Arkansas Separation Notice for Independent Contractor

Description

How to fill out Separation Notice For Independent Contractor?

If you desire to finalize, obtain, or produce sanctioned document templates, utilize US Legal Forms, the largest array of sanctioned forms available online.

Utilize the site's straightforward and convenient search feature to find the documents you need.

Numerous templates for business and personal purposes are organized by types and states, or keywords.

Step 4. Once you have identified the form you need, click the Buy now button. Choose your preferred pricing plan and enter your credentials to register for your account.

Step 5. Complete the transaction. You may use your Visa or Mastercard or PayPal account to finalize the purchase.

- Employ US Legal Forms to acquire the Arkansas Separation Notice for Independent Contractor in just a few clicks.

- If you are already a US Legal Forms customer, sign in to your account and click on the Download button to receive the Arkansas Separation Notice for Independent Contractor.

- You can also access forms you previously obtained within the My documents section of your account.

- If this is your first time using US Legal Forms, adhere to the steps listed below.

- Step 1. Ensure you have selected the form for the correct city/state.

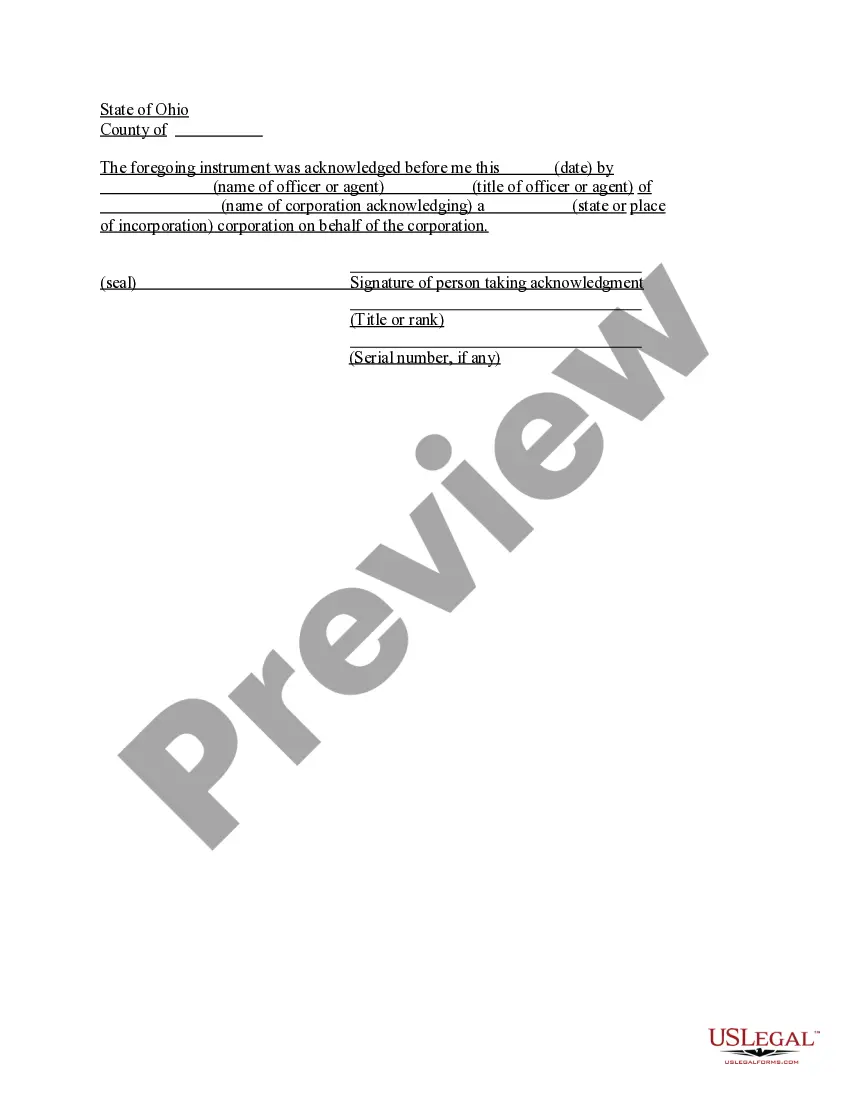

- Step 2. Utilize the Preview option to review the form's content. Do not forget to read the description.

- Step 3. If you are dissatisfied with the form, use the Search bar at the top of the screen to locate other forms from the legal form template.

Form popularity

FAQ

Arkansas uses an ABC test for unemployment insurance, where in order to obtain independent contractor status under the Employment Security Act, it is necessary that an employer prove each of three statutory subsections: that an individual has been and will continue to be free from control or direction in connection

When it comes to employment, Arkansas is an At-Will State. That means that technically an employer or employee can terminate a working relationship at any time with little or no explanation at all.

As an independent contractor, you'll usually make more money than if you were an employee. Companies are willing to pay more for independent contractors because they don't have the enter into expensive, long-term commitments or pay health benefits, unemployment compensation, Social Security taxes, and Medicare taxes.

According to the Arkansas Child Labor Law, a minor 14 or 15 years of age cannot begin work before 6 a.m., work past 9 p.m., nor more than 8 hours a day, 6 days a week, or more than 48 hours a week when school is not in session.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

Arkansas opening unemployment benefits for self-employed, independent contractors. MEMPHIS, Tenn. (WMC) - Arkansans who are self-employed workers or independent contractors and out of work because of COVID-19 can apply for federal Pandemic Unemployment Assistance (PUA) beginning Tuesday, May 5.

30.2 All employers in the State of Arkansas must provide the notice as set out in Attachment A of Rule 30 to an employee upon that employee's separation from employment. 30.3 This rule shall become effective on April 27, 2020 and shall expire on December 31, 2020.

The last employer shall have ten (10) days from the date the notice was mailed or otherwise provided by the Department of Workkforce Services to file his response. If mailed, a response shall be considered to have been filed as of the date of the postmark on the envelope.

You do not generally have to withhold or pay any taxes on payments to independent contractors unless you are not provided with a required taxpayer identification number or are instructed to withhold by the Internal Revenue Service.

What Is a Separation Notice? A general separation notice is a written communication from an employer or an employee saying that the employment relationship is ending.