Arkansas Electrologist Agreement - Self-Employed Independent Contractor

Description

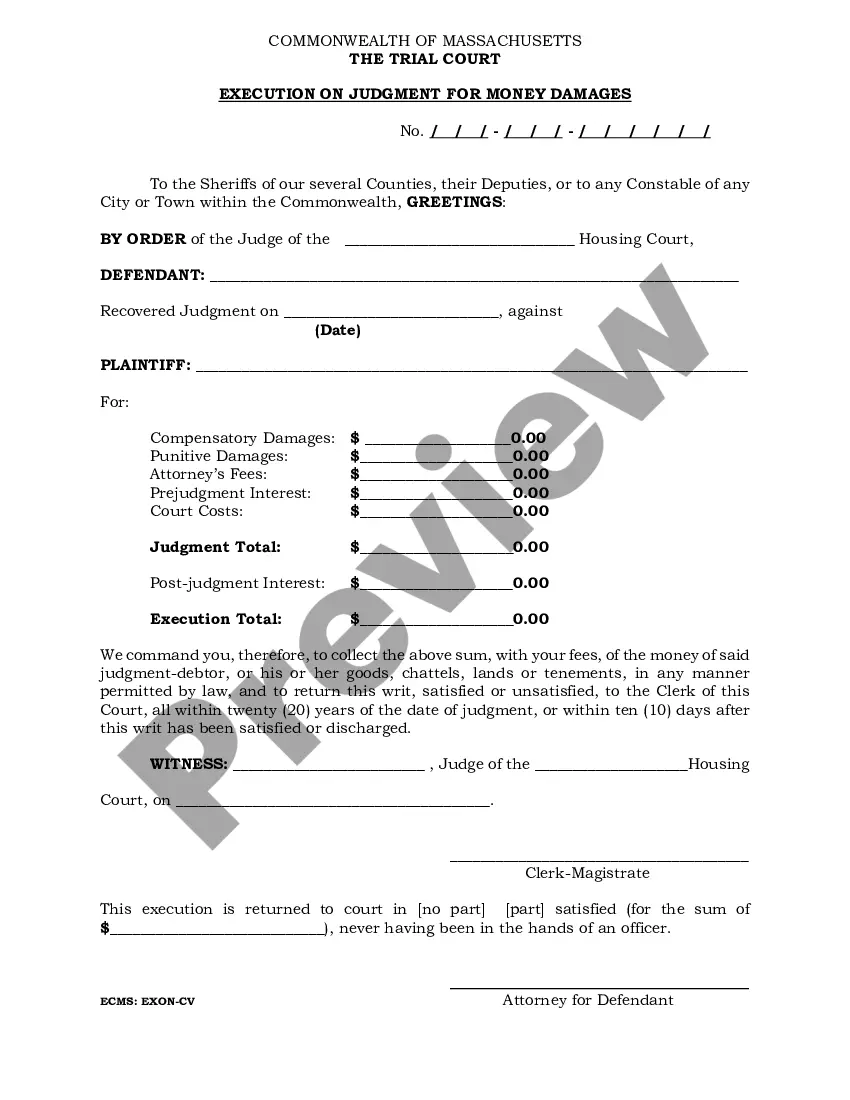

How to fill out Electrologist Agreement - Self-Employed Independent Contractor?

You can spend hours online attempting to locate the official document template that satisfies the federal and state requirements you need.

US Legal Forms offers thousands of legal forms that have been reviewed by professionals.

You can easily download or print the Arkansas Electrologist Agreement - Self-Employed Independent Contractor from my service.

If available, utilize the Preview button to view the document template at the same time. If you wish to find another version of your form, use the Search area to locate the template that meets your needs and requirements. Once you have found the template you want, click Purchase now to proceed. Select the pricing plan you prefer, enter your details, and register for an account on US Legal Forms. Complete the transaction. You can use your Visa or Mastercard or PayPal account to pay for the legal form. Choose the file format of your document and download it to your device. Make modifications to the document if necessary. You can complete, edit, sign, and print the Arkansas Electrologist Agreement - Self-Employed Independent Contractor. Download and print thousands of document templates using the US Legal Forms site, which offers the largest collection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you already possess a US Legal Forms account, you can Log In and click on the Download button.

