Arkansas Unrestricted Charitable Contribution of Cash

Description

How to fill out Unrestricted Charitable Contribution Of Cash?

Are you currently in a situation where you need documents for various business or personal reasons frequently.

There are numerous legal document formats available online, but finding reliable ones is challenging.

US Legal Forms offers thousands of form templates, including the Arkansas Unrestricted Charitable Contribution of Cash, designed to fulfill federal and state requirements.

Once you find the right form, click on Buy now.

Select the payment plan you desire, enter the required information to create your account, and purchase your order using your PayPal or credit card.

- If you are familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Arkansas Unrestricted Charitable Contribution of Cash template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct city/state.

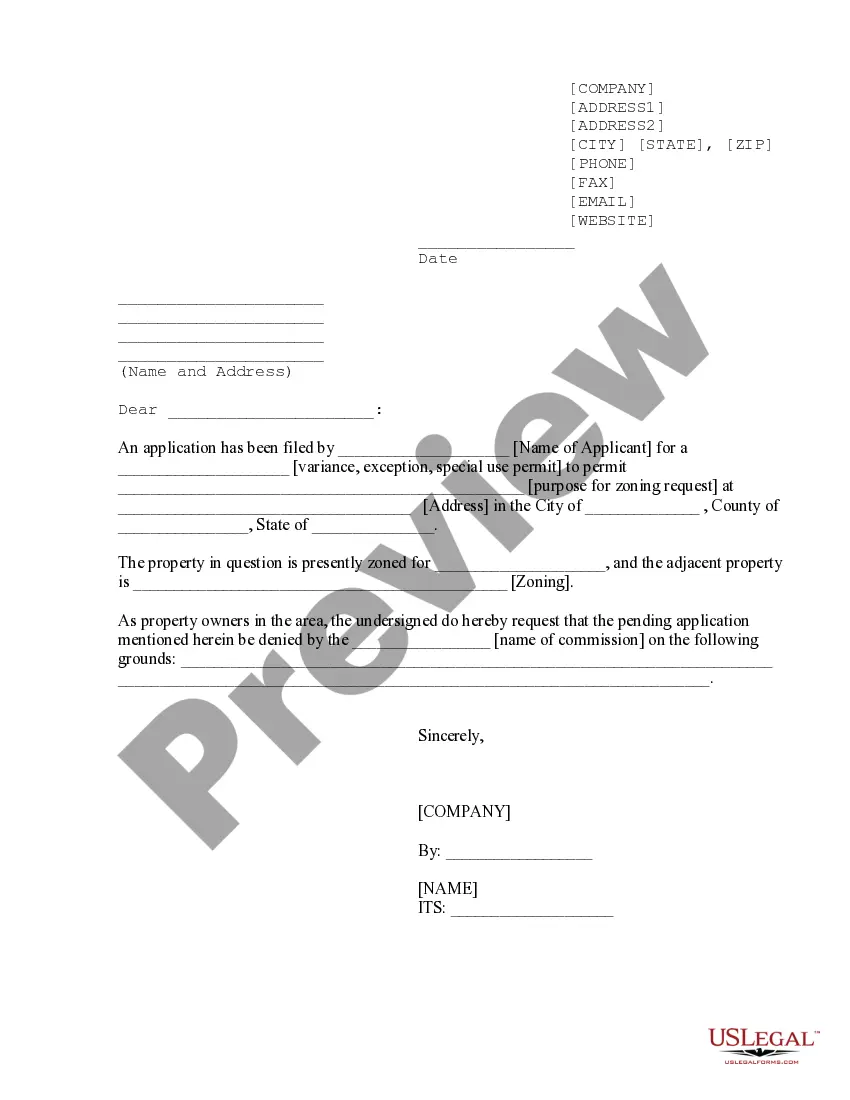

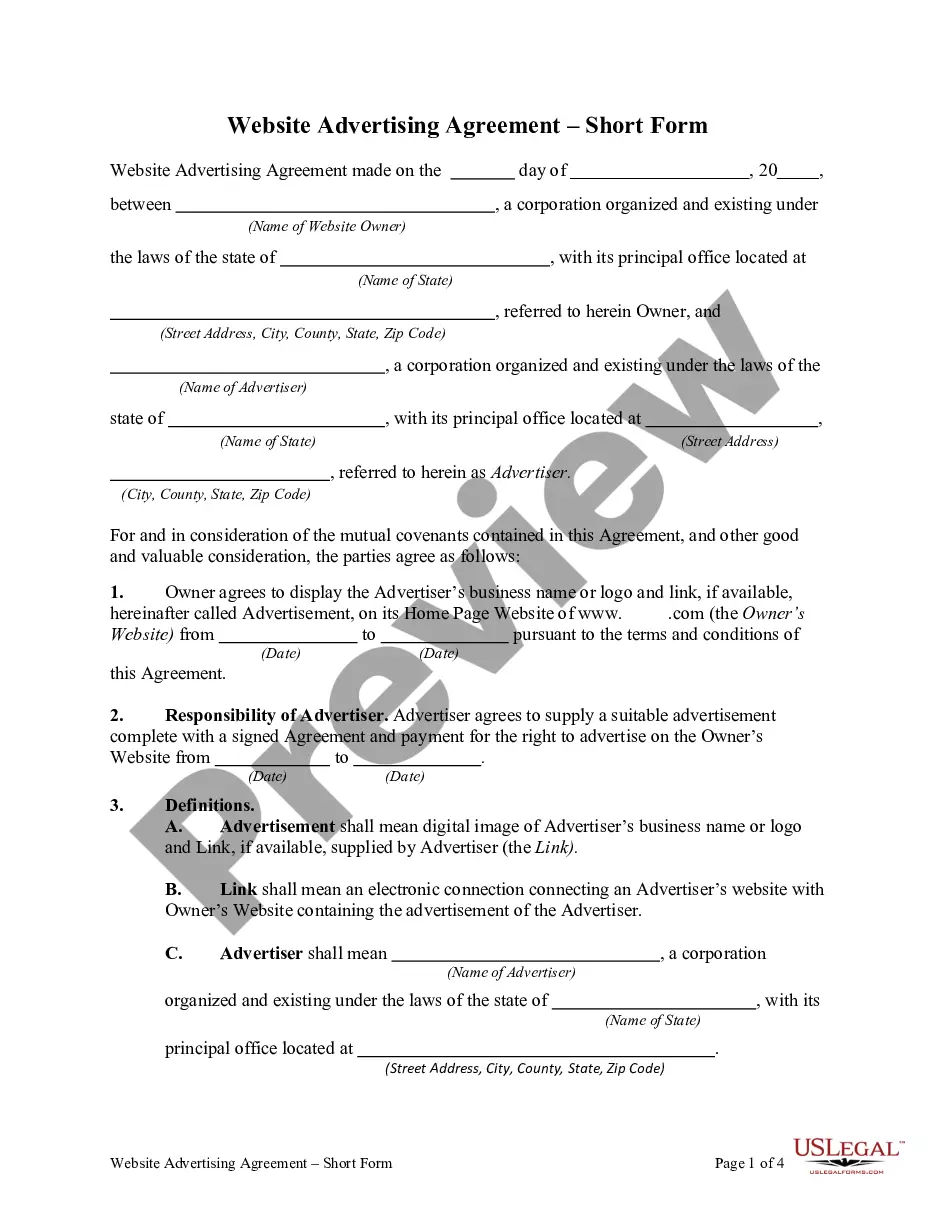

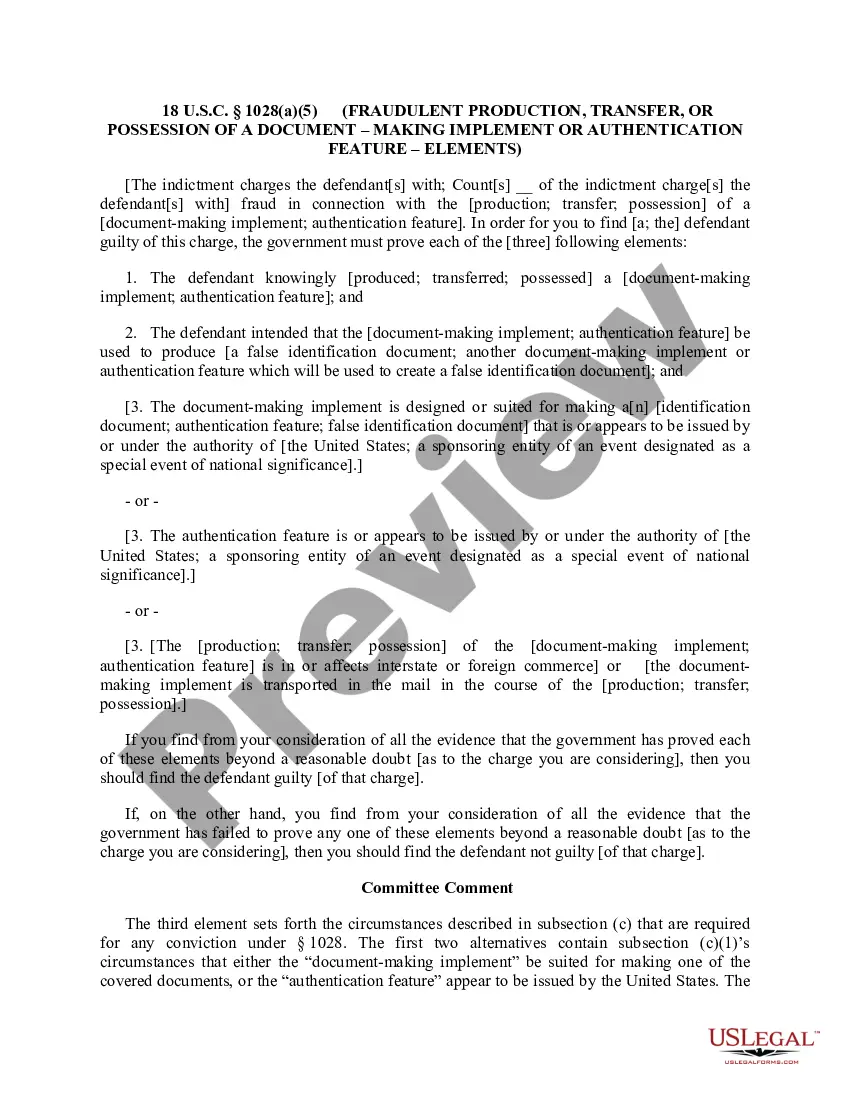

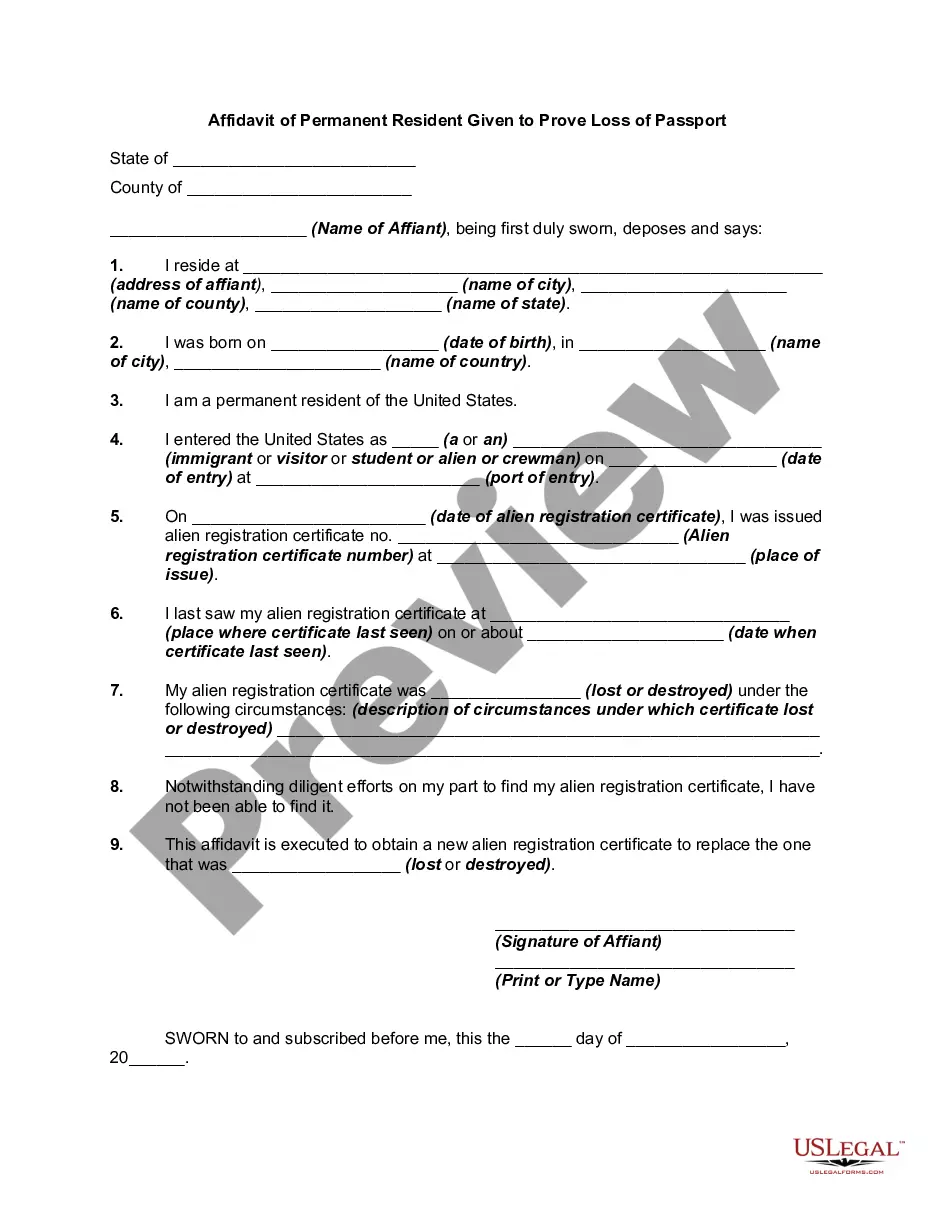

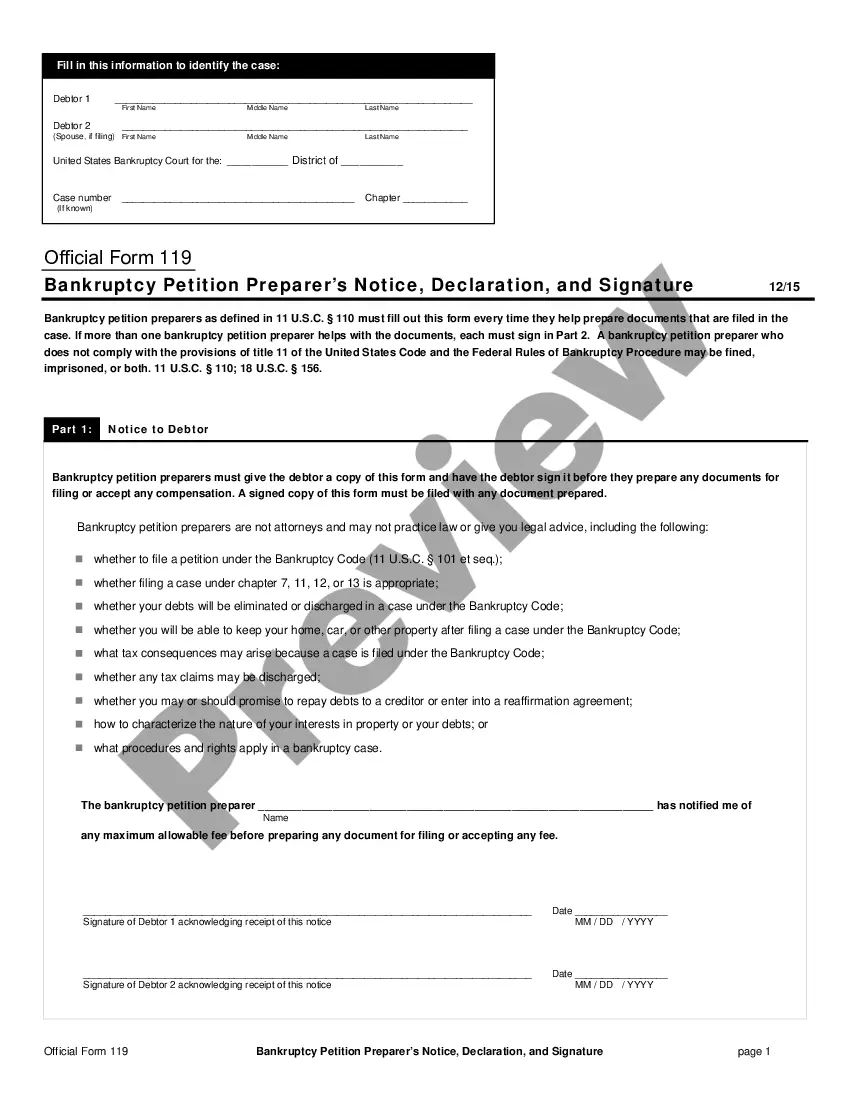

