Arkansas Master Agreement between Credit Suisse Financial Products and Bank One National Association

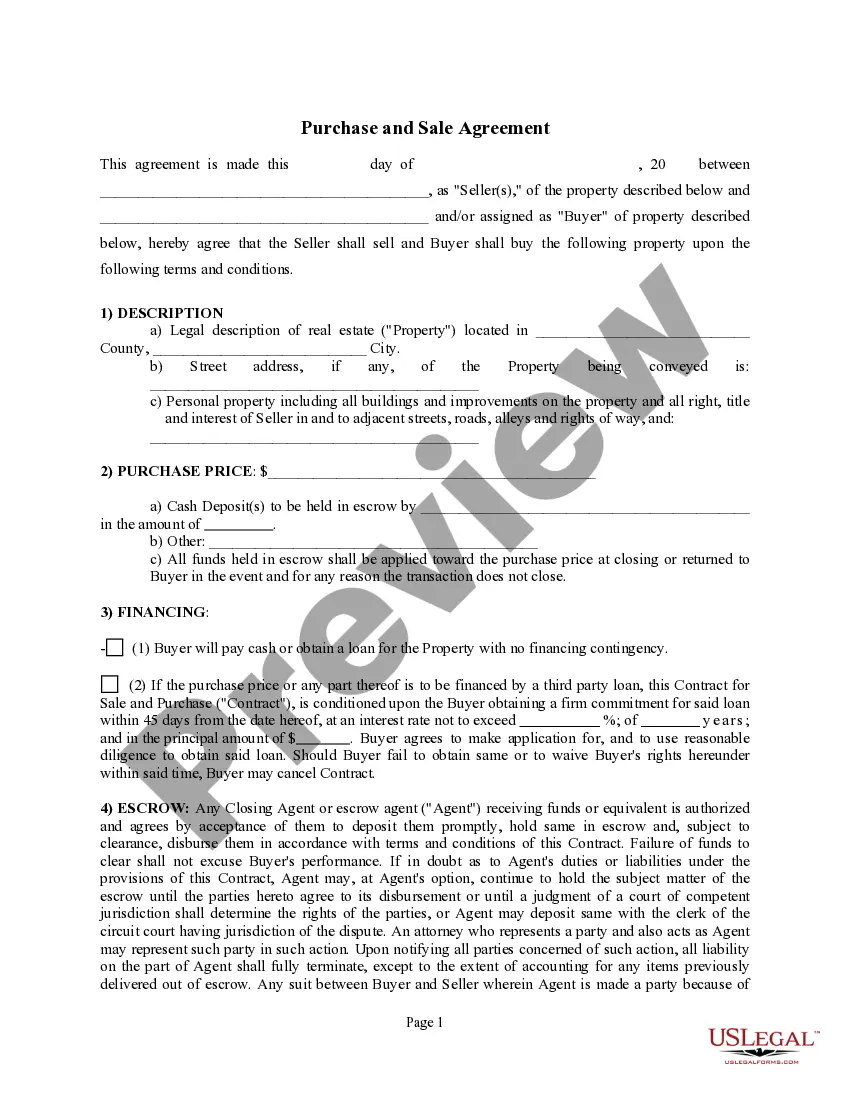

Description

How to fill out Master Agreement Between Credit Suisse Financial Products And Bank One National Association?

Are you presently in a position that you need to have papers for both organization or personal reasons almost every day? There are tons of legal file web templates available online, but finding types you can rely isn`t simple. US Legal Forms gives a huge number of kind web templates, just like the Arkansas Master Agreement between Credit Suisse Financial Products and Bank One National Association, that are created to fulfill federal and state requirements.

Should you be already acquainted with US Legal Forms site and possess an account, simply log in. Next, you may obtain the Arkansas Master Agreement between Credit Suisse Financial Products and Bank One National Association design.

Unless you have an accounts and would like to begin to use US Legal Forms, adopt these measures:

- Obtain the kind you want and make sure it is for your proper city/state.

- Utilize the Review option to check the form.

- See the information to actually have selected the correct kind.

- In case the kind isn`t what you are searching for, use the Research industry to find the kind that fits your needs and requirements.

- When you find the proper kind, just click Buy now.

- Pick the prices plan you would like, complete the desired details to generate your account, and pay for the order utilizing your PayPal or bank card.

- Pick a hassle-free data file file format and obtain your duplicate.

Find each of the file web templates you have bought in the My Forms menus. You may get a more duplicate of Arkansas Master Agreement between Credit Suisse Financial Products and Bank One National Association whenever, if needed. Just click the essential kind to obtain or printing the file design.

Use US Legal Forms, the most considerable collection of legal forms, to save lots of time and avoid faults. The assistance gives skillfully manufactured legal file web templates which you can use for a variety of reasons. Create an account on US Legal Forms and commence generating your way of life easier.

Form popularity

FAQ

Featured here, the Balance Sheet for Credit Suisse Group, which summarizes the company's financial position including assets, liabilities and shareholder equity for each of the latest 4 period ending dates (either quarterly or annually).

One Bank Collaboration (OBC) is all about having an established network of colleagues who have the trust in each other to execute and deliver the right solutions to the bank's clients. Through this strategy, Credit Suisse generates creative solutions and enables stronger client relationships.

Credit Suisse reports pre-tax income of CHF 12.8 bn with a CET1 ratio of 20.3% in 1Q23; results reflect write-down of CHF 15 bn AT1 capital notes. Credit Suisse is one of the world's leading financial services providers.

In the financial report for the first six months of 2023, Credit Suisse also said its suffered net asset outflows of 100.3 billion Swiss francs from the end of 2022. The biggest outflow was in the wealth management business, where 74 billion francs in assets were withdrawn, with money pulled out across all regions.

Despite its long history, Credit Suisse was plagued by a series of scandals, management shifts, and significant losses in recent years. By late summer 2022, new CEO Ulrich Koerner unveiled a strategic review that was hindered by an unsubstantiated rumor that Credit Suisse was facing an impending failure.

The Pension Fund of Credit Suisse Group (Switzerland) posted a performance of -1.42% in September 2023. Its overall performance for the year to the end of September is 0.72%.

Credit Suisse posted an annual net loss of 7.3 billion Swiss francs in 2022, including a 1.4 billion loss in the fourth quarter alone, as Lehmann and Koerner attempted a massive strategic overhaul aimed a bolstering its risk and compliance functions and addressing perennial underperformance in the investment bank.

CS was delisted after March 31, 2023 and its final net worth on that date was $1.902B. How much a company is worth is typically represented by its market capitalization, or the current stock price multiplied by the number of shares outstanding.