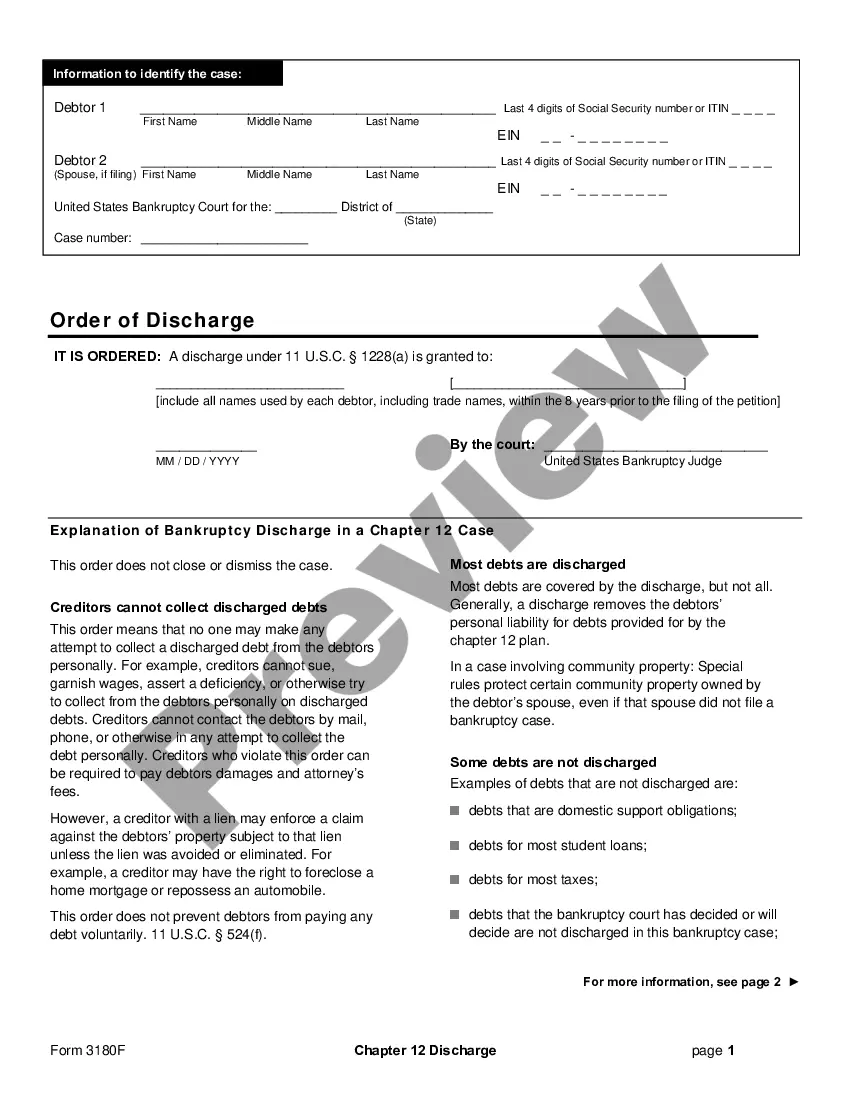

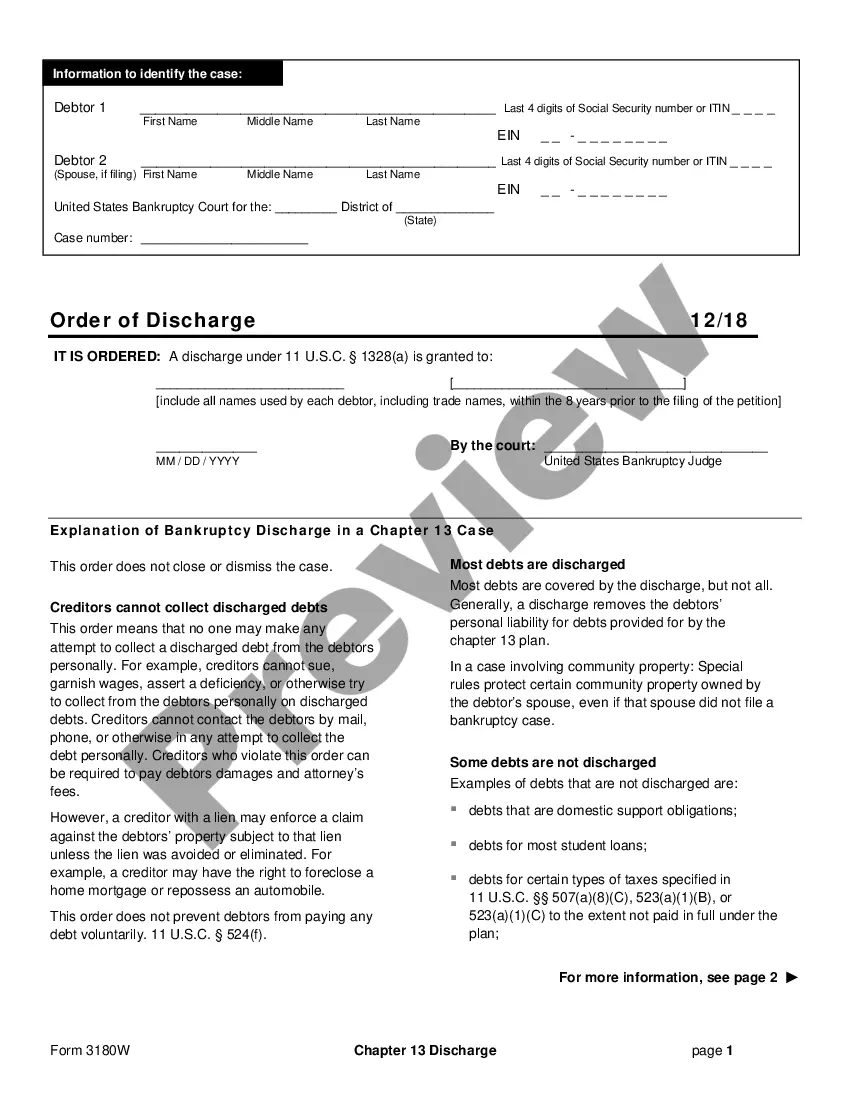

Arizona Discharge of Debtor in a Chapter 7 Case is a process whereby a debtor is legally released from all of their personal liabilities, obligations, and debts. This occurs when the debtor has completed all the requirements of a Chapter 7 bankruptcy, including filing all the necessary paperwork, attending all the required hearings, and satisfying all the court's orders. The discharge order is issued by the court, and it prevents creditors from attempting to collect the debt from the debtor. There are two types of Arizona Discharge of Debtor in a Chapter 7 Case: the Absolute Discharge and the General Discharge. An Absolute Discharge releases the debtor from all debts, regardless of whether they were listed in the bankruptcy petition or not. A General Discharge releases the debtor from all debts that were listed in the bankruptcy petition.

Arizona Discharge of Debtor in a Chapter 7 Case

Description

How to fill out Arizona Discharge Of Debtor In A Chapter 7 Case?

How much time and resources do you typically allocate for drafting official documentation.

There’s a better method to obtain such forms than engaging legal professionals or investing hours scouring the internet for a proper template. US Legal Forms is the leading online repository that provides expertly crafted and validated state-specific legal documents for various purposes, like the Arizona Discharge of Debtor in a Chapter 7 Case.

Another advantage of our service is that you can retrieve previously purchased documents securely stored in your profile within the My documents tab. Access them at any time and redo your paperwork as often as necessary.

Save time and effort in completing official paperwork with US Legal Forms, one of the most dependable online solutions. Sign up with us today!

