This lease rider form may be used when you are involved in a lease transaction, and have made the decision to utilize the form of Oil and Gas Lease presented to you by the Lessee, and you want to include additional provisions to that Lease form to address specific concerns you may have, or place limitations on the rights granted the Lessee in the “standard” lease form.

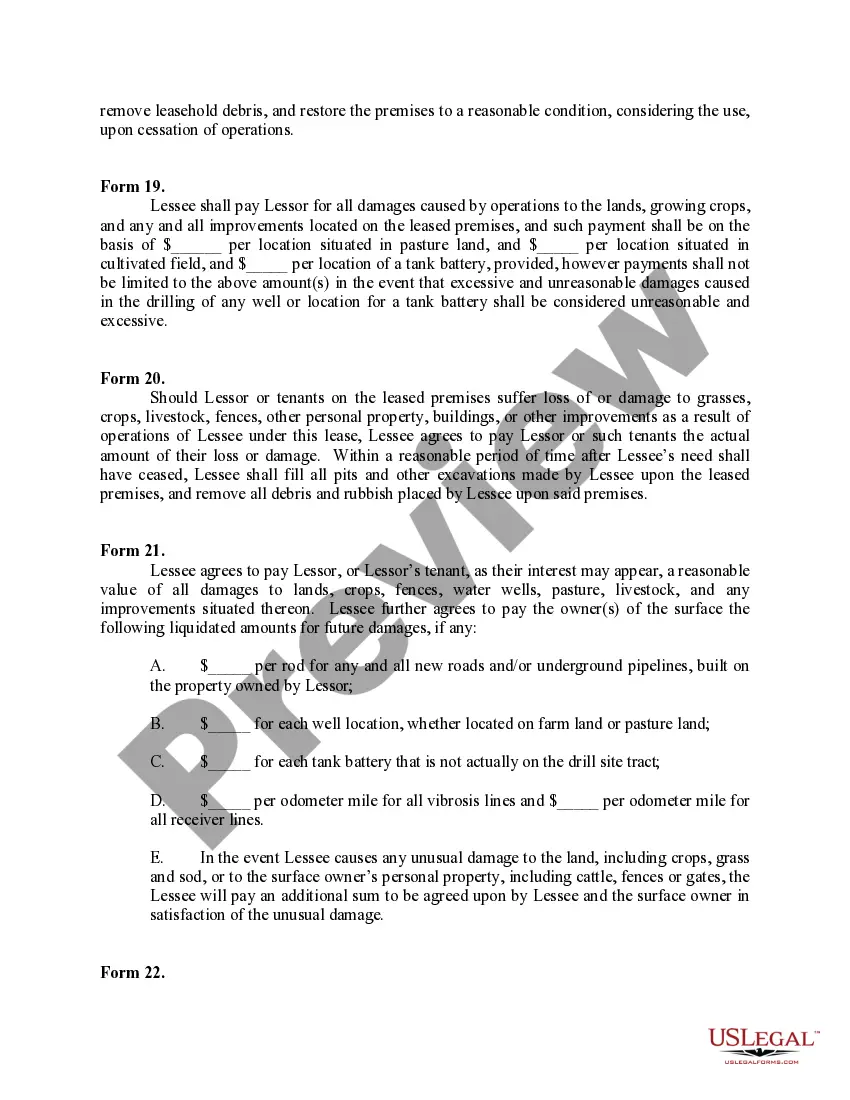

Arkansas Surface Damage Payments

Description

How to fill out Surface Damage Payments?

Have you been in a position in which you will need documents for both organization or person purposes just about every day? There are a variety of legal record layouts available online, but locating types you can trust is not effortless. US Legal Forms delivers a huge number of type layouts, like the Arkansas Surface Damage Payments, that happen to be written to meet federal and state needs.

When you are already acquainted with US Legal Forms web site and get your account, simply log in. After that, it is possible to down load the Arkansas Surface Damage Payments web template.

If you do not come with an accounts and want to start using US Legal Forms, abide by these steps:

- Obtain the type you require and make sure it is for your proper area/state.

- Use the Review switch to examine the form.

- Look at the description to actually have selected the proper type.

- In the event the type is not what you`re trying to find, make use of the Lookup discipline to obtain the type that fits your needs and needs.

- When you obtain the proper type, simply click Buy now.

- Select the prices strategy you desire, submit the desired info to produce your money, and pay money for an order using your PayPal or credit card.

- Pick a handy file file format and down load your version.

Discover all of the record layouts you have purchased in the My Forms menus. You can aquire a extra version of Arkansas Surface Damage Payments anytime, if required. Just select the needed type to down load or printing the record web template.

Use US Legal Forms, probably the most extensive variety of legal types, to conserve some time and prevent blunders. The support delivers skillfully produced legal record layouts which can be used for an array of purposes. Make your account on US Legal Forms and initiate producing your life easier.

Form popularity

FAQ

Code R. § 51-802(b) Any taxpayer with an interest in a partnership which has gross income from sources within Arkansas must directly allocate the partnership's Arkansas income to Arkansas, rather than include partnership income and apportionment factors in the taxpayer's apportionment formula.

In the State of Arkansas when a person sells a piece of property the mineral rights automatically transfer with the surface rights, unless otherwise stated in the deed.

Arkansas law allows for eligible entities to elect to pay tax at the entity level instead of passing through the income to shareholders. To make the election, the pass-through entity must file Form AR1100PET (e-file) or AR 362PT (by mail). The election must be made by the due date or extended due date of the return. AR - Pass-Through Entity-Level Tax (PTET) - Drake Software KB drakesoftware.com ? Site ? Browse ? AR-PassT... drakesoftware.com ? Site ? Browse ? AR-PassT...

Arkansas income taxes Retirees age 59.5 or older can exempt the first $6,000 of an IRA distribution. Up to $6,000 of income from private or government employer sponsored retirement plans is also tax-exempt in Arkansas. Arkansas income tax rates currently max out at 4.7%. The top tax rate will reduce to 4.4% in 2024. Arkansas State Tax Guide - Kiplinger kiplinger.com ? state-by-state-guide-taxes kiplinger.com ? state-by-state-guide-taxes

2021 Low Income Tax Tables To qualify for the Low Income Tax Table, you must earn less than $32,200 and if you're married, you must file a joint tax return. If you itemized your tax deductions, you must use the Regular Income Tax Table. Arkansas Income Tax Calculator 2022-2023 - Forbes forbes.com ? advisor ? arkansas forbes.com ? advisor ? arkansas