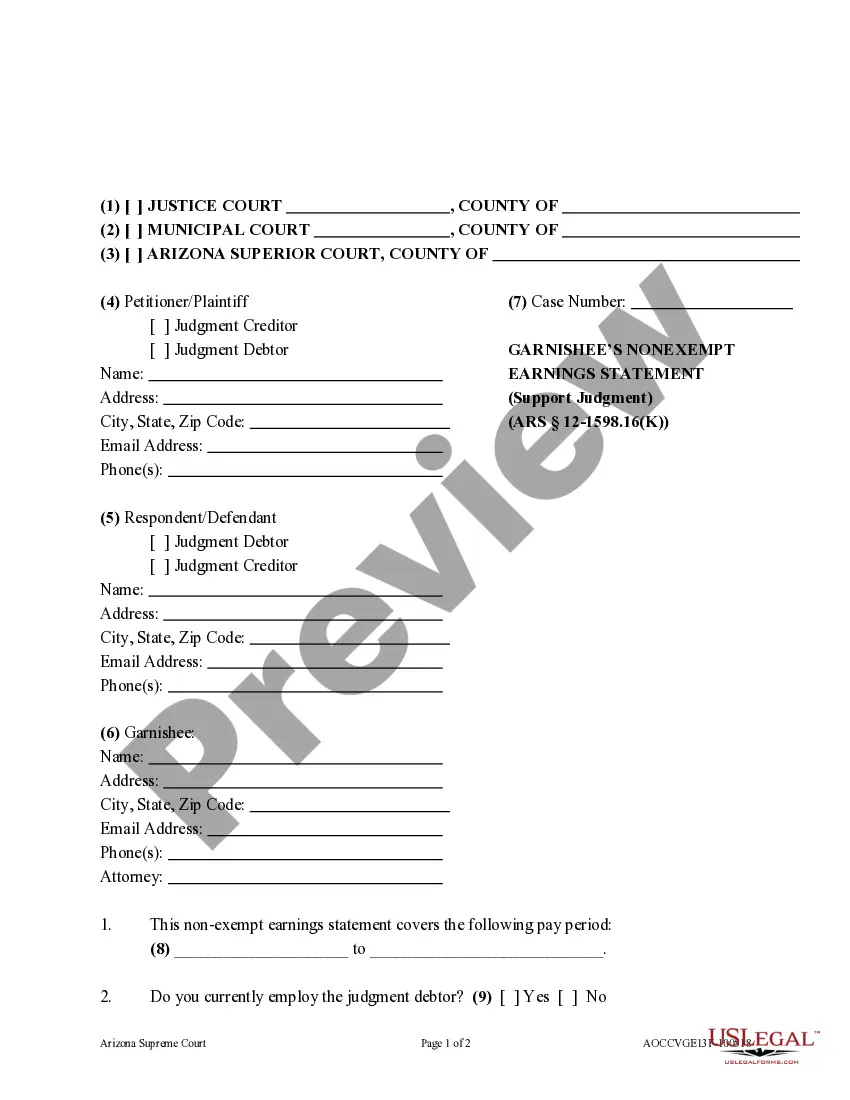

Non Expempt Earnings Statement - Non-Support: This statement gives an employer the calculation to use when garnishing an employee's wages. After he/she completes this form, they are to send a copy to both the Debtor and Creditor. This form is available for download in both Word and Rich Text formats.

Arizona Garnishee's Nonexempt Earnings Statement (Not for Support of a Person)

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Arizona Garnishee's Nonexempt Earnings Statement (Not For Support Of A Person)?

If you're seeking precise Arizona Garnishee's Nonexempt Earnings Statement - Nonsupport forms, US Legal Forms is precisely what you require; find documents crafted and validated by state-certified legal professionals.

Utilizing US Legal Forms not only spares you from troubles related to official paperwork; it also saves you time, effort, and money! Downloading, printing, and filling out a professional template is significantly more cost-effective than hiring an attorney to do it for you.

And that's it. In just a few simple clicks, you obtain an editable Arizona Garnishee's Nonexempt Earnings Statement - Nonsupport. After creating an account, all future orders will be processed even more easily. If you have a US Legal Forms subscription, simply Log In to your profile and then click the Download button available on the form’s page. Then, whenever you need to use this blank again, you'll always be able to find it in the My documents section. Don't waste your time and energy searching through countless forms on various websites. Purchase accurate documents from a single reliable service!

- To start, complete your registration process by entering your email and creating a password.

- Follow the steps provided below to set up your account and locate the Arizona Garnishee's Nonexempt Earnings Statement - Nonsupport template to address your situation.

- Utilize the Preview feature or check the document description (if available) to confirm that the form is what you need.

- Verify its validity in your jurisdiction.

- Click Buy Now to place your order.

- Select a preferred pricing option.

- Create your account and make the payment using your credit card or PayPal.

- Choose a suitable format and save the document.

Form popularity

FAQ

The winner of the case may collect by first sending a letter stating what is owed and trying to collect from the other party . If the other party refuses to pay there are of other tools that a person can use to collect such as: garnishment , executions on property , debtor's examinations, and recording judgments.

If it's already started, you can try to challenge the judgment or negotiate with the creditor. But, they're in the driver's seat, and if they don't allow you to stop a garnishment by agreeing to make voluntary payments, you can't really force them to. You can, however, stop the garnishment by filing a bankruptcy case.

Option 1: Don't allow a judgment to be entered against you. Option 2: Challenge the judgment. Option 3: Don't expose assets to garnishment. Option 4: Reduce the amount that is being garnished (wage garnishments only) Option 5: Settlement. Option 6: Bankruptcy.

Your creditor can garnish your wages once they have obtained a money judgment against you and you fail to pay the balance. At that point, the creditor will request an order to garnish your wages from the court, and have it served on you and your employer.

Limits on Wage Garnishments 25% of the debtor's disposable earnings (what's left after mandatory deductions), or the amount by which the debtor's wages exceed 30 times the minimum wage, whichever is lower.

The journal entry will be Debit Gross Wages, and Credit "Child Support Liability account." When you write the check to pay the garnishment, on the Expenses tab, you list the Child Support Liability account.

Regular creditors cannot garnish your wages without first suing you in court and obtaining a money judgment. That means that if you owe money to a credit card company, doctor, dentist, furniture company, or the like, you don't have to worry about garnishment unless those creditors sue you in court.