Arkansas Liquidation of Partnership with Sale of Assets and Assumption of Liabilities

Description

How to fill out Liquidation Of Partnership With Sale Of Assets And Assumption Of Liabilities?

Have you ever been in a situation where you require documents for either business or personal purposes nearly every day.

There are numerous official document templates available online, but locating versions you can depend on is challenging.

US Legal Forms offers thousands of form templates, including the Arkansas Liquidation of Partnership with Sale of Assets and Assumption of Liabilities, designed to meet federal and state requirements.

Once you have the correct form, click Buy now.

Select the pricing plan you desire, fill in the required information to create your account, and pay for your order using PayPal or your credit card.

- If you are already acquainted with the US Legal Forms site and have an account, just sign in.

- After that, you can download the Arkansas Liquidation of Partnership with Sale of Assets and Assumption of Liabilities template.

- If you don't have an account and want to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct city/area.

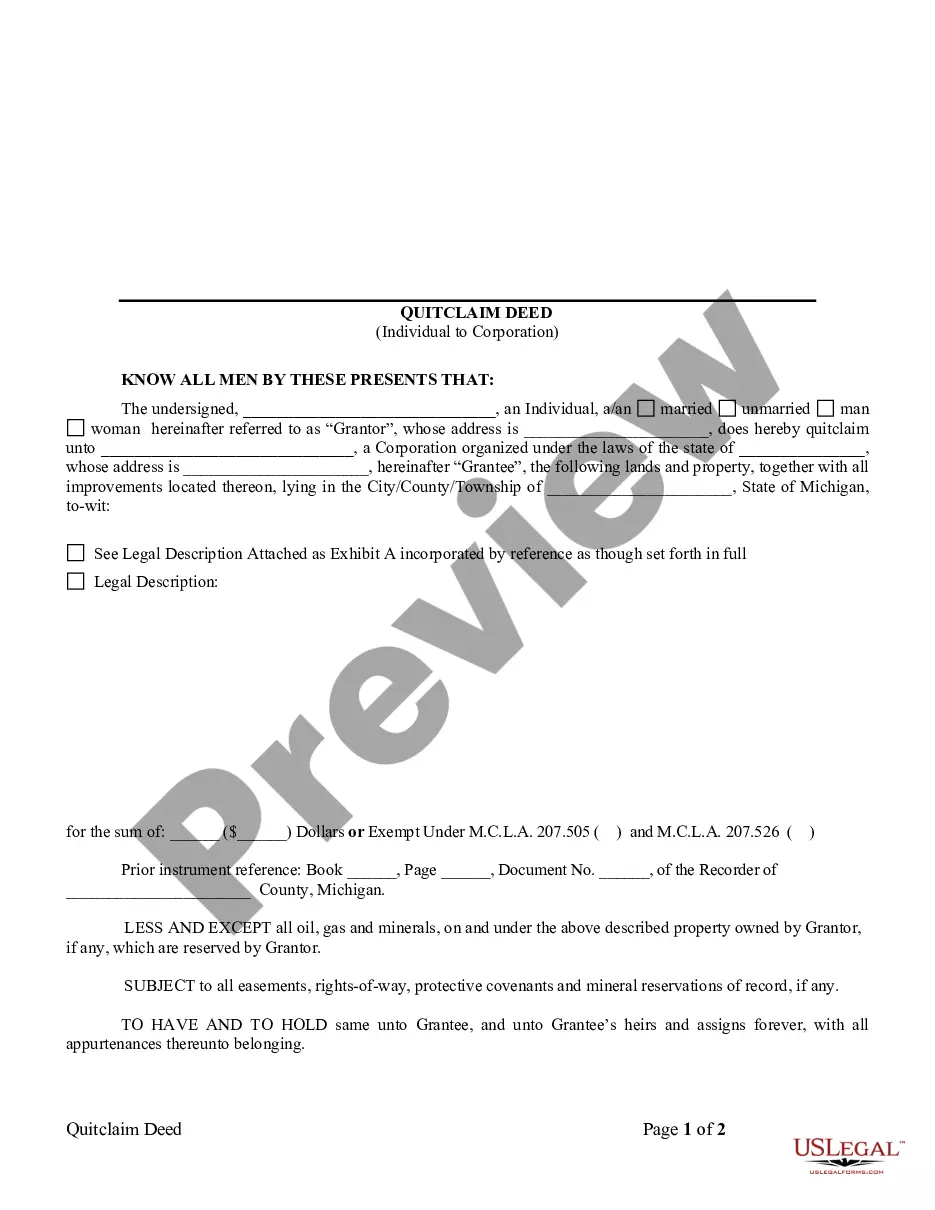

- Utilize the Preview feature to review the form.

- Check the description to confirm you have selected the right form.

- If the form does not meet your needs, use the Search field to find the form that suits your requirements.

Form popularity

FAQ

Assumed Contract Obligations means the liabilities and obligations arising after the Closing Date under the Assumed Contracts which Purchasers shall assume pursuant to the Assignment and Assumption Agreement; provided that the Assumed Contract Obligations shall not include (i) any payments required to be made, or costs

The liquidation or dissolution process for partnerships is similar to the liquidation process for corporations. Over a period of time, the partnership's non-cash assets are converted to cash, creditors are paid to the extent possible, and remaining funds, if any, are distributed to the partners.

To take responsibility for something, typically a cost or expense. When you signed the contract, you assumed liability for fees like this. See also: assume, for. Farlex Dictionary of Idioms.

An assumed liability is a liability that one party takes on under the terms of a contract. In the context of insurance, insurance policies that protect against losses from an assumed liability are available. Assumed liabilities are also known as contractual liabilities.

The purchaser will take on all of the target company's debts and liabilities, whether they are known at the time of the sale or not. That is, even if a purchaser is not aware of a company's debts and the time of the sale, they will still be held responsible for them after the acquisition.

A person who joins a partnership will not be liable for the debts it built up before they joined, unless an agreement is made that says something different. A person who leaves a partnership will still be liable for the firm's debts that were built up before they left.

In an asset purchase or acquisition, the buyer only buys the specific assets and liabilities listed in the purchase agreement. So, it's possible for there to be a liability transfer from the seller to the buyer. Undocumented and contingent liabilities, however, are not included.

Generally, in an asset purchase, the purchasing company is not liable for the seller's debts, obligations and liabilities. But there are exceptions, such as when the buyer agrees to assume the debts, obligation or liabilities in exchange for a lower sales price, for example.

In an asset purchase, the buyer agrees to purchase specific assets and liabilities. This means that they only take on the risks of those specific assets. This could include equipment, fixtures, furniture, licenses, trade secrets, trade names, accounts payable and receivable, and more.

Key Takeaways. In an asset sale, a firm sells some or all of its actual assets, either tangible or intangible. The seller retains legal ownership of the company that has sold the assets but has no further recourse to the sold assets. The buyer assumes no liabilities in an asset sale.