This due diligence form is a detailed summary to be completed for each acquisition or divestiture agreement performed within the company regarding business transactions.

Arkansas Acquisition Divestiture Merger Agreement Summary

Description

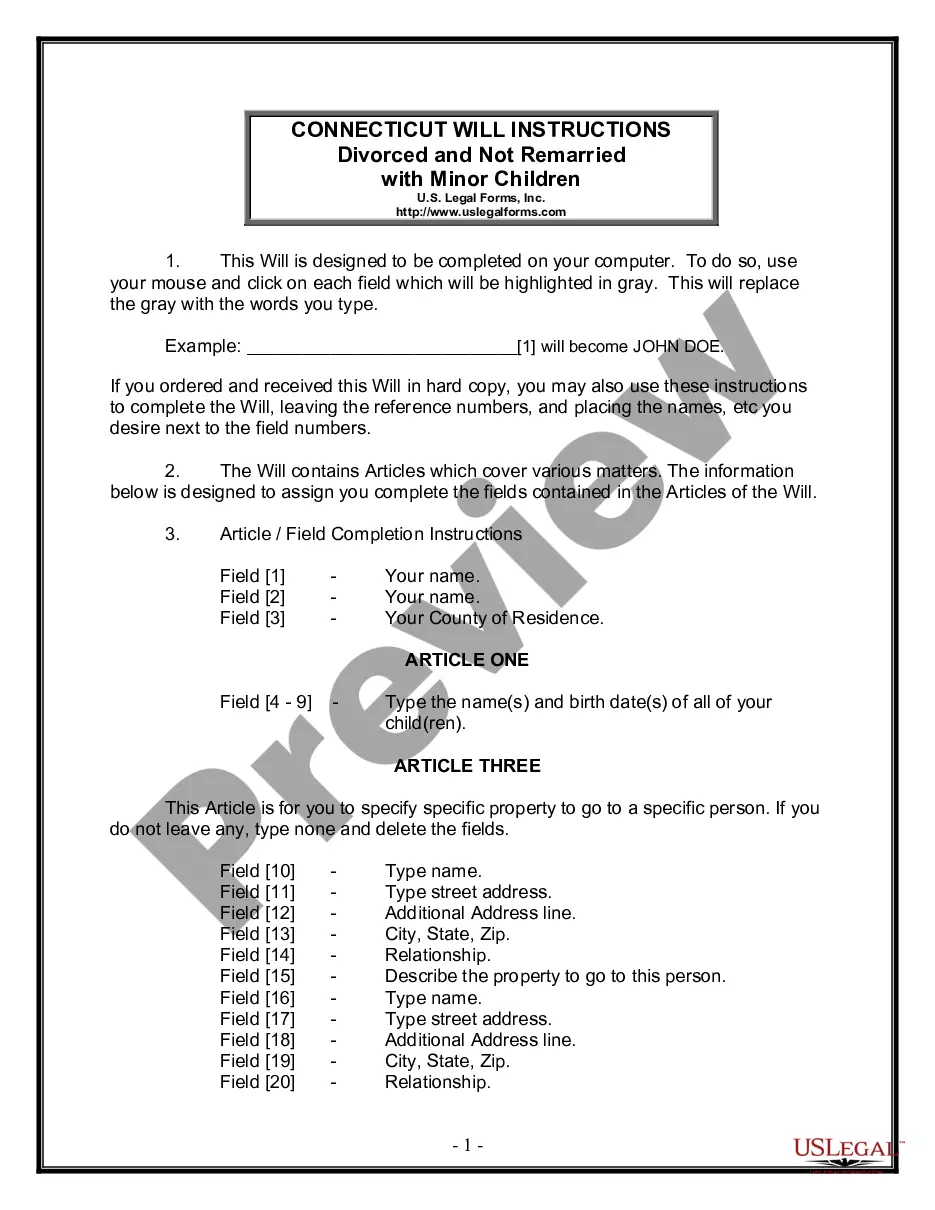

How to fill out Acquisition Divestiture Merger Agreement Summary?

Selecting the optimal legal document template can be a significant challenge.

Clearly, there are numerous templates accessible online, but how can you find the legal form you require? Use the US Legal Forms platform.

The service offers thousands of templates, including the Arkansas Acquisition Divestiture Merger Agreement Summary, suitable for both business and personal needs.

First, ensure you have selected the correct form for your locality. You can examine the form using the Review button and read the form description to confirm that it is the right one for you.

- All of the documents are reviewed by experts and comply with state and federal regulations.

- If you are currently registered, Log In to your account and click the Download button to obtain the Arkansas Acquisition Divestiture Merger Agreement Summary.

- Use your account to search for the legal forms you have purchased previously.

- Visit the My documents tab of your account to download another copy of the required document.

- If you are a new user of US Legal Forms, here are simple instructions for you to follow.

Form popularity

FAQ

You can contact the Arkansas Secretary of State's office via their official website, where you will find phone numbers and email addresses for various departments. They provide assistance with business registrations, elections, and other legal inquiries. Familiarizing yourself with available resources can be especially useful when dealing with legal matters, such as understanding the Arkansas Acquisition Divestiture Merger Agreement Summary.

Before achieving statehood, Arkansas was part of the Louisiana Territory, named after the Arkansas River, which itself comes from the Quapaw word for 'downstream place.' This early designation reflects the region's rich cultural heritage. Understanding the historical context of Arkansas can be valuable while navigating legal documents like the Arkansas Acquisition Divestiture Merger Agreement Summary.