- Browse through the form content to ensure it aligns with your state regulations. To do this, review the form description or use the Preview option.

- If your legal template does not fulfill your needs, find an alternative using the search tab at the top of the page.

- If you already possess an account with us, Log In and download the Arizona Discharge of Debtor in a Chapter 7 Case. If not, continue to the next steps.

- Click Buy now once you identify the appropriate document. Choose the subscription plan that best suits your needs to access our library’s full offering.

- Establish an account and pay for your subscription. Payments can be made with your credit card or via PayPal - our service is completely trustworthy for this.

- Download your Arizona Discharge of Debtor in a Chapter 7 Case onto your device and complete it either on a printed hard copy or electronically.

Form popularity

FAQ

In an Arizona Discharge of Debtor in a Chapter 7 Case, certain properties are exempt from liquidation. Common exemptions include your primary residence, personal belongings, and necessary household goods. This means you can retain essential assets to maintain your living standard, which can significantly ease your transition after bankruptcy.

An exception to the discharge occurs when the court identifies specific types of debts that cannot be eliminated through bankruptcy. For instance, debts related to personal injury caused by fraud or malicious intent are typically non-dischargeable. Understanding these exceptions is crucial in the Arizona Discharge of Debtor in a Chapter 7 Case, as it helps clarify what you will continue to owe after the process.

After an Arizona Discharge of Debtor in a Chapter 7 Case, some debts remain, including those like municipal fines and penalties, debts incurred through willful misconduct, and certain homeowners association fees. It’s essential to identify these debts before filing, as they can significantly impact your post-bankruptcy life. This knowledge can help reduce surprises and assist you in planning your next financial steps.

Debts that may be excluded from discharge during an Arizona Discharge of Debtor in a Chapter 7 Case include debts obtained through fraud, debts related to personal injury claims when driving under the influence, and certain government-funded loans. This exclusion ensures that the bankruptcy process does not create an avenue for dishonest behavior. Knowing which debts can be excluded helps you better prepare for your financial future.

In an Arizona Discharge of Debtor in a Chapter 7 Case, certain debts are not eligible for discharge. These typically include most tax debts, child support, alimony, and student loans. Therefore, if you are facing these types of debts, understand that they will remain your responsibility even after bankruptcy.

The duration of the Chapter 7 process in Arizona usually aligns with the three to six-month timeframe mentioned earlier. After filing the case, the required meetings and processes follow, leading to your discharge. With the help of resources like US Legal Forms, you can efficiently manage the steps and paperwork, helping you reach an Arizona Discharge of Debtor in a Chapter 7 Case as quickly as possible.

In Arizona, the income limit to qualify for a Chapter 7 discharge varies based on family size. You must pass the means test, which compares your income to the median income of similar households in Arizona. If your income is below that threshold, you may qualify for an Arizona Discharge of Debtor in a Chapter 7 Case. This ensures that those in financial distress can seek relief effectively.

The process of filing for an Arizona Discharge of Debtor in a Chapter 7 Case typically takes about three to six months. After you file your paperwork, the court schedules a meeting with your creditors, which usually occurs within a few weeks. Once this meeting is complete, it may take some time for the court to finalize your discharge. Overall, with proper guidance, you can navigate the timeline smoothly.

Typically, a Chapter 7 case is closed within a few months after you receive your discharge in Arizona. Once the bankruptcy court processes your discharge and settles any remaining matters, the case may officially close. The Arizona Discharge of Debtor in a Chapter 7 Case marks an important step toward financial freedom. To stay informed and prepared, consider connecting with a legal representative who can guide you through the entire process.

You may keep your home when filing for Chapter 7 in Arizona, especially if you can meet your mortgage payment obligations and your home falls under the exemption limits. The Arizona Discharge of Debtor in a Chapter 7 Case can allow you to protect your residence while discharging other debts. It's advisable to consult legal experts to understand how to safeguard your home effectively.