Arkansas Complex Will - Income Trust for Spouse

Description

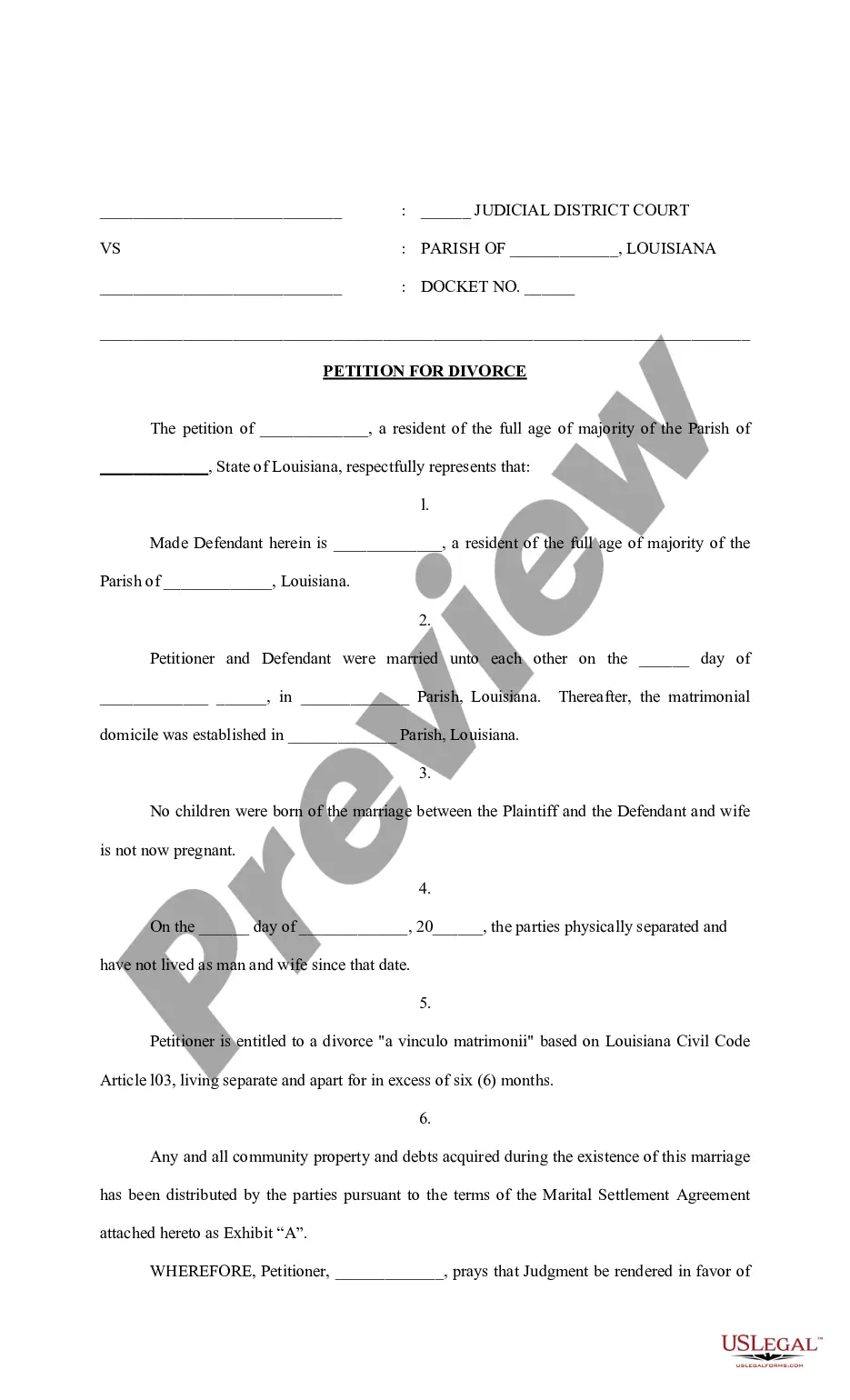

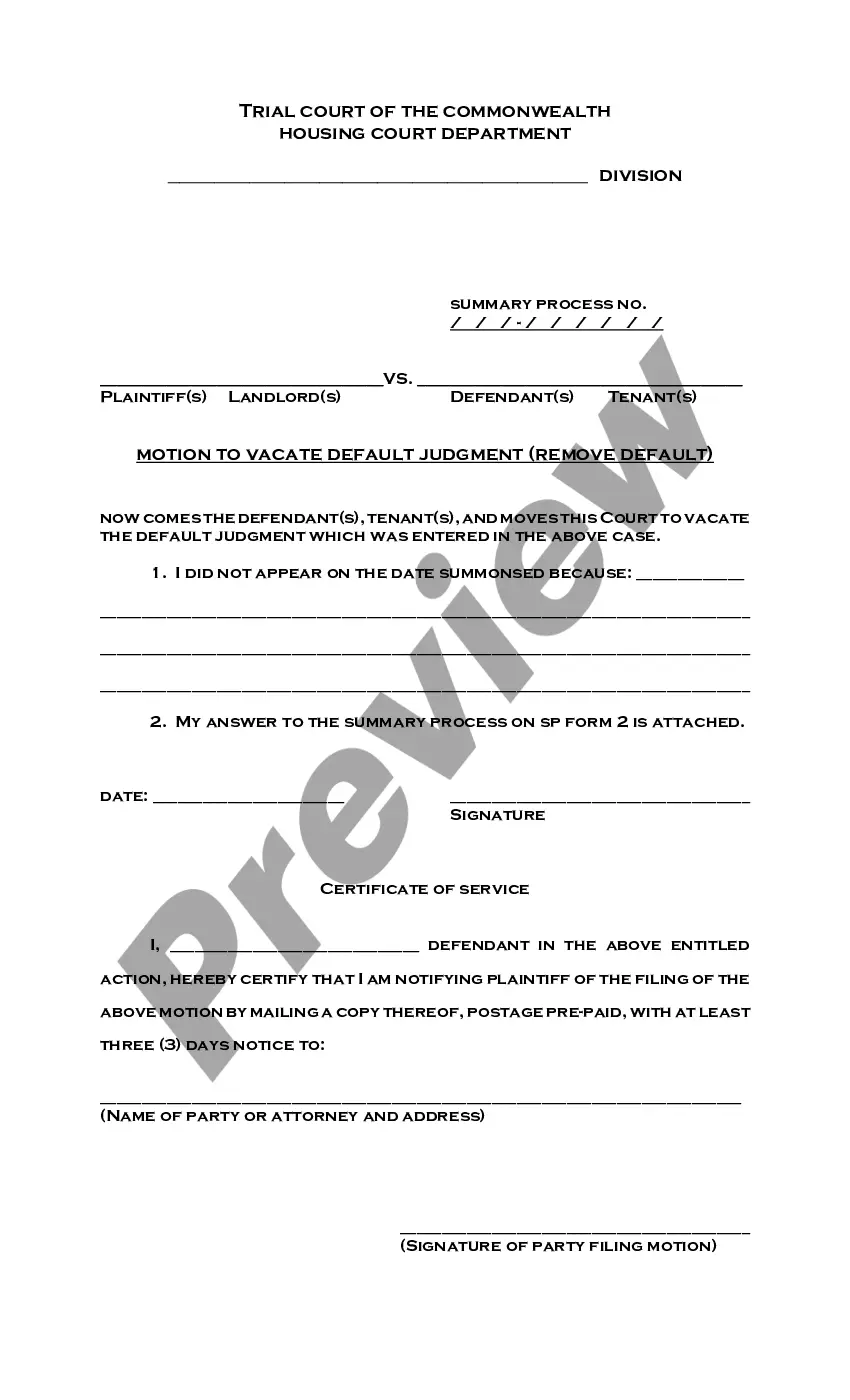

How to fill out Complex Will - Income Trust For Spouse?

US Legal Forms - one of several greatest libraries of authorized kinds in America - gives a wide array of authorized papers themes you are able to acquire or produce. Using the site, you will get thousands of kinds for organization and person functions, categorized by classes, states, or search phrases.You can find the most up-to-date types of kinds such as the Arkansas Complex Will - Income Trust for Spouse in seconds.

If you already possess a monthly subscription, log in and acquire Arkansas Complex Will - Income Trust for Spouse from the US Legal Forms collection. The Down load key will appear on every form you see. You have access to all previously saved kinds inside the My Forms tab of your own profile.

In order to use US Legal Forms the very first time, listed below are easy directions to help you get began:

- Make sure you have picked the proper form to your metropolis/state. Click on the Preview key to examine the form`s articles. Browse the form outline to actually have selected the proper form.

- In case the form does not fit your specifications, utilize the Lookup industry on top of the display screen to obtain the one which does.

- In case you are happy with the shape, validate your choice by simply clicking the Get now key. Then, choose the rates strategy you favor and provide your credentials to sign up for an profile.

- Process the transaction. Make use of your Visa or Mastercard or PayPal profile to perform the transaction.

- Pick the format and acquire the shape on the product.

- Make adjustments. Load, edit and produce and sign the saved Arkansas Complex Will - Income Trust for Spouse.

Every template you included in your bank account lacks an expiration date which is the one you have for a long time. So, in order to acquire or produce one more copy, just check out the My Forms segment and then click on the form you will need.

Get access to the Arkansas Complex Will - Income Trust for Spouse with US Legal Forms, probably the most comprehensive collection of authorized papers themes. Use thousands of skilled and express-particular themes that meet your organization or person demands and specifications.

