Arkansas Self-Employed Seasonal Picker Services Contract

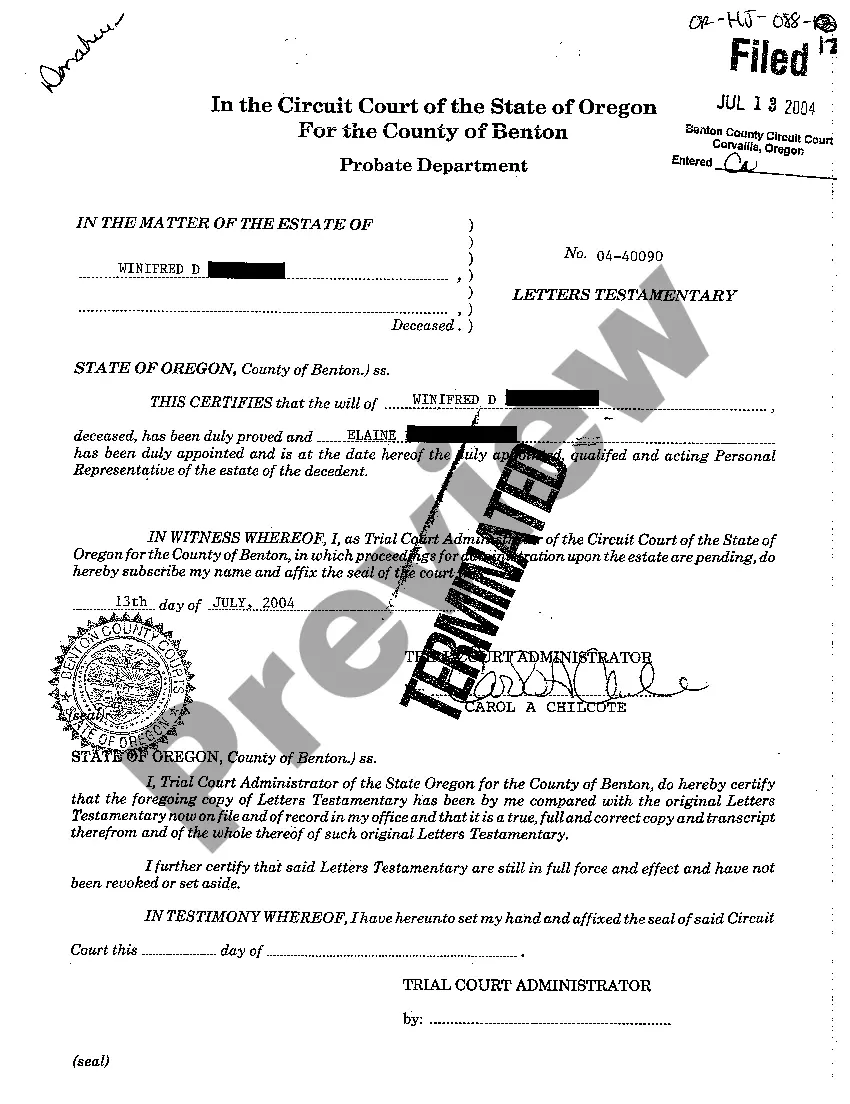

Description

How to fill out Self-Employed Seasonal Picker Services Contract?

It is feasible to spend hours online trying to locate the legal document template that meets the state and federal requirements you need.

US Legal Forms offers thousands of legal documents that can be reviewed by professionals.

You can easily obtain or print the Arkansas Self-Employed Seasonal Picker Services Contract with my assistance.

If you wish to find another version of the form, utilize the Search field to locate the template that fits your needs. Once you have identified the template you desire, click on Get now to proceed. Choose the pricing plan you want, enter your details, and create an account on US Legal Forms. Complete the payment. You can use your Visa or Mastercard or PayPal account to pay for the legal document. Choose the format of the document and download it to your device. Make adjustments to your document if needed. You can complete, edit, sign, and print the Arkansas Self-Employed Seasonal Picker Services Contract. Access and print thousands of document templates using the US Legal Forms website, which provides the largest selection of legal documents. Utilize professional and state-specific templates to address your business or personal needs.