In Arkansas, every corporation that conducts business in the state must file a franchise tax report, regardless of whether they are part of a merger or acquisition. This requirement applies to both domestic and foreign corporations, ensuring compliance with state regulations. Staying informed about the Arkansas Acquisition Divestiture Merger Agreement Summary can aid in understanding the importance of these tax obligations.

To find a merger agreement, you can start by researching databases that specialize in corporate documents, such as uSlegalforms. These platforms often provide access to a variety of legal forms, including merger agreements. A clear understanding of the Arkansas Acquisition Divestiture Merger Agreement Summary can help guide your search for the specific documents you need.

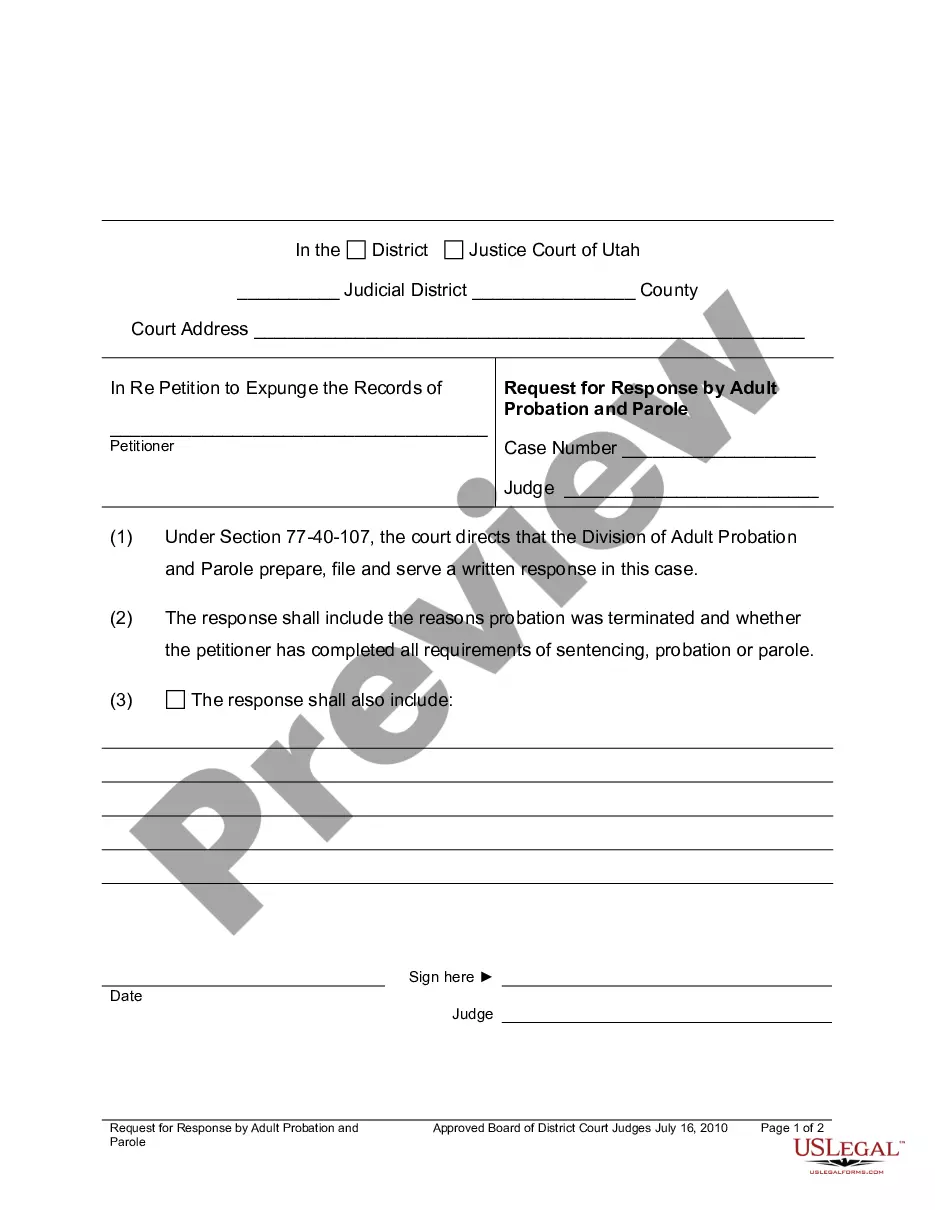

The responsibility for filing the certificate of merger generally falls on one of the merging companies, typically the surviving entity. This filing occurs with the Secretary of State in the jurisdiction where the merger takes place, ensuring that the merger is officially recognized. Proper filing is a key step in the Arkansas Acquisition Divestiture Merger Agreement Summary process.

A certificate of merger is a formal document that legally records the completion of a merger between two or more companies. It details important information such as the names of the merging companies, the date of the merger, and how the companies will operate post-merger. Understanding this document is crucial for anyone navigating an Arkansas Acquisition Divestiture Merger Agreement Summary.

Similar to Arkansas, in Delaware, the authorized representatives of the merging corporations sign the certificate of merger. This reflects the agreement reached during the merger discussions and maintains compliance with the Delaware General Corporation Law. Proper execution ensures that the merger agreement operates smoothly, contributing to an effective Arkansas Acquisition Divestiture Merger Agreement Summary.

In the context of the Arkansas Acquisition Divestiture Merger Agreement Summary, the certificate of merger must be signed by the authorized representatives of the merging entities. This typically includes the president or another designated officer of each company involved in the merger. Having proper signatures is essential for the legal validity of the merger process.