This is a letter from a withdrawing partner to the clients he has represented at his former firm. The letter is also mailed with an enclosure that gives the clients the options of transferring their files with the withdrawing attorney, remaining with the same firm, or choosing another firm to represent them. This letter includes an example of the enclosure with the file transfer options.

Arkansas Letter from Individual Partner to Clients

Description

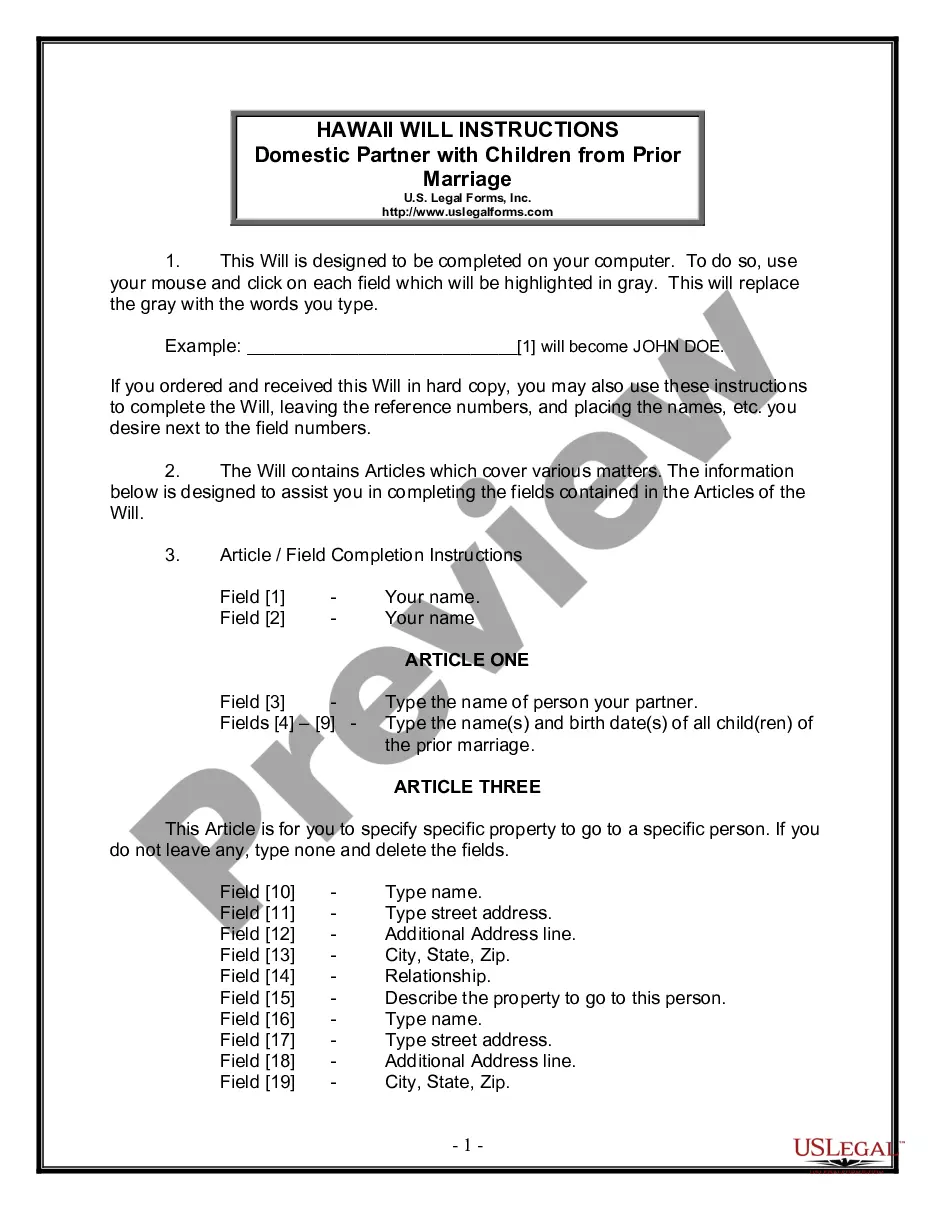

How to fill out Letter From Individual Partner To Clients?

If you have to full, download, or print out legal document layouts, use US Legal Forms, the greatest variety of legal varieties, that can be found on-line. Make use of the site`s simple and hassle-free lookup to obtain the files you require. Numerous layouts for company and personal functions are sorted by categories and claims, or keywords. Use US Legal Forms to obtain the Arkansas Letter from Individual Partner to Clients in just a few mouse clicks.

In case you are presently a US Legal Forms customer, log in to the bank account and click on the Acquire button to have the Arkansas Letter from Individual Partner to Clients. You can even entry varieties you in the past saved inside the My Forms tab of your respective bank account.

If you are using US Legal Forms the first time, follow the instructions beneath:

- Step 1. Be sure you have selected the shape to the proper town/nation.

- Step 2. Use the Review option to check out the form`s content. Never forget about to see the outline.

- Step 3. In case you are unsatisfied with all the develop, use the Look for field towards the top of the monitor to locate other models of your legal develop web template.

- Step 4. Upon having identified the shape you require, select the Get now button. Pick the prices program you choose and put your accreditations to register for the bank account.

- Step 5. Method the financial transaction. You can use your bank card or PayPal bank account to perform the financial transaction.

- Step 6. Pick the formatting of your legal develop and download it in your product.

- Step 7. Total, modify and print out or indication the Arkansas Letter from Individual Partner to Clients.

Each legal document web template you purchase is the one you have forever. You might have acces to every single develop you saved with your acccount. Click on the My Forms area and decide on a develop to print out or download again.

Compete and download, and print out the Arkansas Letter from Individual Partner to Clients with US Legal Forms. There are millions of skilled and status-specific varieties you may use to your company or personal needs.

Form popularity

FAQ

Is an employer still required to issue T4 to non-resident employees for services provided outside Canada? Every person who makes a payment described in subsection 153(1) of the Income Tax Act must issue a T4 regardless of the employer's obligation to withhold tax.

Your tax obligations. As a non-resident of Canada, you pay tax on income you receive from sources in Canada. The type of tax you pay and the requirement to file an income tax return depend on the type of income you receive. Generally, Canadian income received by a non-resident is subject to Part XIII tax or Part I tax.

To Close Login or Sign-Up. Click on account. Click request to close account (under I want to) Must submit closure for each account type.

The notary must be certain that the person appearing before him/her is who that person claims to be. Personal appearance before the notary is required. A notary cannot notarize a document by video or remotely.

Canadian financial institutions and other payers have to withhold non-resident tax at a rate of 25% on certain types of Canadian-source income they pay or credit to you as a non-resident of Canada. The most common types of income that could be subject to non-resident withholding tax include: interest.

T4A-NR slips. Use the T4A-NR slip to report all amounts you paid to non-resident individuals, partnerships, and corporations for services they performed in Canada that they did not perform in the ordinary course of an office or employment.

An employer is required to withhold tax from wages of employees who work within the State of Arkansas. An employer is not required to withhold Arkansas tax from the wages of any employee who does not work within the state of Arkansas. However, the employee's wages are still taxable.

Regulation 105 under the Income Tax Act (Canada) requires 15% to be withheld from payments made to non-resident service providers for services rendered in Canada. It is the responsibility of both resident and non-resident payors to withhold this amount.