Arkansas Moving Services Contract - Self-Employed

Description

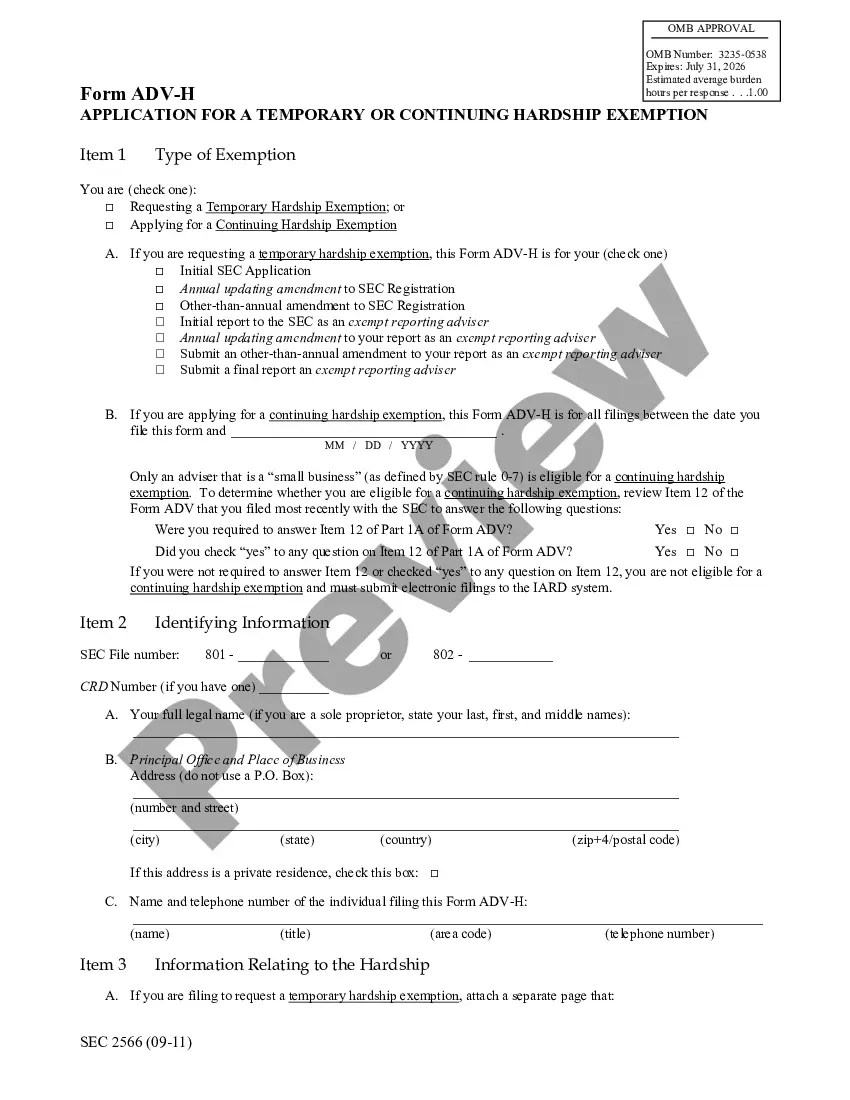

How to fill out Moving Services Contract - Self-Employed?

You have the ability to devote time online searching for the legal document template that meets the federal and state regulations you require.

US Legal Forms provides thousands of legal forms that have been reviewed by experts.

You can easily download or print the Arkansas Moving Services Contract - Self-Employed from my service.

If available, utilize the Preview option to review the document template as well.

- If you have an existing US Legal Forms account, you can Log In and select the Download option.

- After that, you are able to complete, modify, print, or sign the Arkansas Moving Services Contract - Self-Employed.

- Every legal document template you acquire is yours indefinitely.

- To obtain another copy of a purchased form, go to the My documents tab and click on the corresponding option.

- If you are visiting the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct form template for your county/town of choice.

- Review the form description to confirm you have chosen the right document.

Form popularity

FAQ

Yes, you can claim moving expenses if you are self-employed, particularly when using an Arkansas Moving Services Contract - Self-Employed. Ensure you track all related expenses accurately for more extensive deduction possibilities. Consulting a tax professional might also enhance your understanding of what can be claimed.

You can write off moving expenses if you are self-employed, promoting financial savings during your relocation. Engaging with an Arkansas Moving Services Contract - Self-Employed allows you to have clear documentation of costs. This organized approach benefits you during tax season.

If you are self-employed, you can indeed claim moving expenses, provided they meet the IRS requirements. An Arkansas Moving Services Contract - Self-Employed helps to itemize these expenses correctly. Maintaining organized records ensures you don’t miss out on potential deductions.

Yes, you can write off moving expenses on your taxes if you meet the necessary criteria. Using an Arkansas Moving Services Contract - Self-Employed can streamline this process. Always remember to document your expenses thoroughly to support your tax deduction claims.

Moving expenses can be deductible in Arkansas under certain conditions. If you are self-employed and use an Arkansas Moving Services Contract - Self-Employed, you may qualify for specific deductions. It’s wise to review local tax laws or speak to a tax professional for clarity.

Personal expenses related to your move, such as costs for meals during the journey or temporary housing, typically cannot be claimed. When using your Arkansas Moving Services Contract - Self-Employed, focus on qualifying expenses such as transportation and shipment of goods. Keeping a clear distinction between deductible and non-deductible items is key.

The $2500 expense rule indicates that moving expenses exceeding $2500 may require additional documentation to qualify for deduction. This rule is especially relevant for those using an Arkansas Moving Services Contract - Self-Employed. Understanding this rule helps you prepare for potential audits and ensures you claim the right amount.

Yes, you can deduct moving expenses if you are self-employed. However, the deduction may vary based on your specific situation. It's important to keep accurate records of your expenses relating to your Arkansas Moving Services Contract - Self-Employed. Consider consulting tax guidelines or professionals to help maximize your deductions.

To qualify as an independent contractor in Arkansas, you typically must operate your own business, have control over your work, and provide services to clients without direct oversight. By fulfilling these criteria, you align with the specifications of an Arkansas Moving Services Contract - Self-Employed. Additionally, maintaining your own liability insurance and managing your taxes independently can further solidify your status as an independent contractor.

Various factors influence the classification of an employee versus an independent contractor in Arkansas. Key considerations include the degree of control exerted by the employer, the nature of the work relationship, and whether the worker provides their own tools and supplies. Understanding these factors can help you accurately determine whether you fit within the framework of an Arkansas Moving Services Contract - Self-Employed.