Arkansas Indemnities

Description

How to fill out Indemnities?

Discovering the right legal file template can be a have a problem. Obviously, there are tons of web templates available online, but how will you get the legal type you will need? Make use of the US Legal Forms internet site. The support gives a large number of web templates, for example the Arkansas Indemnities, that can be used for enterprise and personal requirements. Each of the forms are inspected by pros and meet state and federal demands.

In case you are presently signed up, log in to your profile and then click the Acquire button to have the Arkansas Indemnities. Make use of your profile to check from the legal forms you might have purchased formerly. Check out the My Forms tab of the profile and obtain another copy of your file you will need.

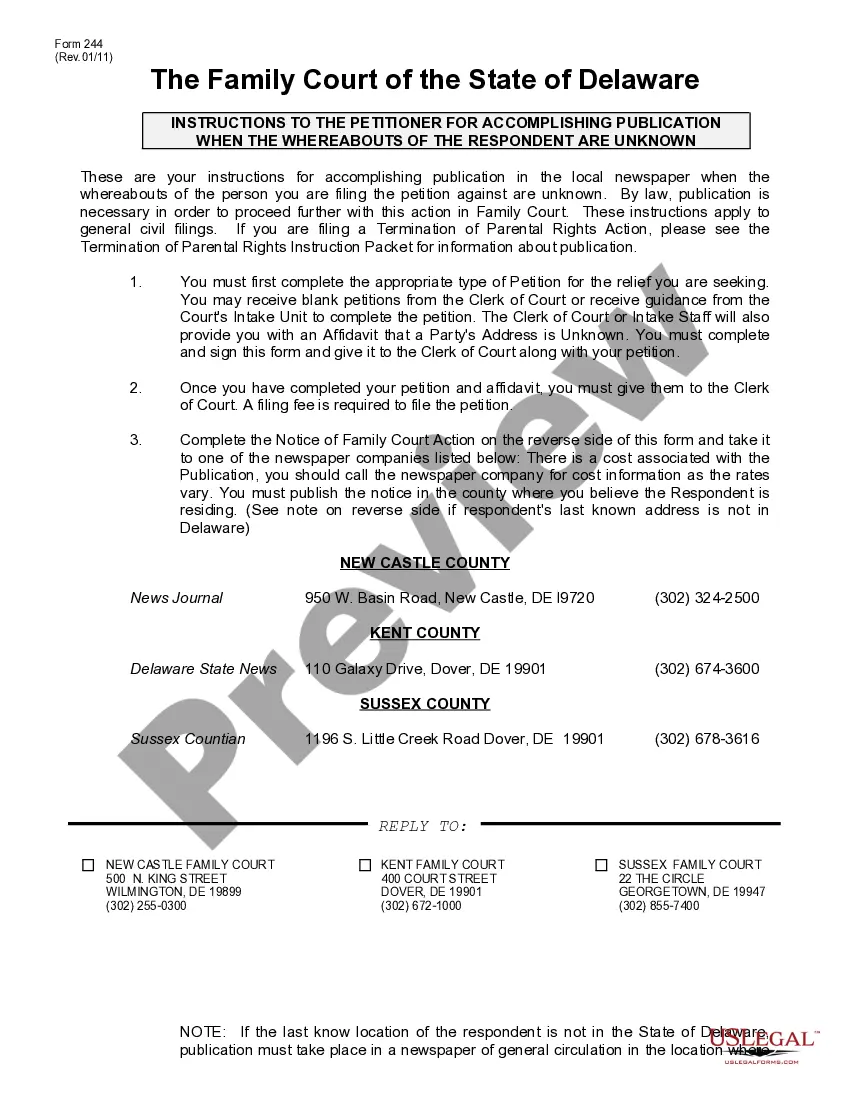

In case you are a new customer of US Legal Forms, listed here are simple guidelines for you to comply with:

