Current Employer Information resources.

Arizona law specifies that the maximum amount that can be withheld for child support is generally 50% of your disposable income for current support obligations. This amount may increase if you owe back support. Always share your Arizona Current Employer Information when addressing the withholding order to ensure proper calculations. If you have questions, uslegalforms offers resources to help clarify your obligations.

To stop paying child support in Arizona, you must file a petition with the court that issued the original support order. It is essential to demonstrate a significant change in circumstances, such as job loss or a change in income. Alongside, providing accurate Arizona Current Employer Information will help the court review your situation effectively. For a smoother process, using uslegalforms can guide you through the necessary steps.

In Arizona, an income withholding order typically takes a few days to process, but it can vary. Once issued by the court, your current employer usually receives the order within one to two weeks. It is important to ensure that you provide accurate Arizona Current Employer Information to avoid delays. If you encounter any issues, consider reaching out for assistance through resources like uslegalforms.