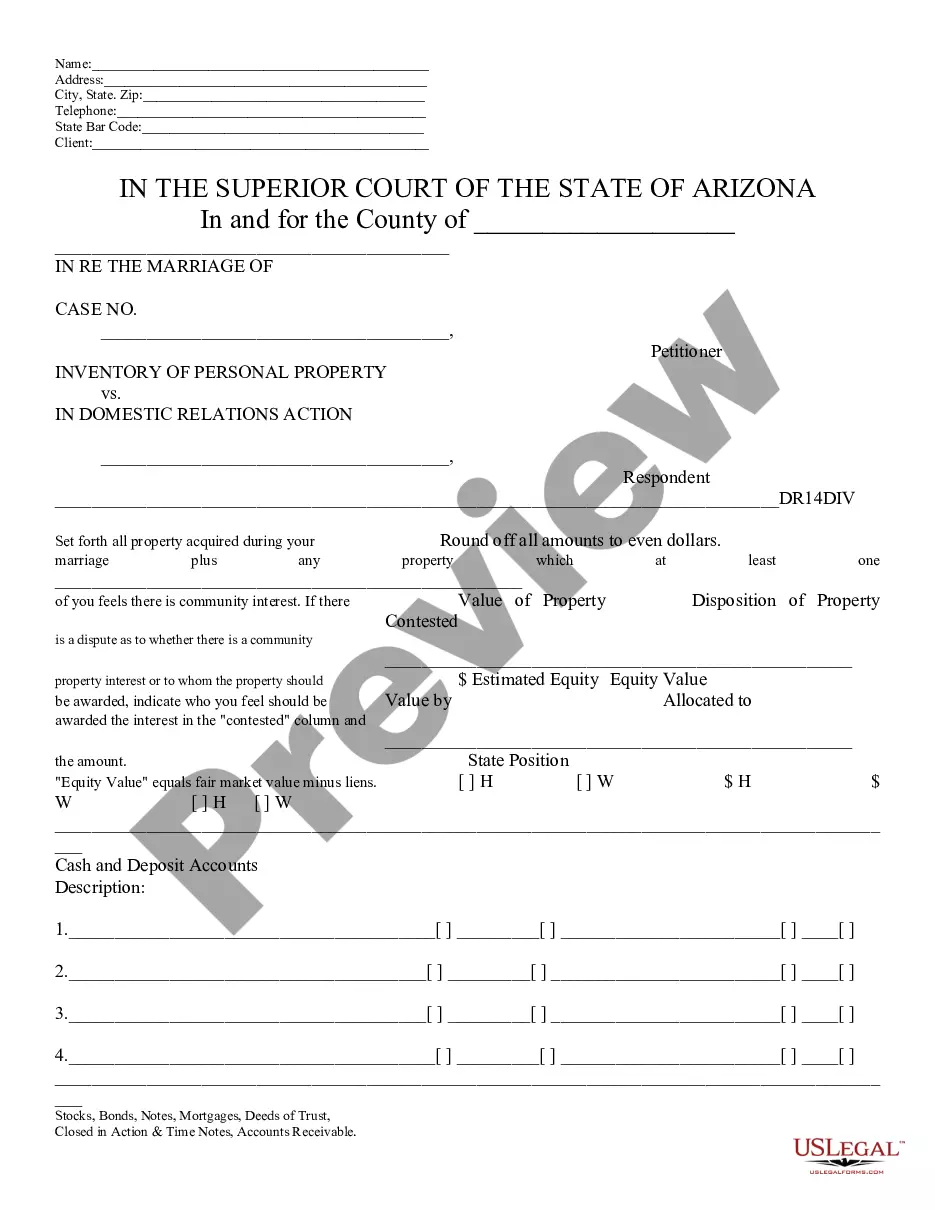

Inventory of Personal Property: The inventory of personal property lists all of the assets, debts and property a couple accumulated during their marriage. It is required that both spouses sign the document. This form is available in both Word and Rich Text formats.

Arizona Inventory of Personal Property

Description

How to fill out Arizona Inventory Of Personal Property?