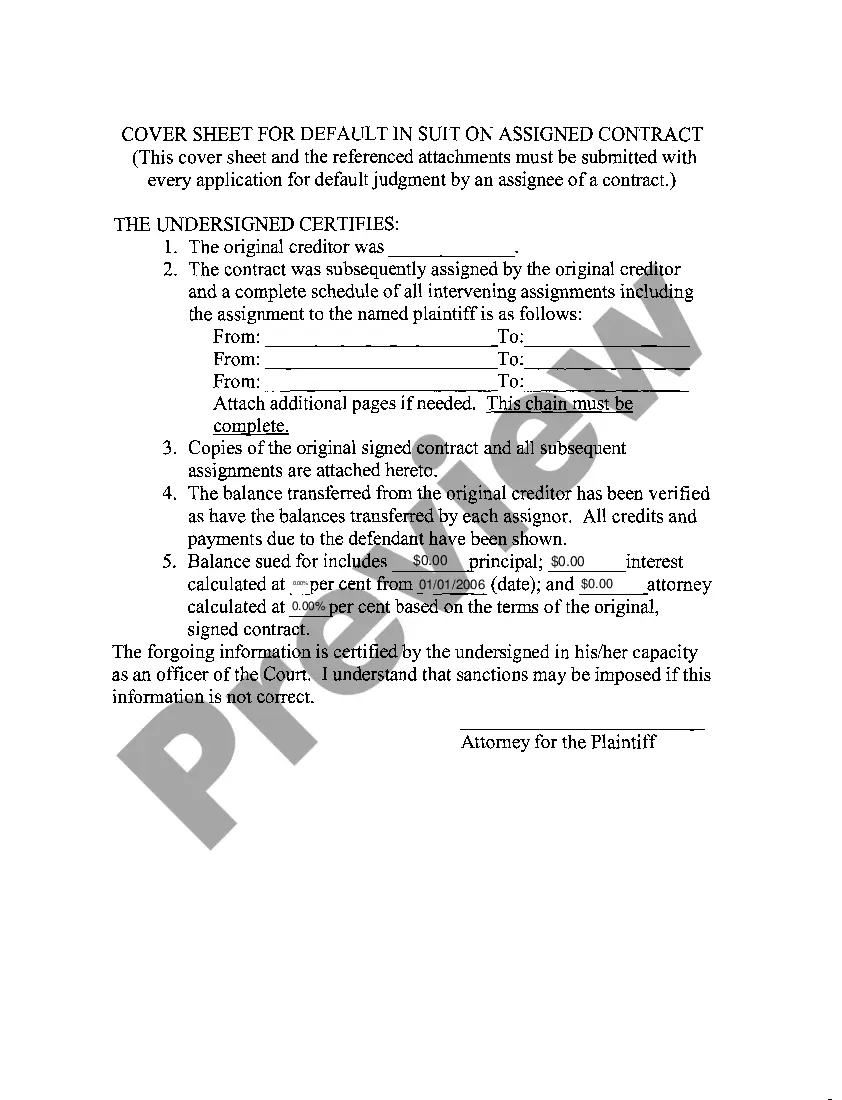

- Initial, make sure you have chosen the right type for your town/state. You can check out the shape making use of the Preview button and study the shape explanation to make sure this is the best for you.

- When the type will not meet your preferences, use the Seach field to find the appropriate type.

- Once you are certain the shape is proper, select the Buy now button to have the type.

- Opt for the prices prepare you need and enter in the essential details. Make your profile and pay money for an order using your PayPal profile or credit card.

- Pick the file structure and down load the legal file template to your gadget.

- Complete, revise and produce and indication the attained Arkansas Indemnities.

US Legal Forms is the largest library of legal forms that you can see various file web templates. Make use of the service to down load skillfully-manufactured paperwork that comply with status demands.

Form popularity

FAQ

As an indemnity creates a contractual obligation on one party to compensate the other party for a defined loss or damage, it is often regarded as a debt claim and therefore the ordinary common law rules relating to calculating damages, such as remoteness and the duty to mitigate, do not apply.

An indemnity is an agreement by one party (the indemnifying party) to bear the cost of certain losses or liabilities incurred by another party (the indemnified party) in certain circumstances. An indemnity will typically give rise to a right to an on demand payment without the need to prove a breach of contract.

A typical example is an insurance company wherein the insurer or indemnitor agrees to compensate the insured or indemnitee for any damages or losses he/she may incur during a period of time.

Indemnity can be claimed for actions of a third party, whereas damages can only be claimed for actions of the parties to the contract.

In the indemnity clause, one party commits to compensate another party for any prospective loss or damage. More common is in insurance contracts, in exchange for premiums paid by the insured to the insurer, the insurer offers to compensate the insured for any potential damages or losses.

Indemnity is a type of insurance compensation paid for damage or loss. When the term is used in the legal sense, it also may refer to an exemption from liability for damage. Indemnity is a contractual agreement between two parties in which one party agrees to pay for potential losses or damage caused by another party.

The principle of indemnity governs that an insurance contract compensates you for any damage, loss or injury caused only to the extent of the loss incurred. Insurance contract ensures that the insurer does not make a profit in the event of an incurred loss.

Indemnification in Contracts They reduce the legal hurdles to recover more. Generally speaking, they're easier to enforce because the indemnity creates an express remedy in the contract for payment of money: for a breach of a contractual promise: a warranty, innominate term or a condition.