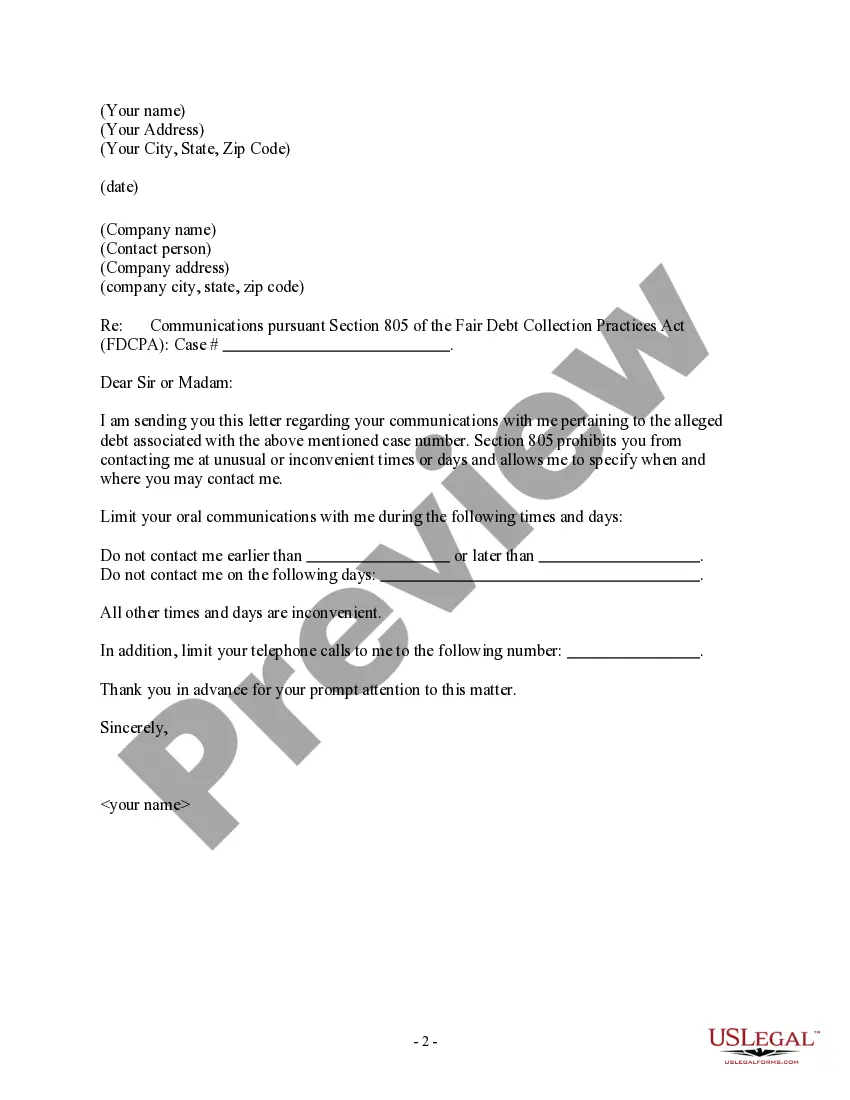

Arkansas Letter to Debt Collector - Only call me on the following days and times

Description

How to fill out Letter To Debt Collector - Only Call Me On The Following Days And Times?

It is feasible to spend time online looking for the valid document template that meets the state and federal requirements you need.

US Legal Forms offers thousands of valid documents that are reviewed by experts.

You can easily download or print the Arkansas Letter to Debt Collector - Only contact me on the following days and times through your service.

If available, utilize the Preview button to view the document template as well.

- If you currently possess a US Legal Forms account, you can Log In and then click the Download button.

- Subsequently, you can fill out, modify, print, or sign the Arkansas Letter to Debt Collector - Only contact me on the following days and times.

- Every valid document template you purchase is yours forever.

- To retrieve another copy of any purchased document, navigate to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions listed below.

- First, ensure that you have chosen the correct document template for your chosen state/city.

- Review the document description to confirm you have selected the accurate document.

