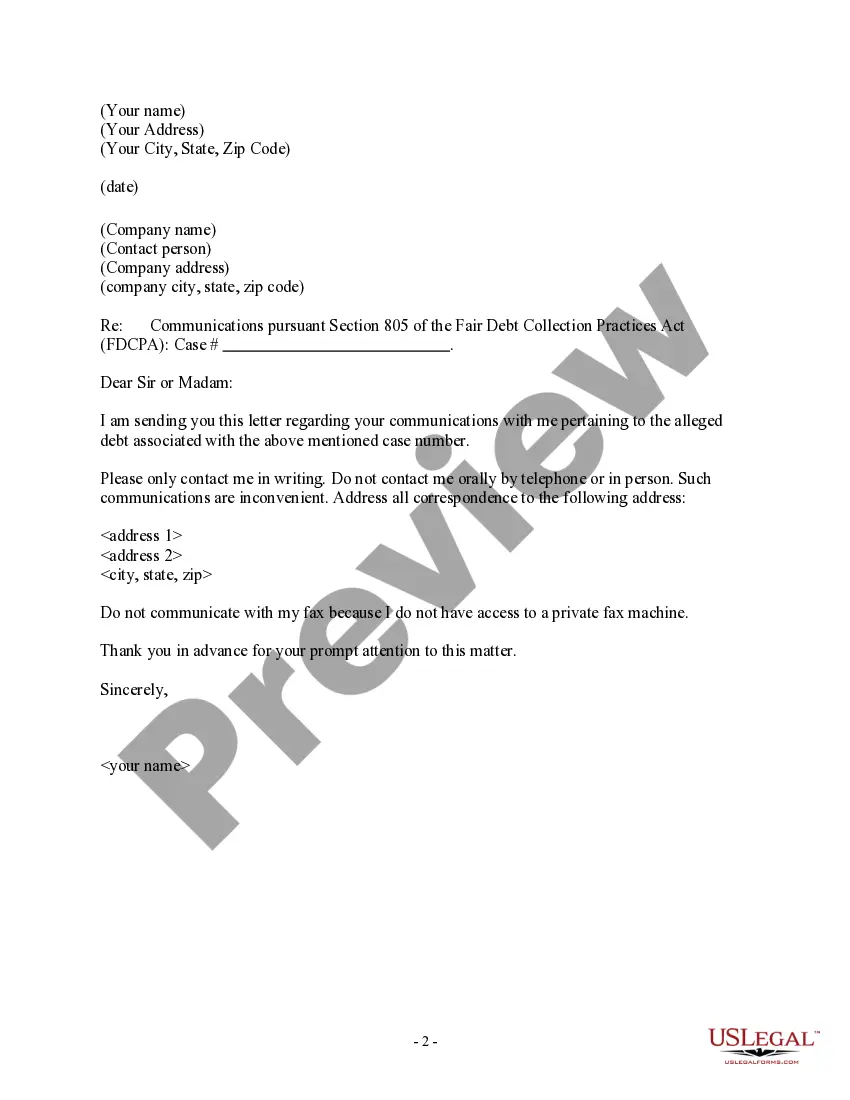

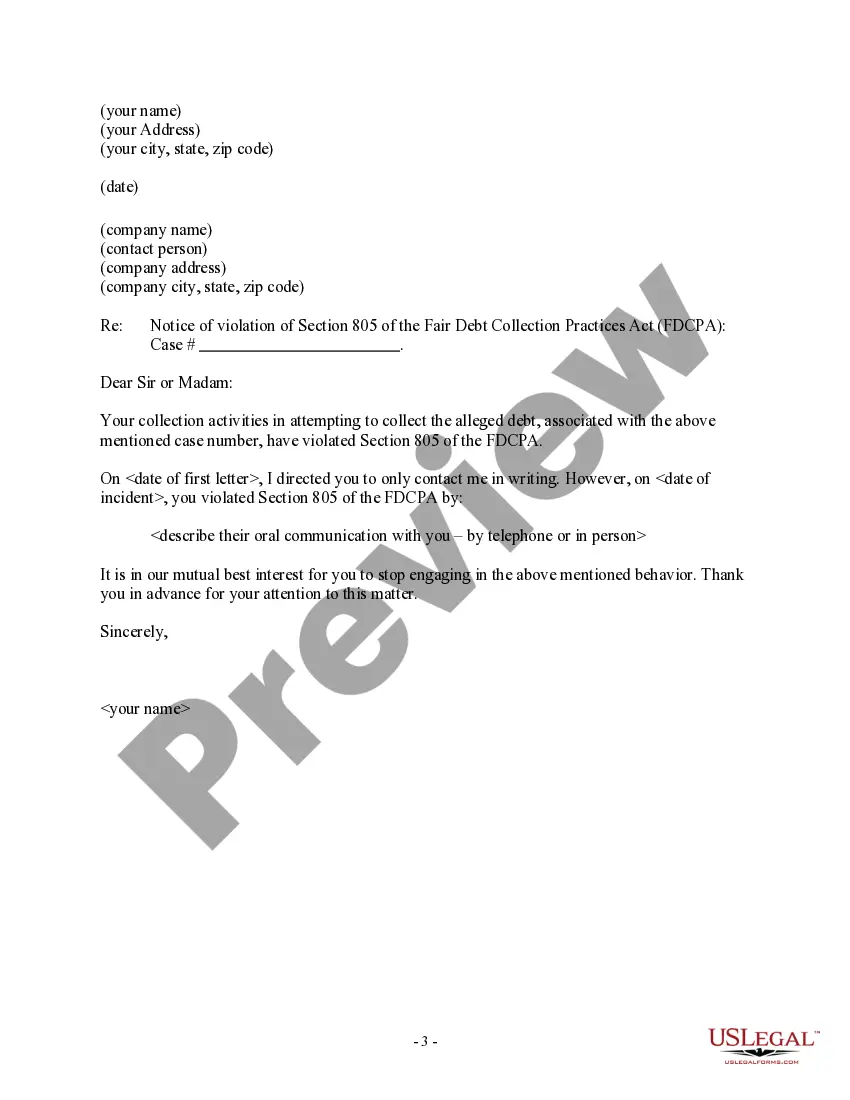

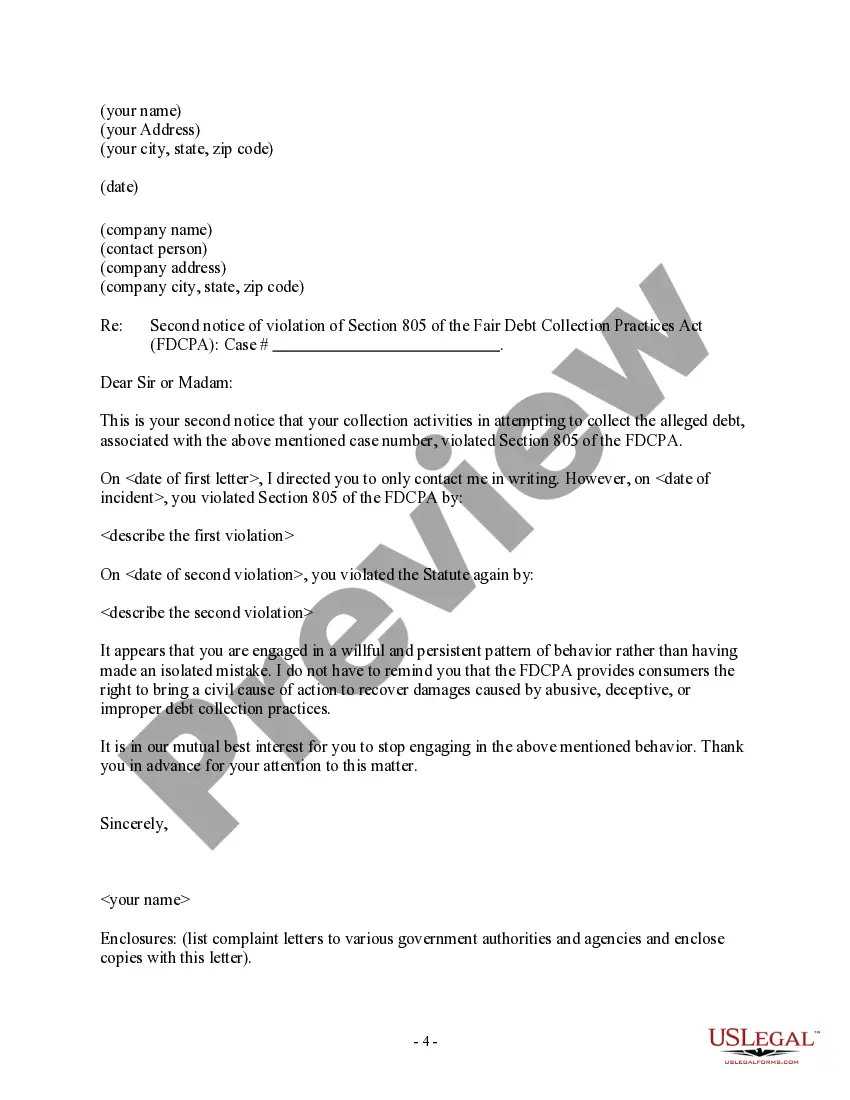

Arkansas Letter to Debt Collector - Only Contact Me In Writing

Description

How to fill out Letter To Debt Collector - Only Contact Me In Writing?

US Legal Forms - one of the largest collections of legal templates in the country - offers a variety of legal document formats that you can download or print.

By using the website, you can access thousands of forms for both business and personal needs, organized by categories, states, or keywords. You can find the latest versions of documents such as the Arkansas Letter to Debt Collector - Only Contact Me In Writing in a matter of minutes.

If you possess a subscription, Log In and download the Arkansas Letter to Debt Collector - Only Contact Me In Writing from the US Legal Forms repository. The Download button will appear on every form you review. You can access all previously downloaded forms in the My documents section of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the payment.

Select the format and download the document onto your device. Edit. Fill out, modify, print, and sign the downloaded Arkansas Letter to Debt Collector - Only Contact Me In Writing. Every template you added to your account does not expire and belongs to you indefinitely. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you desire. Access the Arkansas Letter to Debt Collector - Only Contact Me In Writing with US Legal Forms, the most extensive collection of legal document templates. Utilize a multitude of professional and state-specific templates that cater to your business or personal needs and requirements.