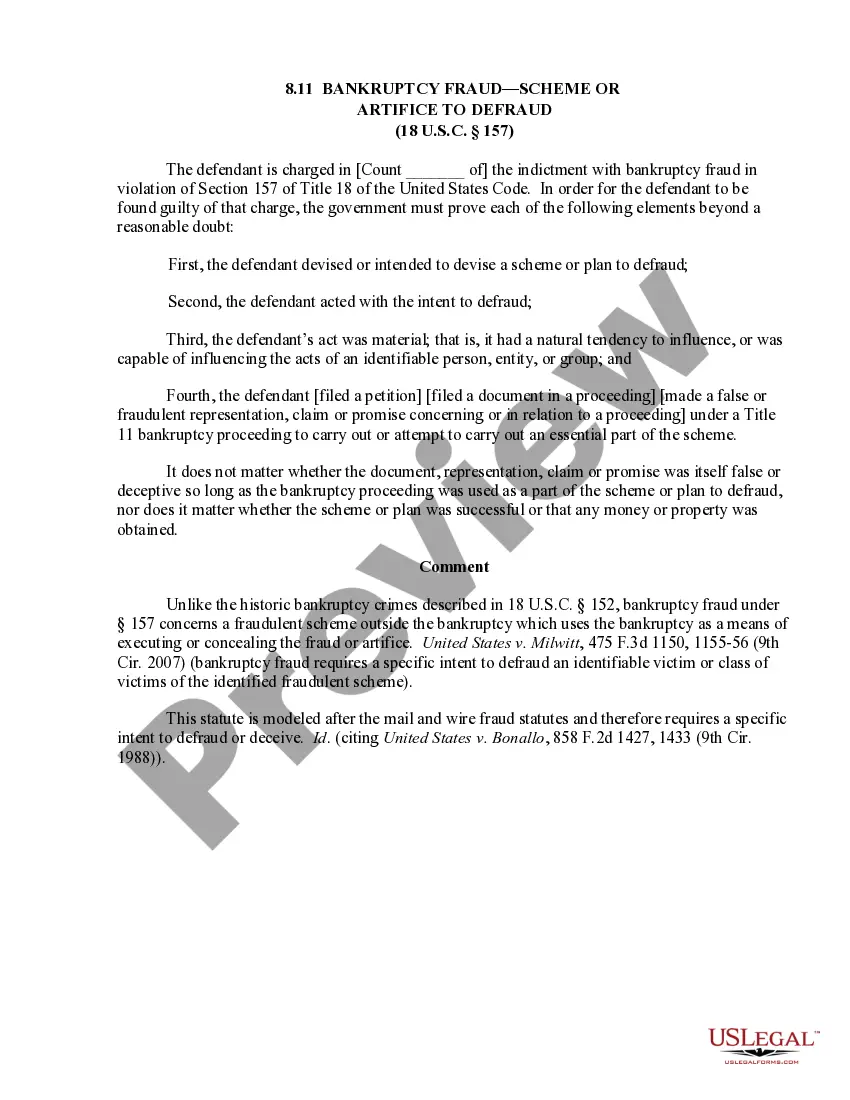

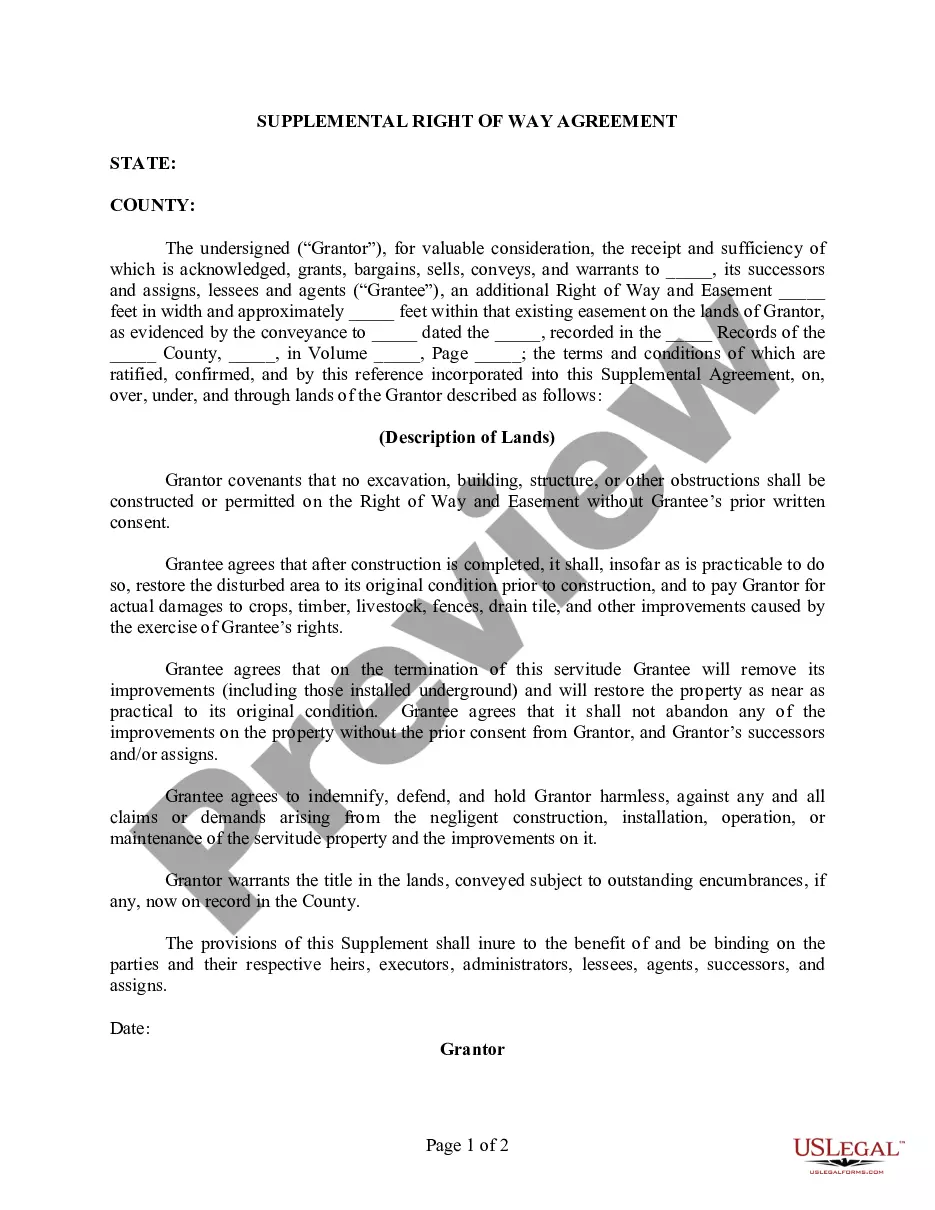

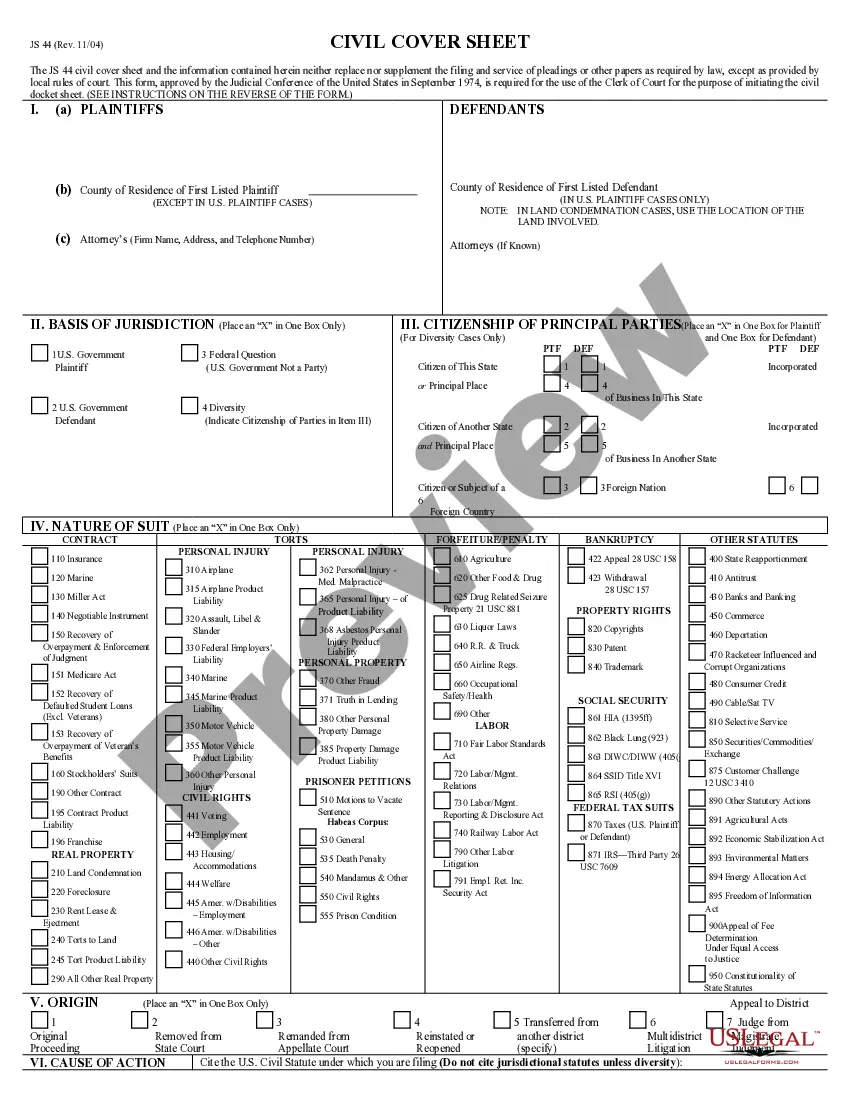

- Use the Preview button to review the form.