Form popularity

FAQ

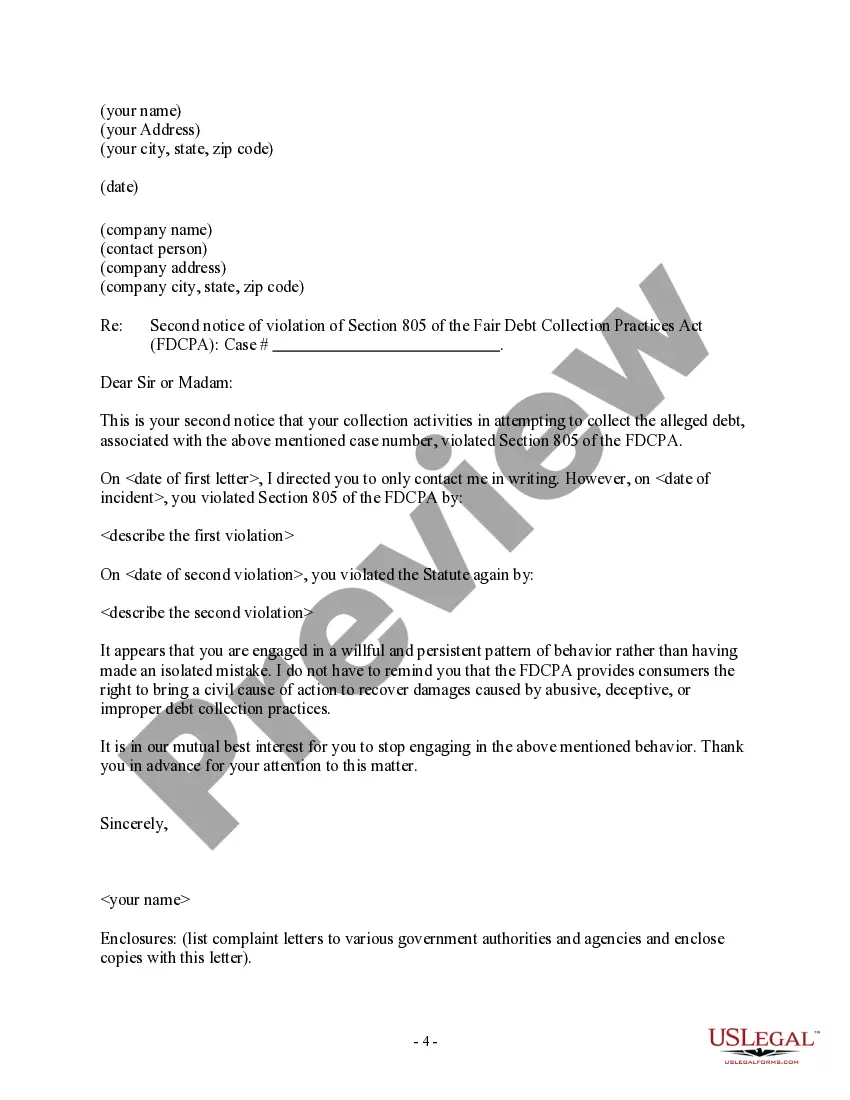

If a debt collector fails to verify the debt but continues to go after you for payment, you have the right to sue that debt collector in federal or state court. You might be able to get $1,000 per lawsuit, plus actual damages, attorneys' fees, and court costs.

