Arkansas Proposals to Approve Employees' Stock Deferral Plan and Directors' Stock Deferral Plan with Copy of Plans

Description

How to fill out Proposals To Approve Employees' Stock Deferral Plan And Directors' Stock Deferral Plan With Copy Of Plans?

If you need to complete, download, or print out legal document layouts, use US Legal Forms, the biggest variety of legal types, which can be found on the web. Take advantage of the site`s simple and easy handy look for to get the papers you will need. Numerous layouts for organization and person functions are categorized by types and suggests, or search phrases. Use US Legal Forms to get the Arkansas Proposals to Approve Employees' Stock Deferral Plan and Directors' Stock Deferral Plan with Copy of Plans within a handful of mouse clicks.

In case you are presently a US Legal Forms customer, log in to the accounts and click the Down load option to get the Arkansas Proposals to Approve Employees' Stock Deferral Plan and Directors' Stock Deferral Plan with Copy of Plans. You can also accessibility types you formerly saved within the My Forms tab of your respective accounts.

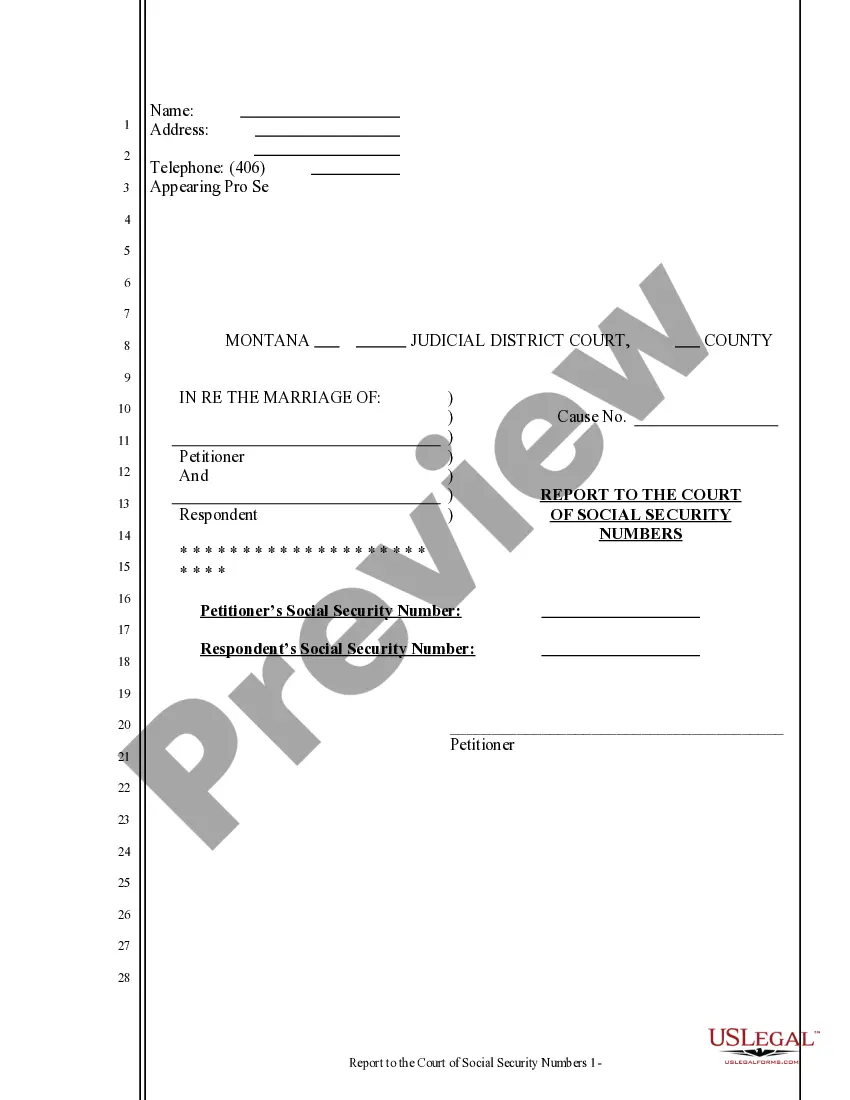

If you use US Legal Forms for the first time, follow the instructions below:

- Step 1. Be sure you have chosen the form for the appropriate area/region.

- Step 2. Make use of the Review choice to look through the form`s content. Don`t forget about to learn the description.

- Step 3. In case you are unhappy using the type, utilize the Research industry near the top of the screen to locate other models from the legal type format.

- Step 4. Once you have discovered the form you will need, go through the Acquire now option. Opt for the pricing strategy you like and add your references to sign up for an accounts.

- Step 5. Approach the purchase. You can use your Мisa or Ьastercard or PayPal accounts to complete the purchase.

- Step 6. Pick the file format from the legal type and download it on your system.

- Step 7. Total, edit and print out or indicator the Arkansas Proposals to Approve Employees' Stock Deferral Plan and Directors' Stock Deferral Plan with Copy of Plans.

Each legal document format you get is your own property for a long time. You have acces to every type you saved in your acccount. Go through the My Forms area and choose a type to print out or download once again.

Be competitive and download, and print out the Arkansas Proposals to Approve Employees' Stock Deferral Plan and Directors' Stock Deferral Plan with Copy of Plans with US Legal Forms. There are millions of professional and status-specific types you can utilize for the organization or person requires.