- Check the description to make sure you have chosen the correct form.

- If the form is not what you're looking for, use the Search field to find the form that meets your needs and requirements.

Form popularity

FAQ

The 4 28 401 law in Arkansas addresses the guidelines for Arkansas Unrestricted Charitable Contribution of Cash. This law allows individuals and organizations to make cash donations without stringent limitations, fostering a culture of generosity. It simplifies the contribution process, ensuring that donors can support various charitable causes while enjoying tax benefits. For anyone seeking to navigate these laws effectively, USLegalForms offers resources to help you understand your rights and options regarding charitable contributions.

The accounting treatment for donations, including Arkansas Unrestricted Charitable Contribution of Cash, involves recognizing the transaction in your financial statements. You will record the donation as an expense in the period it is made, reducing your net income, while acknowledging the decrease in cash or bank accounts. This clear approach allows for better tracking of your charitable contributions. Consider USLegalForms for templates that can assist with your accounting entries and documentation.

To deduct your charitable contributions on your taxes, document all Arkansas Unrestricted Charitable Contributions of Cash you made throughout the year. You can typically deduct these contributions if you itemize your deductions on your federal tax return. It's essential to have proper documentation, such as receipts or bank statements, to substantiate your claims and comply with IRS regulations. USLegalForms provides resources to help you navigate the deduction process effectively.

To make a qualified charitable contribution in the form of an Arkansas Unrestricted Charitable Contribution of Cash, you must donate to an organization recognized by the IRS as a charity. Ensure that your contribution meets the IRS requirements, such as being cash or a cash equivalent, and retain proof of your donation, such as a receipt. For detailed guidance on making these contributions, consider using USLegalForms to access relevant templates and documents.

When you record donations, you'll need to create a journal entry that reflects the Arkansas Unrestricted Charitable Contribution of Cash. Typically, you will debit the donation expense account and credit the cash or bank account from which the donation was made. This process ensures accurate tracking of your charitable contributions in your financial records. Utilizing USLegalForms can streamline this process with templates designed for various donation scenarios.

The maximum amount you can write off for charitable donations varies based on your income and the nature of the donation. For cash gifts, the maximum deduction is typically around 60% of your adjusted gross income. Understanding the specifics of Arkansas Unrestricted Charitable Contribution of Cash helps you navigate tax advantages, ensuring you get the most from your generosity.

Yes, you can claim charitable contributions on your tax return, provided you itemize your deductions instead of taking the standard deduction. This applies to various types of contributions, including those related to Arkansas Unrestricted Charitable Contribution of Cash. To ensure you comply with IRS requirements, it may benefit you to consult with a tax professional.

Individuals can generally deduct charitable contributions up to 60% of their adjusted gross income for cash donations to qualifying organizations. This limit can vary based on the type of contribution and organization, so it's vital to understand these allowances as you consider your Arkansas Unrestricted Charitable Contribution of Cash. Planning your donations effectively can maximize your tax benefits.

To report noncash charitable contributions, you will need to use IRS Form 8283, titled 'Noncash Charitable Contributions.' This form allows you to detail your donation and claim the tax deduction accordingly. Keep in mind that Arkansas Unrestricted Charitable Contribution of Cash specifically focuses on cash gifts, so it's important to differentiate and report properly.

The IRS allows taxpayers to deduct up to $300 for cash donations made to qualified charitable organizations without needing proof when filing taxes. This limit applies to individuals who choose to take the standard deduction. If you exceed this amount, it is essential to keep receipts to substantiate your contributions, especially for Arkansas Unrestricted Charitable Contribution of Cash.