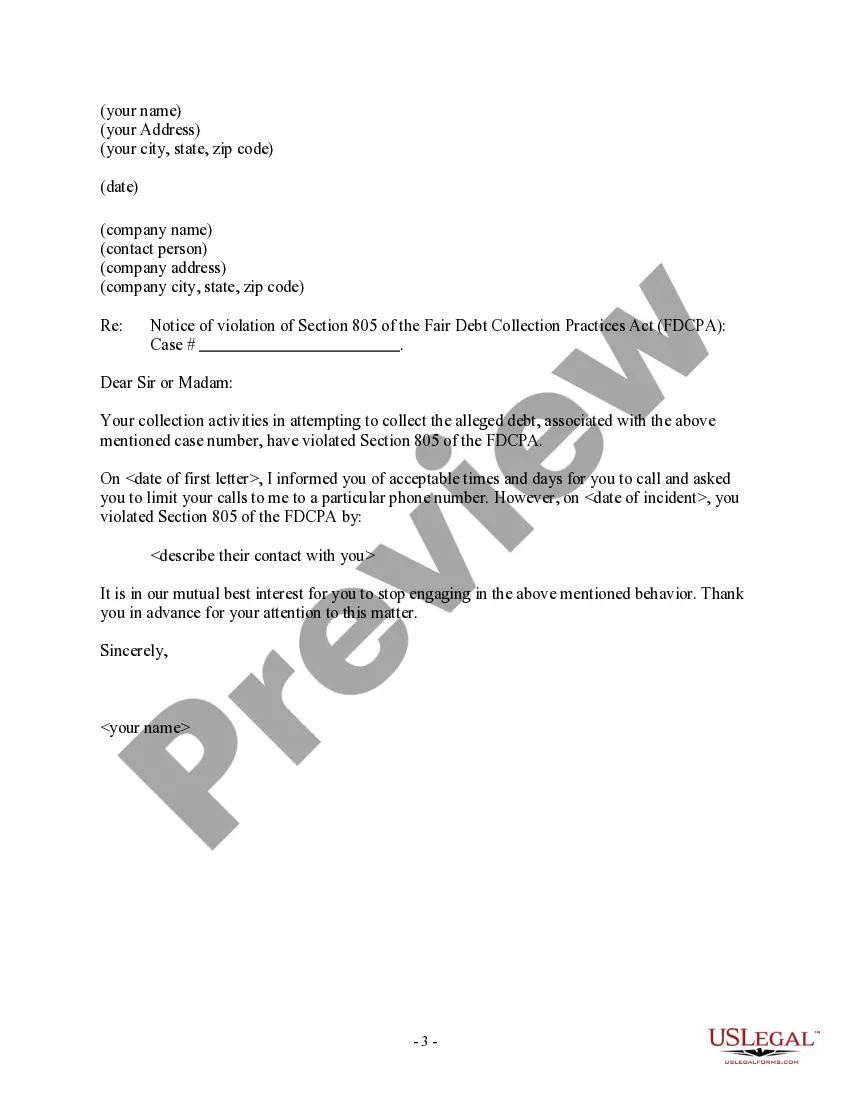

Yes, a debt collector can call on Sunday, unless you've told them that Sunday is inconvenient for you. If you tell them not to call on Sunday, and they do so anyway, then the call violates the Fair Debt Collection Practices Act.

Unfortunately, a debt collection agency can take as long as they want to respond to your request to validate an existing debt. I would say, generally, the usual range is between 130 days or they never respond.

The statute of limitations is a law that limits how long debt collectors can legally sue consumers for unpaid debt. The statute of limitations on debt varies by state and type of debt, ranging from three years to as long as 20 years.

Debt collectors are legally required to send one within five days of first contact. You have within 30 days from receiving a debt validation letter to send a debt verification letter. Here's the important part: You have just 30 days to respond to a debt validation letter with your debt verification letter.

A statement that if you write to dispute the debt or request more information within 30 days, the debt collector will verify the debt by mail. A statement that if you request information about the original creditor within 30 days, the collector must provide it.

Creditors do not have to respond to every debt verification letter sent to them. Under the FDCPA, if a collector contacts you about a debt, you have 30 days to request validation. If you send a verification request within that time, the creditor is legally obligated to respond to you.

Debt collectors are legally required to send one within five days of first contact. You have within 30 days from receiving a debt validation letter to send a debt verification letter. Here's the important part: You have just 30 days to respond to a debt validation letter with your debt verification letter.

A debt validation letter should include the name of your creditor, how much you supposedly owe, and information on how to dispute the debt. After receiving a debt validation letter, you have 30 days to dispute the debt and request written evidence of it from the debt collector.

Do Debt Validation Letters really work? Yes, they do. When a debt collector receives a Debt Validation Letter, they are legally required to provide validation of the debt. Debt Validation Letter's work best when they include a cease and desist clause that forces a lawsuit.