Arkansas Stipulation Governing Payment of Nonparticipating Royalty Under Segregated Tracts Covered by one Oil and Gas Lease

Description

How to fill out Stipulation Governing Payment Of Nonparticipating Royalty Under Segregated Tracts Covered By One Oil And Gas Lease?

Discovering the right lawful record format can be quite a struggle. Needless to say, there are plenty of layouts available online, but how would you discover the lawful type you need? Utilize the US Legal Forms site. The assistance gives thousands of layouts, like the Arkansas Stipulation Governing Payment of Nonparticipating Royalty Under Segregated Tracts Covered by one Oil and Gas Lease, which can be used for organization and private requires. All of the kinds are examined by pros and fulfill state and federal needs.

In case you are currently registered, log in to your accounts and click the Obtain option to get the Arkansas Stipulation Governing Payment of Nonparticipating Royalty Under Segregated Tracts Covered by one Oil and Gas Lease. Use your accounts to look with the lawful kinds you have ordered formerly. Visit the My Forms tab of your respective accounts and get another duplicate of the record you need.

In case you are a whole new user of US Legal Forms, allow me to share straightforward instructions for you to comply with:

- Initially, be sure you have selected the correct type for the town/region. You may examine the form while using Review option and study the form explanation to ensure it is the right one for you.

- When the type will not fulfill your expectations, take advantage of the Seach area to obtain the right type.

- Once you are certain that the form is proper, click the Acquire now option to get the type.

- Choose the pricing program you want and type in the needed information and facts. Make your accounts and pay for your order utilizing your PayPal accounts or charge card.

- Opt for the submit structure and download the lawful record format to your device.

- Comprehensive, revise and print and sign the obtained Arkansas Stipulation Governing Payment of Nonparticipating Royalty Under Segregated Tracts Covered by one Oil and Gas Lease.

US Legal Forms will be the most significant library of lawful kinds where you can find various record layouts. Utilize the company to download skillfully-manufactured papers that comply with status needs.

Form popularity

FAQ

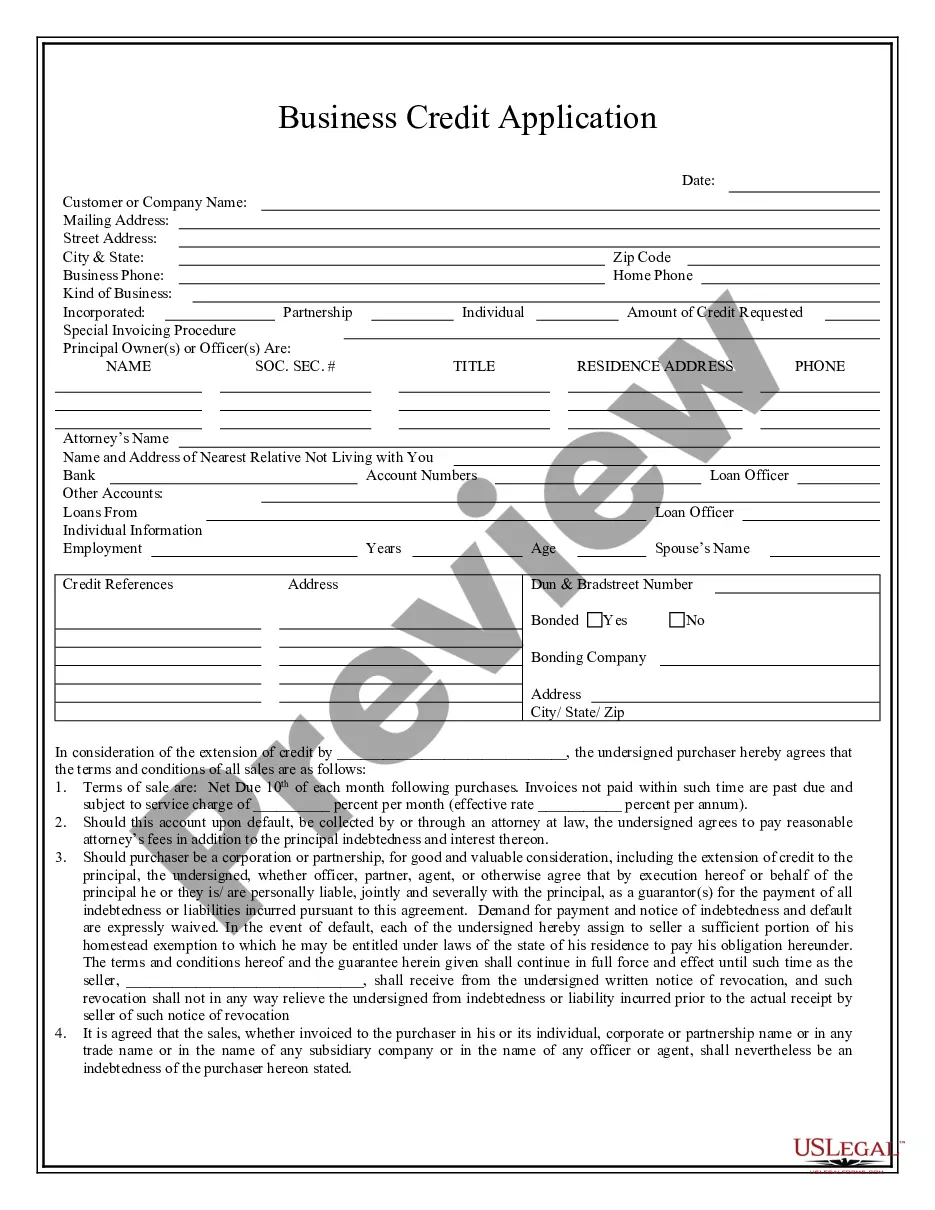

Non-Participating Royalty Interest (NPRI) Unlike a mineral interest owner, the NPRI owner does not have ?executive? rights, meaning they cannot sign an oil and gas lease or participate in the benefits of lease bonus or delay rentals.

