Arkansas Self-Employed Independent Contractor Construction Worker Contract

Description

How to fill out Self-Employed Independent Contractor Construction Worker Contract?

Have you ever been in a situation where you need documentation for either professional or personal purposes almost every day.

There are many legal document templates available online, but finding reliable ones can be challenging.

US Legal Forms offers thousands of form templates, including the Arkansas Self-Employed Independent Contractor Construction Worker Contract, which are designed to comply with federal and state requirements.

If you find the correct form, click Get now.

Choose the pricing plan you want, fill out the necessary information to create your account, and complete the payment using your PayPal or credit card. Select a convenient file format and download your copy. Access all the document templates you have purchased in the My documents section. You can obtain an additional copy of the Arkansas Self-Employed Independent Contractor Construction Worker Contract at any time if needed. Just select the required form to download or print the document template. Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid errors. The service provides properly crafted legal document templates that can be used for various purposes. Create your account on US Legal Forms and start making your life a little easier.

- If you are already familiar with the US Legal Forms website and have your account, simply Log In.

- After that, you can download the Arkansas Self-Employed Independent Contractor Construction Worker Contract template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct state/region.

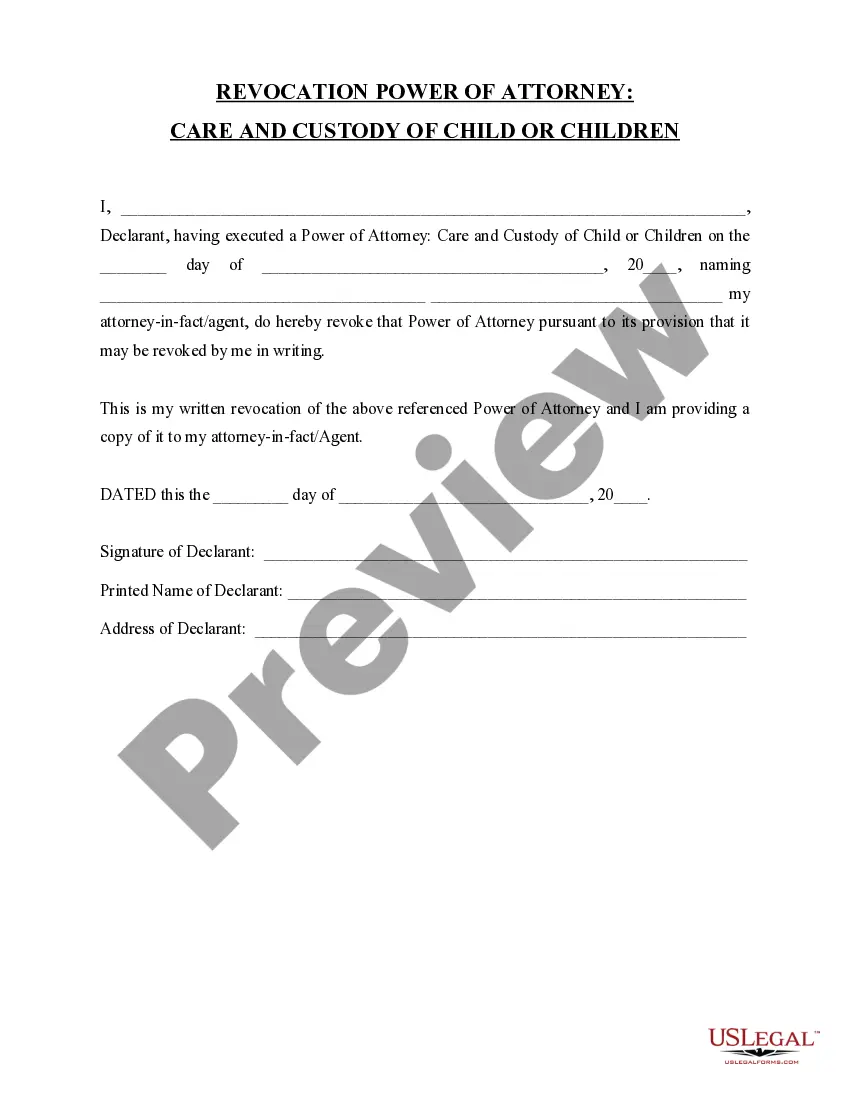

- Use the Review button to examine the form.

- Check the description to confirm that you have selected the appropriate form.

- If the form isn’t what you’re looking for, use the Search field to find the form that suits your needs and requirements.

Form popularity

FAQ

Yes, having a contract as an independent contractor is vital. A well-structured contract protects your rights and clarifies your responsibilities. It serves as a reference point for both parties, making it essential for any Arkansas Self-Employed Independent Contractor Construction Worker to minimize misunderstandings and disputes.

Creating an independent contractor contract involves outlining the scope of work, payment terms, and timeline. Be sure to include specific clauses that address client expectations and deliverables. Utilizing a template for an Arkansas Self-Employed Independent Contractor Construction Worker Contract can simplify this process and ensure you cover essential legal aspects.

In Arkansas, you can perform work without a contractor license as long as the total project does not exceed certain thresholds. Typically, projects under $20,000 may not require a license, but specific conditions apply. Understanding these limits is crucial for Arkansas self-employed independent contractor construction workers, as it influences your legal obligations and business operations.

To establish yourself as an independent contractor in Arkansas, begin by defining your services and identifying your target clients. Register your business name, obtain necessary permits, and understand tax requirements. Additionally, using a clear Arkansas Self-Employed Independent Contractor Construction Worker Contract can enhance your credibility and lay out your terms with clients.

A construction worker can be self-employed, often classified as an Arkansas self-employed independent contractor. This designation allows for greater flexibility in choosing projects and clients. Being self-employed also means taking on responsibilities like managing your taxes and obtaining insurance. If you decide to pursue this path, having a detailed contract is crucial, and US Legal Forms offers resources to help.

In Arkansas, independent contractors must comply with state and federal tax laws and fulfill specific legal requirements. You should obtain necessary licenses and permits pertaining to your work as a construction worker. Additionally, maintaining accurate records of your earnings and expenses helps ensure compliance. Utilizing services like US Legal Forms can assist in navigating these requirements efficiently.

While you can technically receive 1099 income without a contract, it is not advisable for Arkansas self-employed independent contractor construction workers. A contract protects both you and the client by clearly defining the work scope and payment terms. Without a contract, you may struggle to enforce your rights or collect payments. It's best to formalize your agreement with a well-drafted contract.

Yes, having a contract is essential for Arkansas self-employed independent contractor construction workers. A contract outlines the terms of your work, payment expectations, and responsibilities. Without it, you increase the risk of misunderstandings or disputes with clients. Using US Legal Forms can help you create a solid contract tailored to your needs.

Yes, you can write your own legally binding contract, provided it meets specific legal standards. The contract should include clear terms regarding the scope of work, payment structure, and applicable laws. For Arkansas self-employed independent contractor construction workers, using a guided template from US Legal Forms can help ensure your contract is valid and effective.

Writing a contract as an independent contractor involves outlining the project's scope, compensation details, and deadlines. Be sure to include terms regarding confidentiality, liability, and termination. Utilizing US Legal Forms can offer templates tailored for Arkansas self-employed independent contractor construction workers, making the creation process easier and more efficient.