Arkansas Acquisition Agreement between GO Online Networks Corp and Westlake Capital Corp regarding purchase and sale of company shares

Description

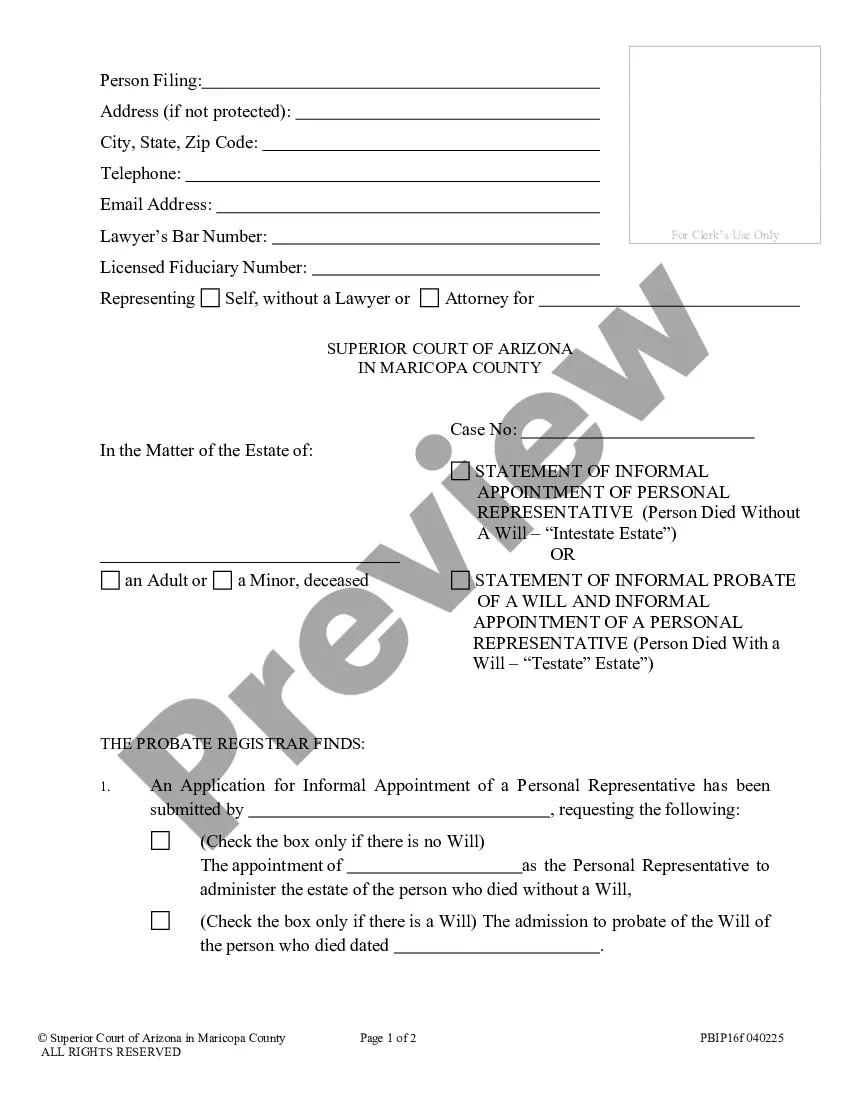

How to fill out Acquisition Agreement Between GO Online Networks Corp And Westlake Capital Corp Regarding Purchase And Sale Of Company Shares?

Are you currently in the position the place you need to have paperwork for sometimes company or individual reasons just about every day time? There are tons of legal document layouts available online, but finding versions you can rely on is not easy. US Legal Forms offers a huge number of develop layouts, such as the Arkansas Acquisition Agreement between GO Online Networks Corp and Westlake Capital Corp regarding purchase and sale of company shares, that happen to be composed in order to meet state and federal specifications.

If you are presently acquainted with US Legal Forms web site and have a merchant account, simply log in. Following that, you may download the Arkansas Acquisition Agreement between GO Online Networks Corp and Westlake Capital Corp regarding purchase and sale of company shares design.

Should you not provide an bank account and wish to start using US Legal Forms, follow these steps:

- Discover the develop you will need and ensure it is to the correct metropolis/area.

- Make use of the Review button to examine the form.

- Look at the outline to actually have selected the proper develop.

- In the event the develop is not what you are searching for, use the Search area to get the develop that fits your needs and specifications.

- When you get the correct develop, simply click Buy now.

- Opt for the costs program you would like, fill out the necessary information to generate your money, and pay money for an order with your PayPal or bank card.

- Decide on a handy document structure and download your version.

Find all of the document layouts you may have purchased in the My Forms food selection. You may get a extra version of Arkansas Acquisition Agreement between GO Online Networks Corp and Westlake Capital Corp regarding purchase and sale of company shares at any time, if needed. Just select the required develop to download or print the document design.

Use US Legal Forms, by far the most comprehensive selection of legal varieties, to save time as well as stay away from mistakes. The assistance offers professionally manufactured legal document layouts that you can use for a variety of reasons. Generate a merchant account on US Legal Forms and begin creating your way of life a little easier.

Form popularity

FAQ

If you are planning to buy or sell shares, a correctly drafted share purchase agreement (SPA) is essential. An SPA is a legal document and it must therefore comply with legislation by providing either party in the transaction with accurate information.

In a sale of shares between two parties, a draft SPA is normally drawn up by the buyer's legal representatives, as it's the buyer who is most concerned that the SPA protects them against post-sale liabilities.

Either the seller or the buyer can prepare a purchase agreement. Like any contract, it can be a standard document that one party uses in the normal course of business or it can be the end result of back-and-forth negotiations.

The share purchase agreement is usually drafted by the seller's lawyer, although the buyer may also seek legal advice and make revisions to the agreement.

Consult a business attorney to help write your stock purchase agreement or review it and make suggestions before you present it to your investor. A stock purchase agreement typically includes the following information: Your business name. The name and mailing address of the entity buying shares in your company's stocks.

The closing date refers to the date when a company purchase and sale transaction is signed off and completed. This date may be different than the effective date, which is the date when the transaction is deemed to have occurred. Most of the time, the closing and effective date of a transaction is the same day.

The buyer's lawyers will generally prepare the first draft of the share purchase agreement (SPA). However, in addition to precedents which assume that the drafter is acting for the buyer, we also provide precedents for drafters acting for the seller (either preparing a first draft or marking up the buyer's draft).

The following are listed in a share purchase agreement: Name of the company. Par value of shares. Name of purchaser. Warranties and representations made by seller and purchaser. Employee benefits and bonuses. Number of shares being sold. Details of the transaction. Indemnification agreement for unforeseen costs.