Generally, the standard royalty rates for authors is under 10% for traditional publishing and up to 70% with self-publishing.

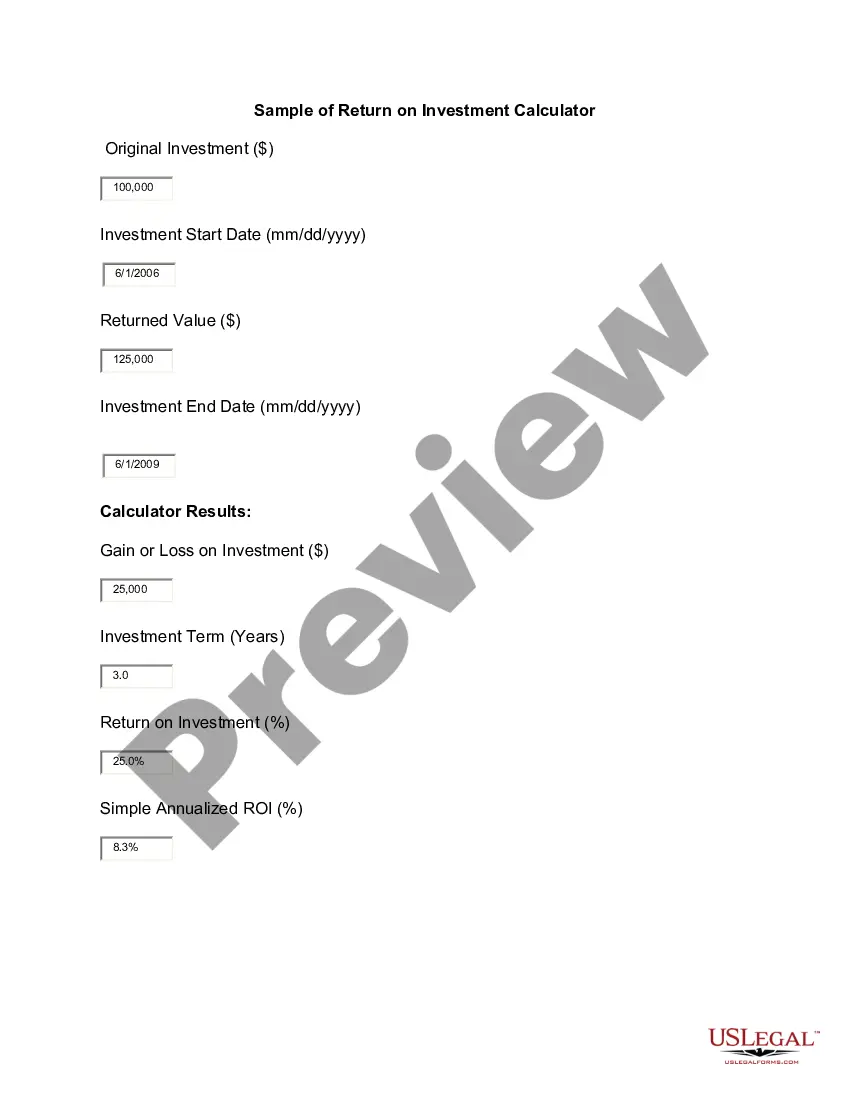

Royalty Clause: The Lessor's only right to receive payments in addition to the Bonus Payment is through Royalties. Royalties are calculated as a percentage of the value of all minerals produced, typically 25%.

Royalty Payment Clauses A royalty is agreed upon as a percentage of the lease, minus what was reasonably used in the lessee's production costs. This is stipulated in a Royalty Clause. The royalty is paid by the lessee to the owner of the mineral rights, the lessor in the lease.

To ?ratify? a lease means that the landowner and oil & gas producer, as current lessor and lessee of the land, agree (or re-agree) to the terms of the existing lease.

Royalty interest in the oil and gas industry refers to ownership of a portion of a resource or the revenue it produces. A company or person that owns a royalty interest does not bear any operational costs needed to produce the resource, yet they still own a portion of the resource or revenue it produces.

Most states and many private landowners require companies to pay royalty rates higher than 12.5%, with some states charging 20% or more, ing to federal officials. The royalty rate for oil produced from federal reserves in deep waters in the Gulf of Mexico is 18.75%.

The rule followed is generally known as the Strohacker Doctrine, named for the case of Missouri Pacific Railroad Co. v. Strohacker,s in which the Arkansas Supreme Court affirmed a chan- cery court decision that reservations of "coal and mineral deposits" in 1892 and 1893 deeds did not reserve the oil and gas.