If you're looking for suitable Arizona Inventory of Personal Property examples, US Legal Forms is precisely what you require; acquire files reviewed and verified by state-qualified attorneys.

Utilizing US Legal Forms not only alleviates your concerns regarding legal documents; it also saves you time, effort, and money! Downloading, printing, and completing a professional template is considerably less expensive than hiring a lawyer to handle it on your behalf.

And that's it. With just a few clicks, you possess an editable Arizona Inventory of Personal Property. After setting up your account, all future purchases will be processed more effortlessly. When you have a US Legal Forms subscription, simply Log In to your account and click the Download button available on the form's page. Then, whenever you need to access this template again, you’ll always find it in the My documents section. Don’t waste your time and energy comparing various forms across different platforms. Obtain accurate documents from a single secure source!

- To begin, complete your registration process by entering your email and creating a password.

- Follow the instructions provided below to set up an account and obtain the Arizona Inventory of Personal Property template to address your needs.

- Utilize the Preview feature or review the document details (if accessible) to ensure that the template is the one you require.

- Verify its validity in your jurisdiction.

- Click Buy Now to place an order.

- Choose a preferred pricing plan.

- Create your account and pay using a credit card or PayPal.

Form popularity

FAQ

You should include all relevant assets in your Arizona Inventory of Personal Property, such as real estate, vehicles, collectibles, art, and personal items of value. Additionally, financial accounts like stocks and bonds should also be included. This comprehensive listing ensures clarity in assessing your financial situation and helps in estate planning.

Inventory property in Arizona encompasses items held for sale, raw materials, and goods in production. This can include anything from clothes in a retail store to furniture at a warehouse. Maintaining a clear and detailed Arizona Inventory of Personal Property helps businesses and individuals assess their net worth and manage their assets effectively.

An Arizona Inventory of Personal Property typically includes all tangible and intangible assets. You should list real estate, vehicles, personal belongings, investments, and financial assets like bank accounts. It is important to document the condition and estimated value of each item, as this will aid in future planning and possible estate management.

Yes, Arizona taxes inventory as part of its personal property tax regulations. Businesses must accurately list inventory on their Arizona Inventory of Personal Property to comply with state tax laws. This tax applies to items held for resale or used in business operations. If you're unsure about inventory tax implications, USLegalForms can provide necessary documentation and guidance.

Yes, Arizona does impose personal property taxes on tangible items used in business operations. These taxes are determined based on the value of the items reported in your Arizona Inventory of Personal Property. Business owners should ensure proper assessment and payment to avoid penalties. For detailed guidance, USLegalForms offers a wealth of resources to aid in compliance.

In Arizona, most grocery food items are not subject to sales tax. This includes food for home consumption, aligning with the Arizona Inventory of Personal Property's intent to support residents. However, prepared foods or items sold for immediate consumption may attract sales tax. It's essential to distinguish between these categories for accurate tax reporting.

Yes, tangible personal property is generally taxable in Arizona. This includes items that are movable and can be touched, such as equipment and machinery. Business owners must accurately report this property in their Arizona Inventory of Personal Property. Additionally, utilizing platforms like USLegalForms can simplify your reporting process.

In Arizona, shop supplies are generally considered taxable under the Arizona Inventory of Personal Property provisions. This includes various items used in the business for maintenance or operations. However, exceptions may apply, so it's essential to review specific categories. For a comprehensive understanding, you may want to consult with a tax professional or use resources from USLegalForms.

In Arizona, there is no specific legal timeframe for how long personal belongings can remain on your property without consent. However, if the items are left unattended for more than 30 days, you may consider them abandoned. To proceed legally, you should notify the owner of the items and provide them with a chance to retrieve their belongings. Maintaining a clear Arizona Inventory of Personal Property helps manage these situations effectively.

Yes, you can claim abandoned property in Arizona, but you must follow the appropriate legal processes. Usually, you will need to report the found property to local law enforcement and wait for a specified period. If the owner does not reclaim the property, you may then be able to claim it legally. Proper documentation and an up-to-date Arizona Inventory of Personal Property can help facilitate this process.