- Then, you can complete, edit, print, or sign the Arkansas Electrologist Agreement - Self-Employed Independent Contractor.

- Every legal document template you purchase is yours indefinitely.

- To obtain another copy of a purchased form, go to the My documents tab and click the corresponding button.

- If this is your first time using the US Legal Forms site, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the region/area of your choice.

- Review the form description to confirm you've selected the appropriate form.

Form popularity

FAQ

Creating an independent contractor agreement involves several key steps to ensure clarity and legal compliance. First, outline the scope of work, including the specific services the contractor will provide. Next, detail the payment terms, including rates and deadlines, to establish clear expectations. Lastly, you can utilize a platform like USLegalForms to help you draft an Arkansas Electrologist Agreement - Self-Employed Independent Contractor that meets your needs and adheres to local regulations.

Filling out an independent contractor agreement is straightforward. Start by entering the primary details of both parties, and then describe the services you will provide. It is important to define payment terms and any deadlines for deliverables. Resources like US Legal Forms offer templates that can make the process easier and more efficient.

Yes, an independent contractor is considered self-employed. By engaging in the Arkansas Electrologist Agreement - Self-Employed Independent Contractor, you operate your own business and are responsible for managing your taxes and expenses. This arrangement allows for greater flexibility and the ability to work with multiple clients simultaneously.

To prove independent contractor status under the Arkansas Electrologist Agreement - Self-Employed Independent Contractor, you can provide documentation that shows you control your work schedule and tasks. Keep detailed records of your contracts, invoices, and payments. Additionally, showing proof of a business license or tax identification can help demonstrate your independent status.

Writing an independent contractor agreement involves outlining key elements that define the working relationship. First, include both parties' names and contact information, followed by a description of the services rendered. Incorporate essential terms such as compensation, duration, and conditions for termination. Utilizing a template from a reliable source like US Legal Forms can simplify this process significantly.

To fill out an independent contractor form for the Arkansas Electrologist Agreement - Self-Employed Independent Contractor, you will need to gather essential information such as your personal details and the specific services you provide. Ensure that you clearly state the terms of the agreement, including payment details and service expectations. After completing the form, review all sections carefully to confirm accuracy before submission.

Yes, independent contractors are a specific category of self-employed individuals. When you sign an Arkansas Electrologist Agreement - Self-Employed Independent Contractor, you operate as an independent contractor, which means you have control over your work. This classification allows you to manage your services and client interactions independently, while enjoying the benefits of being a business owner. Remember, your status also comes with obligations, particularly regarding tax responsibilities.

Both terms denote that you work independently, but 'self-employed' often implies a broader scope of responsibility for business management. When discussing your role under an Arkansas Electrologist Agreement - Self-Employed Independent Contractor, you may choose either term based on the context. Using 'independent contractor' emphasizes a contractual relationship with clients, while 'self-employed' indicates overall autonomy. Your choice might depend on your audience's understanding.

Yes, receiving a 1099 form typically indicates that you are self-employed. If you enter into an Arkansas Electrologist Agreement - Self-Employed Independent Contractor, you are likely treated as an independent contractor by those who hire your services. This classification means you have greater flexibility in your work while being responsible for your own taxes. Always ensure that your work aligns with self-employment criteria to maximize your benefits.

Being self-employed means you run your own business and are responsible for its success. With an Arkansas Electrologist Agreement - Self-Employed Independent Contractor, you maintain control over your clients and services while managing your own schedule. This status also provides the opportunity to deduct business expenses when filing your taxes, as you are not directly employed by another entity. Moreover, you can build your brand and grow your client base independently.