- Ensure you have selected the correct form for your locality/state.

- Click on the Preview option to review the contents of the form.

- Read the form description to confirm you have chosen the right one.

- If the form does not meet your needs, utilize the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your selection by clicking the Purchase now option.

- Then, choose the payment plan you prefer and provide your information to register for the account.

Form popularity

FAQ

The statute of limitations is a law that limits how long debt collectors can legally sue consumers for unpaid debt. The statute of limitations on debt varies by state and type of debt, ranging from three years to as long as 20 years.

Although rarely asserted in the context of a collection action, under Arkansas law, an individual who is married or is the head of a family may claim as exempt up to $500 of their personal property (up to $200 if they are not married or the head of a family). Ark.

In cases against consumers for unpaid debts, the statute of limitations is three years in Arkansas. To achieve this short statute of limitations period, it must be filed as breach of contract claims, and there cannot be proof in writing, under A.C.A. 16- 56-105.

The term "debt validation letter" refers to a letter that an individual sends to their creditor or collection agency requesting proof that the debt in question is valid and not outside the statute of limitations for collecting the debt.

You have the right not to be contacted at work, and some local and state laws make it illegal for creditors to contact your place of employment if they have reason to know those calls are forbidden.

In cases against consumers for unpaid debts, the statute of limitations is three years in Arkansas. To achieve this short statute of limitations period, it must be filed as breach of contract claims, and there cannot be proof in writing, under A.C.A. 16- 56-105.

The statute of limitations for most debts, under Arkansas law, ranges from two to five years. Debt collectors are not allowed to call you at work. Ever. If they call after you have asked them to stop, you may have a claim under the Fair Debt Collection Practices Act.

Try not to let all of the calls badgering you from a debt collector get to you. If you need to take a break, you can use this 11 word phrase to stop debt collectors: Please cease and desist all calls and contact with me, immediately. Here is what you should do if you are being contacted by a debt collector.

10 years. Once the statute of limitations passes, you still legally owe the amount due, although it's considered time-barred. And collectors can still do things like call you or mail you letters to seek payment. That old debt also may still be on your credit report.

Among the insider tips, Ulzheimer shared with the audience was this: if you are being pursued by debt collectors, you can stop them from calling you ever again by telling them '11-word phrase'. This simple idea was later advertised as an '11-word phrase to stop debt collectors'.