Arkansas Restricted Stock Plan and Trust Agreement of Home Federal Savings and Loan Assoc.

Description

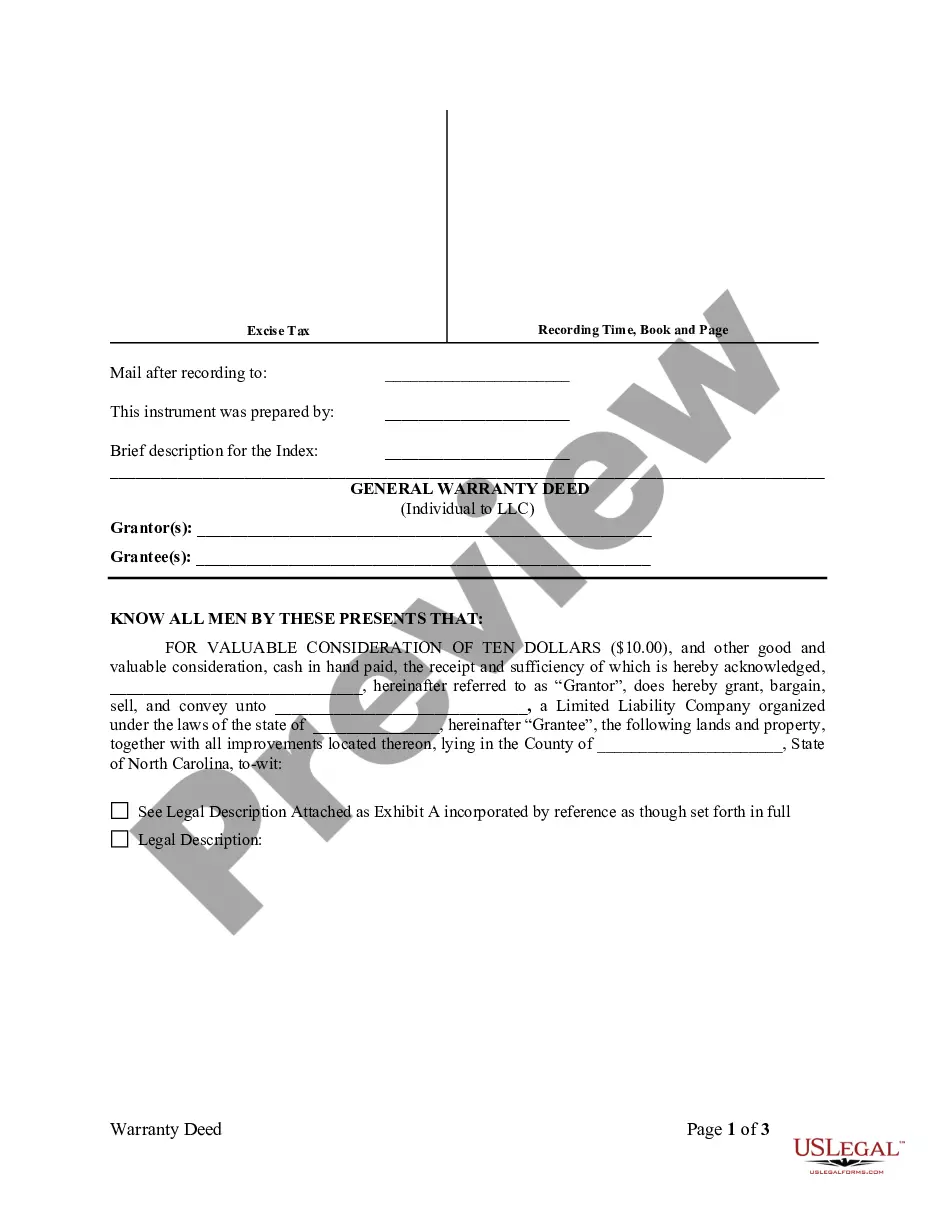

How to fill out Restricted Stock Plan And Trust Agreement Of Home Federal Savings And Loan Assoc.?

Are you in a placement in which you require documents for possibly enterprise or specific purposes virtually every working day? There are a lot of legitimate papers layouts available on the Internet, but finding types you can rely isn`t straightforward. US Legal Forms offers 1000s of kind layouts, much like the Arkansas Restricted Stock Plan and Trust Agreement of Home Federal Savings and Loan Assoc., which are written to fulfill federal and state requirements.

If you are previously knowledgeable about US Legal Forms website and have an account, merely log in. Following that, you may download the Arkansas Restricted Stock Plan and Trust Agreement of Home Federal Savings and Loan Assoc. template.

Should you not provide an bank account and would like to begin to use US Legal Forms, adopt these measures:

- Find the kind you need and ensure it is for the right metropolis/state.

- Utilize the Preview key to check the shape.

- Look at the outline to ensure that you have chosen the appropriate kind.

- In the event the kind isn`t what you are searching for, take advantage of the Research industry to obtain the kind that suits you and requirements.

- When you obtain the right kind, just click Get now.

- Select the costs program you desire, fill out the necessary info to make your money, and pay for the transaction utilizing your PayPal or charge card.

- Pick a convenient document structure and download your duplicate.

Find all the papers layouts you might have purchased in the My Forms menu. You may get a additional duplicate of Arkansas Restricted Stock Plan and Trust Agreement of Home Federal Savings and Loan Assoc. anytime, if possible. Just click the necessary kind to download or print out the papers template.

Use US Legal Forms, the most substantial assortment of legitimate varieties, in order to save some time and avoid faults. The support offers professionally produced legitimate papers layouts which can be used for an array of purposes. Produce an account on US Legal Forms and initiate making your way of life easier.

Form popularity

FAQ

Banks are community, regional or national for-profit business corporations owned by private investors and governed by a board of directors chosen by the stockholders. Savings institutions (also called savings & loans or savings banks) specialize in real estate financing.

Post-Crisis S&Ls. The difference between commercial banks and S&Ls has narrowed significantly. In 2019, there were only 659 Savings and Loans, ing to the FDIC.

Post-Crisis S&Ls. The difference between commercial banks and S&Ls has narrowed significantly. In 2019, there were only 659 Savings and Loans, ing to the FDIC.

Savings and loan associations ? also known as savings banks, thrifts and thrift institutions ? are financial institutions typically owned by their customers or shareholders. Savings and loan associations were established in the 1930s to provide more affordable mortgages to consumers.

The S&L crisis culminated in the collapse of hundreds of savings & loan institutions and the insolvency of the Federal Savings and Loan Insurance Corporation, which cost taxpayers many billions of dollars and contributed to the recession of 1990?91.