Form popularity

FAQ

So, if there are any funds remaining in the trust after your death, the state is repaid for the care provided. This payment must be less than or equal to the total amount the state actually paid for care. However, it's rare that a Miller trust will have excess funds over and above that dollar amount.

Also, a limited amount of cash is excluded ($2,000 for an individual and $3,000 for a couple). There are other types of assets that may not be counted. However, the determination as to what is exempt is made on a case-by-case basis. Each state has its own Medicaid program, and its own qualifications.

Any property stored inside the trust is not subject to probate court, a time-consuming and sometimes privacy-invading process that most trusts have to go through. This may be especially important in Arkansas, which does not use the Uniform Probate Code, which simplifies the probate process in some other states.

A basic Revocable Living Trust generally ranges from $1,000 to $3,000. More complex trusts can cost several thousand dollars more. Online services like Snug can provide a more affordable alternative to traditional legal services, offering estate planning services, including trusts, at a lower cost.

A Miller Trust could be crucial if you need Medicaid long-term care benefits, but your income exceeds your state's published income cap which would render you ineligible. Creating a Miller Trust can help you receive the benefits you need.

Miller Trusts are called by a variety of names and include the following: Qualifying Income Trusts, QITs, Income Diversion Trusts, Income Cap Trusts, Irrevocable Income Trusts, Income Trusts, d4B trusts, and Income Only Trusts. These names are often state specific.

If your income exceeds the limit, you may meet the income eligibility criteria by setting up an Irrevocable Income Trust (also known as a Miller Income Trust or MIT.) An Irrevocable Income Trust is established by signing a legal document and setting up a special bank account to fund the trust.

It allows individuals to become income eligible under Medicaid. It does not require any advanced planning and is often used in a crisis (like the example above). Once someone is eligible for Medicaid, the cost of nursing home care would be covered.