- If you already hold a US Legal Forms account, you can sign in and click on the Obtain button.

- Then, you can complete, modify, print, or sign the Arkansas Self-Employed Seasonal Picker Services Contract.

- Every legal document template you purchase is yours indefinitely.

- To get another copy of any purchased form, visit the My documents section and click on the appropriate option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for your region or area of interest.

- Read the form description to confirm you have chosen the correct template.

- If available, use the Review option to examine the document template as well.

Form popularity

FAQ

In Arkansas, several factors can disqualify you from receiving unemployment benefits. If you voluntarily quit your job without good cause, are dismissed for misconduct, or fail to meet the eligibility criteria outlined in the Arkansas Self-Employed Seasonal Picker Services Contract, you may not qualify. Understanding these disqualifications is critical to ensure you can access the benefits you need. Resources like uslegalforms can help clarify these criteria and guide you through the process.

The new unemployment law in Arkansas has introduced changes that affect eligibility and benefit amounts. These adjustments aim to streamline the process for seasonal workers, including those under the Arkansas Self-Employed Seasonal Picker Services Contract. It's essential to stay informed about these updates to ensure you understand how they may impact your unemployment benefits. For clarity on your rights and options, uslegalforms can provide valuable assistance.

Yes, a seasonal employee may qualify for unemployment benefits in Arkansas under certain conditions. If you have worked enough hours and earned sufficient wages during your seasonal employment, you could be eligible. However, the specifics can vary based on your individual circumstances and the Arkansas Self-Employed Seasonal Picker Services Contract. To navigate these complexities, consider consulting resources like uslegalforms for detailed guidance.

Writing a simple employment contract involves summarizing the key details of the job, including duties, compensation, and duration of employment. Ensure that both parties understand all terms outlined in the Arkansas Self-Employed Seasonal Picker Services Contract. Clear communication is essential to avoid misunderstandings. US Legal Forms provides easy-to-use templates that can simplify this process.

Yes, you can write your own legally binding contract as long as it meets the necessary legal requirements, such as offering consideration and mutual agreement. The Arkansas Self-Employed Seasonal Picker Services Contract must be clear, specific, and signed by both parties to ensure enforceability. However, if you want peace of mind, consider using US Legal Forms for professional templates.

To write a self-employment contract, start with a clear statement of the services offered and payment structure. Specify the duration of the agreement and any necessary legal clauses that protect both parties. Make sure the Arkansas Self-Employed Seasonal Picker Services Contract is signed by both parties to ensure it holds legal weight. Platforms like US Legal Forms offer useful resources to guide you through the process.

Writing a self-employed contract involves detailing the services provided, payment terms, and responsibilities of both parties. Include clauses for confidentiality and termination to protect your interests. The Arkansas Self-Employed Seasonal Picker Services Contract should be clear and concise, preventing potential disputes. Consider using US Legal Forms to access templates tailored for self-employed contracts.

Legal requirements for independent contractors include ensuring they meet IRS criteria for independent status, which generally involves control over how work is performed. Additionally, the Arkansas Self-Employed Seasonal Picker Services Contract should outline tax responsibilities, insurance requirements, and compliance with state regulations. It is important to keep documentation organized and accessible. Using US Legal Forms can help simplify this process.

To write a contract for a 1099 employee, start by clearly defining the scope of work and responsibilities. Include payment terms, deadlines, and any legal obligations related to the Arkansas Self-Employed Seasonal Picker Services Contract. Ensure both parties sign the document to make it enforceable. You can utilize platforms like US Legal Forms to find templates that fit your needs.

The self-employment tax is 15.3%, not 30%. This rate comprises 12.4% for Social Security and 2.9% for Medicare, which applies to your earnings from an Arkansas Self-Employed Seasonal Picker Services Contract. It's essential to calculate your net earnings accurately to determine the exact amount owed. Remember, this tax is separate from your income tax, so planning accordingly is vital.